We here at Equity Guru have been bullish on all commodities, but particularly the precious metals and oil. From a technical analyst’s perspective, oil was breaking above key resistance zones. We have been warning about this since 2021.

The thing about technicals is we know where prices could be heading. The charts show us market sentiment and human psychology. We just don’t have a crystal ball to tell us WHY oil prices are heading there. The news LAGS the technicals. Our best guess on why oil prices would be higher was the inflation trade. I still think this will be driving oil prices higher in the future, but of course we know why energy is popping. Russia-Ukraine.

It doesn’t need to be said how large of an energy exporter Russia is. With SWIFT restrictions coming in, Russia may find it tougher to export oil and gas. I say may, because I believe some Russian banks that deal with energy are exempt. The Europeans still technically need Russian gas.

We have also seen the US and allies try to bring oil prices down by releasing reserves. The US and 30 countries have committed to release 60 million barrels of oil from strategic reserves to stabilize global energy markets. We saw President Biden do this before, but his ‘OPEC war’ was lost in a short amount of time. Geopolitically, China might still stock up, and who knows what the Saudis are thinking. They probably love these high prices and we have seen Mohammed Bin Salman and President Putin become close friends. Yes I am talking about that meme:

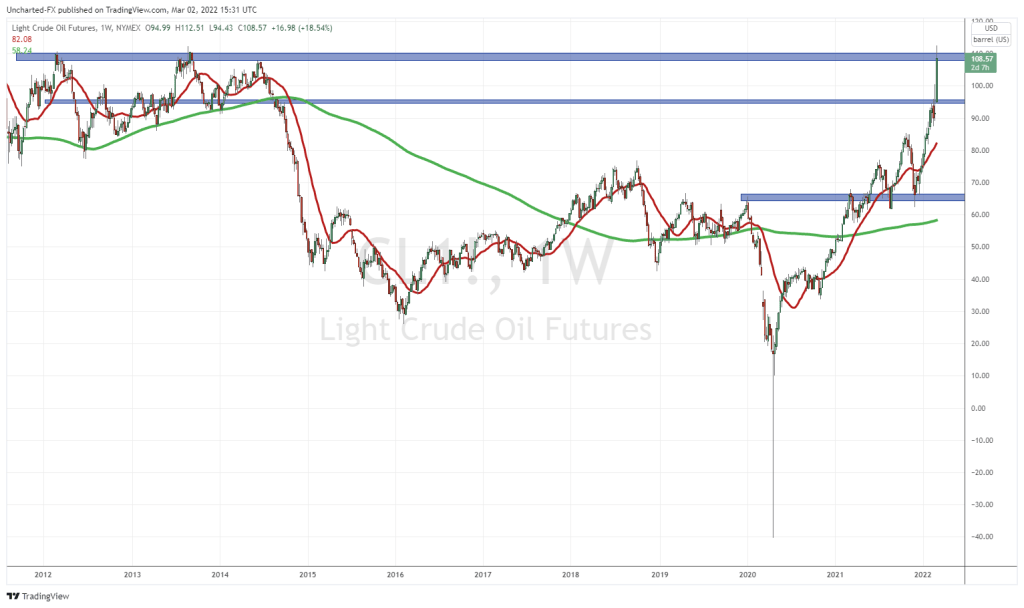

Getting to the charts, oil has hit all of our resistance zones which I highlighted in January of 2022, and just last month in February. We were already making new records back then, and the big psychological number of $100 has been penetrated.

Above is the weekly chart of US Oil. Today, we made 9 year highs with price hitting $112.51 on the highs of the day. Since then, we are pulling back. Which is what I expect…and hope for us consumers. But more on that in a bit.

Let’s just get the weekly chart out of the way. Our major resistance has been reached, and we should expect to see a pullback from here. The $100 zone is an obvious support level, but I would also say so is $95. You will see why on the daily chart below.

If things escalate in Russia-Ukraine and the weekly candle closes ABOVE $110 on Friday close…then we have a weekly chart breakout. We would then be looking at $120…and then a test towards all time record highs around $140.

We had a monster rally yesterday. U.S. oil benchmark, jumped 11.5% at the highs of the day to $106.78 per barrel. The contract eased off that level during afternoon trading and ended the session at $103.41, for a gain of 8.03%. At time of writing, we are up 4.9% on March 2nd 2022.

Note how we are rejecting our $110 resistance zone though. A nice wick so far indicating sellers. However, this can easily change throughout the day. Hope is we form some sort of pinbar candle here, and prices can pullback in the next few days.

When oil shoots higher, I watch the oil currencies: the Russian Ruble, the Canadian Loonie, and the Norwegian Krone. Obviously the Russian Ruble isn’t the best judge right now given the SWIFT issue.

The Canadian Loonie and the Norwegian Krone, which are positively correlated with oil prices, have not moved up. They have weakened against the USD. Not really what we would expect, and provides some concern. However, I think this goes to tell us that the fear trade is ongoing. Money will run into the US Dollar for safety. Makes sense when you are the safe haven fiat, although I know many contrarians will disagree.

We have established where prices could be heading. But what does higher oil prices mean for your money?

Inflation will pick up. Things will get more expensive. Sure, you will be paying more at the pumps, but you will also be paying more at stores. Transportation costs will be moving higher, which means higher prices for goods. We know this will impact food prices, which will see a double whammy because agricultural commodities are also skyrocketing. Check out my weekly Agriculture Sector roundups released every Friday to stay in the loop!

With central banks raising rates, this will also pinch the consumer. Canada just hiked 25 basis points to 0.50%. Doesn’t seem much, but for an indebted consumer, it means more money out of the pocket. Not to mention that most Canadians have a variable mortgage.

Funnily enough, higher oil prices might be enough to spur a recession. People might begin to save more rather than spend due to the higher prices of transport and everything else. If this happens, then central banks will not be aggressively hiking rates as once thought. We could be very well talking about central banks CUTTING interest rates late Q2 and Q3 because of a recession. 2022 is setting up for a crazy year, and we still haven’t completed Q1!