If I was getting paid by the number of pitches I hear, I’d be making a lot more money than I do. Often, they’re terrible. And I include ‘just okay’ in the terrible column, because if your investment pitch isn’t lights out amazing, it’s death.

Sometimes I hear pitches that I really love, but the number of hours in a day restricts me from getting into them in the usual extensive way on this site, but right now a lot of you are starting to wonder if cannabis has any further to fall, so it might be a good time to look askew at something less weed-related.

Today I’m going to play a little catch up, and bring you three deals that fall into that latter category, one from each of the Canadian exchanges (I see you, Aequitas Neo exchange, I just don’t respect you enough to also pick one of the six companies you list), with all of them deals that made me go ‘hmm.’

It’s important to note that none of these companies have commercial arrangements with us. I just think there’s something worth exploring on each front.

1. PARCELPAL (PKG.C): THE TOTAL PACKAGE?

The first time I heard about Parcelpal, I hated Parcelpal. It was a terrible deal that involved having people send their packages to a gas station so they could be picked up later, presumably while filling up your gas tank and buying a Monster energy drink. This is my idea of a personal hell.

Don’t get me wrong, I think there’s a ton of money to be made in the home delivery space, but if I have to go anywhere to pick my item up, I may as well just go to the store and be done with it.

I get everything home delivered nowadays. If I have to come out to a mall, or a standalone store, I’m already annoyed. If I then have to listen to smooth jazz, standing in line for half an hour while a high schooler takes an age to fold a shirt, scan a tag, and press five buttons on the Moneris machine, I’m already predisposed to scowl.

But home delivery? As long as my package isn’t being delivered by DHL (kings of the ‘we missed you’ note), FedEx (kings of the $25 customs fee for clearing $4 in GST) or UPS (a savvy mix of both), home delivery is amazing! I get clothes, electronics, furniture, groceries, mattresses, all from a delivery guy, left on my front step.

No free tables at my favourite restaurant? Fine, I’ll go home and you can just bring the food to me.

Office fridge is out of lime Diet Pepsi? Fine, I’ll just have 4 cases sent up from Save-On foods. I just, three days ago, realized I needed a gadget to shave butter when it’s too cold to spread. Within 48 hrs, such a thing was at my door. What a time to be alive!

But this ‘delivery me the world’ attitude stops when you’re not doing business with a giant megachain. Amazon can bring me a lot, but I hate Amazon, which treats its employees like crap and drives little competitors out of business and allows some pretty shoddy third parties to use its system.

I can get my groceries from a supermarket chain with a delivery setup, but I can’t get my fruit and veggies from my local fruiterer. I can have Coastal Contacts send me eyeglasses, but what about the funky little boutique in Gastown with better styles? Why does my desire for convenience have to force me into deals with the devil?

ParcelPal is looking to change that, and their plan is just cunning enough that it might work.

ParcelPal also saw the error of its early ways, and recently pivoted to a new plan, wherein they provide an app to consumers that allows you to book a delivery of any product, at any store, for the advertised price..They’ll send a driver to go buy it, and deliver it – within an hour.

An hour, people.

This is, of course, ludicrous on the face of it. Business plans exactly like this existed back in the dotcom days, and crashed hard.

Kozmo.com was the poster child of the dotcom bubble of the late 90’s. Their literal pitch was they’d go out and get you what you wanted, videos, music, food, etc, and bring it to your door inside an hour. They were the talk of the town for a while, raising $200m but giving $150m of that back to Starbucks in return for permission to place ‘video return boxes’ in Starbucks locations.

And then they lost $26m on revenue of $3m.

So what’s changed between then and now?

Penetration: We’re used to receiving and placing online orders now, and nowhere near as scared to put our payment details online as we were in 1999. Customers won’t just accept home delivery as an option, they increasingly demand it.

Technology: Kozmo worked via email and a website, and dispatchers, and figured it would save money by not having big offices. Now, AI can do much of the dispatching job, apps keep drivers not just on point, but can tell them what’s the fastest route to take, or have them stack multiple orders to different customers, or make a last minute change to the order, as well as show a customer where their driver is and when they’ll arrive.

Economics: We’re in the ‘gig economy now, which means a lot of people have only one job, but for as many as a dozen companies. That includes drivers, who could give you a ride to the airport for Uber, then grab dinner for your husband from SkiptheDishes, take a bouquet of flowers to his girlfriend, and then maybe pick up a copy of Sports Illustrated, some Cheetos, and a 2 litre of Dr Pepper from the bodega to keep the kids quiet, all on the same shift.

That last run is where ParcelPal could come in, offering independent stores of all types the ability to offer delivery through PKG, and offering their customers the ability to force the issue if the company doesn’t already offer the service, by simply having a PKG driver show up with your credit card number at the ready.

And an existing delivery option isn’t a gamebreaker – KFC has its own delivery drivers that drop food off for free, but also offers its service for a fee through SkipTheDishes. There’s no reason they couldn’t let ParcelPal show up and grab a quick zinger or two.

This combination of improved options make for a decent landscape for delivery companies to do business, even in competition with the biggest companies on the planet. Now, ParcelPal doesn’t need to buy trucks and drivers, it doesn’t need maintenance programs and service departments. It can hire drivers quickly and let them go just as quickly. The drivers schedule themselves. Payments move across wires without human intervention.

WHAT ARE THE NEGATIVE ISSUES?

Where they’ll have issues is in ramping things up globally. Or even nationally. There’s no model that’s going to make one hour delivery to homes in 100 Mile House, BC, a reality. If you’re not in a big city, forget it, and that will make it harder to really employ a national model.

Spending on national marketing means getting the most out of every dollar, and if a lot of those dollars will land in places you can’t operate, that’s going to make costs run high.

They say they’ll use algorithms to keep that overflow to a minimum, and I”m sure they will, but other delivery options have proved tough to scale because of the issues with centres of population. I think of Foodora, which I can’t use in the Vancouver suburbs because the hipster cyclists don’t ride that far, or Just Eat, which spent a mint on marketing on TV but ultimately didn’t have near the selection it promised outside of the urban downtown areas.

Without the one hour promise, ParcelPal competes with Canada Post, and that’ll be a tough game considering the reach of that outfit, and their pricing – and Amazon, which spends so much money delivering goods, a single grocery order can show up in three batches on separate days. I just ordered some coffee pods from Amazon and they showed up – with free delivery – from the UK. That sort of loss leadering is nuts..

And some existing players with max penetration, such as SkipTheDishes, often have issues with barely committed drivers not turning up inside an hour with food that doesn’t stay hot longer then ten minutes, because they’ve got other, more lucrative orders coming in from elsewhere.

There’s a lot to figure out. But ParcelPal are figuring it out. And the chart is starting to look really promising.

This past week, the company announced it was moving into the cannabis delivery business, through a partnership with branding play, Choom Holdings (CHOO.C), and a recent shift into Calgary after more than year polishing the concept in Vancouver shows they’re on the move.

I’ll be interested in how they hope to make the weed delivery promise work because, right now – not legal, and there’s no indication as to whether what they propose will become legal going forward.

So when I value it, I’m all but ignoring the weed portion of the pitch, which at a $25m valuation is fair. I want to see revenues start, I want to see them move the Android version out of beta, I want to see a web-based portal, and more than nine stores on their directory.

But I’m more than okay with where they are currently, and the plan to get further down the road to revenues. Worth adding to the watchlist.

Available on the Apple store and Android store.

2. CLEAR BLUE TECHNOLOGIES (CBLU.V): POWER TO THE PEOPLE

I was on a boardroom tour of Toronto late last year with some high rollers and big brokers, when we were walked into a room and confronted with a woman around my age looking to pitch us a green energy play.

I could sense the boys club that had walked in was apprehensive. We’d just heard a synthetic breast milk pitch, so the boys in their suits were a bit mommy-businessed out.

Boy did they get a lesson in how it’s done.

This is Miriam Tuerk. If you’re having a dinner party, you want her there, and not because she makes a mean salmon mousse, but because she may be the most interesting exec I’ve heard. Hell, if you’re putting on a TED Talk, you want her there. She destroys boardrooms.

After I heard her pitch on the opportunity that is Clear Blue Technologies last year, I thought to myself, I’m going to buy some of this. Unfortunately for me, my broker was sitting right next to me and, quick as a whip, said, ‘how much do you want?’ so much for a coll-off period.

So I’ve been a stakeholder in Clear Blue since before it went public. My initial investment is down, at the time of writing, but not by much. The reason I’m still in is Miriam.

It’s not that she tosses on an earpiece mic and booms her words to the back of the room, though she does, it’s that, as an electrical engineer, she’s got supreme knowledge of her product on the hardware side and coding side, and of the real world situations that require her product – and how she intends to get that product to the masses.

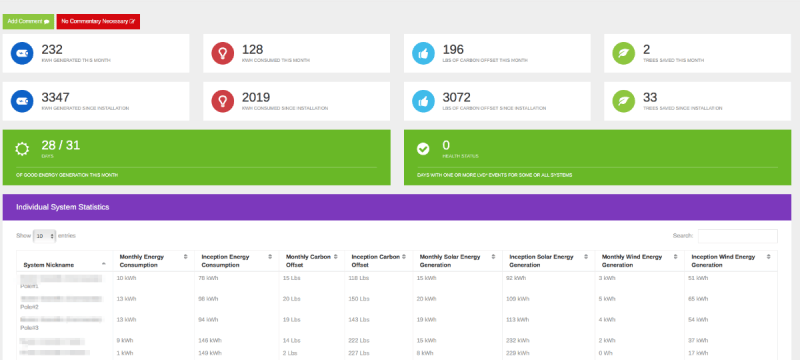

Rather, how she’s already got her product to the masses. She’s literally already sold thousands of systems to 34 countries, as of the time of writing. 55% of those systems have gone to Africa. The vast majority of the remainder have been US/Canada installations.

SO WHAT DOES CLEAR BLUE DO?

Imagine you’re in an African nation, let’s say Lesotho, and you’re farming and breeding goats, but the weather this time of year is notoriously unpredictable and you don’t exactly have a phone or a laptop to check the weather forecast.

Or an internet connection for a laptop or phone to connect to.

Or electricity, for much of the day.

In today’s world, that means you may or may not starve, but you definitely will not succeed, not against the billions of people across the world who DO have electricity and DO have wifi and DO have laptops.

So, many African nations, and Western nations, and telecommunications companies, and electricity utilities, and even individual villages and towns, are looking at options as to how to get connected – or at least powered up.

You could hang a wind turbine out by the side of the road, which would work whenever there’s wind but require a big battery, occasional maintenance, and there’s the issue that there might not actually be a grid around to connect it to. You could slap solar panels out there, but you’d have the same issues in batteries, maintenance, no grid..

Clear Blue’s Smart Off-Grid system is built for this situation.

A large part of the world is off-grid, meaning billions are not connected to a reliable power source, and connecting disparate places and building power plants is absurdly costly, so it just doesn’t happen until the cost is warranted.

Clear Blue’s system allows customers to install a solar/wind-powered, wifi-enabled street light with remote controlled management, to be dropped in any location for a low installation and management cost.

If you have a railway switch hundreds of miles from nowhere, a Clear Blue system can not only allow you to remove the diesel generator you’re probably using to keep it going (and the guy refilling that generator every dew days), but can also turn that location into a virtual small power grid, bringing services to the location that wouldn’t make economic sense normally.

Security monitoring. Cellphone tower. Power generation. The internet.

All from a streetlight.

Currently, if you’re doing anything in remote locations, you lug a generator with you, and a big old container of diesel to keep it going. Want to have internet access at your mine site? Need to run an oxygen tank in a makeshift hospital tent? Want to put security cameras along your oil pipeline to stop people from illegally tapping into it? Want to stick a camera in your corn field so you can tell when it needs water?

Right now, you need a generator. With Clear Blue, your security camera – or streetlight, or railway switch, or cell tower, IS the generator. It makes the grid less relevant, and creates mini grids all over.

Now, this would be a good deal for the world, and for Clear Blue, if all they were doing was dropping hardware all over the world, but the remote monitoring is really the goose laying a seriously golden egg.

Rather than send a maintenance person all over hell’s half acre to check that everything is working every few months, the Clear Blue systems self report when maintenance is needed, with 70% of all issues able to be fixed remotely. The systems also allow for tweaking of the power generation schedule, monitoring of batteries, maximizing performance… heck, they even monitor weather patterns, so you can know if poor conditions for power generation mean you should minimize your usage for a day or two.

Imagine hundreds of these outposts, all linked via the cloud, sending back ongoing reports to HQ, helping ramp systems up at times of peak need, or ramp them down if the batteries are full already.

Clear Blue’s systems are inexpensive, and that’s actually an issue I have with them. We all want to save the world, and there’s no question there’s a social responsibility imperative to help those in need by pricing systems in a way they remain within reach. That 55% of Clear Blue’s business is with Africa is impressive, but also a sign that it may be too cheap.

An example of this is in Morocco, where a pilot project using Clear Blue tech is expecting to install (or be a part of the installing of) 5,000 smart Off-Grid lights, for a minimum contract value of $5.4 million by 2021. Assuming the ‘maximum’ contract value won’t add a digit to that total, that’s cheap. From what I could find online, an average streetlight in the UK can cost $8,000 to purchase and install, and that’s without solar or wind powered anything attached.

Clear Blue may only be installing a part of the finished product, but the fact remains such contracts are heavy on the sales timeline side, and a bit light on the revenue end – for now.

The defence on being inexpensive is, likely, there needs to be a critical mass of systems to really enable cost savings and maximize profit potential. If you’re covering the world on the cheap because there’s some ulterior motive in having access to the ensuing data, or being able to upsell later when you’re depended on in a bigger way, or in having a system build out that a bigger player might want to come in and acquire, then going in inexpensively to the world can make sense.

For Clear Blue, that last option may be a very real one.

Enter the Telecom Infra Project, AKA: TIP.

TIP is a collaboration between Intel, Nokia, SK Telecom, Deutsche Telecom, and Facebook. It’s goal is to connect the unconnected around the world. On the telecom side, the reasons for that are obvious. On Facebook’s side, they plug into an initiative that company already has, to bring the internet to the populations of the world that don’t currently have access to us.

TIP and Clear Blue will jointly provide the Smart Controller Management application programming interface (API) for OpenCellular-Power. The API will define how the OpenCellular-Power system communicates with the cloud to enable users to remotely monitor its status, transmit data and alarms, control smart battery settings and more. Clear Blue will also deliver the first smart off-grid remote management and control service for OpenCellular-Power.

What this means is, Facebook and Clear Blue are rolling out big pilot projects to see if dropping a Clear Blue system into Bangladesh, or Western Samoa, or rural Arkansas, can bring Facebook and the telecom companies new customers who might otherwise take generations to be connected to the internet.

Think about that now. At a $17 million market cap, if these pilot projects work (and evidence from existing contracts being served everywhere from Nigeria to Rwanda to Morocco to New Brunswick, Facebook could cancel a mid-Thursday boardroom lunch and use the savings to buy Clear Blue outright.

The market tends to be shy about companies that are ‘sales and service’ focused, especially when there’s a potential government approval process that can drag things out a bit, and when the service end could mean sending a tech to Nigeria.

Such companies bring revenue statements that include healthy and ongoing revenues, but lack the billion dollar jump off that a tech investor is often hoping for.

But I’m sticking with Miriam on this one, because the product, though advanced, is still probably a few iterations away from being a worldchanger, which means the price to get in now is cheap, and because I think someone like Miriam (with apologies to her husband John, who serves as Chief Power Officer and I’m sure is just as capable, if less media-present) will always be close to the pinnacle of technological advancement in this field.

Bet on the jockey, not the horse, as the old saying goes. This time around, I think both horse and jockey have amazing things to come.

3. TITAN MEDICAL (TMD.T): DR ROBOT

I’m all for investing in future tech, and nothing speaks future tech like a world where robots are responsible for fixing your medical issues. But if you have visions of Titan Medical creating some sort of Robbie The Robot android who is going to diagnose, dig into your spleen, and then hold your hand at the bedside as you recover, you’re a few generations ahead of yourself.

Here’s what Titan Medical has created.

This is the SPORT Surgeon Workstation, featuring a 9.1″ inch touchscreen that displays patient data and an HD 3D display to show internal video for the surgeon, who can use the hand controllers to guide his robotic user interface, which uses a light and high def video to send that imagery back.

The point here is, rather than having Doctor McTwitchyhands rip open a patient and leave a massive scar to get to what ails them, the SPORT can make a small incision at the bellybutton, insert its instrumentation, and allow, with 4-6 incisions, a specialist to operate on you, potentially in a clinic situation instead of a hospital, with HD clarity.

On the left, a specialist using Titan’s system to move robotic instruments inside the body, that can cut, manipulate, coagulate, stitch, and examine your organs so the doctor outside can make miniscule movements in a minimally invasive way. On the right, the multi-directional multi tool does it’s business in an only slightly mortifying manner.

The system, which will have multiple use cases eventually but, for now, is being focused on abdominal surgeries in women, is expected to be commercialized in 2020, once it’s been approved for use and clinical trials have been run that verify its effectiveness.

Titan isn’t expecting that track to be a tough one because all this instrument really is, is an extension of a doctor’s hands. There’s no AI making a decision to cut out your kidney to get at your spleen, or potential for a Nigerian spam email to accidentally convince the machine to make you a eunuch.

Doctor moves hand left, robot moves instrument left. That’s it.

Now, that’s hardly revolutionary. The old lady at the thrift store on my corner uses a pincer tool to reach the top shelf, where the Playstation 1 games are, and she’s pretty good at not accidentally dropping them on her head.

But when you’re dealing in micro-surgical moves, you need a tool that is calibrated and designed to make a movement of millimeters when your hands are moving inches. And you need a tool on the pointy end that can move in any direction, that can grab and cut and probe without the surgeon needing to perform heroics.

The other side of the system is the patient cart, where the magic happens at the pointy end.

This goes over the patient proper and does the business based on the doc’s moves at the workstation.

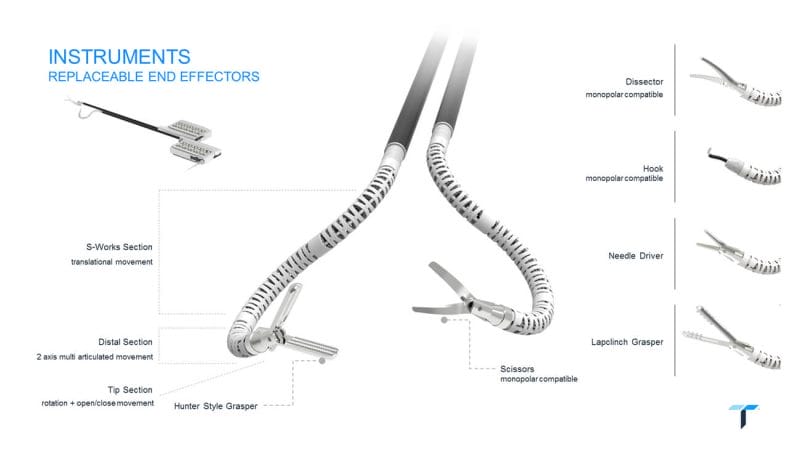

What goes inside are these:

Yes, they look scary. But so does the stuff the surgeon currently uses on you. At least these guys leave a few holes inside of a chainsaw rip.

Titan has created a virtual reality simulator for the training of operators of the machine, and it looks like something I’d play with my kids. According to the company, after one hour on this sim, experienced doctors are ready to go in for reals on people, or at least be accredited by their hospitals to do so.

VR is the family friendly version, but if you’re a cynic like me, a simulation makes me think, “You guys haven’t made this actually work yet.”

Well, turn your cynical attention to the following video, if you can stomach it, where surgeons use the actual system to perform a single-port prostatectomy. NOTE: There’s fire and flesh and a vas deferens involved in this, so don’t watch it, like I did, while eating chili. Or at work. Or around kids who know where the blowtorch is kept. I’m just going to go sit cross-legged for a bit.

For mine, the economics of this product and its development are interetsing. Titan wants to earn $1500 per use, and $1.25 million in pricing per robot, with around 50% of that being margin. Service revenues is another avenue they believe will bring in good cashflow, and they expect around $225k in fees per unit annually.

The downside is, they’re burning through a lot of cash to get there. They’ve raised $70m so far, and burn around $4m a quarter, mostly in research and development. There’s $32m in cash left.

At a $58m market cap, they’re already valued under what they’ve put into development, which is good for potential investors now, and if you apply that $32m in cash against the cap, you’re looking at an enterprise value of just $26m, which compares even better against the money that’s been put into it.

In short, the guys who got in early and sold have lost a bunch of dough, whereas the execs at the company believe they’re closing in on the moment where that investment finally pays off..

The Canadian markets disrespect med tech deals in this way pretty consistently.

It’s always useful to look over a year of a company’s stock chart and figure what happened when.

For Titan, the ups have been related to times when the machine has been used by major medical facilities, and the downs have been related to losses and money spent on R&D, as well as financings. A mid-June 30-1 rollback kicked it in the guts all over.

Today, you get a company for $2.63 that you would have had to pay $20 for a year ago, and that company is a lot closer to where it wants to be.

This is a fairly regular occurrence in this space, where guys get in on news and lose faith over time as the FDA trail lumbers along. The key to med-tech is not watching the daily ups and downs but, rather, feeling that your team, their tech, and the need for both are strong enough that – eventually – you’ll wake up one day to find great news and a tripled stock.

It doesn’t always finish that way. But Titan is pretty far down the road, considering where they’re valued. Worth a look.

— Chris Parry

FULL DISCLOSURE: As discussed in the piece, the author owns stock in Clear Blue. There is no commercial arrangement with any of the companies mentioned between the author and/or Equity.Guru.