A comparable company analysis is a method used to appraise the value of a concern using the metrics of other businesses of similar scope in the same industry. Comparable company analysis functions under the assumption that similar companies will have similar valuation multiples, such as enterprise value to earnings before interest taxes depreciation and amortization (“EV/EBITDA”), enterprise value to sales (“EV/Sales”) or enterprise value to operating income net taxes (“EV/NOPAT”). Security Analysts and investors accumulate a list of available statistics for the companies being evaluated and determine the estimate multiples to compare them.

Simple Steps in Performing Comparable Company Analysis are as follows:

- Find the right comparable companies

The investor should run a screen based on criteria that includes the industry, the sales figures, past and future growth , and many other financial economic measures including qualitative measures.

- Gather financial information

Once the investor has collected all the comparable companies, they feel are best in line with the company that they’re trying to analyze, or the industry that they’re trying to compare, they need to collect the financial information from either the audited annual reports on the company’s websites or other third-party data collection sites like yahoo.com.

- Set up the comps table

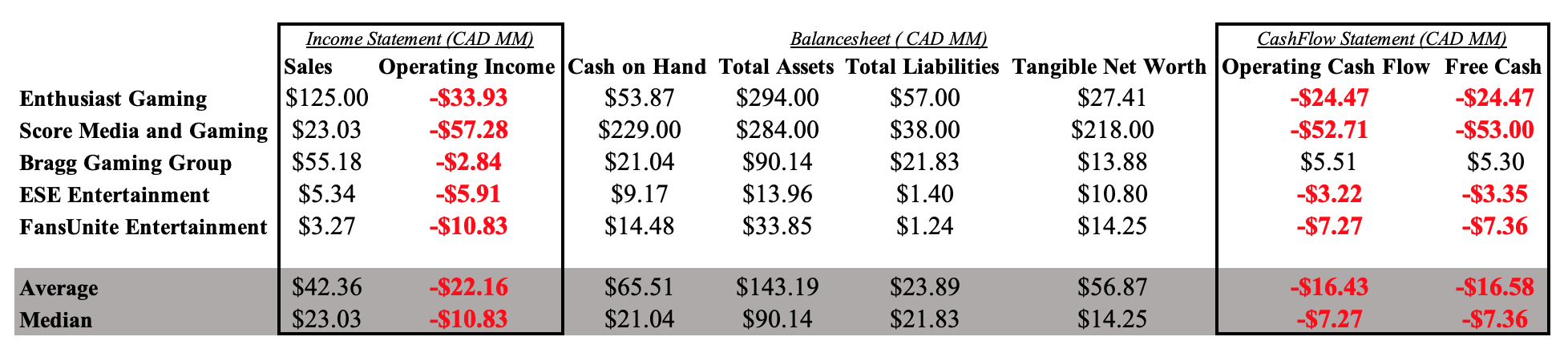

The data collected in step two should be compiled in a comp table, like the one we have below. This representation of the data will make it easy to compare and contrast different financial metrics as well as calculate average and median numbers.

- Calculate the comparable ratios

We won’t be trying to compare ratios or calculate the intrinsic value of any particular security, but we want to use the analytical steps to make our competitive analysis a little clearer. Since we focus on the esports sector, I’ve collected the financial data for five companies in the sector that I feel are in line with each other. I should also not forget to mention that everybody’s list will be different because of whatever characteristics they are looking at, but for our purposes we use this as a base case.

On average the five companies that I picked generated $42 million in sales and negative $22 million in operating income with $65 million in cash. The five companies also had an average of $143 million in assets compared to 23 million in liabilities. This means on average total asset were six times the total liabilities, majority of which came from the large cash positions.

The group also generated negative $16 million on average in operating cashflow and around the same in free cash flow. From this we can conclude a few things:

- First thing is that the five companies I picked are generating negative operating earnings meaning the organic business is still in either a development stage or trying to address the total market.

- The group I picked is also cash heavy, the average cash balance was 45% of the total assets and the median cash balance was 14% of the total average assets.

- Thirdly is the fact that the group had more assets than liabilities or a positive net worth majority of which was in cash and in one situation mostly in intangible assets.

- lastly the group was not generating cash from its organic business and was probably utilizing equity or debt financing to find its day-to-day operations reflected in the negative cash from operating figures.

Now that we know what the average group was doing, we can focus on individual companies and see how they performed compared to our sample.

Enthusiast Gaming (“EGLX.T”) a $577 million market cap firm had total sales of $125 million in the last 12 months compared to the group’s average sales of $42 million and the median sales of $23 million in the last 12 months. EGLX was the group leader in total sales in our sample but also generated the second highest operating loss of negative 33.93 million compared to the group average of 22.16 million.

When we look at the balance sheet, we notice that they had $53 million in cash and $294 million in total assets compared to $57 million in liabilities, but they had $27.41 million tangible net worth. If we do some simple arithmetic, we can find out that they had a total of 200 million in goodwill and other intangible assets.

On top of having the bulk of their assets in an intangible form, they also generated an above average operating cash loss compared to the sample ($24 million vs $16 million respectively). Having a negative operating cash position means the business is using more money that is generating and would need to fund its operations utilizing either equity or some sort of debt obligation. But we know this is not out of the ordinary because majority of the group in our sample functions in the same way outside of Bragg Gaming Group (“BRAG.T”) who had an operating loss of 2.84 million but generated an operating cash position of $5.51 million.

BRAG accomplish this by turning $54.18 million into $5.3 millions of free cash flow which is a cash flow operating margin of just shy of 9%. In other words, the company generated return on tangible net worth of about 40% (5.3/13.8 = 0.382).

We could continue this analysis with each individual company coming up with our own conclusions about each enterprise compared to the average of our sample giving us a clear indication of the differences between things like

- operating efficiencies

- business or management objectives

- capital allocation choices

- capital structure

- business model

- and economies or diseconomies of scale between all the enterprises.

Below I’ve listed the other companies that I haven’t talked about and their market caps just for comparison’s sake.

Score Media and Gaming (“SCR.T) – $2.43 B

Bragg Gaming Group (“BRAG”) – $242 M

ESE Entertainment (“ESE.V”) – $79 M

FansUnite Entertainment (“FANS.C”) – $162 M

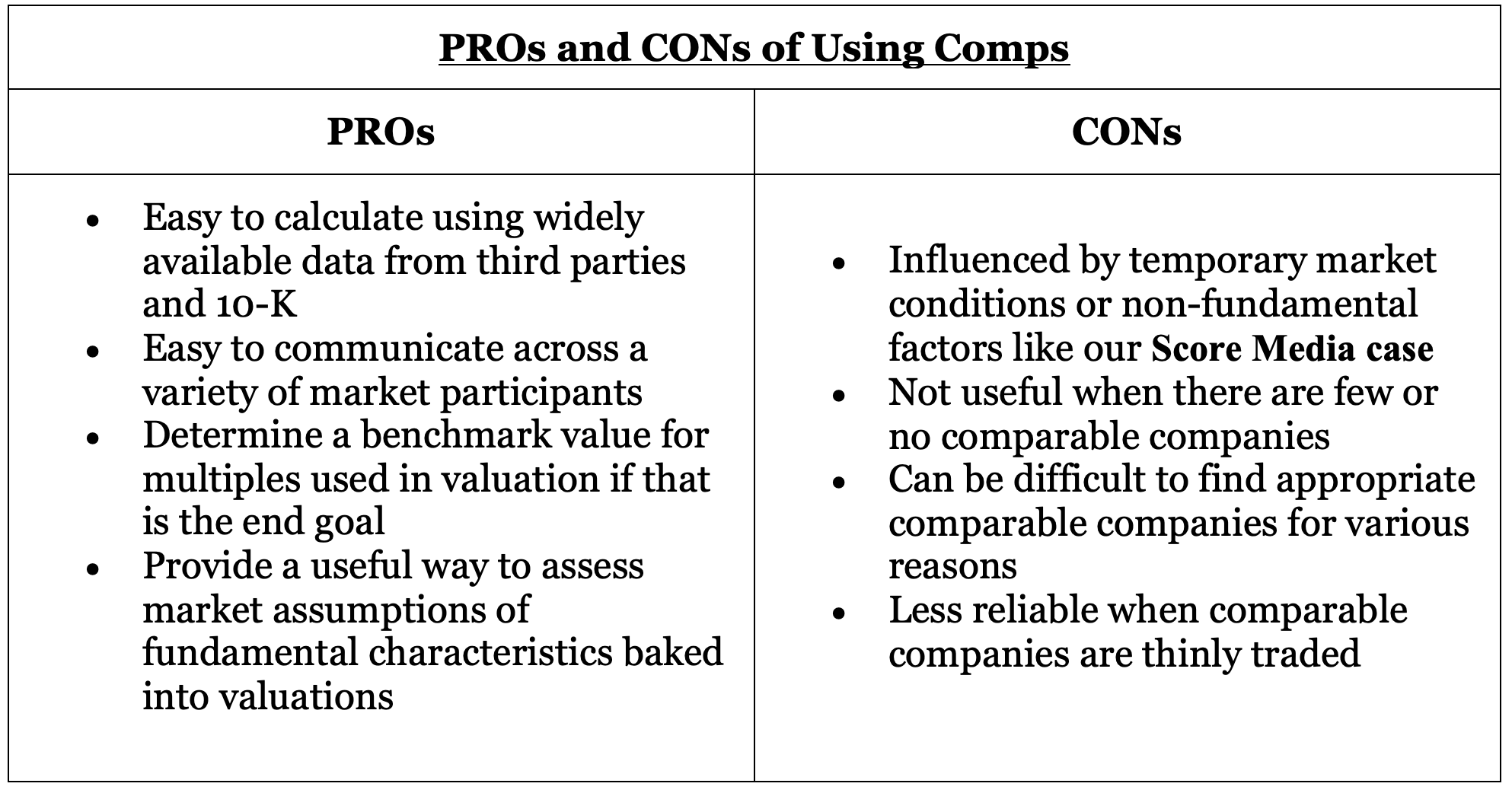

The one that stood out the most for me was Score Media Gaming with a market capitalization of $2.43 billion and they generated $23.03 million in sales which is below the group’s average of 42.36 million. They also generated the largest operating loss, $57 million in the last 12 months, compared to the group’s average loss of 22.16 million. But the company had cash on hand of $200 million and total liabilities of $38 million. The mere sight of having $200 million in cash is probably what the market is applying to the common stock as a premium. This cash can be seen as a potential catalyst for organic growth or mergers and acquisitions that will help boost the company’s top line.

Having more money than God is great, but it can be a drag on performance when there’s nothing productive to buy. As for now Score Media can be seen as overvalued compared to our sample.

Conducting competitive analysis helps with an understanding of the market and each firm is addressing the needs of its customers. It can also be used to keep track of the economic climate of the industry as the investors prepares their forecasts and “predictions”.

This sort of information helps when you have an industry that is still in its embryonic stage of development and its difficult to pick the winners.