As supply chains wreak havoc on many commodities, uranium is safe… for now.

The world’s largest uranium miner, Kazakhstan’s Kazatomprom, said that its uranium continues to pass through St. Petersburg, and to date, there are no restrictions on its activities related to the supply of its products to customers worldwide.

In recent Q3 results, management said they would continue to monitor the growing list of sanctions on Russia and their potential impact on the transportation of uranium through Russian territory. Q3 saw uranium being shipped via St Petersburg without any disruptions or logistical/insurance issues.

Last week I spoke about uranium prices potentially breaking out and Russia being the case. ROSATOM is not under Western sanctions after the Russian invasion of Ukraine because of the Russian state firm’s importance in the supply chain of the global nuclear power industry. But this could change.

Citigroup sees a potential western ban on Russian uranium.

Citi’s uranium price bull case assumes the US, the UK, the EU and countries in Asia will introduce bans on Russian uranium supplies starting in 2023, based on publicly available information on ongoing discussions in the US Congress and the European Parliament.

In addition, any Russian-related projects would likely be halted in Eastern Europe, including reactor construction in Hungary, Slovakia and Turkey, Citi suggests.

Under this scenario, uranium production in Kazakhstan with Russian state-owned shares would also likely be banned from Western markets. Such an embargo would create a shortage of enriched products and add even further tightness in the conversion market in the short term, and provide a bid to the U3O8 price.

If this is the case, the world’s largest uranium producer has a plan. The Trans-Caspian Transport Route (TITR) is an alternative to the St Petersburg route and has been used by Kazatomprom since 2018. Primarily being used to help mitigate the risk of the primary St Petersburg route being unavailable.

Kazatomprom is now working to increase the quota limit for the TITR route, and is assisting its joint venture partners “if they would prefer not to receive their share of material via the established route that passes through the port of St Petersburg.”

TITR route requires Kazatomprom to use chartered sea vessels on the black sea rather than commercial shipping companies. To ensure cost efficiency, the shipment must be consolidated at the Port of Poti in the country of Georgia. Currently, there are no issues of shipment reaching the Port of Poti. However, Kazatomprom’s joint venture operations can see delays due to requirements of transit country authorities. We have seen this with a joint venture shipment between Kazatomprom and Cameco seeing delays at the Port of Poti.

Going forward, TITR related jurisdiction arrangements are being reviewed, and until then, there are elevated risks of transportation delays.

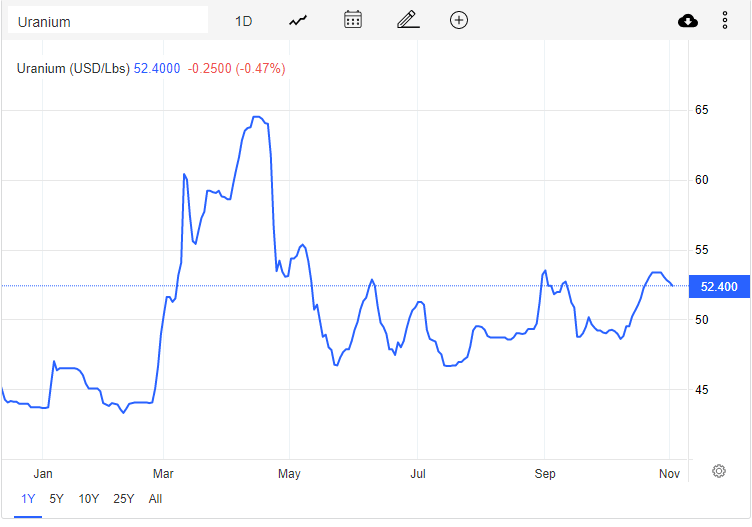

Uranium prices continue to hold our range. Remember, the breakout trigger requires a close above $53.50. If this does not happen, spot uranium could continue to range between $46.60 and $53.50 until we get some major fundamental catalyst.

Here is what happened with the Athabasca basin based uranium companies this week:

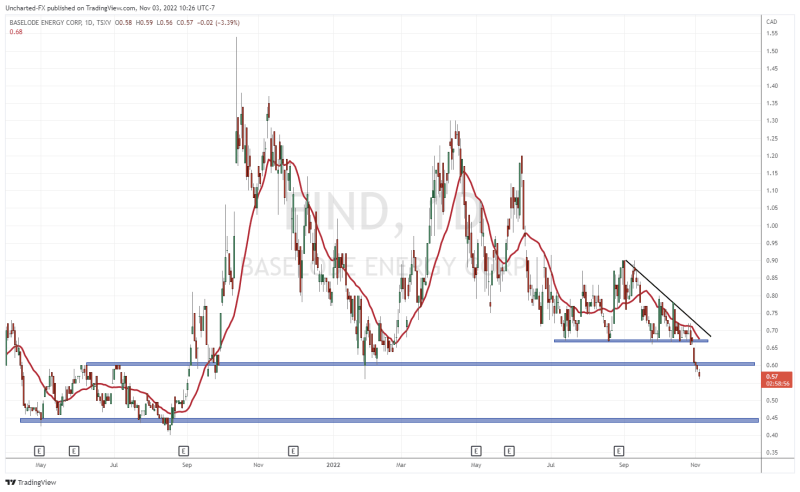

Baselode Energy (FIND.V)

Baselode Energy is an uranium explorer looking for the next world class deposit in the Athabasca region. The company is focused on discovering ear-surface, basement-hosted, high-grade Uranium orebodies outside of the Athabasca Basin. The company controls approximately 227,000 hectares for exploration.

Last week, the company outlined 2023 exploration plans. This week, the company announced a brokered private placement for CAD $10 million. A sale of 10,204,082 flow-through units of the Company is to be sold to charitable purchasers at a price of CAD $0.98 per unit for gross proceeds of CAD $10 million.

Each unit will consist of one common share and one half of one common share purchase warrant. Each warrant will entitle the holder to purchase one common share of Baselode at a price of CAD $0.90 at any time on or before that date which is 24 months after the closing date of the offering.

Baselode intends to use the proceeds for exploration of the company’s projects in the Athabasca basin. Funding their 2023 exploration plans.

The stock has broken below $0.60 support and until it can close back above it, more downside is possible. The stock attempted to hold above support at $0.67 but financing news saw the stock take a hit.

The next support level comes in at $0.45, but $0.50 is also an important psychological zone which will see some reaction.

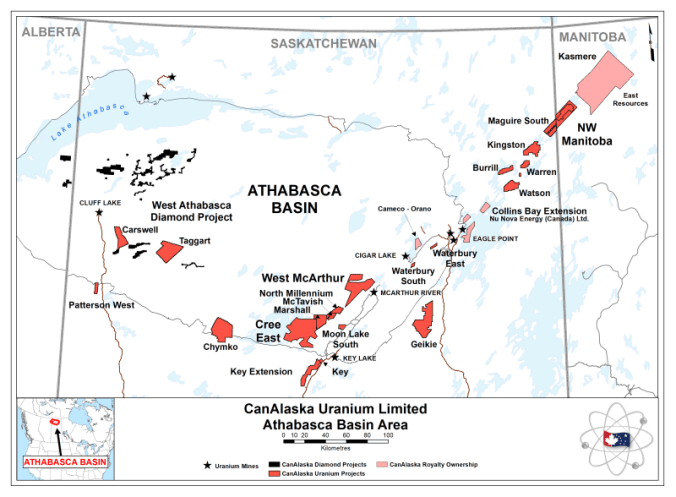

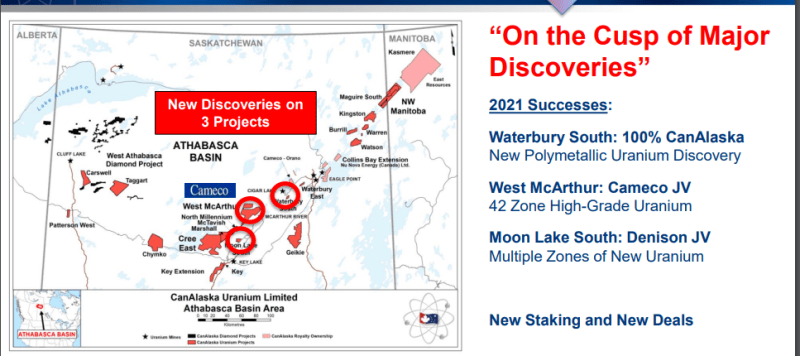

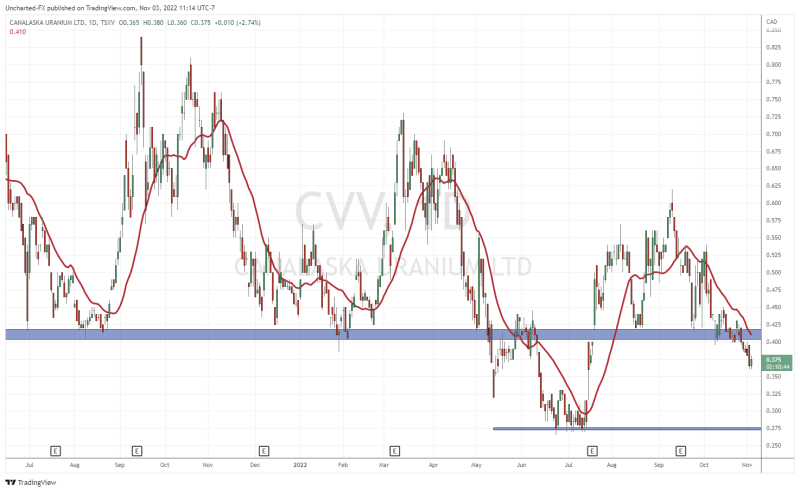

CanAlaska Uranium (CVV.V)

CanAlaska is a junior which holds one of the largest uranium exploration portfolios in the Athabasca region. CanAlaska Uranium Ltd. holds interests in approximately 300,000 hectares (750,000 acres), strategically located in the eastern Athabasca Basin. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin.

The company is a project generator and also holds nickel, copper, gold and diamonds prospective projects.

The company completed a CAD $10 million financing. CanAlaska will be issuing 13,173,212 units for gross proceeds of $6,850,070.24 and 4,499,900 charity flow through units for gross proceeds of $3,149,930 for total gross proceeds of $10,000,000.24.

The stock recently broke below a major support level at the $0.40 zone. CanAlaska needs to close back above and reclaim $0.40 in order to begin a new uptrend. Otherwise, the next support level comes in at $0.275.

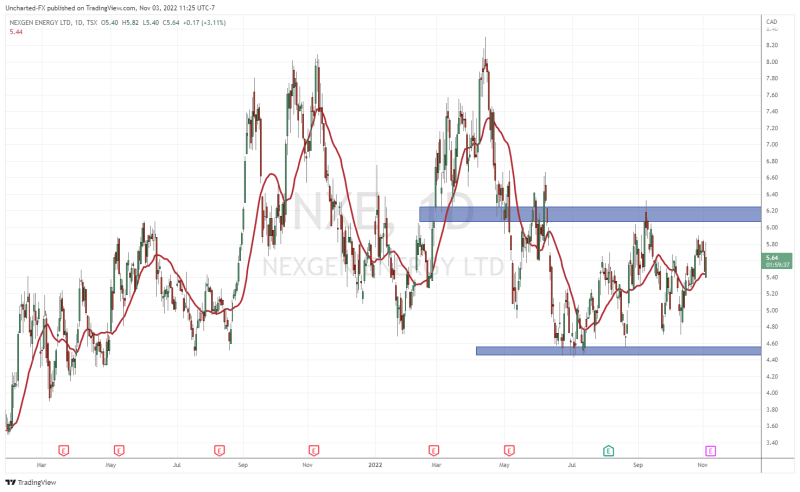

NexGen Energy (NXE.TO)

NexGen Energy is developing the Rook I project located in the southwestern Athabasca Basin into production. The project has a NI 43-101 compliant feasibility study which outlines environmental performance and industry leading economics.

Rook I hosts the Arrow Deposit that hosts Measured Mineral Resources of 209.6 M lbs of U3O8 contained in 2.18 M tonnes grading 4.35% U3O8, Indicated Mineral Resources of 47.1 M lbs of U3O8 contained in 1.57 M tonnes grading 1.36% U3O8, and Inferred Mineral Resources of 80.7 M lbs of U3O8 contained in 4.40 M tonnes grading 0.83% U3O8.

This week, NexGen released its 2021 sustainability report highlighting programs, initiatives and organizational frameworks created to deliver positivity for as many people as possible. Heavy ESG stuff.

Leigh Curyer, Chief Executive Officer commented: “The principles of NexGen’s approach to sustainability aren’t dependent on the stage of our development – it’s a focus that’s embedded into our daily business decision making across the organization. The Report demonstrates seamless integration of sustainability across all areas of people and project development, execution and operations, and long-term strategic planning. It reflects NexGen’s ‘elite standards’ approach to everything we do and is a great insight into the philosophy of how we’ve conducted our business since inception.”

Benefit Agreements: NexGen signed Benefit Agreements with the Buffalo River Dene Nation and Birch Narrows Dene Nation covering all phases of the Rook I Project including closure, and formalizing NexGen’s commitment to work in partnership with all local communities, with the mutual objective to responsibly develop the Rook I Project. In early 2022 NexGen and the Clearwater River Dene Nation signed a third Benefit Agreement.

Greenhouse Gas (“GHG”) Emissions Inventory: In order to help understand the Company’s impacts, NexGen carried out a GHG Emissions Inventory for the period 2013 (since Company going public)-2021, using the operational control approach with geographic boundaries set to include the Company’s Saskatoon and Vancouver offices and the Rook I property.

Integrated Management System (“IMS”): NexGen implemented an IMS for all employees and contractors with robust occupational health and safety processes and established a joint Occupational Health and Safety Committee (“OHC”) for the Rook I site during field activities.

The stock continues to range between $4.60 and $6.20 just awaiting major catalysts. This isn’t a stock to trade though as they are sitting on a large advanced project and production is the goal.

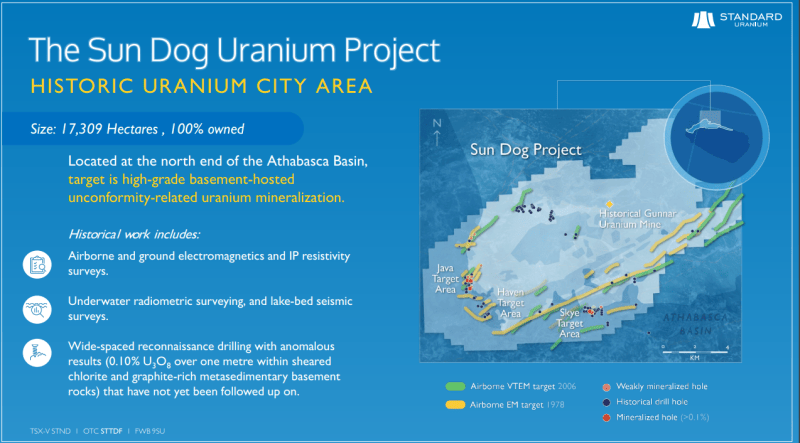

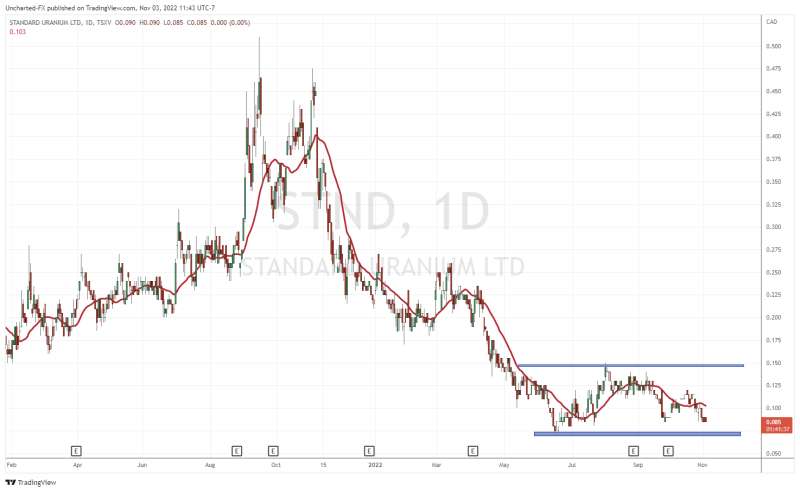

Standard Uranium (STND.V)

Standard Uranium is an exploration company and evaluates, acquires and develops uranium properties in Canada. Its flagship project is the Davidson River Project. The Davidson River Project is located in the heart of the Patterson Lake Uranium District (Southwest Athabasca region). Surrounded by major players in uranium exploration and development including Cameco, Orano, NexGen, Fission Uranium, Fission 3.0, Denison, Purepoint, UEX, ALX and Skyharbour. Other projects include the Sun Dog and East Basin Projects.

In a recent press release, Standard Uranium announced it will be following up on prospective drilling results from 2022 on its flagship Davidson River Project (“Davidson River”) in the southwestern corner of the Basin and its 100% owned Sun Dog Project (“Sun Dog”) near Uranium City, Saskatchewan. In addition, the Company has planned inaugural drill programs over two of its three 100% owned projects in the eastern side of the Basin, which are drill ready following successful geophysical surveys that were completed throughout 2022.

Today, the company announced analytical highlights from the winter drill program and details of the fall mapping program at its 100% owned Sun Dog Project, which is located at the northwestern edge of the Athabasca Basin.

Here are the key points from the results:

- Analytical data from Sun Dog drilling revealed elevated pathfinder elements and spectroscopy confirms presence of significant dravite alteration, indicating proximity to uranium mineralization.

- Elevated uranium is present in drill holes SD-22-001, -002, and -003, related to graphitic structures and/or hydrothermal breccias with pervasive hematite alteration.

- Elevated uranium in the basement exceeds thorium values by a factor of 2 or more in multiple intervals supporting a hydrothermal input for uranium emplacement.

- Several high-priority drill targets have been identified for the 2023 drill program.

- Additional radioactivity >65,535 counts per second discovered at surface during fall mapping program.

Standard Uranium has been in a downtrend and is now in the range, or consolidation phase. This is positive for technical traders as a consolidation is a phase which tends to come before a new uptrend.

Support comes in at $0.07 (which is the previous record all time lows) and resistance comes in at $0.145. Support is an area where buyers enter and we can expect to see a wall of buyers at $0.07. For those wanting to enter on a technical breakout, we would need $0.145 to break. This triggers the end of the range and the beginning of a new uptrend.