NioCorp Developments (NB.TO) announced today that its demonstration processing plant in Quebec, has now completed demonstrating its planned process for removing calcium and magnesium ore from the Elk Creek Critical Minerals Project, the second largest indicated-or-better rare earth resource in the US.

This is part of the phase 1 operations of the demonstration plant, and is a key milestone in NioCorp’s optimized process flow sheet for the project, which was designed by L3 Process Innovation (L3). Thermal heat and leaching is used to remove calcium and magnesium carbonates from the ore. This is a well-known and time-tested process. This step has successfully been completed, and the removed calcium and magnesium were produced at demonstration scale as a mixed calcium and magnesium carbonate. Removing these carbonate minerals is expected to reduce the size of the follow-on planned production steps and make them more efficient.

The Elk Creek resource is a carbonatite and its mineralization is largely carbonate minerals. However, as of now, NioCorp does not include calcium or magnesium as part of the project’s resource estimate. But due to the successful completion of the phase 1 operations, NioCorp expects to conduct an assessment of adding both calcium and magnesium to the mineral resource with sufficient exploration and sampling. NioCorp will also assess the salability of the material that was produced from the demonstration plant once sufficient funding for the project financing is obtained.

“The team at L3 has been working very hard to complete Phase I of the demonstration plant and deliver results. We look forward to the completion of the remainder of the demonstration plant operations, and most importantly, the rare earth metallurgical performance metrics showing the full potential economic benefits of rare earths for the Elk Creek Project,” said Scott Honan, NioCorp’s Chief Operating Officer.

What comes next? Phase 1 plant operations will continue and ramp up leaching operations as testwork and assembly for phase II and III. Here is a recap of the demonstration plant phases:

- Phase 1 is designed to demonstrate a new approach to the initial processing of the ore that NioCorp expects to mine from the Project site, subject to receipt of necessary project funding, including calcination, initial leaching, and rare earth extraction.

- Phase 2 is designed to demonstrate an improved process for the second stage of leaching along with Niobium and Titanium separation.

- Phase 3 is designed to demonstrate the technical viability of separating high-purity versions of several target magnetic rare earth products from Elk Creek ore samples, as well as confirming previously achieved high recovery rates for high-purity Scandium trioxide. The potential magnetic rare earth products include Neodymium-Praseodymium (“NdPr”) oxide, Dysprosium oxide, and Terbium oxide. NioCorp will utilize conventional solvent extraction (“SX”) technology to test a rare earth separation approach developed by NioCorp and L3. NioCorp and L3 have years of collective experience in SX technology.

NioCorp has been a hot stock with plenty of fundamentals backing the stock. Recently, the company announced the acquisition of a SPAC which will see NioCorp listed on the NASDAQ exchange in the US. This will give NioCorp access to as much as $285 million in net cash from the GXII (SPAC) trust account which can be deployed to advance the Elk Creek Critical Minerals Project.

Elk Creek is the second largest indicated-or-better rare earth resource in the US. The project is advanced and is ready for production. All that is required is financing. Personally, I believe this project will go into production given the geopolitical tension with China and the Biden administration’s new tax benefits for domestic production. More domestic production will be coming online to meet the demand for rare earth minerals.

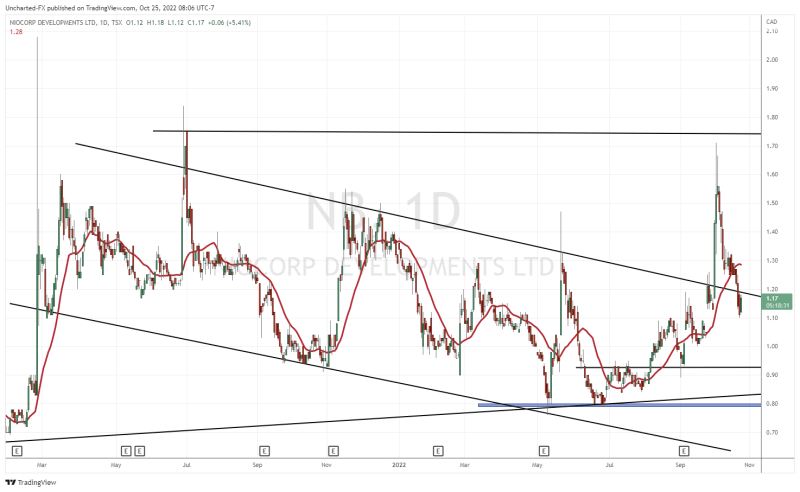

NioCorp stock has been on a tear. The stock saw a rise up to $1.71 with the stock breaking out with the SPAC news and when it was announced that CEO Mark Smith would appear on Fox Business News’ “The Claman Countdown”. Getting US investors prepped and excited for NioCorp’s upcoming US NASDAQ listing.

We have seen the stock fall now to $1.16 and it is from a combination of the broader markets dropping, and traders taking profits from the large pop.

The stock did break above my trendline triggering a breakout, but we have now closed back below it. Today’s candle is retesting the trendline break at $1.20, which is current resistance. Support comes in at $1.10, and I would be watching the $1.00 psychologically important zone.

At time of writing, the stock is up over 4.5% with 34,980 shares traded.