Tempus Resources (ASX: TMR, TSX.V: TMRR, OTCQB: TMRFF) is an Australian-based growth-oriented gold exploration company with a focus on developing its flagship Elizabeth-Blackdome Gold Projects in British Columbia. Listed on multiple stock exchanges, Tempus is also actively exploring projects in Canada and Ecuador. In this article, we will delve into the key aspects of Tempus Resources, from its high-grade gold projects and recent exploration successes to its strategic plans for future growth.

The Elizabeth Gold Project: High-Grade Mesothermal Gold Mineralization

The Elizabeth Gold Project boasts high-grade mesothermal gold mineralization, with vein sets ranging from 1.5 to 5 metres in width. There is potential for processing at the nearby Blackdome Mill, as metallurgical tests indicate a gold recovery rate of approximately 95%. In 2009, the project had an estimated resource of 206,000 ounces at a grade of 12.3 g/t gold.

Since acquiring the Elizabeth project, Tempus has discovered three new veins and completed 80 drill holes in exploration. Highlights from the No. 9 vein include:

- Drill hole EZ-22-20: Multiple bonanza grade zones, including 28.1 g/t gold over 28.50 metres

- Drill hole EZ-22-22: Multiple bonanza and high-grade gold zones in sheeted quartz, including 49.4 g/t gold over 1.15 metres

- Drill hole EZ-22-19: 87.0 g/t gold over 2.11 metres

Highlights from the Elizabeth Blue Vein include:

- Visible gold high grade in drill hole EZ-21-12: 1.0 metre at 33.7 g/t gold

- Drill hole EZ-21-25: 2.7 metres at 13.4 g/t gold

- High bonanza grades over 300 metres strike with eight intersections greater than one ounce per tonne over 2021/22 drilling

Future exploration at Elizabeth is focused on resource expansion and fast-track development.

The Blackdome Gold Mine: High-Grade Epithermal Gold Mineralization

The Blackdome Gold Mine is a previous producer known for its high-grade epithermal gold mineralization. From 1986 to 1991, the project produced 231,547 ounces of gold and 564,300 ounces of silver. Tempus drilled 5,000 metres at Blackdome in 2020, with an estimated 53,000 ounces of indicated resource at a grade of 11.3 g/t gold in 2010.

A total of 26 drill holes were completed in 2020 for a total depth of 5,087 metres. Results indicate broad mineralized alteration zones surrounding high-grade epithermal gold-silver veins.

JDS Mining is currently conducting a restart study at Blackdome Mill. Existing infrastructure offers a low capital, fast-track restart path. When mining ceased at Blackdome in 1991, 330,000 tonnes of ore had been milled at a grade of 21.9 g/t gold.

Tempus President and CEO, Jason Bahnsen, commented on the company’s progress, stating, “2022 was our most successful year to date at the Elizabeth Gold Project. We successfully delineated two new high-grade vein structures, the No. 9 Vein and the Blue Vein. The No. 9 Vein is proving very promising with wide zones of high-grade gold intersected in the first 10 drill holes (including 28.1 g/t gold over 28.5 metres). We now have six vein sets under development that will contribute to our updated JORC/NI43-101 resource estimate for both Blackdome and Elizabeth Gold Projects in H1 2023.”

Exploration in Ecuador: The Zamora Projects

In addition to the Elizabeth-Blackdome Gold Projects, Tempus also holds mineral assets in Ecuador, known as the Zamora Projects (Valle del Tigre / Rio Zarza). These projects are situated in the heart of the Cordillera del Condor mineral belt of southeast Ecuador, which hosts numerous major gold and copper porphyry deposits. Both projects are currently in early-stage exploration.

Key Investment Points and Future Plans for Tempus Resources

Tempus Resources offers investors several key investment points, including high-grade gold exploration and development in the storied region of southern British Columbia. The company has planned a 10,000-metre drill program for 2023, commencing in May, targeting the No. 9/Blue Vein intersection area and expansion of the newly discovered veins (Hanging Wall Vein, West and Main Vein extensions No. 9 Vein, and Ella Zone veins).

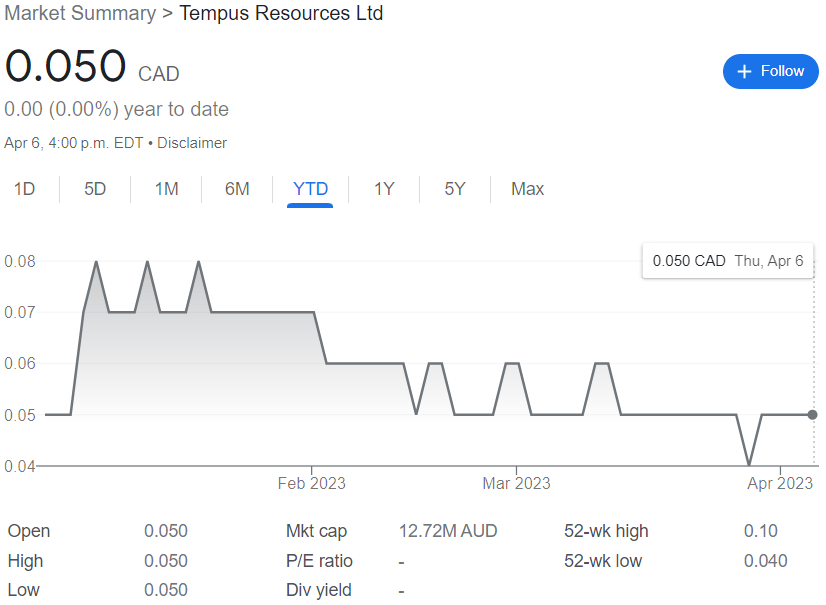

A process plant and mill study are pending, with additional engineering work planned for 2023, including preliminary mine planning and haul road design. Tempus Resources presents an attractive valuation, as it currently trades at $0.05 CAD per share for a market cap of $12.71 million AUD.

Management Team and Board of Directors Driving Exploration Efforts

The management team and board of directors at Tempus Resources boast an impressive array of experience in natural resources finance, operations, and corporate executive roles, positioning the company to excel in its exploration and development efforts.

Leading the team is President & CEO, Jason Bahnsen, who brings over 30 years of experience in the resources industry. His background spans various roles in resource exploration and development companies, investment banking, and mining engineering. Bahnsen’s extensive experience at companies like Rio Tinto, Deutsche Bank, Macquarie Bank, and Fox Davies Capital has equipped him with the knowledge and skills to drive the strategic growth of Tempus Resources.

Exploration Manager, Sonny Bernales, has over 35 years of experience working on projects ranging from grassroots to advanced-stage across multiple commodities. Having served as a Senior Geologist and Project Manager for Mexican Gold Corporation, Bernales has honed his skills in project management and geology. His diverse experience in various mining companies across Canada, the Philippines, Indonesia, South Korea, Myanmar, and Mexico makes him a valuable asset to Tempus Resources as they advance their exploration efforts.

Non-Executive Chairman, Alexander Molyneux, has an impressive 25-year track record in corporate executive roles in mining and resource investment banking. Currently serving as Non-Executive Chairman for both Azarga Metals Group and Argosy Minerals Ltd., Molyneux’s experience in corporate roles at publicly listed companies and his knowledge in investment banking services make him an essential part of Tempus Resources’ leadership.

Lastly, Non-Executive Director, Jonathan Shellabear, brings over 30 years of experience in the mining and financial services industries to Tempus Resources. His diverse background spans technical, commercial, and financial disciplines. Shellabear’s extensive experience in capital markets, advisory roles, and senior executive positions in the gold industry, including his time as CEO of Dominion Mining Limited, makes him a vital member of the Tempus Resources board.

With this experienced and diverse team at the helm, Tempus Resources is well-positioned to drive exploration efforts forward, capitalizing on the potential of their flagship Elizabeth-Blackdome Gold Projects and other projects in their portfolio. This strong leadership, combined with the company’s strategic plans and robust growth potential, makes Tempus Resources a compelling investment opportunity in the gold exploration sector.

Conclusion

Tempus Resources, with its high-grade gold projects in British Columbia and Ecuador, has positioned itself as a gold exploration company with significant potential. The promising exploration results from the Elizabeth Gold Project, combined with the potential for a fast-track restart of the Blackdome Gold Mine, offer a strong foundation for future growth. The company’s strategic plans, including the upcoming 10,000-metre drill program and pending process plant and mill study, further highlight its commitment to unlocking the full potential of its mineral assets.

As Tempus Resources continues to develop its flagship Elizabeth-Blackdome Gold Projects and expands its exploration efforts in Ecuador, investors should closely monitor this growth-oriented gold exploration company. With high-grade gold mineralization, strategic project locations, and a focus on resource expansion and fast-track development, Tempus Resources is poised to make a significant impact in the gold mining industry.

Gold Market

In the broader context of the gold market, Trading Economics reports that gold fell below $2,000 an ounce on Monday as the US dollar gained ground after the recent non-farm payrolls report pointed to a tight labor market, supporting bets for another interest rate hike from the Federal Reserve in May. The markets are currently pricing in a 66% chance that the Fed would raise rates by 25 basis points next month. Investors are now looking ahead to key US inflation data on Wednesday for clues on the central bank’s tightening campaign. Furthermore, European Central Bank governing council member Klaas Knot suggested that a smaller quarter-point rate increase in May might be possible, voicing doubts about the need for another half-percentage point rate hike.

Gold is expected to trade at 1844.68 USD/t oz. by the end of this quarter, according to Trading Economics global macro models and analysts’ expectations. Given these market conditions, Tempus Resources’ focus on high-grade gold projects and its strategic growth plans offer an attractive opportunity for investors seeking exposure to the gold sector. As the company progresses in its development and exploration activities, it stands to benefit from potential shifts in the gold market and capitalize on opportunities that arise from changing market dynamics.

Here’s More

Our own Jody Vance sat down with Jason Bahnsen to get an inside look at the company, its portfolio and why investors should be putting the company on their investment radar. Check the video out here.

Equity Guru founder, Chris Parry, also gets into Tempus Resources laying out the company and how its bonanza grade results make an interesting investment opportunity. Check out his Three Minute Hits video here.