Clearwater Lithium Project

- $137.47M Market Capitalization

E3 Lithium (ETL.V) announced today that it has received TSX Venture Exchange approval to issue 3,413,979 prepaid warrants to Imperial Oil Limited (IMO.T). In addition to these warrants, the Company has also received approval to issue 128,024 common shares to the finder with respect to E3 Lithium’s transaction with Imperial Oil. E3 Lithium is now poised to begin advancing the Clearwater Lithium Project.

“E3 Lithium is pleased to have completed the agreement with Imperial Oil and we look forward to working closely with their team to rapidly advance our Clearwater Lithium Project development,” commented Chris Doornbos, E3 Lithium’s CEO.

To begin with, E3 Lithium’s partnership with Imperial is intended to advance the Company’s Clearwater Lithium Project. What is the Clearwater Lithium Project? Put simply, this project is expected to draw lithium from below the Leduc oil field. To provide some background, the Leduc oil field is where the historic Leduc No. 1 crude oil discovery was made.

Interestingly, Leduc No. 1 was first discovered by Imperial, however, it was not an easy discovery. At the time, Imperial had drilled 133 dry holes in a row with no luck. Just as Imperial was about to call it quits, the company struck gold, or oil in this case, approximately 15 kilometers (km) west of Edmonton in 1947. Thus began Alberta’s oil boom, bringing economic wealth to the province.

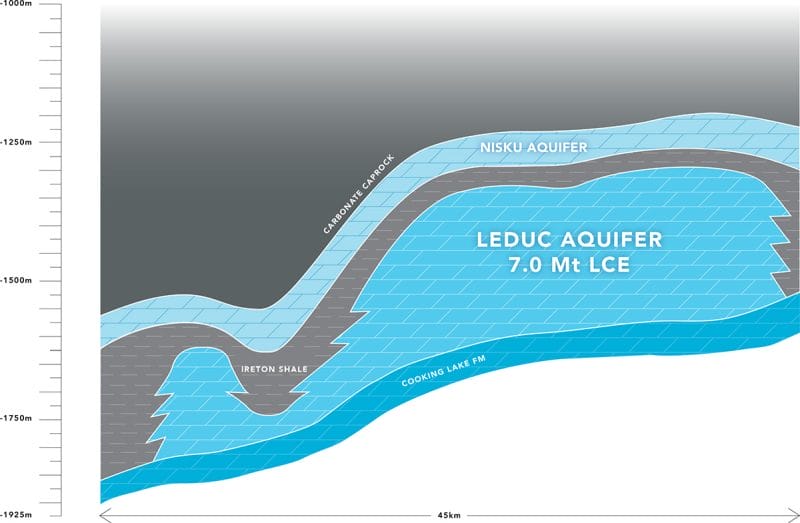

With this in mind, E3 Lithium is looking to revive the Leduc oil field via its Clearwater Project. Through this project, instead of oil, the Company will source lithium from the production of brine water taken deep below the surface. Utilizing E3 Lithium’s Direct Lithium Extraction (DLE) technology, the Company is capable of reducing large volumes of low-grade brine into high-grade lithium concentrate.

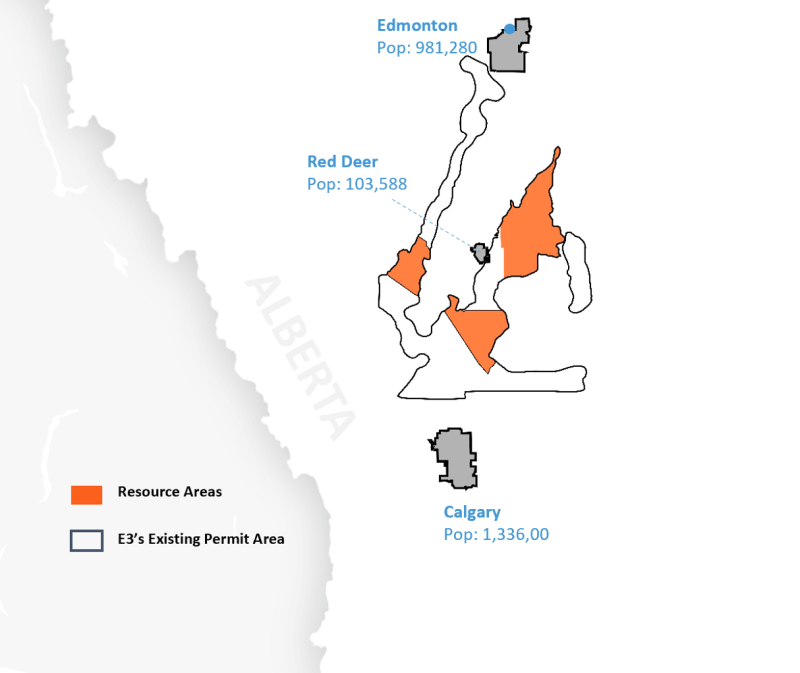

E3 Lithium possesses three resource areas in Alberta, namely Clearwater, Rocky, and Exshaw. In total, E3 Lithium boasts 7 million tonnes of lithium carbonate equivalent (LCE), hosted in the Company’s Leduc Aquifer. For context, an aquifer refers to a body or rock and sediment that is capable of holding groundwater. In particular, Clearwater is host to 2.2 million tonnes of LCE within the Leduc Aquifer.

If you’re a sustainability nut like myself, E3 Lithium appears to be doing its part to reduce its carbon footprint. For example, 100% of the brine brought to the surface for lithium extraction is recycled and injected back into the aquifer. Furthermore, the Company claims that, in addition to reduced carbon emissions, it uses 97% less land and potentially requires no fresh water.

At closing yesterday, E3 Lithium issued and delivered the prepaid warrants to Imperial against receipt of the sum of CAD$6.35 million. Moreover, the Company also issued and delivered the finder’s shares as well as paid the finder’s fee, which amounted to CAD$79,375. If you would like to know more about E3 Lithium’s collaboration with Imperial, check out this article.

E3 Lithium’s latest news comes shortly after the Company announced the successful development of a battery made using DLE-produced lithium. With this in mind, E3 Lithium is making headway in the global lithium market, which is poised to reach USD$8.2 billion by 2028, expanding at a compound annual growth rate (CAGR) of 14.8% between 2021 and 2028.

E3 Lithium’s share price opened at $2.38 today, up from a previous close of $2.35. The Company’s shares were up 1.28% and were trading at $2.38 as of 1:38 PM EDT.