The legendary investor who anticipated the Enron collapse 20 years ago has two new short positions against the food-delivery app DoorDash and our case study for this week, the large sports-betting firm DraftKings.

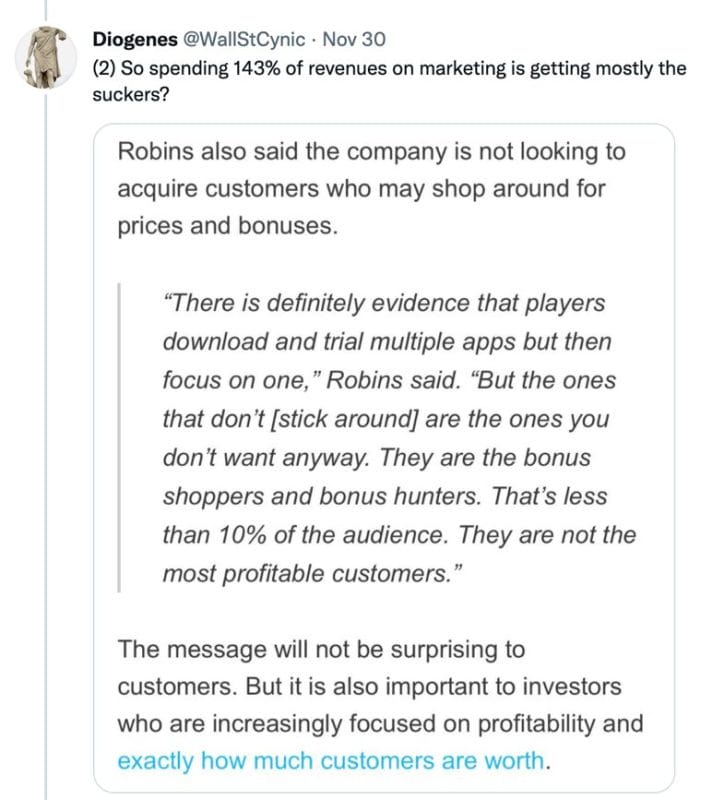

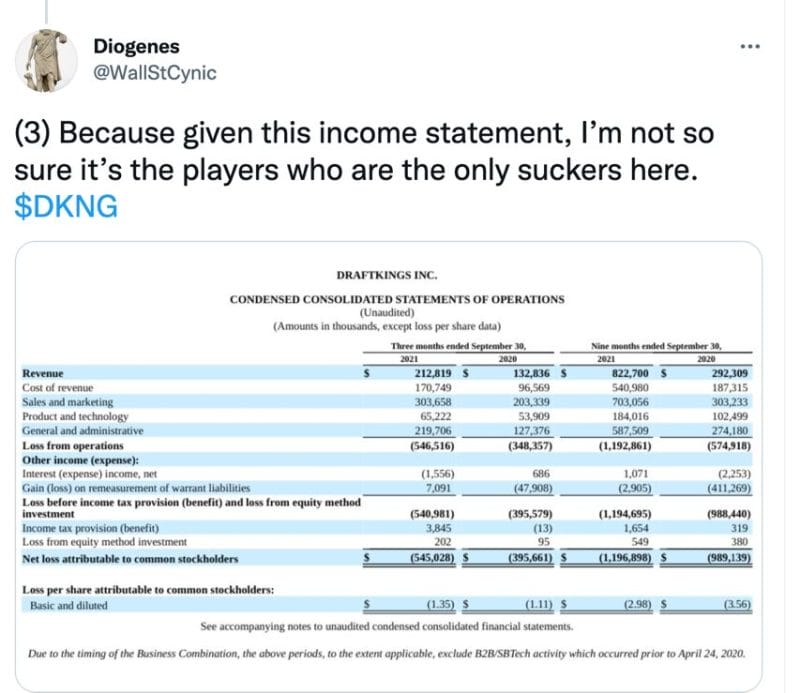

In an interview on CNBC, Mr.Chanos said the company has high marketing costs relative to its actual revenue. He has also been very active on social media with posts about his concerns referencing the firms’ quarterly reports.

He also said, “You can believe in sports betting, but this business model is flawed.”

The message from the Wall Street cynic is clear. He feels that the company doesn’t generate enough sales to cover its sales and marketing expenses. But why he focuses on sales and marketing is what piqued my interest and the only thing we could do is look at the numbers and some of the disclosures from the company to get a deeper understanding of why this legendary short seller would bet against one of the Titans of the sports betting world.

DraftKings operates as a digital sports entertainment and gaming company in the US. It operates through two segments, Business-to-Consumer (B2C) and Business-to-Business (B2B). The firm offers users daily sports, sports betting, and iGaming platforms.

The firm has also become more involved in the design, development, and licensing of sports betting and casino gaming platform software for online and retail sportsbooks, and casino gaming products.

The company went public through a blank check company incorporated on March 27, 2019. Diamond Eagle Acquisition Corp was the name of their Special Purpose Acquisition Company (SPAC).

On December 22, 2019, we entered into a business combination agreement (the “Business Combination Agreement”) with DraftKings Inc., a Delaware corporation (“DK”), SBTech (Global) Limited, a company limited by shares, incorporated in Gibraltar and continued as a company under the Isle of Man Companies Act 2006, with registration number 014119V (“SBT”), the shareholders of SBT (the “SBT Sellers”), Shalom Meckenzie, in his capacity as the SBT Sellers’ Representative, DEAC NV Merger Corp., a Nevada corporation and a wholly-owned subsidiary of the Company (“DEAC Nevada”) and DEAC Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of the Company (“Merger Sub”), pursuant to which (i) the Company will change its jurisdiction of incorporation to Nevada by merging with and into DEAC Nevada, with DEAC Nevada surviving the merger (the“reincorporation”), (ii) Merger Sub will merge with and into DK with DK surviving the merger (the “DK Merger”), and (iii) immediately following the DK Merger, New DraftKings (as defined below) will acquire all of the issued and outstanding share capital of SBT. Upon consummation of the transactions contemplated by the Business Combination Agreement (the “Business Combination”), DraftKings and SBT will become wholly owned subsidiaries of DEAC Nevada, which will be renamed “DraftKings Inc.” and is referred to herein as “New DraftKings” both as of the time of the reincorporation and following such name change.

A SPAC is a blank check company or a shell company listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process. These became popular in the 1990s but since the dot-com bubble has experienced a resurgence attributed to the SPAC King himself Mr. Chamath Palihapitiya.

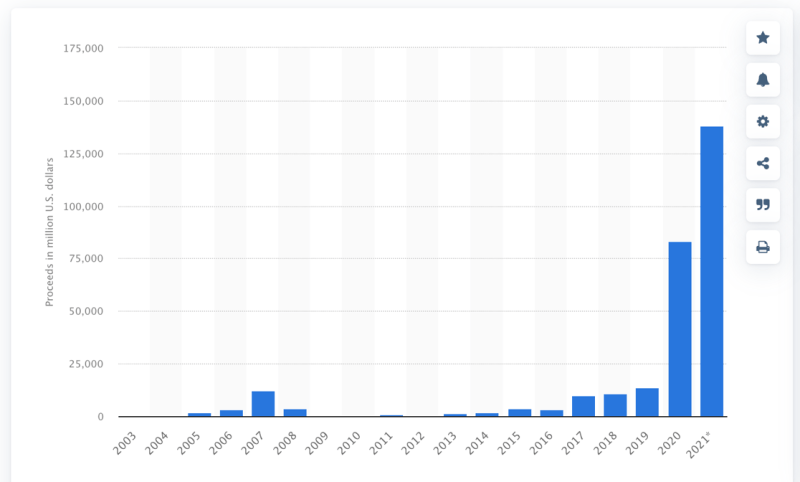

Chart A is the proceeds of special purpose acquisition company IPOs in the United States from 2003 to October 28, 2021, in million U.S. dollars. This chart shows an obvious exponential uptrend since 2003.

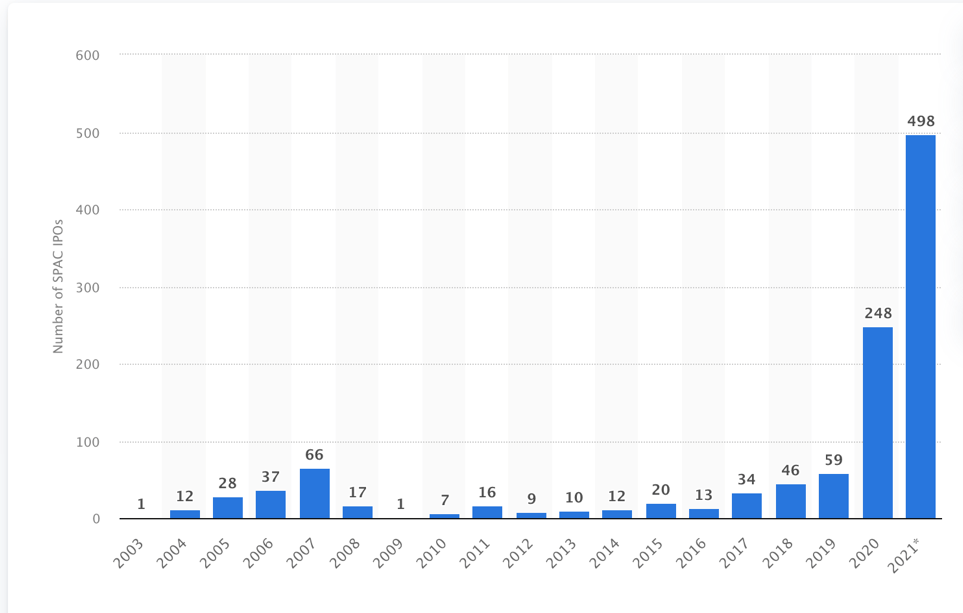

For those who argue that a dollar value graph might be misleading chart B below shows the number of special purpose acquisition company IPOs in the United States from 2003 to October 28, 2021.

The SPAC mania has been beneficial for some firms but others have been ridiculed by the public for overselling the expected growth of the target companies during the campaign period. The poor results of the target companies mixed with the selfish financial motives of the sponsor managers have caused many SPACs to underperform.

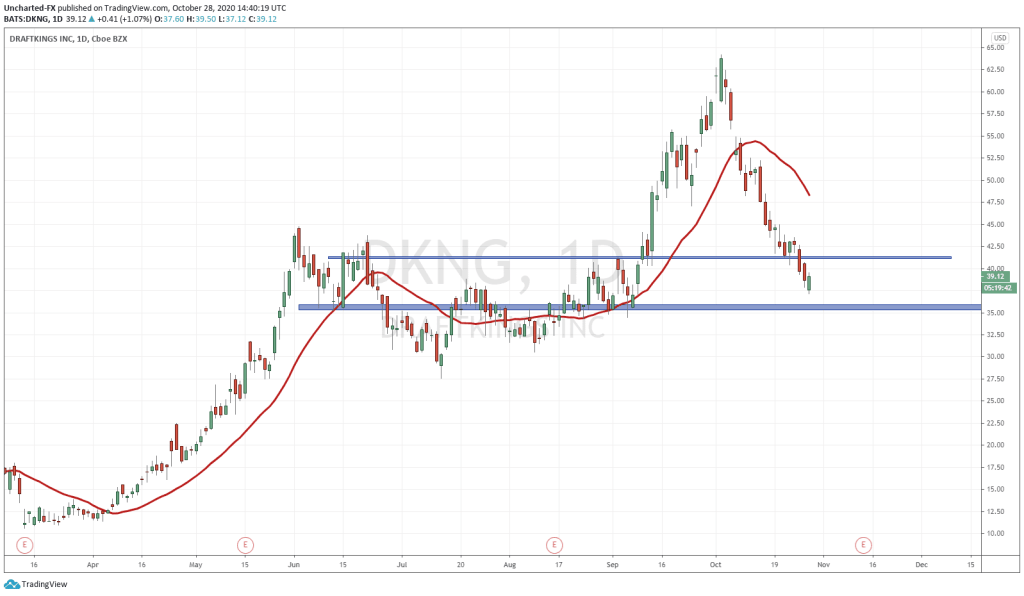

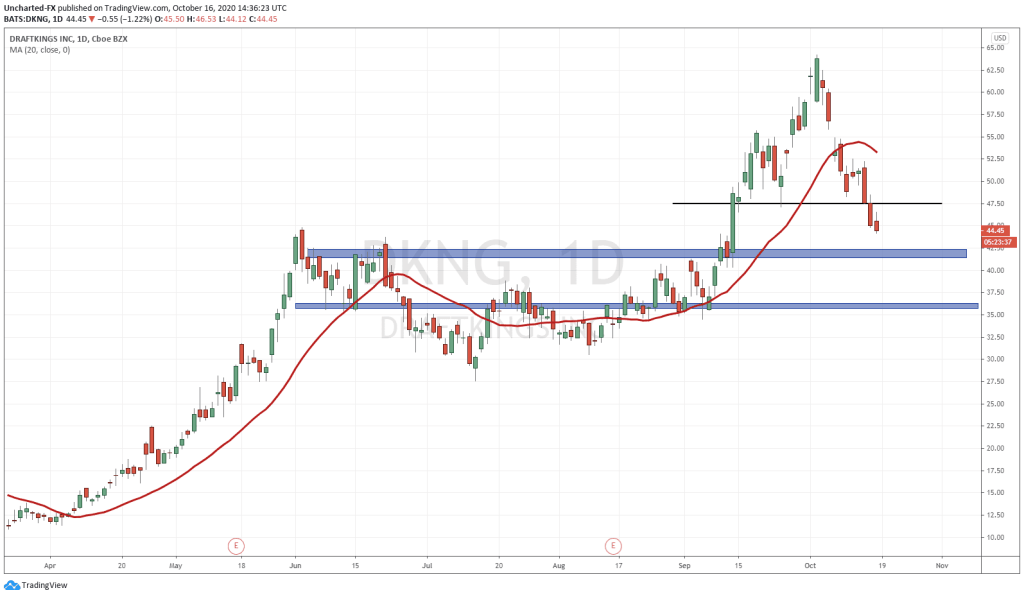

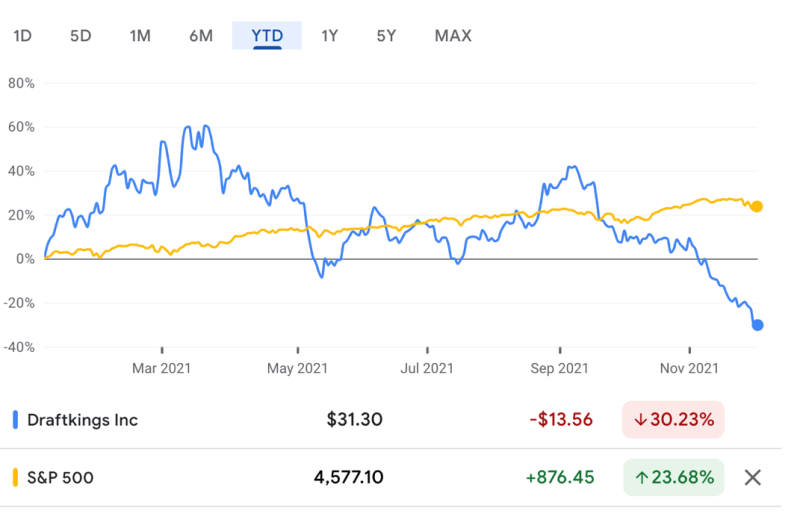

So far DraftKings is showing this relative underperformance.

So, what the hell is going on with sales and the marketing expenses at DraftKings.

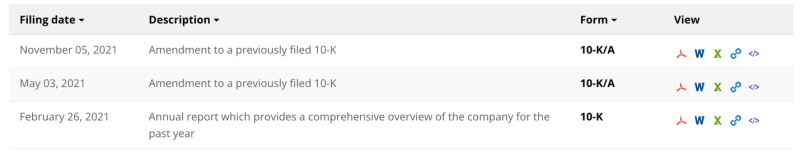

Firstly, the company has amended its 10K ended December 2020 3 times. For reference, I will pull all the data from the 10K (Amendment No. 1) For the fiscal year ended December 31, 2020. This for me is a red flag. If I was an inventor, I would also look deeply into exactly what has changed in their reports specifically focused on

- Financial Statements and Supplementary Data

- Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

- Controls and Procedures

- Certain Relationships and Related Transactions, and Director Independence

But for today we focus on the revenue and marketing expenses disclosures.

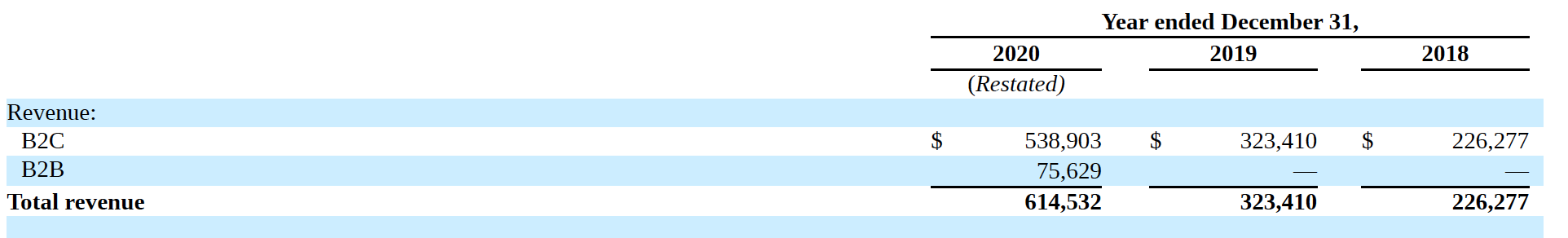

The firms’ revenues are predominantly generated through their B2C and B2B offerings. B2C has three main offerings,

- Daily Fantasy Sports – here the firms’ revenue is the difference between the entry fees collected and the amounts paid out to users as prizes and customer incentives in a period

- Sportsbook – revenue is generated by setting odds that are intended to provide a built-in theoretical margin in each proposition offered to their users making their revenues for this segment volatile.

- iGaming – they function like land-based casinos by generating revenue through the hold, or gross winnings, as users play against the ‘house’.

The B2B generates revenue from operators by providing sports betting and integration to iGaming content directly to operators in exchange for a share of operators’ revenues, as well as through fixed-fee contracts with resellers.

In the accounting footnotes, which have been restated, by the way, the company conforms to ASC Topic 606, Revenue from Contracts with Customers. The Company determines revenue recognition through the following steps:

- Identify the contract, or contracts, with the customer;

- Identify the performance obligations in the contract;

- Determine the transaction price;

- Allocate the transaction price to performance obligations in the contract; and

- Recognize revenue when, or as, the Company satisfies performance obligations by transferring the promised good or services.

The sales and marketing expenses that Mr.J.Chanos thinks are too high relative to the sales consist primarily of expenses related to advertising and related software, conferences, strategic league, and team partnerships, and costs related to free-to-play contests. They also carry the rent and facilities maintenance expenses including and the compensation of sales and marketing personnel, including stock-based compensation expenses measured at fair value on the grant date and recognized as compensation expense over the requisite service period.

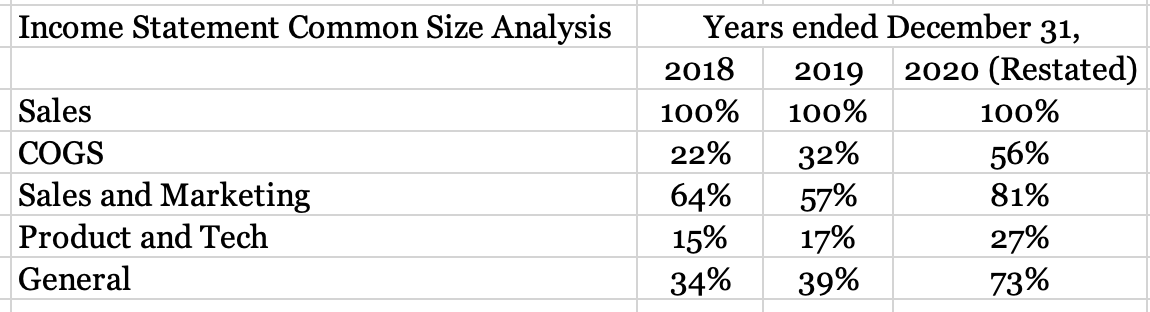

Now that we know how they generate their sales and what exactly is in their sales and marketing expenses we can use an income statement common size analysis tool to understand the breakdown of how each expense item in their income statement is related to sales and the trend here is obvious.

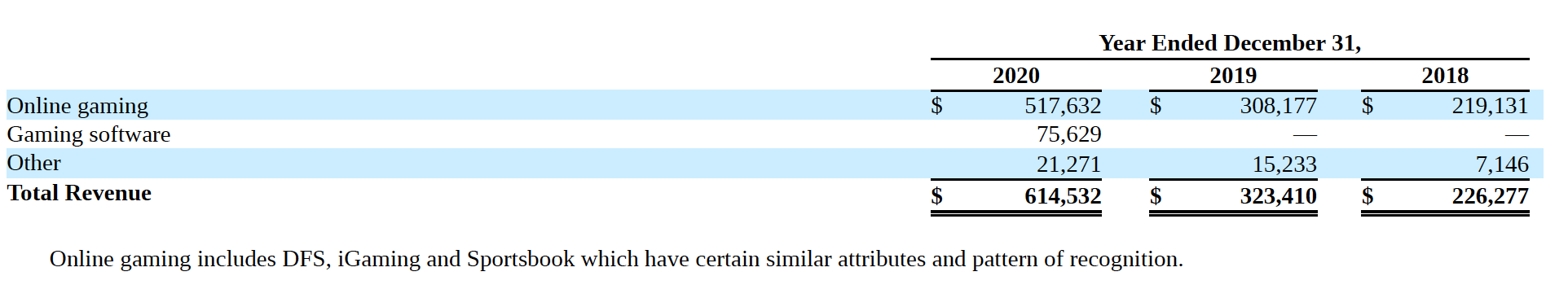

From 2018 to 2020 sales have grown by a CAGR of 40% from $US226 Million to 614 million in three years. This is amazing growth considering the rest of the sector has grown between 9% to 11%. But their Cost of sales has grown by 92% from 48 million to 346 million, sales and marketing have grown by 50% from 145 million to 495 million, product and tech expenses have grown by 72% from 32 million to 168 million and finally, the administrative expense has ballooned by 81% to 447 million in 2020.

Going even further we know that COGs was 22% of sales in 2018 and is now 56% of sales. The Sales and Marketing expenses went from 64% to 81% of sales, Product and tech have gone from 15% to 27% of sales and General expenses have gone from 34% to 73%. Yikes! The company went from losing 76 million in 2018 to 843 million in 2020 before other expenses like interest.

In the 10K, the company noted that:

Sales and Marketing. Sales and marketing expense increased by $309.9 million, or 167.3%, to $495.2 million in 2020 from $185.3 million in 2019. Our B2C segment accounted for substantially all of this increase, reflecting higher advertising and marketing spend to increase awareness and user acquisition for our Sportsbook and iGaming offerings, particularly in newly launched states; higher headcount; marketing technology and support costs; and an increase in stockbased compensation expense. While we decreased our advertising spending upon the outbreak of COVID-19 in mid-March of 2020, we increased advertising and customer acquisition marketing spending beginning in May 2020 and ramped up this spending in July 2020 with the resumption of major sports including the MLB, the NBA and the NHL, as well as the beginning of the NFL season in September 2020.

General and Administrative. General and administrative expense increased by $322.5 million, or 258.3%, to $447.4 million in 2020 from $124.9 million in 2019. Of this increase, $13.8 million was attributable to SBTech. Excluding the impact of the SBTech Acquisition, the increase would have been $308.7 million, driven by an increase in stock-based compensation expense, an increase in transaction costs, including transaction-related employee bonuses, and an increase in general and administrative headcount.

NOTE: There is no breakdown of the operating expenses except for the disclosures I have given above in their three amended reports consisting of a total of 295 pages of disclosures of material information.

Obviously, this is not all conclusive and it’s just a simple overlook of what I found by skimming through their reports, but a deeper analysis would be needed to conclude that DraftKings is a candidate for a short position.

I would look at a few things,

- Sales generated compared to the accounts receivables and deferred sales to test the quality of the sales process in the firm compared to the guidelines of ASC Topic 606

- I would analyze the accounts payables and expenses in detail

- I would also look at the cash flow statement and break down the loss from operations minus the stock-based compensation as a pseudo-cash expense to the users of the financial statements to reflect its impact on operations

- And finally, the largest shareholders and any insider activities with the common stock (P.S. From November 12, 2021, to November 26, 2021, the insiders filed 18 From 4s or Statement of changes in beneficial ownership of securities)