I have been bullish commodities since the central bank money printing bonanza began, and Crude Oil was one of them. I know I have listed here $75 for our next resistance target, but long term, I think we even take that out. Currently, a major resistance zone has been taken out and we will look at all of this under the Technical Tactics portion of this article.

West Texas Crude Oil is up 3.25% at time of writing. A two year high. Financial media is attributing this to good old supply and demand. OPEC+ members gathered and have agreed to gradually ease production cuts:

- OPEC+ members will boost output in July, in accordance with the group’s April decision to return 2.1 million barrels per day to the market between May and July.

- Production policy beyond July was not decided on, and the group will meet again on July 1.

- Iranian higher production would not be a cause for concern

Oil and Copper are two commodities that have made a run behind the vaccine and reopening play. Today, it came out that US air travel hit a pandemic high, and the CEO of Hilton said they have had the best night in bookings since the pandemic hit. Travel is coming back. In a Market Moment post months back, I mentioned how Hedge Fund manager Kyle Bass predicted higher Oil prices due to higher travel demand than anticipated. People have been locked down that they are itching to travel.

Oil prices were buoyed on some geopolitical events and unforeseeable events. Yes, I am referring to the cargo ship that “Austin Powered” in the Suez Canal. Recent events in Israel and Palestine has also impacted Oil prices. Any event in the Middle East will have this effect regardless of if the nation is an Oil producer or not. Oh, and we cannot forget the pipeline that was hacked.

My regular readers know that I just have a feeling the Federal Reserve itself wants higher Oil prices. We keep hearing the term transitory inflation and how there is no real inflation. Oil is the perfect way for the Fed to mask inflation from their monetary policy. As Oil moves higher, and we see rising prices in food and transportation which will impact inflation data, the Fed will say this inflation is transitory due to rising Oil prices. So yes, inflation is rising, but we will not change our monetary policy or raise interest rates since it does not meet our 2% consistent target. If you are interested in this, I wrote about this a few weeks back. You can read my article titled, “Is the Federal Reserve Masking Inflation with Higher Oil Prices” here.

Technical Tactics

The energy sector is green. Top movers of the day are Marathon Oil, Devon Energy and APA corp. Couple of my favorites, Chevron and Exxon are also performing well and their technicals are still holding up well.

A little secret of the trade: when energy is up, we should see the financials up as well. When Oil dumped a few years ago, banks were pressured by the government to provide loans to struggling Oil and Gas companies to keep them afloat, but more importantly, to prevent massive lay offs. Because a lot of bank loans are tied to the energy sector, when Oil rises, these banks tend to do well.

Not a surprise that we are seeing breakouts and all time record highs in Goldman Sachs (GS), and JP Morgan (JPM).

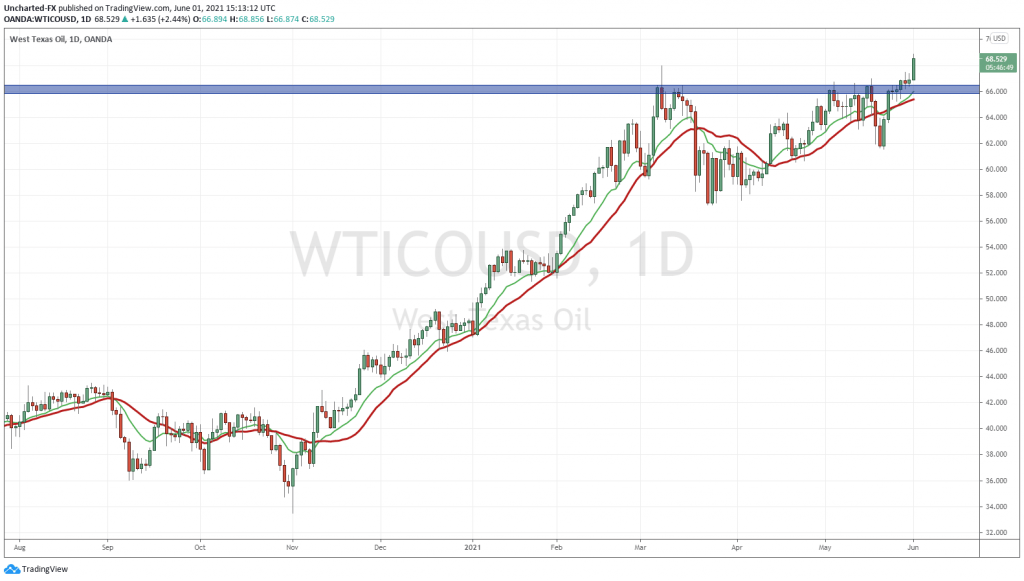

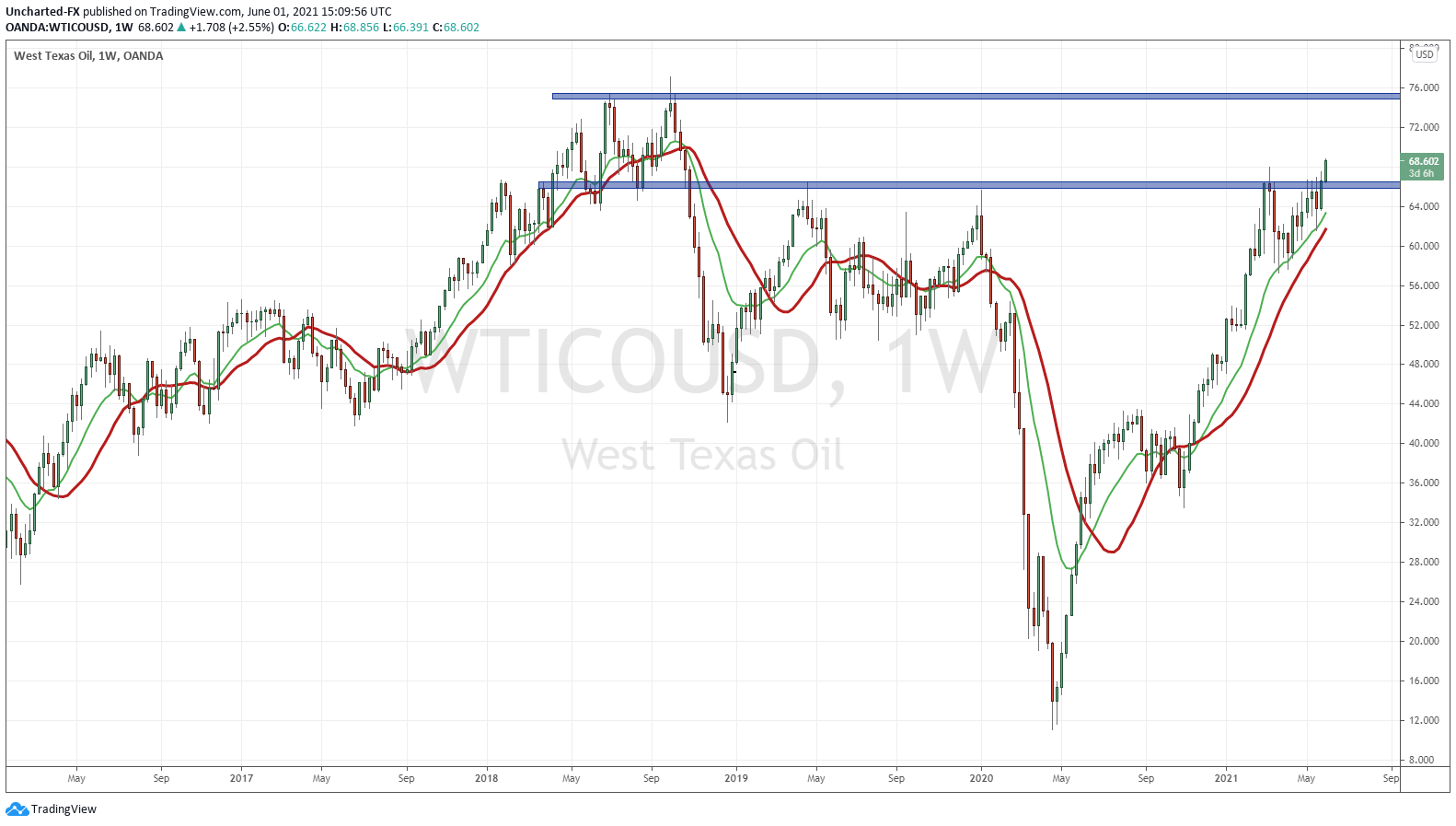

Above is the weekly chart of Crude Oil. I want to point out the resistance zone that we are breaking above of currently. This zone falls around $66. If we close above $66 by the end of this week, we get a confirmed weekly breakout. Expect higher Oil prices. As you can see from the chart, the next target would be the resistance at around $75-$76.

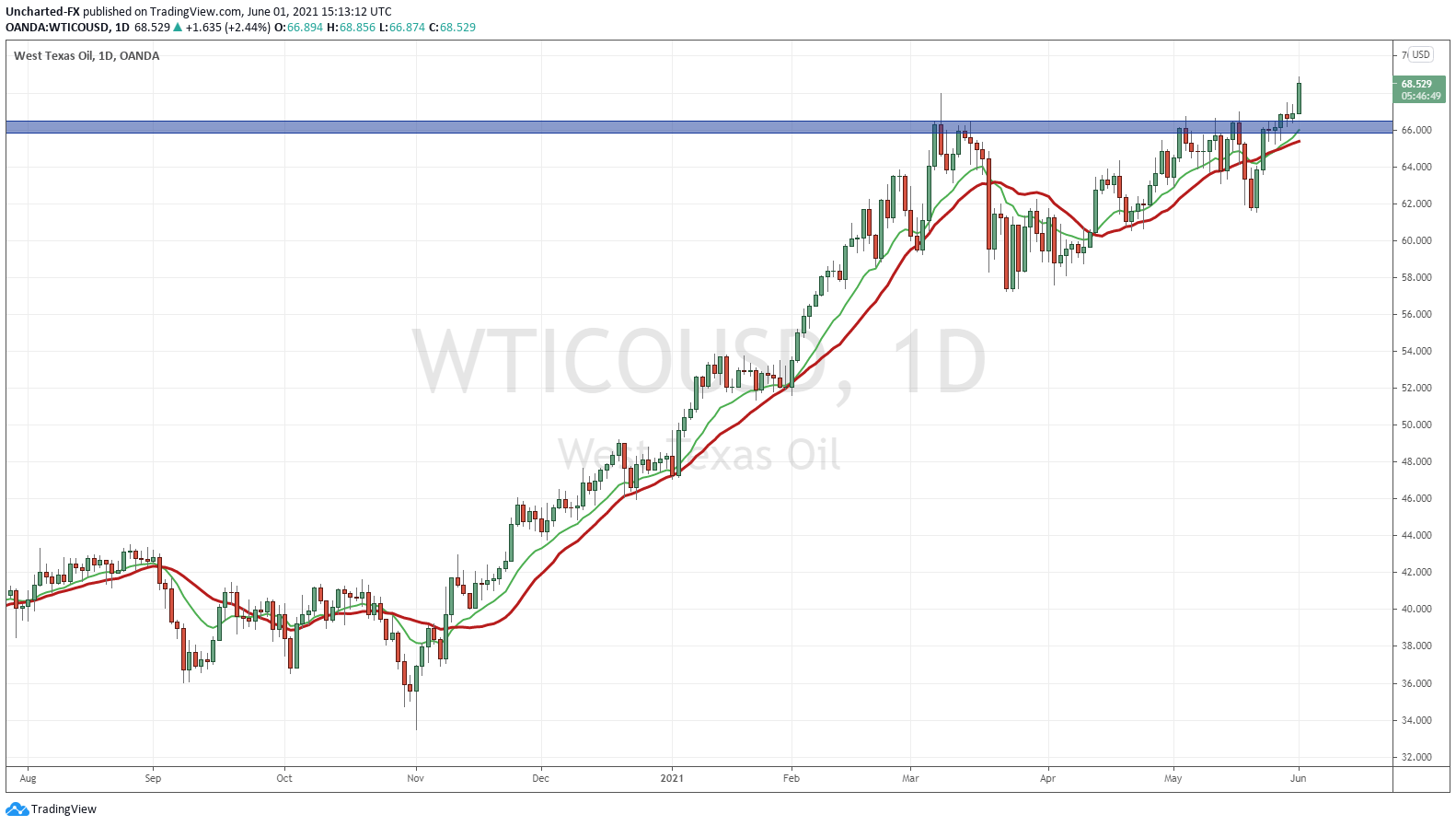

Oil on the daily chart gives us a better snapshot on this current break of resistance above $66. As you can see, it took a few weeks to break above. Resistance was holding, and sellers were defending $66. They have now been taken out, and I bet a lot of stop losses were hit in the process.

Going forward, today’s daily candle will be crucial. If Oil retains current price action and closes strong late in the trading day, the breakout would be even stronger. The major thing to note though is what was once resistance, now becomes support or price floor. Meaning that price can retrace to $66 and we should this time expect buyers to defend.

Technically, the break out sets us up for higher Oil prices. Fundamentally, macro events will buoy prices. Some of these on a geopolitical level, and others due to monetary policy reasons. Oil is a commodity, and many tend to run into hard assets to protect themselves against inflation.