Globex Mining (GMX.T) is perhaps best characterized as a project bank and incubator.

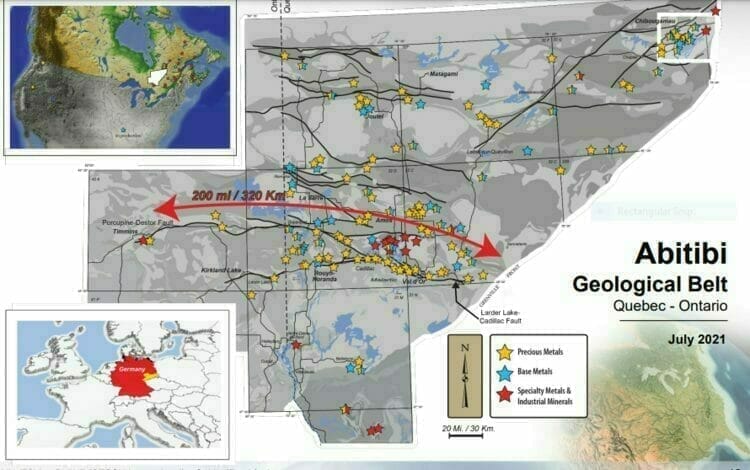

The Company’s operating model involves scouring the landscape along well-established mining camps—the prolific Abitibi Greenstone Belt of Ontario and Quebec for example—acquiring strategically positioned properties under favorable terms, advancing the newly-acquired projects via the application of good science and intellectual input, and then monetizing the asset while retaining a fat royalty interest.

In a July 20th Guru article, I highlighted the following digits:

The Globex project portfolio currently consists of 195 properties, 97 of which are prospective for precious metals, 61 for base metals, and 37 for specialty metals. These numbers are moving targets as there always seems to be a new deal in the works.

Seventy-nine of these properties carry underlying royalties in favor of Globex—4 are active options (cash/share payments, exploration commitments, Gross Metal Royalties). Fifty-four of these properties hold historic or 43-101 compliant resources—40 host past-producing mines.

The count now tops 200 exploration properties and royalty assets, with more (undoubtedly) on the way.

Globex is deftly helmed by Jack Stoch, a well-connected industry veteran with a complementary combination of technical expertise and capital market smarts.

Well-connected? Stoch once held the title of THE largest (private) mineral rights holder in the province of Quebec.

The Company has been around for decades. Its share structure—never once rolled back since Stoch picked up the reins in 1983—currently stands at just over 55 million o/s (roughly 57.8 million f/d). This is a remarkable feat for such a capital-intensive arena (some companies blow out their share structure within their first year of trade).

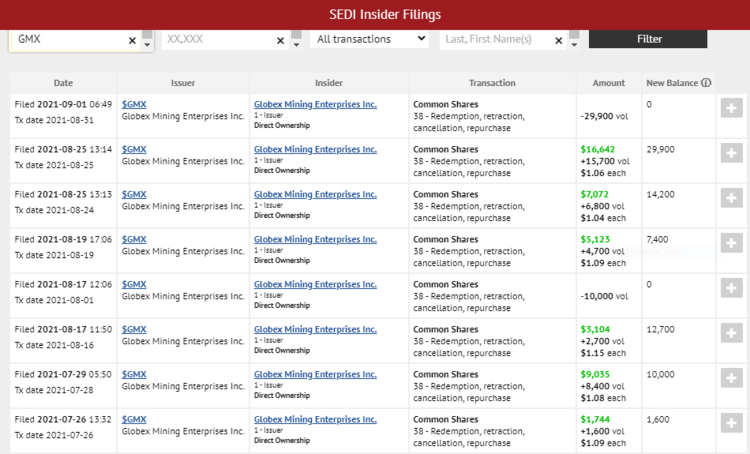

Recent transactions over on SEDI show a CEO buying up shares on the open market… and then cancelling them (to reduce the outstanding count)…

If you examine Stoch’s deals, you’ll note that they very often include an upfront component of cash and marketable securities. This is how he keeps the share count low and the company coffers stoked.

Over the past year and a bit, CEO Stoch has been busy both acquiring and monetizing assets. :

- July 21, 2020 – Globex Sells 91 Claims South of the Troilus Gold Mine and Other Updates

- August 10, 2020 – Globex Sells Three Properties to Starr Peak Exploration

- August 25, 2020 – Globex Mining Enterprises Closes Two More Property Deals

- September 22, 2020 – Globex Receives Option Renewal Payments From Excellon

- March 11, 2021 – Globex Agrees to Sell Two Royalties for $13 million Cash and a Significant Equity Stake in Electric Royalties

- March 31, 2021 – Globex: Payments Received, Projects Sold with Retained Gross Metal Royalties

- May 26, 2021 – Globex: Update on Zinc Royalty Sale

- June 9, 2021 – Globex Vends McNeely Lithium Property

- June 14, 2021 – Globex to Sell Francoeur/Arntfield/Lac Fortune Gold Property to Yamana Gold Inc. for +$15 Million

- June 22, 2021 – Globex Completes Sale of Francoeur/Arntfield/Lac Fortune Gold Property to Yamana Gold Inc. for $15 Million

- July 12, 2021 – Globex Sells Tarmac Gold Property to Wesdome

- July 19, 2021 – Globex Options Former Eagle Gold Mine

- July 21st, 2021 – Globex Purchases Rockport Mining Corp

- August 5th, 2021 – Globex Purchases the Rouyn Merger Gold Property

On August 11th, the Company dropped the following headline:

Globex Mining Enterprises Inc. Closes Sale of Mid-Tennessee Zinc Mines Royalty

Here, the Company announced having closed the sale of its Mid-Tennessee Zinc Mine royalty asset to Electric Royalties Ltd. (ELEC.V) for the following considerations:

- $13,750,000 in cash, of which $250,000 was received previously, net of applicable withholding taxes;

- 8,752,860 Electric Royalties shares; and

- 5,348,970 Electric Royalties warrants, each of which entitles Globex to purchase one additional Electric Royalties share at a price of $0.60 for a period of four years.

Nice cheque.

This deal includes a provision where if the price of zinc exceeds US $2.00 per pound for any continuous three-month stretch, Globex will receive an additional cash payment of $1 million.

Nice provision.

Globex also announced having closed the sale of a 1% Gross Metal Royalty on its 100%-owned Glassville, New Brunswick manganese exploration property for the following considerations:

- 247,140 Electric Royalties shares; and

- 151,030 Electric Royalties warrants, each of which entitles Globex to purchase one additional Electric Royalties share at a price of $0.60 for a period of four years.

These two transactions now make Globex the largest shareholder of Electric Royalties, holding (in total) 12,000,000 common shares and 5,500,000 warrants.

All told, a per the guts of this August 11th press release, Globex now holds:

- More than 200 exploration property assets and royalties;

- More than $30,000,000 in cash and shares of other companies (including the cash and shares received from Electric Royalties);

- No debt;

- Out-of-the-money warrants of Electric Royalties and Falco Resources;

- An additional $11 million of revenue over the next four years from the sale of its Francoeur/Arntfield/Lac Fortune gold property to Yamana Gold;

- $200,000, half in cash and half in shares, over the first six months of the five-year option period from the recent option of the historic Eagle Gold Mine to Maple Gold Mines.

This August 11th press release goes on to state…

“Globex continues to vend projects and acquire new ones such as the recently-announced purchase of the Rouyn-Merger gold property which includes three areas of drill-outlined gold mineralization along a 6.5 kilometer stretch of the gold localizing Cadillac Break.

Globex’s strong balance sheet should now enable us to undertake various types of transactions that we previously were unable to consider.”

Stay tuned, I suspect CEO Stoch is just getting started (In Stoch We Trust).

END

—Greg Nolan

Full disclosure: Globex Mining is an Equity Guru marketing client.