Asking: did your cannabis stocks go up this year, is like asking – do I look sexy in yellow clogs?

We don’t need to look.

The answer is no.

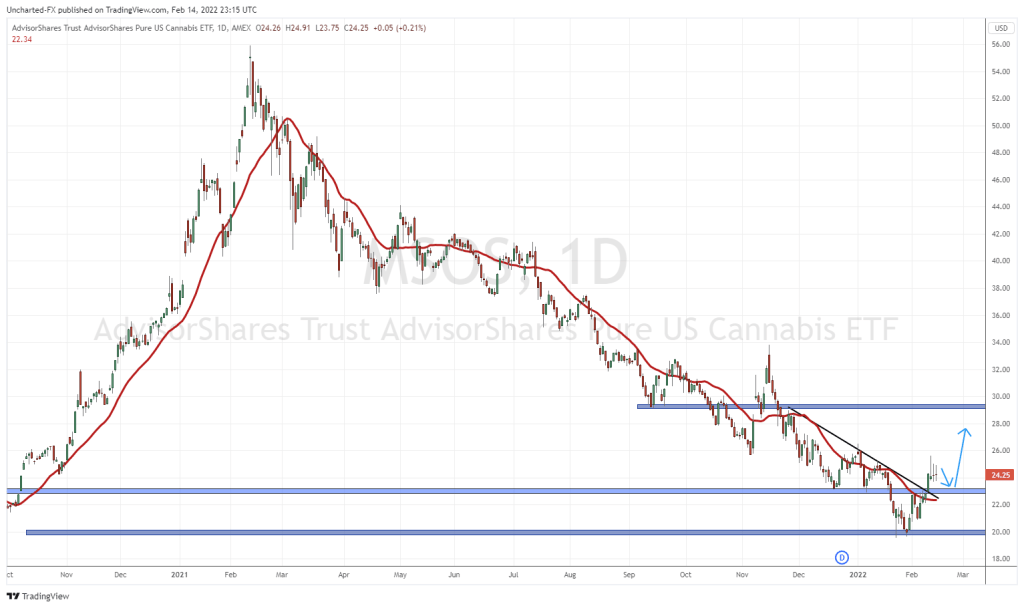

In 2021, cannabis stocks have been mutilated across the board.

Big girls like the Canopy Growth (WEED.T), fell from a high from of $71 to its current market cap of $13, shedding about $23 billion in market cap.

The dramatic exodus of money from the pot sector started three years ago.

Smaller companies like Heritage Cannabis (CANN.C) did not escape the blood bath.

Investors who’ve survived other sector down-turns (gold, graphite, lithium, copper, uranium etc.) know that there are always a few gems buried in the wreckage.

The two companies mentioned above – Heritage Cannabis and Canopy Growth – are now commercial partners.

On November 15, 2021 Heritage Cannabis announced it has signed a deal with Canopy Growth to supply bulk concentrates to Canopy, including live resin.

Heritage Cannabis offers products to both the medical and recreational legal cannabis markets in Canada and the U.S.

It operates under two licensed manufacturing facilities in Canada. The company’s portfolio of brands include Purefarma, Pura Vida, RAD, Premium 5, feelgood., CB4 suite of medical products in Canada, and ArthroCBD in the US.

“The Company recently provided the first shipment of live resin to Canopy,” reported CANN, “with future purchase orders and shipments to follow.”

Canopy has engaged Heritage for bulk concentrate supply.

A month ago, Canopy released financial results for Q2, 2022 ended September 30, 2021.

Q2, 2022 Highlights in Canadian dollars:

- Net revenue of $131 million in Q2 FY2022 was a decline of 3% versus Q2 FY2021.

- Reported gross margin in Q2 FY2022 was (54%) as compared to 19% in Q2 FY2021.

- Total SG&A expenses in Q2 FY2022 declined by 15% versus Q2 FY2021,

- Net Earnings in Q2 FY2022 amounted to a loss of $16 million, which is an $80 million improvement versus Q2 FY2021

- Adjusted EBITDA loss in Q2 FY2022 was $163 million, a $77 million wider loss versus Q2 FY2021 driven by lower sales, a decline in gross margins, partially offset by the reduction in our total selling, general and administrative expense.

- Free Cash Flow in Q2 FY2022 was an outflow of $101 million, a 47% decrease in outflow vs Q2 FY2021.

- Cash and Short-term Investments amounted to $2.0 billion at September 30, 2021, representing a decrease of $0.3 billion from $2 .3 billion at March 31 , 2021 reflecting EBITDA losses and capital investments.

Canopy chose Heritage based on its product quality, consistency, industry proven technology and innovation, and the ability to execute on pace with Canopy’s growth.

“I am honoured that Heritage is being recognized by Canopy and was selected as the pre-eminent commercial partner to supply their bulk concentrates,” stated David Schwede, CEO of Heritage.

This relationship “provides a high gross margin revenue stream to our well-established platform – one that we will continue to grow through a number of additional commercial relationships we are pursuing,” added Schwede.

On August 4, 2021 Schwede joined Steve Darling from Proactive to talk about the company’s monthly sales record of $3.2-million dollars, marking the 5th monthly sales record in 2021.

“Things are going exactly as planned,” stated Schwede, “We laid out our pro forma growth expectations by quarter. We’ve been doing exactly what we planned. I think a lot of it comes from launching innovations, launching new SKUs, and just purely executing.”

“Coming in, Heritage had the two brands,” added Schwede, “Now we’ve got five”.

“The brands we have are resonating with consumers. We make things that people actually want, versus just whatever we think we can get out. We have repeat buyers, who are becoming loyal to consistency and price.”

“As long as we’re reliable, and we produce good product, I think will continue to grow sales,” added Schwede.

A month ago, Heritage announced a third consecutive record gross revenue quarter. The company expects its Q4 revenue to increase between 20-25% above its record Q3.

Along with growth in sales and revenue, Heritage has been focused on cost reduction across the Company and based on the current trajectory expects to be cash-flow positive in early calendar 2022.

Recently, Headset published data showing Heritage’s compound annual growth rate (CAGR) of sales from February 2021 to August 2021 of over 16% compared to the average CAGR of the top eight Canadian Licensed Producers of 3%.

Also, over the latest 3-month period at the time (July to August), Heritage saw an increase in sales of over 19% in the period compared to a decline of 3% for the same group.

“Heritage has continued to outpace our larger peers in sales growth, and we don’t plan on slowing down”, commented Schwede. “The growth in sales and prudent cost management we have undertaken in the past few months are driving the Company.”

Trading at .07, with a market cap of $55 million, Heritage Cannabis may be one of the gems lying in the wreckage.