Factory Farming Crisis

CULT Food Sciences Corp. (CULT.C) is an innovative investment platform with an exclusive focus on clean, lab-grown food. The Company is committed to the development of novel technologies to provide a sustainable, environmental, and ethical solution to the global factory farming crisis. For context, factory farming entails rearing livestock using intensive methods, whereby animals are raised indoors in conditions intended to maximize production at a minimal cost.

More often than not, these conditions are far from sanitary, increasing the risk of pathogens like E. coli and salmonella that cause food-borne illness in people. Additionally, factory farming is responsible for pumping our atmosphere full of greenhouse gases (GHG). Factory farming also required forest clearance to grow crops and rear animals, which reduces vital carbon sinks.

With this in mind, livestock farming produces 37% and 65% of our global methane and nitrous oxide emissions, respectively. In total, animal agriculture is responsible for 18% of all worldwide GHG emissions and accounts for 56% of water usage in the United States (US). Factory farming is cyclical in nature, fueling climate change and encouraging potentially devastating environmental effects including floods, droughts, and wildfires, to name just a few. As a result, adverse weather conditions can cause crops to fail or livestock to succumb to diseases.

In addition to producing harmful greenhouse gasses, livestock farming required vast amounts of land, food, and water. In fact, approximately 77%, of global soy is fed to farmed animals instead of being used for human consumption. It is worth noting that to produce just 1 kilogram (kg) of beef, conventional farm production requires 25 kg of feed, 1,451 liters of fresh water, and 3,500 square feet of land.

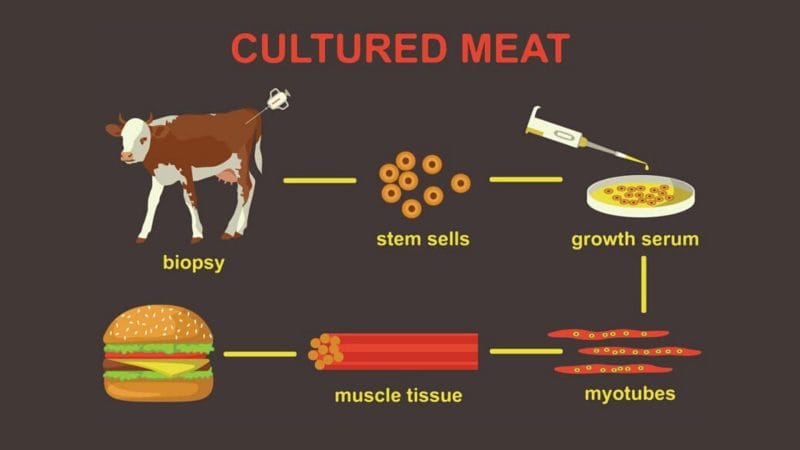

On the contrary, cultured meat production could achieve up to 96% lower GHG emissions, 99% lower land use, 96% lower water use, and 45% less energy than conventional meat production, according to a report published by the University of Oxford. However, I still have some hesitations when it comes to lab-grown meat.

For example, a study published in Frontiers of Sustainable Food Systems found that the production of cultured meat had the potential to generate even greater concentrations of carbon dioxide (C02) over time. However, the study also notes that the climate impacts of cultured meat production will depend on what level of decarbonized energy generation can be achieved, and the specific environmental footprints of production.

If you’d like to know more about my opinion on cultured meat, check out this Plant-Based Sector Roundup where I talk about MeaTech 3D Ltd. (MITC.Q), a popular cultured meat company. Referring back to CULT, the Company recognizes that traditional agricultural practices are putting an incredible strain on our environment and will not scale.

That being said, CULT believes that cellular agriculture is the answer, providing investors with access to “the next generation of food,” including cultivated meat, cultured dairy, and cell-based foods. The Company’s platform currently consists of 13 portfolio companies across 4 continents, with exposure to cell line development, scaffolding technologies, growth medium, and IP-yielding research initiatives.

Latest News

Most recently, on January 17, 2022, CULT announced that its common shares have been approved for listing on the Canadian Securities Exchange (CSE) and will commence trading on January 17, 2022, under the ticker CULT. To mark CULT’s listing on the CSE, the Company’s website has been updated with new information related to CULT and its investee businesses.

“The listing of CULT’s common shares on the CSE is a great milestone for the Company and our shareholders. As a public issuer, CULT stands to offer investors a democratized opportunity that is the first of its kind on the capital markets, which is to participate in the important, rapidly growing, and global cellular agriculture space that is expected to materially reduce the large and negative impact that the global food supply chain currently makes on the planet every day,” said Dorian Banks, CEO of CULT.

Following CULT’s listing on the CSE, the Company will be pursuing options for increased liquidity for its shareholders in Europe and the US. Moreover, the Company intends to submit an application to the Depository Trust Company (DTC) to have CULT’s common shares eligible for delivery and depository services with the DTC to facilitate electronic settlement of transfer of its common shares in the US.

Furthermore, CULT announced that it has engaged Media Nation Corp. (MN) for premium capital markets advertising and other related services for a period of 75 days, whereby MN will assist the Company in enhancing its online profile with the global investment community. According to the terms of the agreement, CULT will pay MN an aggregate, upfront, cash amount of $100,000.

Additionally, CULT announced that its portfolio company, MeliBio Inc. (MeliBio) has recently provided a commercial update with various highlights related to sales, R&D pipeline, fundraising, and public relations efforts, among others. For context, MeliBio is a technology-based company developing proprietary technology based on plant biology, precision fermentation, and food science. In doing so, the company intends to replace honeybees with microorganisms as a medium for honey production. Some of MeliBio’s recently announced highlights and near term milestones include:

Highlights

- In Q3 2021, MeliBio had its bee-free honey placed on the menu of numerous plant-based restaurants throughout New York City

- Invited to present at TED Women conference in Palm Springs

- Featured by celebrity chef Matthew Kenney and vegan celebrity chef Priyanka Naik on their respective social media channels

- MeliBio has attracted over USD$2 million as part of a rolling capital raise, based on a current USD$25 million post-money valuation

- The company has identified a co-manufacturer to produce its first commercial run of plant-based honey in Colorado

Near Term Milestones

- complete first commercial production run with a co-packer

- expanding its team on both the plant-based and microbial fermentation sides

- setting up a kitchen space in Oakland

- closing its seed round financing

- rolling out in additional restaurants and with business-t0-business clients that will use MeliBio’s honey in formulating their products

“Honey made without bees is an important innovation for the global food industry as it alleviates some of the pressure on its fragile supply chain and on the environment…MeliBio’s multi-faceted investor update shows that it is gaining traction on multiple fronts, all of which are strengthening its competitive strategy, brand equity, and ultimate value for the benefit of shareholders, stakeholders, and consumers,” commented Dorian Banks, CEO of CULT.

CULT also announced that it has entered into an agreement with Meadowbank Strategic Partners Inc. (Meadowbank) to provide investor relations, capital markets, and corporate development advisory services. The agreement between the Company and the Consultancy is for an initial term of 12 months, effective January 5, 2022, for a minimum cash fee of $6,000 per month plus GST.

Neither Meadowbank nor any of its directors and officers currently own any securities of the Company. However, an affiliate of Meadowbank has been granted 300,000 options to purchase common shares of the Company at a price of $0.10 per share. The fees payable to the Consultancy will be paid from the Company’s working capital on hand.

Should You Join the CULT?

By 2024, meat consumption is estimated to grow by 50%, reaching a market size of USD$1.8 trillion, which will ultimately put additional strain on resources, land, and the environment. However, in response to the ongoing factory farming crisis, more than 70 cultivated meat startups have been launched. With this in mind, approximately $366 million was invested into the Lab-Grown Meat market in 2020, with an additional $440 million invested in the first half of 2021.

That being said, CULT’s portfolio includes a stacked lineup of cultivated meat and cultured dairy companies including big names like Eat Just, Fiction, MeliBio, and MeaTeach, to name just a few. Keep in mind, CULT’s portfolio expands across multiple areas including pork, beef, chicken, milk, cheese, honey, and chocolate food sectors. Fortified by a pipeline of cell lines, end products, and intellectual property, CULT is well-positioned to capitalize on the growing cultured meat market.

Financials

According to the Company’s Financial Results for the nine months ended September 30, 2021, and 2020, the Company had cash of CAD$4,848,445 on September 20, 2021, compared to CAD$1,727 on December 31, 2020. CULT’s total assets and total liabilities were CAD$7,448,498 and CAD$821,666, respectively, on September 30, 2021. In total, for the nine months ended September 30, 2021, the Company reported a net loss of CAD$75,382 or $0.02 per share.

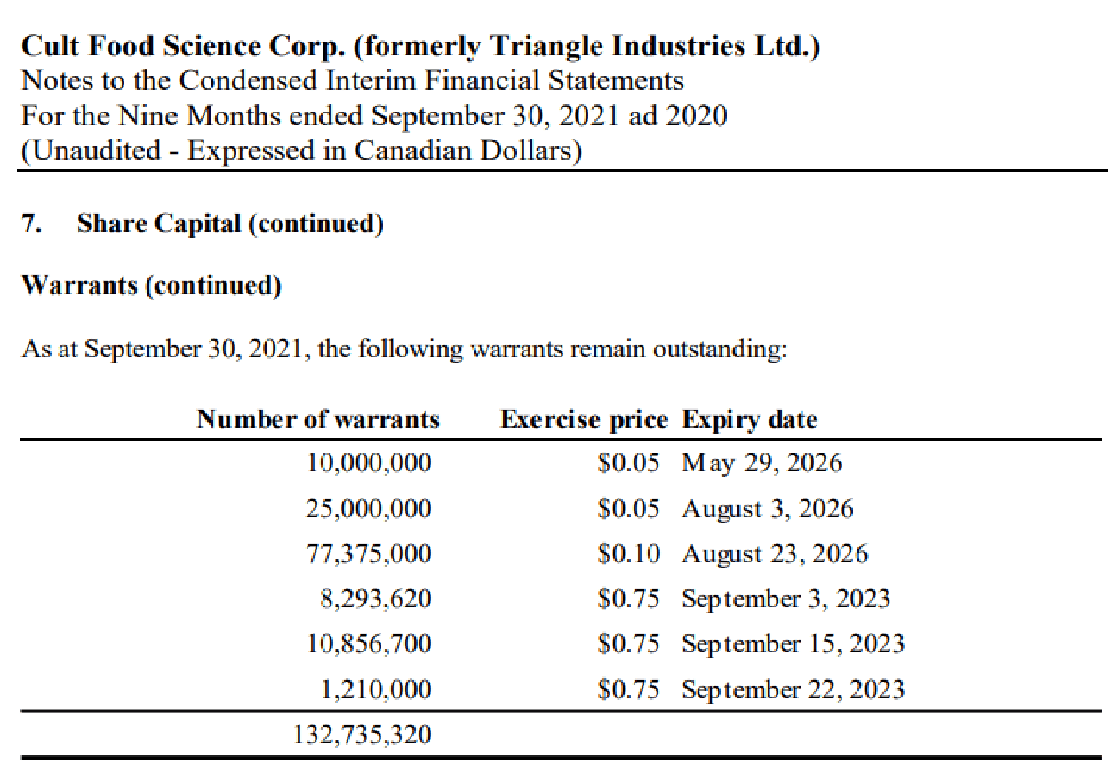

On August 31, 2020, CULT granted 12,200,000 stock options with an exercise price of $0.10 per share and an expiry date of August 30, 2026. As of September 30, 2021, the Company had outstanding warrants of 132,735,320, with 77,375,000 warrants at an exercise price of $0.10 expiring on August 23, 2023.

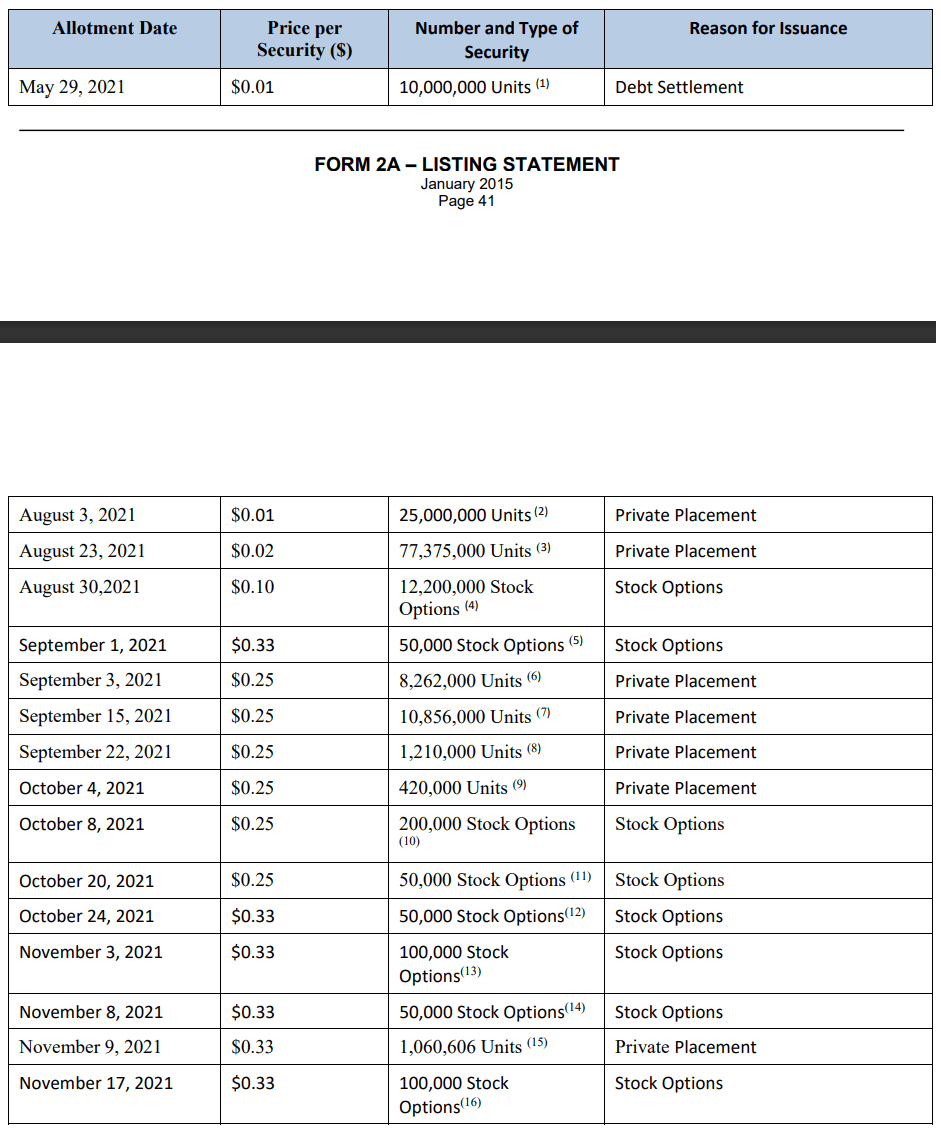

It is worth noting that as of January 5, 2022, the total issued and outstanding share capital of CULT consisted of 139,304,150 shares. According to the Company’s Filing Statement, a significant amount of shares were issued prior to CULT’s Listing Statement. In particular, on August 23, 2021, 77,370,000 units of the Company were sold at a price of $0.02 via a private placement. Similarly, on August 3, 2021, an additional 25,000,000 units were issued at an exercise price of $0.01 via a private placement.

CULT’s share price opened at $0.26 and is currently up 7.69%. The Company’s shares were trading at $0.28 as of 12:11 PM EST.