There are two narratives on the financial markets. Earnings vs Pandemic Problems due to the Delta Variant. The stock markets seem to be occupied with earnings…but with current price action, this might be changing now. Meanwhile, commodities seem to be factoring in pandemic issues hinting at supply chain disruptions and economic slowdown/restrictions. What better commodity to gauge this sentiment than Oil? The commodity may be hinting at oversea issues with Delta.

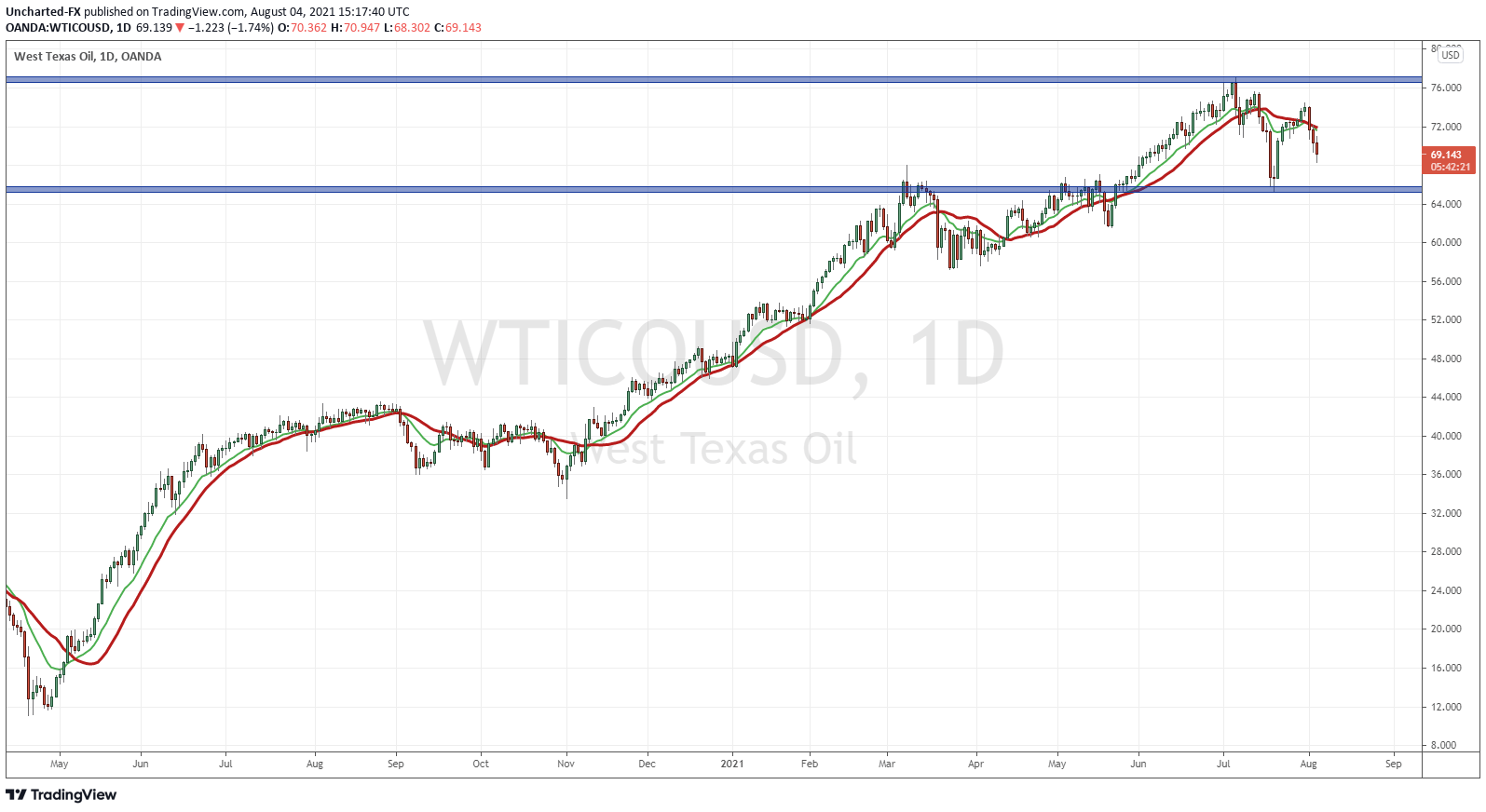

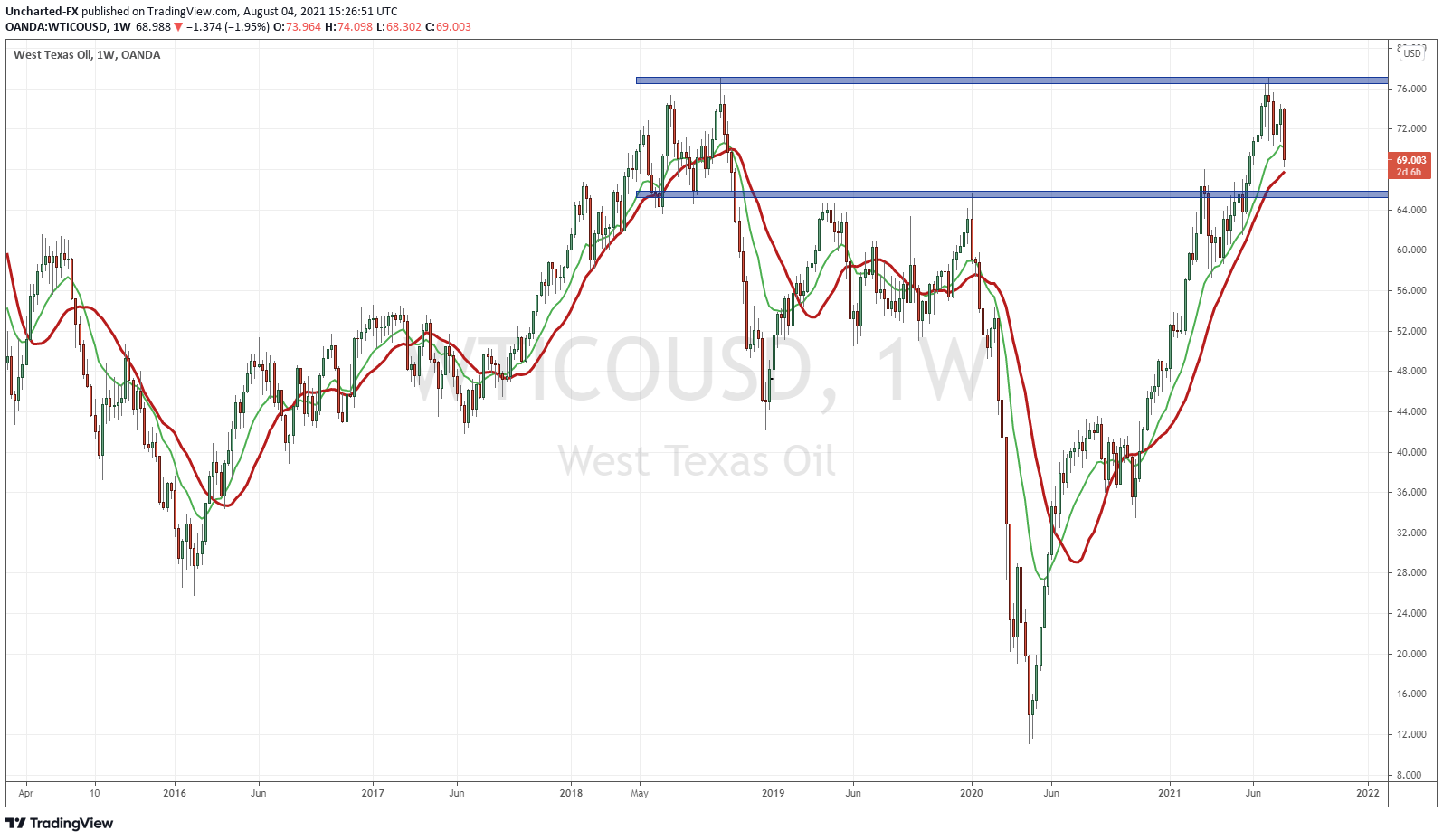

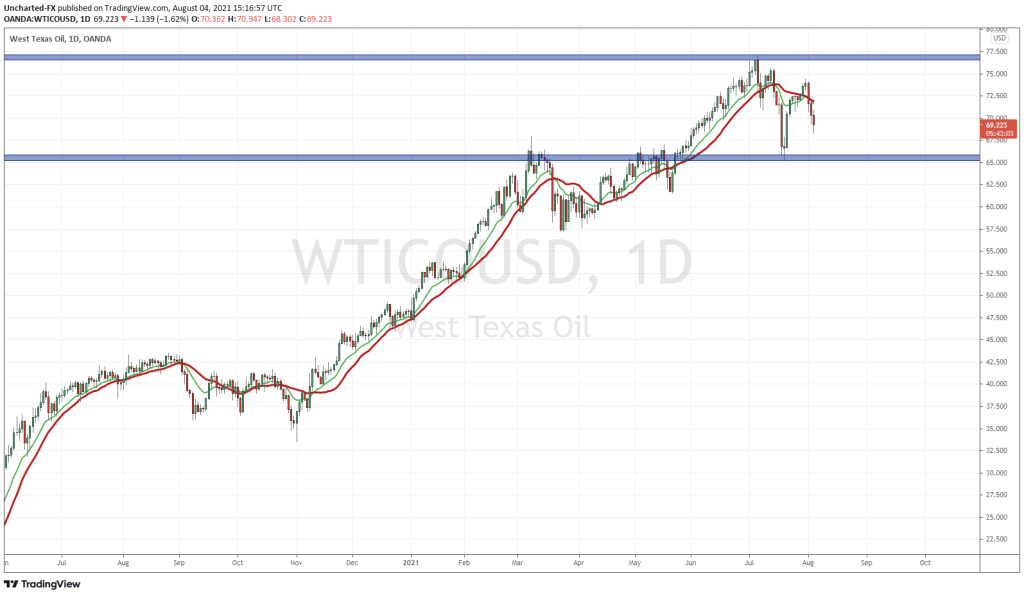

Oil prices hit highs of $76.55 at the beginning of July. It was painful. Well, it is still painful at the pumps. For someone who drives a vehicle that needs premium gas, I am paying around $1.90. Summer tends to see higher Oil prices as it is when people travel a lot…well before the pandemic anyways.

And the Pandemic is key. Perhaps things are not going back to normal. At least not yet. We are hearing about the Delta variant surging. Over in Israel, they are already giving third shots to people over the age of 60, as vaccine efficacy against Delta is around 40%. Talks of possible new lockdowns in September, with restrictions already re-implemented. We are seeing the same in some European Countries, Australia is initiating extreme lockdown measures with the military helping to enforce them, Japan has even reinstated a state of emergency with the Olympics occurring.

But when it comes to Oil demand, we need to talk about China. This is the worrying part: China is initiating lockdown in certain cities and even certain residential compounds. With the strict measures the Chinese Communist Party (CCP) took in certain cities during the first lockdown, the markets are surprised regarding this predicament. Especially since the Chinese Sinovac vaccine has been out months before Western ones. This is signaling a slowdown in China.

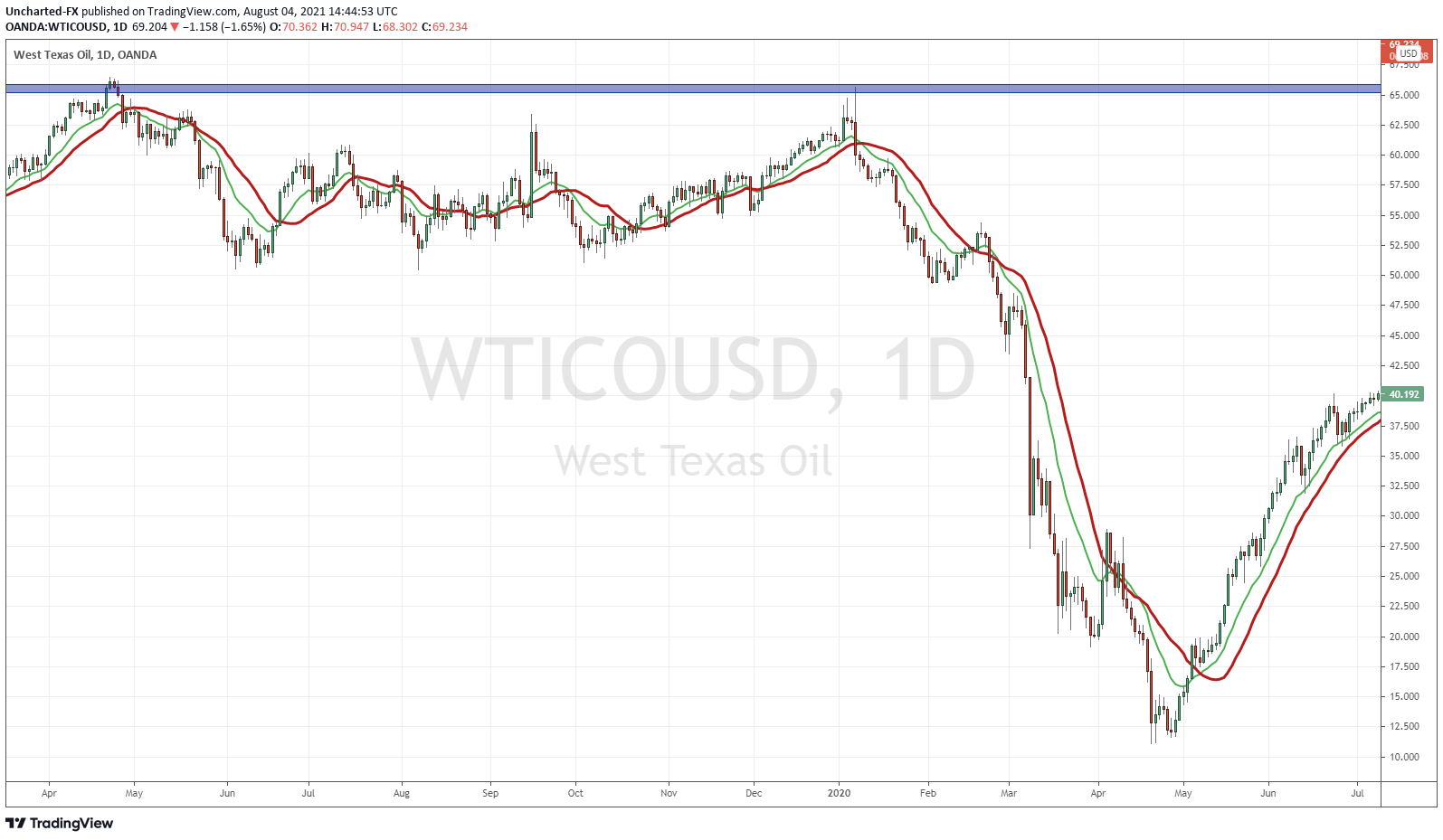

Remember what happened to Oil the last time China and the rest of the world went into lockdown?

Am I saying new lockdowns are coming? No…and I hope I am right, because new lockdowns would be devastating. But restrictions which could mess up supply chains and slow down economic growth are already here in certain parts of the world, and will likely be coming to the US and Canada. Delta cases are rising, and word is already coming out that mass gatherings need to be curbed, which hints at restrictions.

Currently, market analysts are not expecting lockdowns, but restrictions would definitely put a damper on economic recovery. This could impact stock markets (new lockdowns would cause a huge drop because the market is not pricing them in), but things are sort of different this time. If you recall, before the first lockdown, interest rates were above 2%. The Fed dropped rates to zero and began increasing their balance sheet. Many see this as the driving force for stock markets. Me included. It is all about the Fed, and if restrictions come, markets can still move higher because it means more cheap money.

Just going to play the Devil’s Advocate here, but I don’t think the Fed would mind new lockdowns or restrictions. They get to walk back all the tapering talk, which is key for those who think the Fed can never raise rates due to all the debt out there. AND the Fed can keep the cheap money policy going keeping things propped.

Back to Oil, and we have already seen a major Oil story in the US. US airports are facing serious jet fuel issues:

Flights were delayed at California’s Santa Barbara airport, and some departing planes were forced to add stops for refueling last weekend. Meanwhile, the airport in Nantucket, Massachusetts, ran out of jet-A-grade fuel over the weekend.

Those problems followed a similar situation last week at the airport serving Reno, Nevada, and Lake Tahoe.These problems are strictly labor challenges and not supply issues with jet fuel in U.S. inventory. As early as May, we noted semi-truck driver shortages may spark fuel shortages by summer.

Technical Tactics

My regular readers know that there are three things we look at to determine where stock markets are going.

- The 10 Year Yield

- The US Dollar

- Oil Prices

If the 10 year yield is dropping (money running into the safety of bonds), The US Dollar is rising, and Oil is dropping, this usually means the stock market will come under pressure. Watch these three things going forward, especially since the S&P 500 and the Dow Jones are beginning to range.