The Ugly Duckling

High school was a rough place, putting the studies aside there were so many expectations growing up and most could not help but feel like outcasts. And as a young boy (note: According to convectional measures I am still a young boy), I sure as hell felt some of this pressure and related to the story of the ugly duckling.

“The classic nineteenth-century fairy tale, by Hans Christian Andersen, tells the story of a duckling who, when hatched along with his brothers and sisters, is ridiculed and ostracized because they perceive him as ugly.

He wanders alone through the fall and winter and suffers from fear, loneliness, and sadness. In the spring he flies away from the marsh and meets up with a group of swans and realizes that he too has become a beautiful swan.”

What a wonderfully powerful tale!

In my personal life, I am still waiting for my beautiful swan moment, but I’ve noticed that professionally in the investment field they are beautiful swans that are currently overlooked by others and being labeled as ugly ducklings.

Naspers Limited (NPN: JSE) a short history

Our ugly duckling analogy continues with a relatively unknown firm in Cape Town South Africa.

This ugly duckling is Naspers Limited a publishing and online retail firm with interests in venture capital investing in the consumer internet sector. Founded in 1915 by attorney W. A. Hofmeyr, Naspers was the largest publishing company in South Africa throughout the 20th century with interests across newspapers, magazines, and books.

In the 80s the firms’ strategic position shifted from its main publishing operations to a more diversified holding company. It launched a subscription television service and invested in markets outside of South Africa for the first time. As the firm focused more on the international digital businesses, they listed their global internet investment business unit Prosus in 2019 on the Euronext Amsterdam.

Prosus (PRX: AMX) Unlock True Value

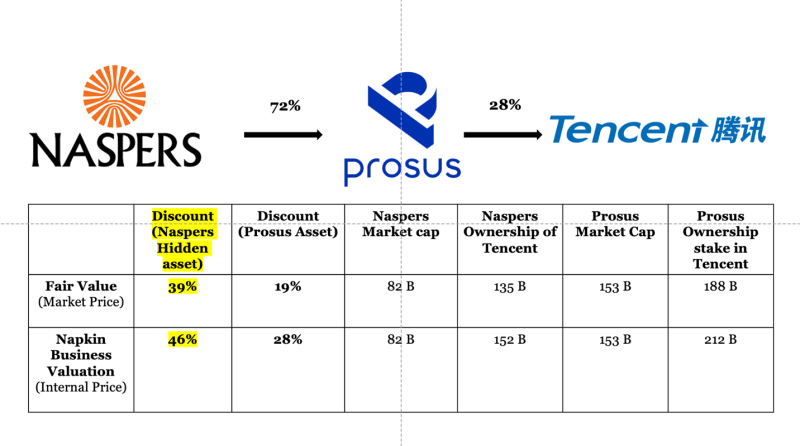

Subsequent to the listing in September 2019 and certain shareholders electing to receive Prosus shares for no consideration, 26.16% of the issued Prosus N ordinary shares were recognized as a non-controlling interest in the Prosus group. Naspers held the remaining 73.84% of Prosus.

The Prosus group represents a significant portion of Naspers’s net asset value as it comprises the international e-commerce and internet assets, including an investment in Tencent.

The Hidden Asset ( Tencent ) and some accounting (Sorry!)

Where do swans invest their cash? In the stork market. (Pause for laughter)

So, the real story here is obviously the fact that this relatively unknown large-cap stock in South Africa holds a 28% ownership stake in Tencent the largest and fastest-growing Chinese technology company. Most skeptics would say… “of course everybody knows that Naspers owns 28% of Tencent, how can anyone overlook this”. To the skeptic I respond with, brace yourself we’re about to dive into the fun topic of accounting for investment associates. How exciting! (Note: this was not meant to come off as sarcastic at all)

The Prosus group prepares its own consolidated financial statements, which are reported to its shareholders in accordance with its listing obligations on Euronext Amsterdam. When it comes to their noncurrent investments or long-term investments, they have to report these according to IFRS guidelines.

IAS 28 Investments in Associates & ASC 323 Investments – Equity Method and Joint Ventures (ASC 323) provides guidance on the criteria for determining whether you have an investment that qualifies for the equity method of accounting and how to account for the investment under IFRS and US GAAP respectively.

The equity method is used to value a company’s investment in another company when it holds significant influence over the company it is investing in. The threshold for “significant influence” is commonly a 20-50% ownership stake.

Under the equity method, the investment is initially recorded at historical cost, and adjustments are made to the value based on the investor’s percentage ownership in net income, loss, and dividend payouts.

Net income of the investee company increases the investor’s asset value on their balance sheet, while the investee’s loss or dividend payout decreases it. The investor also records the percentage of the investee’s net income or loss on their income statement.

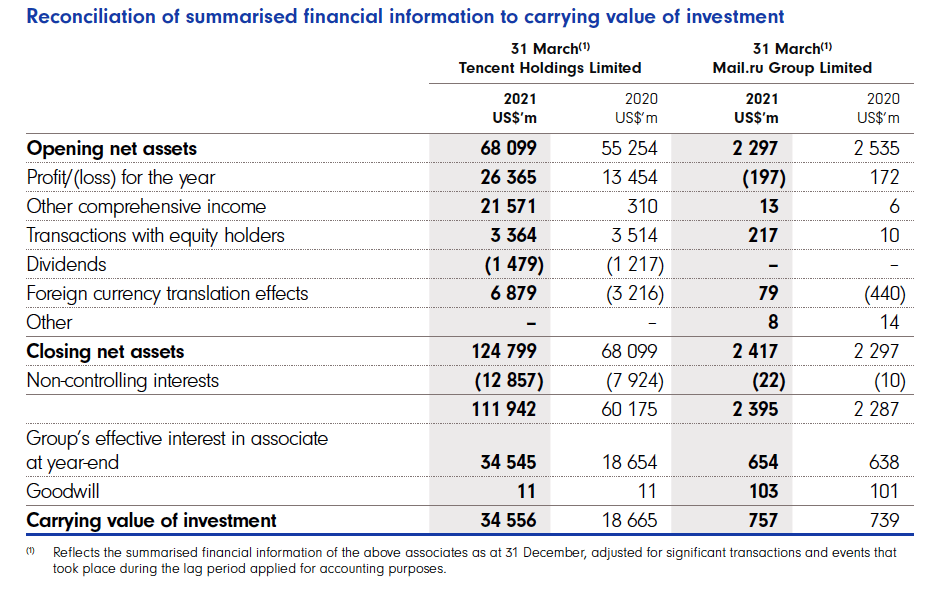

As you can see from the excerpt above that I pulled from their latest report, Prosus holds their Tencent stock utilizing the equity accounting method as is required of them. On March 31st, 2021, their Tencent investment was valued at $34.5 billion utilizing the equity accounting method. For accounting reasons, this makes a lot of sense. The main role of accounting guidelines is to be as conservative as possible, most of the time it works out great but sometimes this does not reflect the true economic reality of some of the business’ operations.

As we know by doing a quick google search, Tencent has a current market value of over $600 billion USD. That means Prosus could sell their stake in the open market (in reality this sale would take months or weeks depending on market conditions and liquidity) and report a capital gain before taxes of approximately $168 billion. Comparing this valuation from the current market price and the book value of the net assets in the financial statements you can see that there’s seems to be a wide dispersion between market price and accounting book value.

If we take this analysis even further and realize that the company(Naspers) has held their investment in the Chinese tech conglomerate for over 20 years we realize that at some level the management team must fully appreciate the business model and relationships that they have built with Tencent overtime.

Knowing this we can’t take the market price at face value. We have to realize that the business is still a going concern meaning it is going to produce future cash flows for its shareholders. So, for us to really appreciate the economic impact of those future cash flows we have to come up with a rough estimation of what the earning power of Tencent actually is outside of the influence of the accounting book value and the market price value. We will call this third benchmark the napkin business valuation.

The napkin valuation is a term used when a business appraiser sits down with an owner and uses a napkin and a pen to make quick notes which results in an estimated value of the business. It’s essentially business talk for the lazy man’s business valuation without going through an intricate financial model.

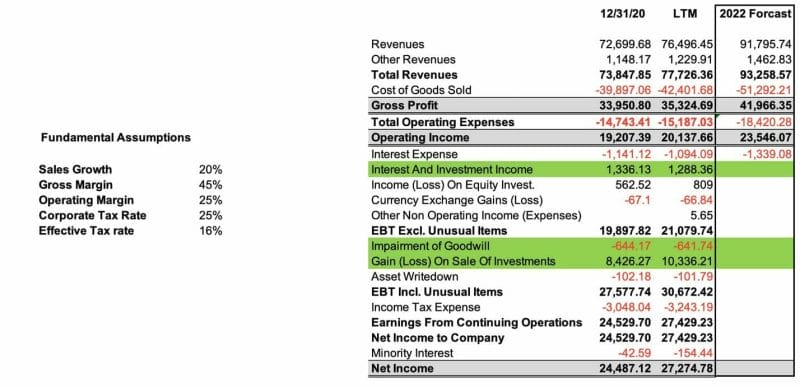

The starting point for any business valuation is obviously the top line or the sales figures. As you can see from the table below Tencent generated $72 billion in sales in 2020 for the full year, and for the last 12 months, they have generated $76.4 billion.

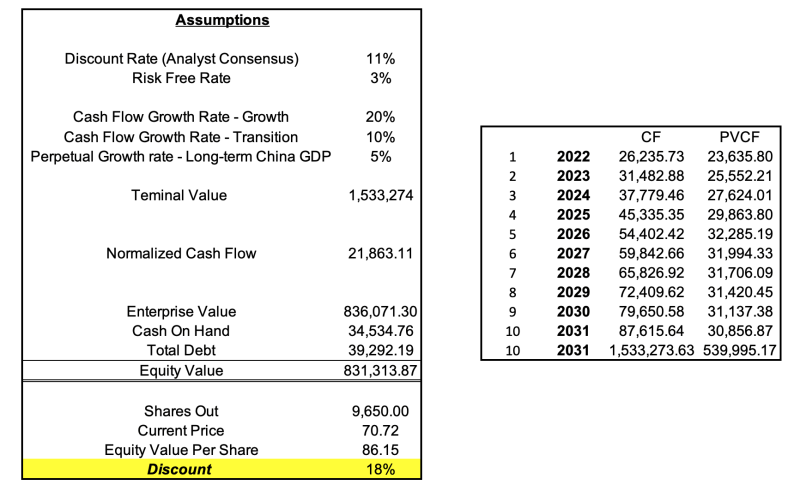

- Assuming sales grow at their historical average of 20% we get a forecast of total sales in 2022 of $91billion from their organic business.

- Next, we make an assumption about how much it will cost them to produce these services, and because they have economies of scale and network effects on their side, we can assume the cost of goods sold would decrease as a percentage of revenues increasing the gross profit margin to 45%.

- These economies of scale are well reflected in the gross profit margin increasing over time as the business produces more volume with higher efficiencies. Taking this into account we can assume a certain percentage of the gross profit is taken as operating and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses. Leaving us with an operating profit of just above $20 billion or an operating margin of 25%.

- Since this is a napkin valuation, we will ignore nonrecurrent or non-operating income and expenses and will also ignore the impact of interest and investment income but in a deeper valuation, this income and the gains on sales of investments should also be considered. Tencent has a large equity portfolio that is significant to its strategic positioning.

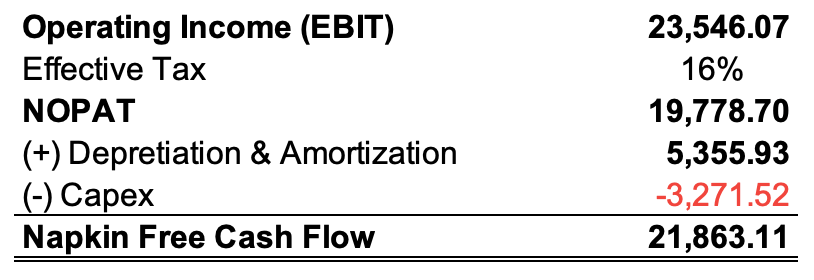

- Now that we have our earnings before interest in taxes (EBIT) we can adjust these for the tax effect of 16% which is lower than the corporate tax rate (25%) because of tax credits and other advantageous research and development credit incentives that are provided by the government. It also factors differences in the tax jurisdiction of certain subsidiaries.

- Once we subtract the effects of taxes, we have operating profits after taxes of $19 billion, which we will use as our figure for paying for working capital and capital investments that help maintain and grow the business. We will add back the depreciation as it is a non-cash charge and subtract capital expenditures and working capital needs.

- After all the adjustments to operating income, we have our napkin-free cash flow. This free cash flow is the money available to pay dividends, repurchase common stock and pay for debt interest and principal payments. This money in theory is what can be taken out of the business without destroying its intrinsic value or operations.

- To get the total value we will need to discount all the future cash flows for the business as a going concern over a certain period to get a rough estimate of how much we think it’s worth today.

- to do this we take our normalized cash flow of $21 billion and grow it using a three-stage growth model where it initially grows at 20%, and then transitions to 10%, and then grows at the perpetual growth rate of 5%.

- to ensure that we account for the purchasing power of money over time we will discount these cash flows at 11%. This 11% is not random but is the weighted average cost of capital used by most analysts on Wall Street for Tencent currently. They think of it as an adjustment for the riskiness of the cash flows. I do not subscribe fully to the usage of weighted average cost of capital but for our napkin value purposes, we will use it.

- once we have grown out the cashflows using the three-stage model we add up the cash flows and the terminal value and discount them back to the present day and we get a rough estimate of what the enterprise value should be.

- From that, we add a total of $34 billion in cash on hand and subtract $39 billion in debt and we get an equity value of $831 billion. If we divide by the total shares outstanding, we get a current price of 70.72 as of the day of this writing and an equity value per share of 86.15 meaning the stock is trading at a reasonable discount, but to be conservative, we can say it is fairly priced.

Just a note on the process above. I left out 120 billion in long-term investments that I forgot initially. For a proper valuation, this $120 billion should be added to our total as it is a large portion of their strategic associates and investments. It is also a large part of their total assets although it is not part of their operating assets. I also forgot to adjust our cash flows for the working capital in my calculations.

Both of these adjustments are material and should be done, but for reasons far beyond explaining (my laziness), I will assume for our purposes they are not material.

Market Price vs Accounting Value vs Napkin Value

After such a deep dive, and even with such a simple back of the napkin valuation I think we can conclude one thing with the highest amount of certainty:

It’s always best to understand the price and value relationship between any security that you wish to purchase. For common stocks, unlike other securities, it is usually easier to quantify what is value and what is price.

In the case of Naspers, we know that the value of the firm comes from their operating assets net of any operating liabilities plus their non-operating assets usually cash and short/long-term investments.

If we add all that up and compare it to the market price of $80 billion, we can see that there is a discrepancy between the price and value relationship for Naspers and its common stock.

Although the corporate structure might be a little bit confusing at first once you get the gist of it it’s pretty simple. If you were to purchase Naspers shares at the current market price you are buying a 72% interest in Prosus which owns 28% of Tencent.

Using current market prices, you would be buying Naspers at a 39% discount compared to its ownership stake in Tencent. Keep in mind this ignores the other businesses that they own and its main business line. In a way, we’ve assumed everything else that they own has a value of $0 which is obviously a simplification. If you do the same thing using our napkin business valuation you get a 46% discount from buying the Naspers shares at the current price compared to the estimated intrinsic value of their Tencent ownership stake.

I think it goes without saying that although the process above might seem complicated it is actually an oversimplification of the whole process. The discount has been immune to almost every attempt by the operators to make it disappear. You can’t ignore some of the business risks and terrible capital allocation that has happened in Naspers over time. The management team has also been ridiculed for taking 10 to 12% of the net assets in the business as remunerations further destroying shareholder value. But…

…“He who wanders alone through the fall and winter, and suffers from fear, loneliness, and sadness. In the spring he will fly away from the marsh and meets up with a group of swans and realizes that he too has become a beautiful swan.”

What a wonderfully powerful tale!

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Very insightful

Thank you. If there are other topics you would like to be covered please let me know. And give me a follow at https://takundachena.substack.com. I will warn you though I rarely have great ideas. But once in a blue moon, I am not lazy lol

well written. Can you please elaborate on “The management team has also been ridiculed for taking 10 to 12% of the assets in the business as remunerations further destroying shareholder value.”

I am a recent shareholder with significant portion of my networth in this stock. The way I see it as a double discount on owning cheap Tencent stock.

But if management in the middle is going to be a bad capital allocator its going to be always undervalued.

Hey, thank you for the feedback I appreciate it. What I meant from that statement is if you take the total stock-based compensation and add the dues owed to the managers the remuneration bill would reach between 10-12% of the net assets of the business. Since this discovery, I must mention the remuneration packages have been adjusted. Although Capital allocation at the firm is still relatively mediocre. Long-term economics for Naspers is dependant on great capital allocation by the management team(the underlying business is weak if you check the operating income performance over the last few years). Like you said you are really buying Naspers for its exposure to Tencent and its other strategic investments.

Could you provide the source of 10-12% figure ? Are you saying management is owed 15-18Billion dollars in remuneration ?