Business Overview

Graphene Manufacturing (“GMG.V”) is an Australia-based clean-technology-focused company. The firm offers energy-saving products and energy storage products. The firms’ segments include the Energy savings segment and the Energy storage segment. In the Energy savings segment, GMG is focused on Graphene improved heating, ventilating, and air conditioning (HVAC) coatings, lubricants, and fluids. In the energy storage segment, GMG is focused on the commercialization of GMG graphene aluminum-ion batteries.

Guy Outen holds the position of Chairman for Graphene Manufacturing Australia and Chairman at Graphene Manufacturing. Mr. Outen is also a Member of the Australian Institute of Corporate Directors, a member of CPA Australia, and a Member of The Institute of Directors (United Kingdom).

In his past career, he was the Executive Vice President-New Business at Shell Exploration & Production. He owns 734,000 shares of GMG or 1% of the outstanding common (As of May 7, 2021, the Company has 69,081,717 ordinary shares issued and outstanding)

Craig Nicol founded Graphene Manufacturing Group and Graphene Manufacturing Australia. Mr. Nicol holds the position of Chairman for Australian Graphene Industry Association, Chief Executive Officer & Managing Director at Graphene Manufacturing Australia Pty Ltd., and Chief Executive Officer, MD, Secretary & Director at Graphene Manufacturing Group Ltd. He is also a Member of the Australian Institute of Co. Directors. Mr. Craig Nicol is a founder, Operator, Director, and Owner (He owns 12,650,000 shares of GMG or 18% of the outstanding common) which makes him fully invested in the economic, financial, and operational wellbeing of GMG with the shareholders.

Business highlights in the quarter

Revenue progress

For the nine months ended March 31, 2021, the company made $208,000 in sales from their operations (vs $87,000 in March 31, 2020). They also generated $215,000 in sales from other income including subsidies, grants, and incentives.

During the same period, the company spent $1.8 million (vs $1.5 million in 2020) on Employee expenses. These expenses consist of salaries, on-costs, and share-based payments for all employees, directors, and certain contractors. Their second largest expense category for the quarter was the Overheads expenses at 904,000 for the period.

This segment of costs included Accounting and tax planning expenses, Legal expenses, R&D third party expenses, Testing, and quality control expenses, Meeting expenses, international travel expenses, and Consultants and contracting expenses.

At the end of the period, the firm had a total operating loss of 3.1 million compared to 2.6 million in the same period in 2020.

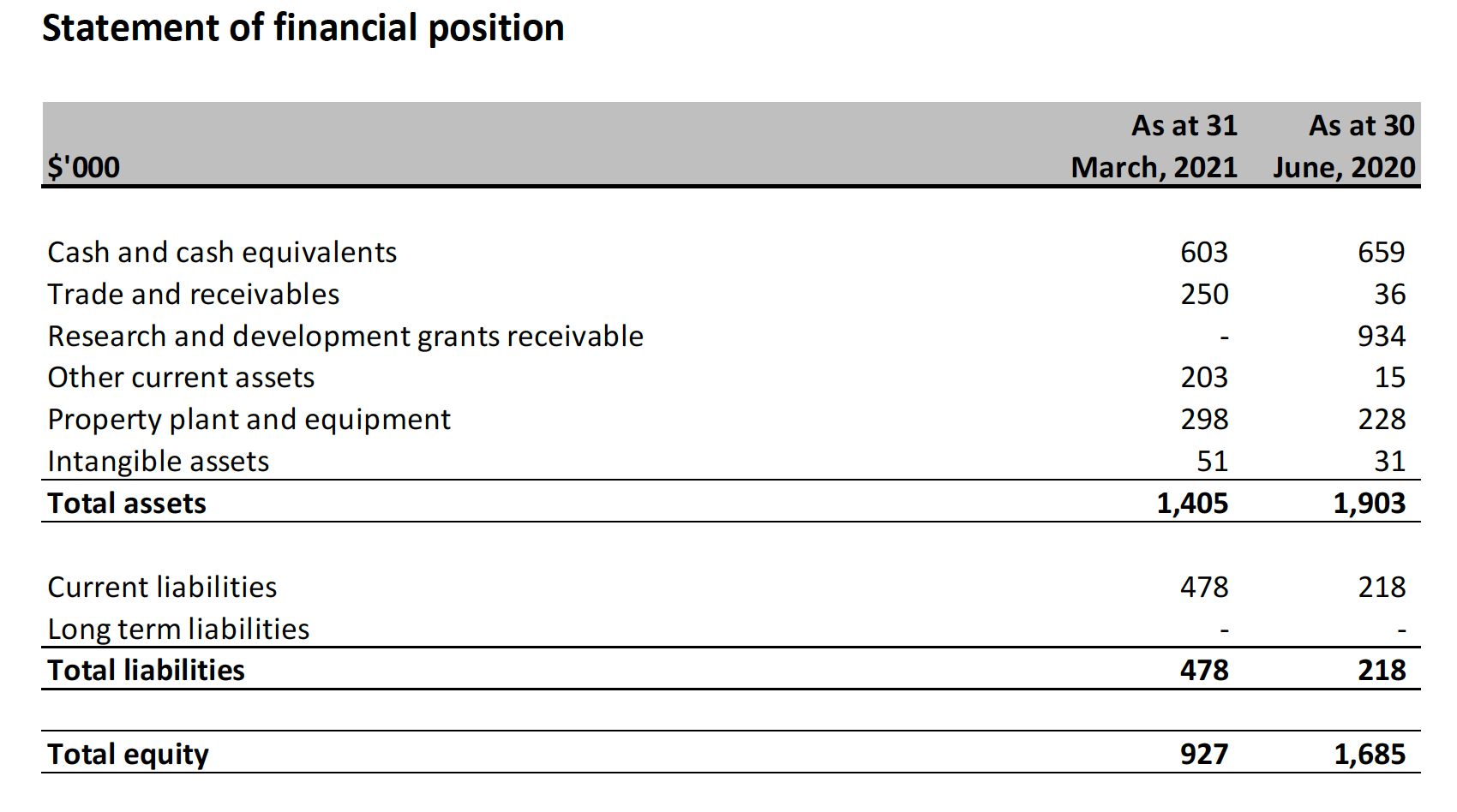

Moving onto the balance we see that the firms have a very simple balance sheet structure. They are a manufacturing firm that has an account of $298,000 in property plant and equipment that they use for production. The firm has $250,000 in receivables and of that 250 the prepayments are $198,000.

They have $187,000 in inventories of which $179,000 is in Energy saving products and $8,500 in Graphene powder. They have also structured favorable contractual agreements with suppliers and creditors where they hold about $375,614 in payables and $603,000 in cash giving them the liquidity to deploy into other capital projects like the TXR venture. TXR is a product in the early commercial production stage (produced by TXR Supplier), and the business is focusing on developing the market for TXR. The firm is also undertaking significant product development activities to commercialize various other products.

The company has no debt to speak of more current assets than liabilities, previous sales, and an owner-manager who is dedicated to the business. With $600,000 in cash and $250,000 in prepayments, they are well-positioned to take advantage of the energy storage and energy savings market.