We’ve been warning about rising oil prices over here on Equity Guru. Been talking about oil being a part of the inflation trade over on Market Moment for a few months now. Recently, we here at Equity Guru have been covering oil companies like Southern Energy and InPlay Oil. I suggest you read our deep dives about the company. Inplay Oil can be read here. Southern Energy can be read here. I also want to highlight my technical Chart Attack where I covered the oil chart.

To cut a long story short, our analysis has come true. We still have room to the upside here on oil. Before we jump into the charts and targets (sort of spoiled by my title), let’s talk about some fundamentals.

Why is oil rising? A few months ago, I spoke about the Biden oil price war. President Biden and a few nations decided to release reserves to flood supply in order to bring oil prices down. He wanted OPEC plus to do the US and the rest of the world a favor and increase production to drop prices. However, members like Russia and Iran likely have no intention of doing the US a favor. Oil prices slightly dropped on the price war, but it is clear to see that OPEC plus won.

Oil has now taken out 2021 highs, and people are wondering what is behind this?

Jeff Currie, the head of commodities research at Goldman Sachs, has been warning of a commodities super cycle. He is super bullish on oil and copper. He believes the oil markets are currently in a big deficit of 2% of global demand, with inventories about 5% below their 5-year moving average.

“relative to oil prices, the sector looks cheap. Free cash flow yields are very attractive, capital discipline has improved, and the sector should benefit as demand recovers.”

The commodities expert adds that stretched equity valuations and low Treasury yields make commodities even more attractive for investors wary of the high risks in these markets but still hunting for decent returns. In other words, commodities not only offer good prospects on a pure return basis but can also be a good hedge against growing market volatility. Very similar to our approach on commodities long term trade. Compared to everything else, they look cheap, and tend to do well in inflationary periods as money runs into hard, tangible assets.

Mr. Currie came out today saying he expects an oil price of $105 in the second half of 2022.

Besides the fact that commodities still look cheap compared to everything else, here are a few observations I have noted in my trading journal.

The breakout is being attributed to an explosion of an Iraq-Turkey pipeline. But it has reopened now, and it does not explain the rise in oil before.

I am looking at this from three angles.

Is it an inflation trade? I think for sure money will head into commodities just as Mr. Currie has said. However, recent price action in the markets have seen other commodities drop. Even some inflation hedges like gold were dropping. So I think something else may have been brewing.

Is it due to economic growth? I don’t think so. We have seen the US come out with bad retail sales and employment numbers. More importantly, China, which is often used as the gauge for world economic growth, two days ago cut interest rates to boost a weak economy.

The geopolitical element makes a lot of sense to me. I am singling out Russia. We have seen tensions rise between Russia and Ukraine. Canada has sent special forces, and US Secretary of State, Antony Blinken, headed over to Kiev amongst headlines of a Russian invasion anytime. I would say this counts as a black swan if it occurred. It is something that would see stock markets fall, and oil rise. This is a key point because oil tends to prop up financials and energy, which are two large market sectors.

Furthermore, with the rise in oil prices, we did not see the oil currencies such as the Canadian Loonie, the Norwegian Krone or the Russian Ruble rise in tandem. Money is running into the US dollar. So a tricky situation where this Dollar rise could be seen as markets pricing in Fed hawkishness and rising rates… or a run into safety given the geopolitical situation. Keep watching the oil and dollar charts folks.

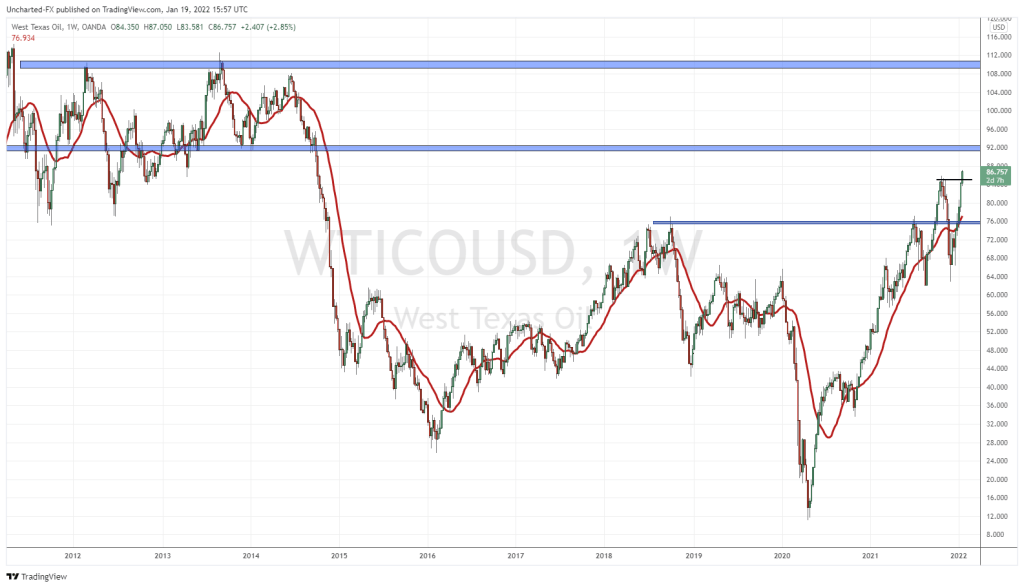

Oil has broken above 2021’s highs, and has not seen price levels like this for seven years. Just a typical breakout for us. We may see a retest, but oil is bullish above $84. Where to next? Well, let’s zoom out shall we?

Above is the weekly chart of West Texas oil. I have a major resistance zone around $92, and then another one much higher at $110. Of course it is prudent to see how prices react at the psychological resistance levels of $90 and $100. To be honest, $90 and $92 can be tested very soon. Maybe even by the end of January 2022.

What does this mean for the middle class? More pain. Energy inflation is obviously moving higher, but so will food inflation, and many other things. Transportation costs are rising, and that extra cost will be transferred to the consumer. Food prices will rise. Consider this with the fact the central banks might begin to hike interest rates. It will make things much tougher since many members of the middle class have a lot of debt. Just seems like they are being pinched.

In summary, oil has triggered a major breakout, and it seems we have a date with $90-$100 a barrel oil. Commodities will continue to get a bid as they are cheap compared to other parts of the market. Oil will also be buoyed by geopolitical volatility.