Prismo Metals (PRIZ.CN) is a gold and silver explorer focused on metals exploration in Mexico. The company is leveraging decades of exploration experience on its team and holds two projects in underexplored districts in Mexico. Underexplored districts which have proven resources and produce top-tier assets.

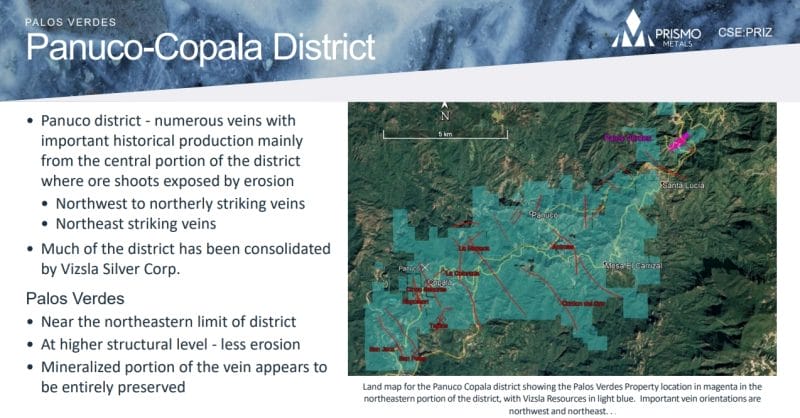

The Palos Verdes project is located in the historic Panuco vein district. This is a district with important historical production and has recently been consolidated by Vizsla Silver Corp. A stock that went from $0.20 to highs above $3.00 with the type of silver drill results they were pulling out of the ground in this district. We know there’s a lot of silver here.

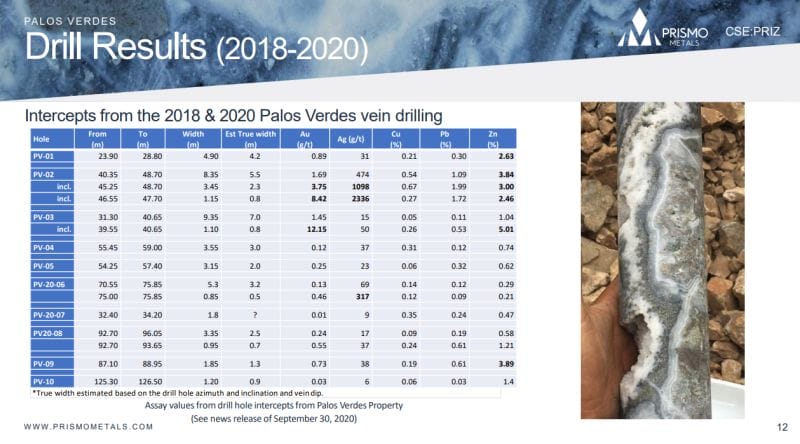

Prismo did some drilling here between 2018-2020. Here are the results:

Results from a current drill program which commenced in August 2022 is a near term catalyst for the stock. A total of 1,203 meters have been drilled to date out of a planned minimum of 2,000 metres. The Company expects to complete the current drilling in early November. The drilling program is designed to test the Palos Verdes vein at depths where it is believed that potential for a large ore shoot is present, similar to the drilling accomplished by Vizsla Silver Corp.

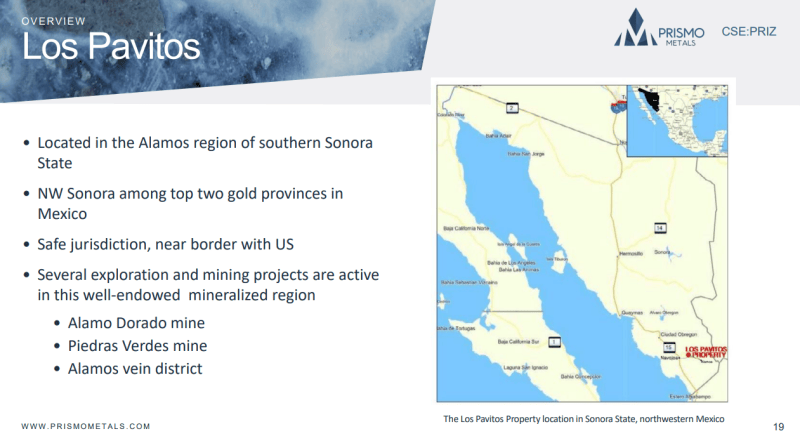

Prismo’s second project is the Los Pavitos project located in the Alamos region of southern Sonora State.

Prismo did exploration here in the first half of 2022 with assay results including 40g/t gold and 160 g/t silver.

The exciting part? Los Pavitos could host a deposit similar to deposits discovered and put into production over the last two decades in this district. We are talking about 15-20 million ounce gold deposits. An exciting discovery potential.

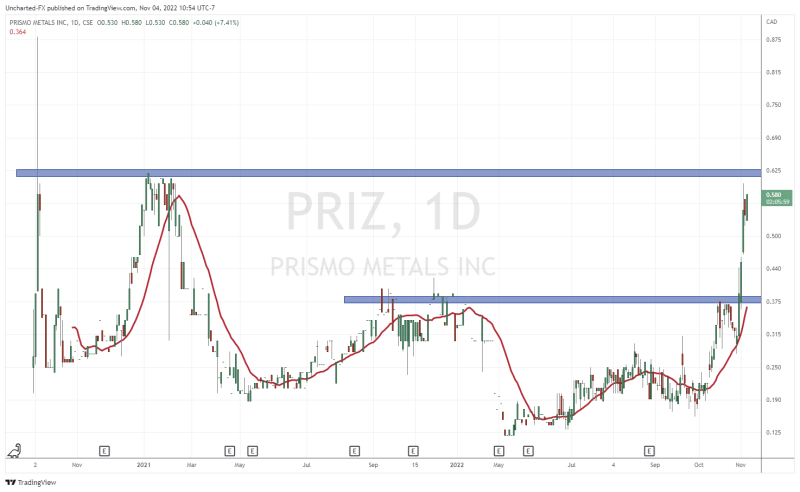

This exciting story is the reason why Prismo’s stock jumped over 90% this week (from October 31st 2022- November 4th 2022).

On October 31st 2022, Prismo Metals signed a formal access agreement with the Francisco Villa Ejido, the surface owners over the Los Pavitos project. This will allow Prismo Metals to conduct exploration and drilling work.

“This agreement allows Prismo to proceed with its drilling permit application, opening the door to a drilling program in early 2023,” said Dr. Craig Gibson President and CEO of the Company. He added: “While we are getting to work right away on the environmental permitting necessary for drilling, we are also continuing the geological mapping and sampling program to cover the remaining area as the basis for the more detailed work necessary for identifying drill targets.”

Markets loved the news:

The stock closed 25% on the 31st. The following day saw a 15% gain followed by another massive 22% close. From the beginning of October 31st to the highs printed on November 2nd 2022, the stock had a 92% gain. At time of writing, Prismo is still up 86% for the week!

Investors really are excited about the potential discovery at Los Pavitos. Drilling is now the next catalyst for the stock.

From a technical perspective, a close above $0.375 confirmed a breakout. Notice that this price zone has been resistance going back to Fall of 2021. It is now broken which means a technical breakout is in play.

Going forward, as long as Prismo Metals remains above $0.375, more highs are in store as we continue this new uptrend. I am looking for higher lows for entry.

For those wanting to get in, be a bit cautious. With gains like this, some investors are likely to take some profits off the table. But as I said, as long as $0.375 holds, we will have plenty of opportunities to buy dips.

The stock could potentially drop all the way back to $0.375 which would be typical breakout and retest action. But with the momentum I am seeing, this seems highly unlikely.

I am watching the resistance zone here at $0.625.

As you can see from the left, this is a very important resistance zone for the stock as we approach previous record all time highs. But this zone is technically where Prismo made all time record CLOSES. So a break above would be making new records.

If we close above $0.625 on the daily chart, then we can apply the same breakout and retest play. This time, our target would be previous highs at $0.88.

The Guru himself, Chris Parry, has been notifying investors about the opportunity and the exciting story with Prismo Metals. He has been talking about this stock when it was well below $0.25. Tune into his recent video to find out what comes next for Prismo.