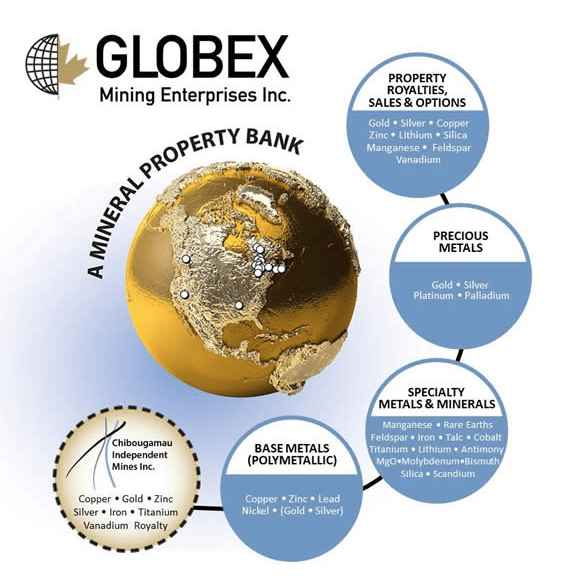

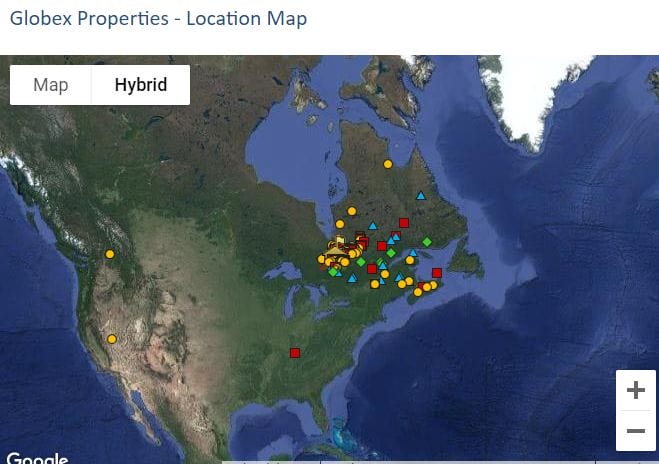

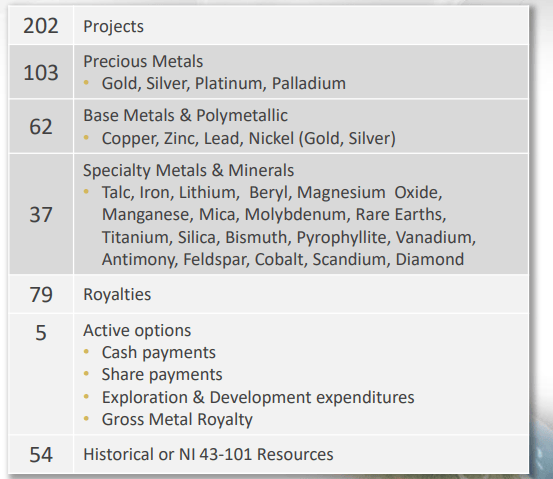

Globex Mining (GMX.TO) calls itself a mineral property bank. And for a very good reason with a whopping 202 projects:

Part of me wants to approach this company not necessarily as a Gold mining and royalty company, but a commodity play.

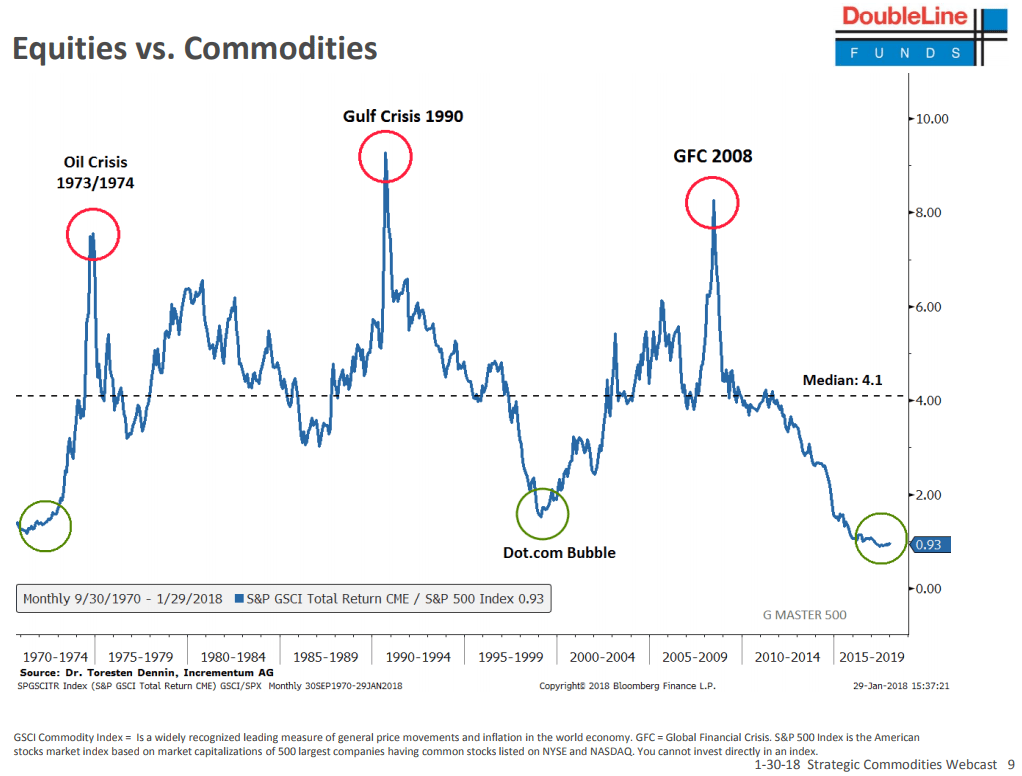

A while back, Fund Manager, and the new Bond King Jeffrey Gundlach turned some heads when he said the best opportunity in markets will be commodities. He posted this:

In a market where everything looks overpriced: stocks, bonds, real estate, maybe even some crypto’s…the commodities look cheap in comparison.

But one reminder: Energy (oil) is a large part of Gundlach’s chart and other commodity indexes like the Bloomberg Commodity Index. Oil is not in Globex’s commodity bank portfolio, but they have pretty much everything else.

For those wanting a more in depth look at the Geology and certain projects, be sure to read Greg Nolan’s deep dive into Globex Mining released today. I won’t be covering that aspect as there are so many projects to cover. Take a look at the portfolio here.

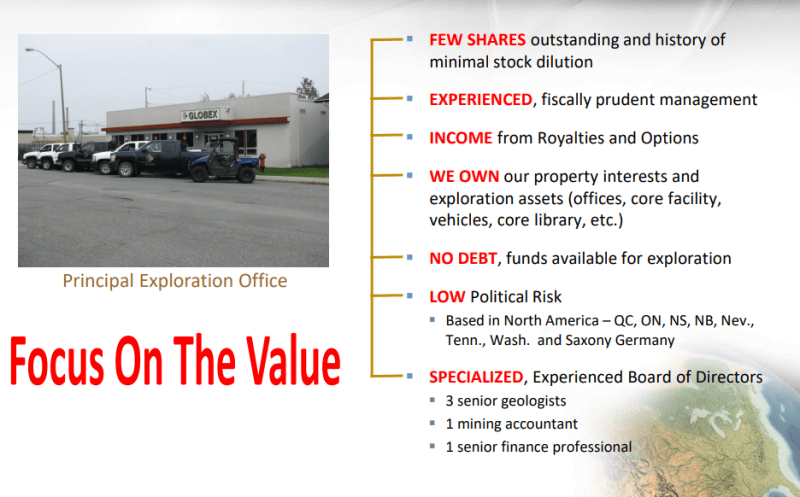

But as readers know I am a fan of Gold, Silver, and other commodities. In terms of investing in juniors, I like to look at management experience, the cash position, and the jurisdiction they are in.

Globex gets a high score in all these categories. Plus they pull in an income from their royalties. Our financial analyst Taku Ndachena said he would go all in on the stock. A big call from him, and the first time one of us went this bullish on our Investor Roundtable. Be sure to take a look at that which was also released today!

And I should talk about Royalty and Streamers. They are my favorite type of plays for the Gold miners. You can read why here, but to summarize, they can provide catalysts when Gold prices are moving up or down…and still make an income due to their low costs. Globex Mining does have some Royalty and Streaming deals in place which provides income:

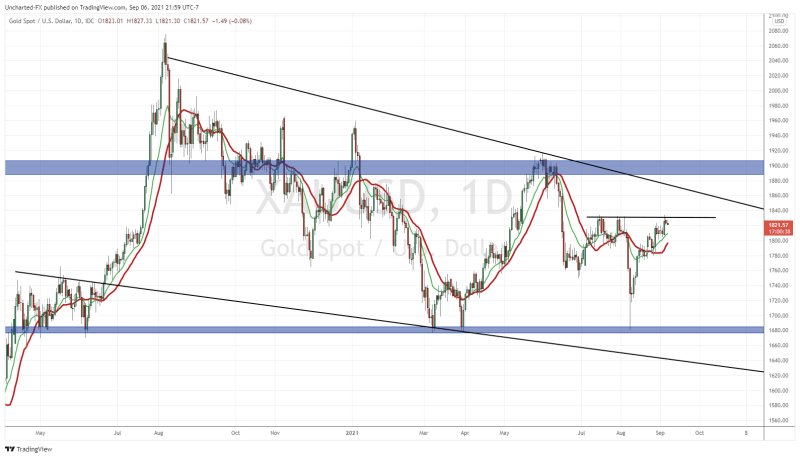

Green/clean energy as well as Electric Vehicles will be catalysts for copper, cobalt, lithium, silver and other commodities going forward. But right now, I am excited about the Gold chart.

We are watching for a Gold breakout. We almost had this confirmed with a break above $1830 on Friday, but alas, we must wait a few more days. Depending on how Gold reacts here, we can confirm a new major uptrend…or continued weakness or a range. A close above $1830 on the daily chart would take out a previous lower high signifying the end of the current downtrend. We would turn bullish.

On to Globex Mining.

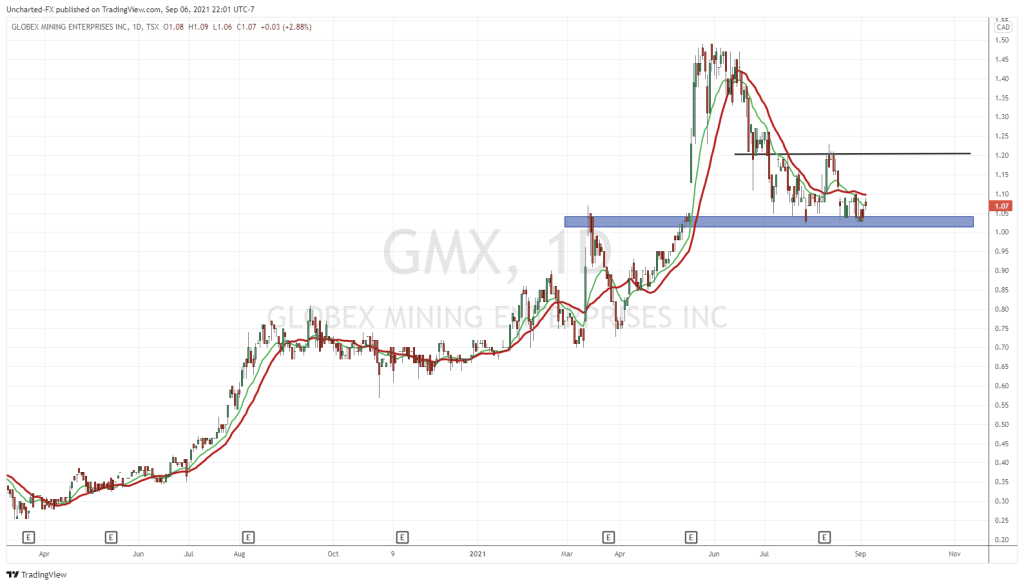

The stock is up 55.07% year to date, and Globex has a market cap of $59.17 million according to MarketWatch. I got to say, this is still a quite attractive market cap given the mineral bank Globex is sitting on.

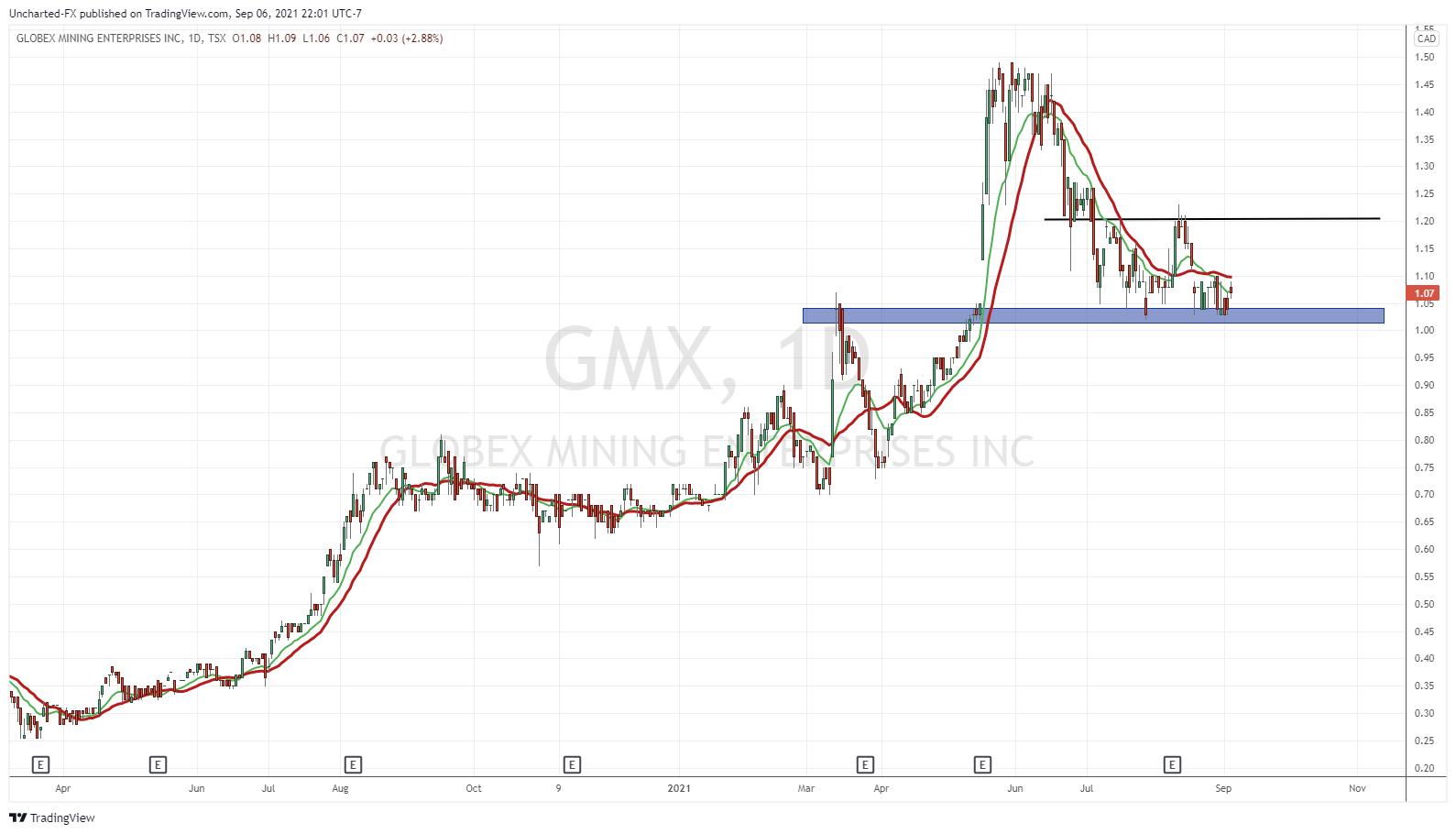

Globex has been on a tear this year, and we had a huge gap up pop after May 17th 2021 earnings. The stock hit highs of $1.49 this year. Since those highs in June, Globex has drifted downwards. Very similar to the Gold price action.

Now we are at a major support zone. The major $1.00 zone, which tends to be an important psychological zone. Notice how after drifting downwards, price began ranging. This is indicating that buyers are stepping in.

You can see that I have drawn a horizontal line at $1.20. What I would like to see for continued momentum would be a candle close above this zone. This would also create a double bottom reversal pattern.

A very appealing entry here given the assets Globex holds, and if you are bullish commodities in general, not just Gold. I am liking the link to Gold, and Gold looks ready to break. Finally, watch the US Dollar. It gave up its gains after the Fed did not provide a taper timeline. Looks like taper will be on hold given Friday’s dismal NFP numbers. A weaker Dollar bodes well for commodities as they are priced in US Dollars.