*originally published November 23, 2022

We here at Equity Guru are big fans of uranium. The commodity is still up 7% for the year, but could be on the verge of making another large run taking us back to the highs of 2022 and above.

In my most recent uranium weekly sector roundup, I discussed the range on uranium. Unfortunately, we did not breakout when uranium price tested the range highs:

The range still holds between $48.60-$53.60 with the breakout almost occurring just a few weeks ago. On the technicals, uranium bulls still need to be patient but a range provides a good time to search for and accumulate good uranium stocks while they are still cheap.

Longer term, analysts remain bullish on uranium. Recently, Amati Strategic Metals stated that the uranium outlook has turned favorable due to “accelerated decarbonisation initiatives and the emergence of financial players in the uranium spot market.”

“A supply deficit is forecast to continue for a few years, which is being exploited by financial players trying to soak up as much supply on the spot market, in an attempt to establish a more realistic incentive price for new supply coming onto the market,” says Lequime.

“In addition, the West is facing a real threat of a bifurcated world, where the continued source of cheap uranium is no longer guaranteed.”

A major upcoming catalyst could be a western ban on Russian uranium which is being discussed by European countries.

Citigroup sees a potential western ban on Russian uranium.

Citi’s uranium price bull case assumes the US, the UK, the EU and countries in Asia will introduce bans on Russian uranium supplies starting in 2023, based on publicly available information on ongoing discussions in the US Congress and the European Parliament.

In addition, any Russian-related projects would likely be halted in Eastern Europe, including reactor construction in Hungary, Slovakia and Turkey, Citi suggests.

Under this scenario, uranium production in Kazakhstan with Russian state-owned shares would also likely be banned from Western markets. Such an embargo would create a shortage of enriched products and add even further tightness in the conversion market in the short term, and provide a bid to the U3O8 price.

In a nutshell, there are real fundamental and technical reasons to be bullish on uranium. Nuclear energy is coming, and will be the solution for clean energy but perhaps an energy crisis in Europe could be what stirs action.

There are many ways to play uranium. Sprott’s Physical Uranium Trust (U.UN) and Uranium Royalty Corp are some of my favorites. It is also prudent holding near term uranium producers. However, uranium juniors and explorers will provide real alpha especially since they move with the price of uranium. Expect big moves!

Knowing that, we need to find a junior that is in a safe jurisdiction, has good assets, and is backed by a management team with success in this industry. Skyharbour Resources (SYH.V) fits the bill.

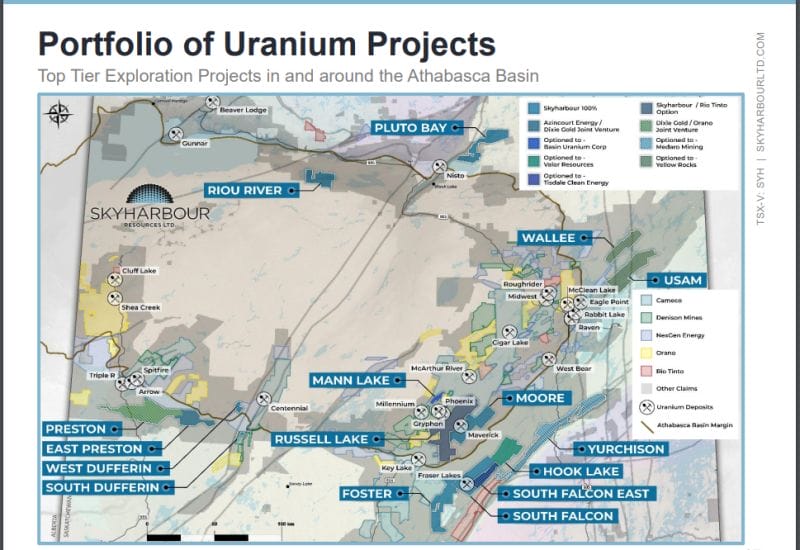

Skyharbour Resources (SYH.V) is a $50 million company that controls 15 uranium and thorium exploration projects in Canada’s famed Athabasca Basin. Ten of the projects are drill-ready, covering over 450,000 hectares of land.

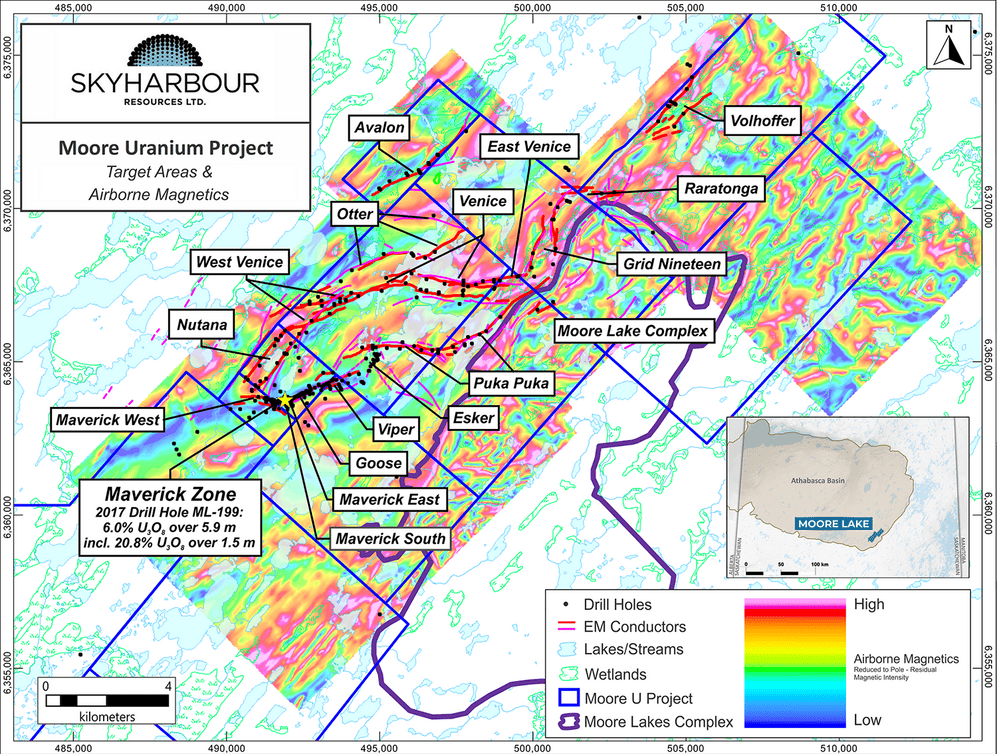

Skyharbour’s flagship project is the Moore Uranium Project which is located 15km east of Denison’s Wheeler River Project and 39km south of Cameco’s McArthur River Uranium Mine. Moore is an advanced-stage uranium exploration property with high-grade uranium mineralization at the Maverick Zone including highlight drill results of 6.0% U3O8 over 5.9 metres including 20.8% U3O8 over 1.5 metres at a vertical depth of 265 metres.

Spring 2022 drilling results at the Moore Uranium Project were recently released on October 13th 2022. Drilling totalled 2,467 metres in seven diamond drill holes. Four exploratory holes (ML22-01 to -04) were drilled at the Grid Nineteen target conductors, two exploratory holes (ML22-05 and -06) were drilled in the Viper target area, and one hole (ML22-07) was drilled at the Maverick East Zone.

- Hole ML22-07 was drilled within the western part of the Maverick East Zone. It intersected 5.0 metres of unconformity- and basement-hosted mineralization returning 0.13% U3O8 starting at 275.9 metres.

- Drilling in the Viper area continued to show that this part of the Maverick conductive corridor is geochemically anomalous with uranium mineralization of 0.11% U3O8 encountered over 1.0 metres in the basement of ML22-05.

- Drilling in the newly identified Grid Nineteen area continued to intersect structurally disrupted, altered, and geochemically anomalous sandstone and basement rocks, including variably graphitic pelitic gneisses. All four holes drilled in 2022 showed enrichment in uranium, boron, and other pathfinder elements, with up to 382 ppm U encountered in hole ML22-03 within graphitic pelitic gneisses. A significant unconformity offset was also discovered between holes ML21-07 and ML22-02, which is believed to be related to the strong structural disruption of the sandstone seen in three out of the four holes drilled here in 2022.

The next catalyst for investors would be the upcoming fully funded Winter drill program which will follow up on the encouraging Spring results.

On May 19, 2022 Skyharbour announced that it has entered into an Option Agreement with Rio Tinto Exploration to acquire up to 100% of the Russell Lake Uranium Project which comprises 26 claims covering 73,294 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west). Skyharbour has the option to acquire an initial 51% and up to 100% of Rio Tinto’s 73,294 ha Russell Lake Uranium Property strategically located in the central core of the Eastern Athabasca Basin of northern Saskatchewan.

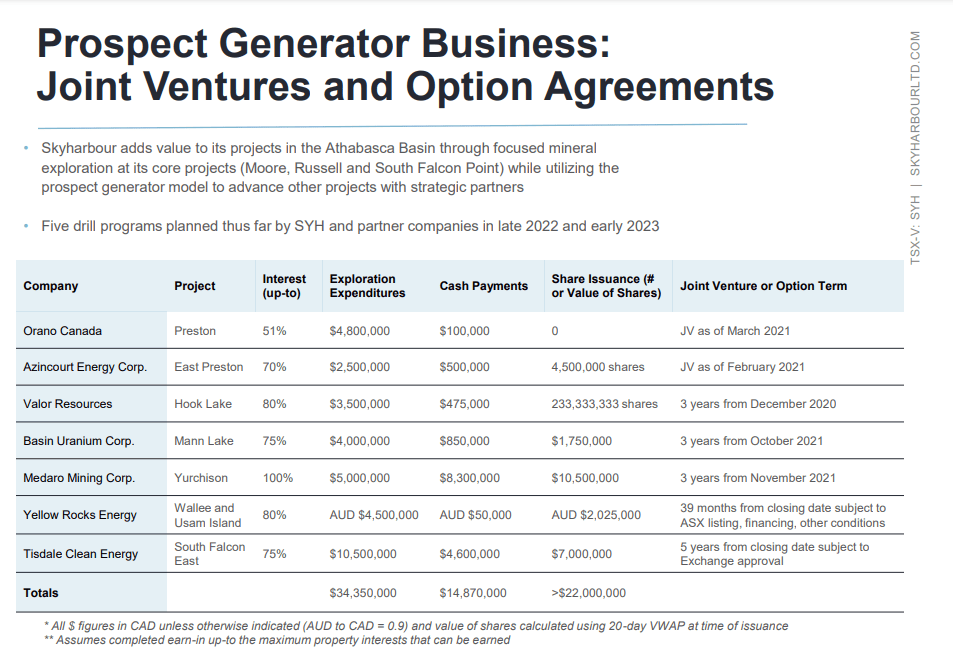

Denison and Rio Tinto are big names, but Skyharbour also has joint ventures and option agreements with other mining companies:

The most recent option agreement was announced on October 20th 2022 with Tisdale Clean Energy (TCEC.V). The agreement provides Tisdale with an earn-in option to acquire an initial 51% interest and up to 75% interest in the South Falcon East (SFE) property which makes up a portion of Skyharbour’s South Falcon Point project.

South Falcon Point is located in the Athabasca Basin and consists of 21 claims totaling 44,470 hectares and is 55 kilometres east of the Key Lake Mine. Of that, SFE totals approximately 12,464 hectares and lies 18 kilometres outside of the Athabasca Basin.

If Tisdale completes the 75% earn-in requirements, Tisdale will issue Skyharbour 1.11 million Tisdale shares upfront, fund exploration expenditures totaling $10.5 million CAD and pay Skyharbour $11.1 million in cash, of which $6.5 million can be settled for shares in the capital of Tisdale over the five-year earn-in period.

Jordan Trimble, president, and CEO of Skyharbour commented on the deal, “We are very excited to have this new Option Agreement signed as we continue to execute on our business model by adding value to our project base in the Athabasca Basin through strategic partnerships and prospect generation, as well as focused mineral exploration at our core projects of Moore and Russell Lake. We are looking forward to working with Tisdale Clean Energy and its management team as they advance the South Falcon East Project over the coming years with a substantial amount of exploration planned and significant cash and share payments to Skyharbour. Assuming the option earn-in is completed, Skyharbour will retain a minority interest in the project as well as an NSR while maintaining a 100% interest in the surrounding claims. News will be forthcoming on exploration plans at the Property and will complement our aggressive drill campaign forthcoming at Russell Lake as well as those at various other partner-funded projects in our portfolio.”

Before we look at the chart, a quick word on the notable and strategic shareholders:

These are some BIG names and big institutions/companies. The point is when it comes to mining explorers and juniors, there is always the risk that the geology doesn’t pan out. When you have big names and institutions like this holding the stock, you know that they are because they have a team who have done their due diligence and see potential in Skyharbour’s assets. A big plus for me.

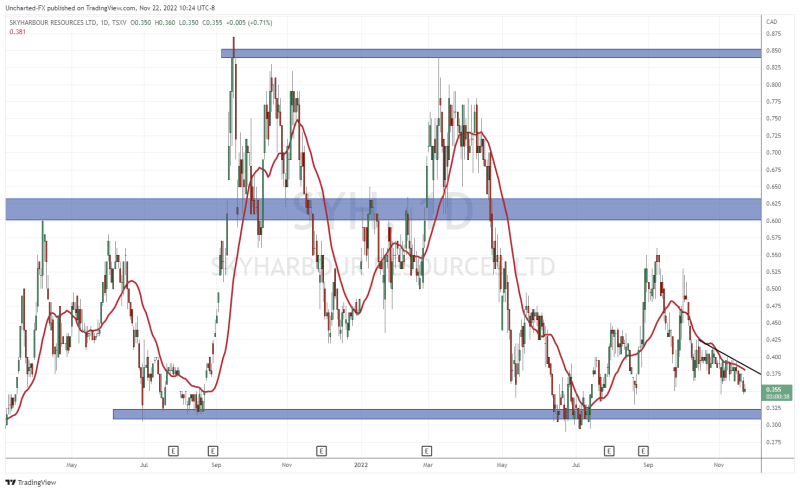

The stock has been ranging for a month but is now turning lower. A major support zone is approaching at the $0.30 zone. This zone has been held since June 2021. I expect there to be big buyers there. A close below this support would be quite bearish for the trajectory of this stock.

Ideally, we want to see a range or pattern develop at this support zone, just like we saw recently between June 14th 2022- July 15th 2022. This is a sign of selling exhaustion and a battle between the bulls and the bears, which the bulls win with a range breakout.

With uranium price looking to potentially drop to its lower end of the range, Skyharbour and other uranium stocks may follow.

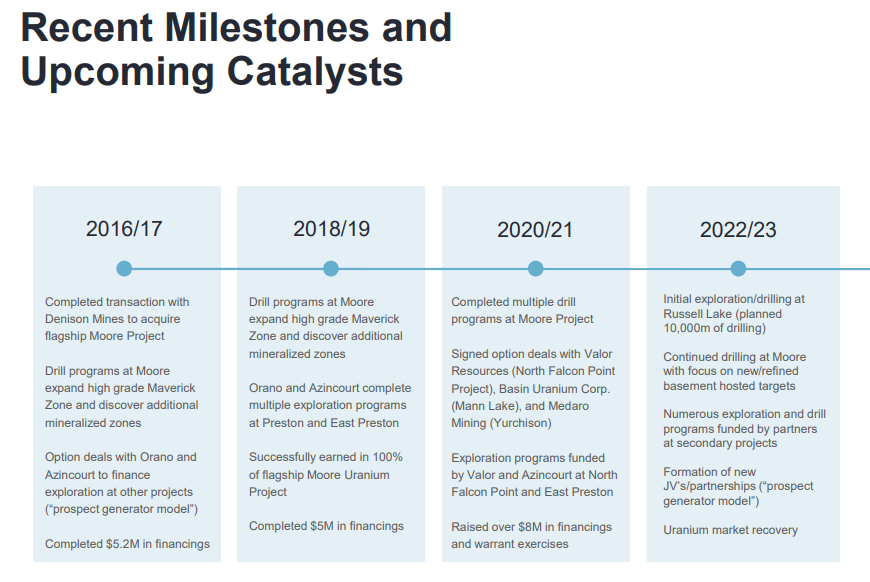

In terms of upcoming catalysts for Skyharbour, the Moore Lake follow up drilling and initial drilling at Russell Lake are at the top of the list.