It’s 2031, COVID is long gone.

Jose Conseco is president of the USA.

Jeff Bezos redesigns the human digestive system to not need food or water

Peter Thiel spends $500M USD lobbying congress to get a VICE article corrected

Built to last

One of the most obvious questions to ask when investing in a company is, is this company going to be around in 10 years?

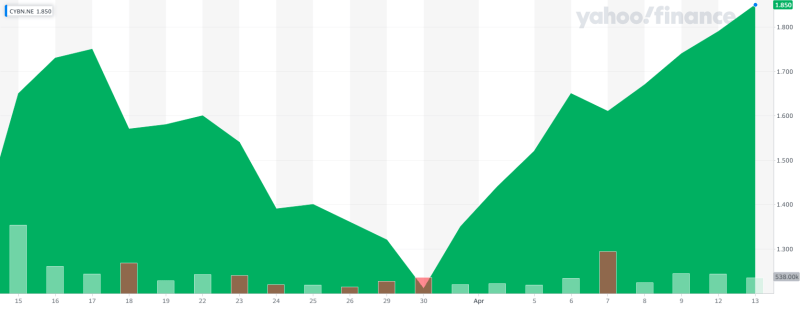

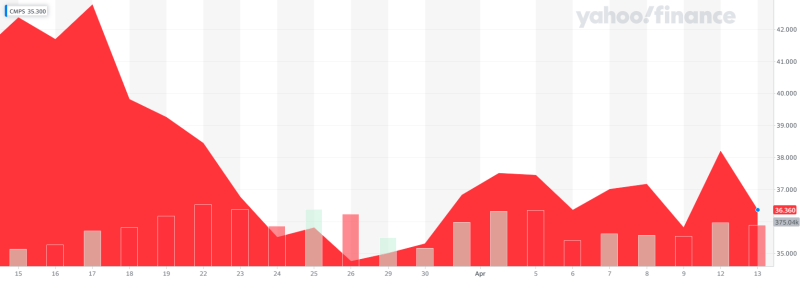

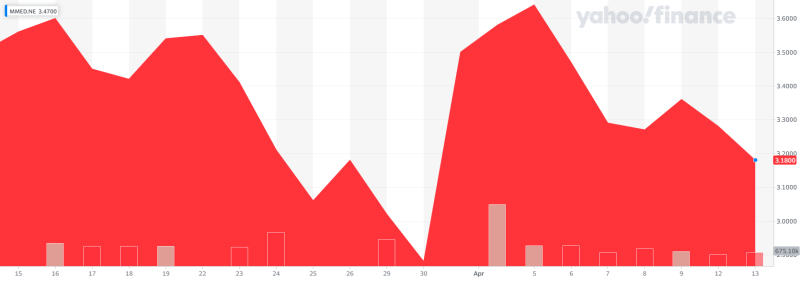

Seems like a no-brainer, but after combing through MD&A’s, insider filings, financials, pitch decks etc. it’s clear many psychedelics companies won’tbe. Small ass raises with no unique selling points or differentiation, they are a dime a dozen. After a bullish 2020 the sector is starting to slow down as we are seeing a correction here in Q2. One company bucking the trend is Cybin (CYBN.NE).

While many psychedelics companies are doing work for pre-clinical trials, Cybin has an already established head start. Speed will be important as competition will increase as more attention and capital goes into the industry. Cybin has outpaced much of its competition with its early start in clinical trials, the company is also using technology to stay ahead of the curve.

Cybin’s plan is to create novel drugs, study them through clinical trials, and then patent them. Because psilocybin itself can’t be patented, companies like Cybin see an opportunity to create their own IP. A big advantage over the natty’s.

Cybin has multiple active phase 2 trials with several more phase 1 and pre-clinical trials in the pipeline. One of their main projects, a sublingual film that goes under the tongue as a psilocybin delivery method was created to speed up the psychedelic-assisted therapeutic process.

This delivery method would remove that 45-60 minute onset period of a psychedelic trip.

Psychedelic therapy sessions are also usually time-intensive, so shaving off an hour from the process without compromising the patient’s experience is a solid value prop for Cybin. For first-time patients, this extra waiting time only adds more anxiety. It’s like waiting before the needle.

Outpacing

Today Cybin announced a plan to start pre-clinical work on novel compounds CYB003 and CYB004. These molecules have been designed to have a faster onset and a shorter duration of action while retaining all of the clinical benefits of psilocybin. After the studies are completed the company plans on filing IND applications, targeting treatment-resistant psychiatric disorders and certain forms of addiction.

Cybin (CYBN.NE) Announces Clinical Trial Plans for Two Psychedelic Molecules

Every company boasts about its leadership but finding a CEO like Doug Drysdale who has 30 years of experience in health care is rare. Many psychedelics companies are being run by rookie or sophomore CEOs, adding a level of risk to the investment. These more inexperienced CEOs can surround themselves with experienced vets who give great advice, but at the end of the day, a young and inexperienced CEO can hurt a company, or attract the wrong people altogether. Drysdale’s extensive 30 year track record in health care, raising capital, and running public companies are three things mentioned by investors who like Cybin.

The company has raised around $90M CAD so far. The company’s market cap currently sits at $259M CAD with a daily average of 678,195 shares traded.

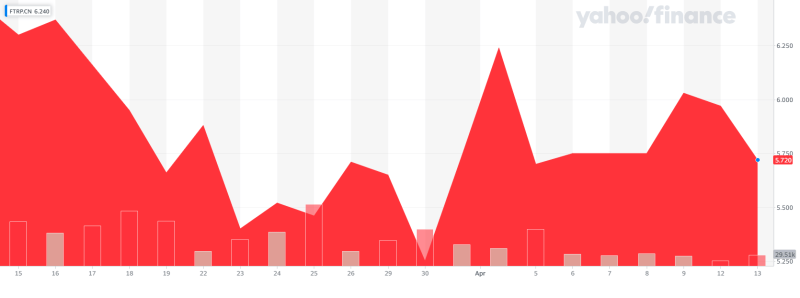

With the Q2 correction in the psychedelics sector, most companies took a hit. The last 2 weeks of March were especially bad. It was red across the board, even for Cybin. But while other companies have had a rather limp recovery, Cybin has climbed 40% in the last 2 weeks.

Move over, Elon

Cybin also has a partnership with Kernel that will give Cybin the ability to gather and process measurable results from psychedelics trips via Kernel’s non-invasive neural technology. Most of Kernel’s competitors like Elon Musk’s Neuralink are invasive, meaning something needs to be ingested.

The microdosing and neurohacking communities are big on measurable results. And with tech being a big supporter of the psychedelics sector I could see Kernel’s wearable tech becoming a hot consumer item. It’s pretty far down the line, but it’s interesting to speculate what that could look like. I think many consumers would choose it over an invasive option.

How Cybin would profit off of that? I’m not sure. Maybe if people could take psychedelics at home wearing a piece of Kernel tech and Cybin could create a series of processes to read complex data back to the user? They could also do a 23&Me type of deal but for the human brain instead of genetics. I’m just guessing at this point, but my gut feeling is there’s a lot of potential here. This is a smart space for Cybin to enter regardless of how it shakes out.

Every psychedelics company talks about building a tech platform, it’s become somewhat of a buzzword. AI and machine learning get thrown around, but if you read the fine print most of those projects are destined to be outsourced, there aren’t many open positions for data scientists in psychedelics right now. It’s an important thing to consider when investing in a company that claims to be interested in tech but isn’t willing to put up the funds necessary to make it robust. Cybin partnering with an established tech company makes a lot of sense.

Cybin also acquired Adelia Therapeutics last year for $15M USD which involved Adelia’s IP, patents, and tech. Through Adelia, Cybin plans on releasing a novel drug discovery platform for psychedelic therapies among many other projects.

A real ass company

Yesterday I wrote about how the cannabis company Valens (VLNS.T) beat out a sea of early-stage weed extraction companies. As several of its contemporaries have filed for chapter 11, Valens has increased its revenue from $5M CAD in 2018 to $83M CAD in 2020. They have a management team who have executed well, none of which are insiders in any shady weed company. As someone who nerds out on SEDI and SEDAR, I can’t begin to quantify how rare that is for the cannabis space. Cybin appears to be following a similar trajectory to Valens.

Many psychedelics companies aren’t too worried about communications yet this early in the game. Cybin has successfully created a company story whereas many psychedelics companies have remained somewhat ambiguous. Cybin talks to its current and future investors consistently, the company released 9 press releases in March.

Having a base of dedicated retail investors is important. Not only does it diversify risk, but it also allows your message to spread further. Unfortunately, many shady companies abuse this strategy, tossing out useless press releases every time they update their website. Cybin actually backs up its PR with substance, and the reason they release so much news is that their business has many moving parts.

This sounds basic as hell, and it is, but Cybin actually makes sense as a company. I can see them existing in 5,10,20 years. They are already doing so many right things this early in the game, and they have an effective communication strategy for distributing their accomplishments, and they can raise capital. I can’t say the same about a lot of psychedelics companies who when capital dries up will probably run to the next trend. It happened in the cannabis sector, lots of the folks are either in psychedelics or gold right now. Or both.

Full Discloser: Cybin is an Equity Guru client