Most Canadian cannabis companies don’t actually cultivate cannabis so much as they cultivate the perception that they’re going to be able to grow copious amounts of cannabis in the great, wide open retail future.

The medium for this performance art is often a complacent financial press. Witness Sean Williams of the Motley Fool. Williams usually just passes along company projections to his readers whole, but has recently begun to use his (content) farming experience to make projections of this own. These projections include 500,000 kg per year for Canopy Growth (WEED.T) and 100,000 kg per year for Emerald Health Therapeutics (EMH.V), who currently grows no dope at all, as near as we can tell.

Whether Williams’ apparently methodless preponderances are accurate or not, the fact remains that well-financed LPs have put themselves a position to create great volumes of commercial-grade marijuana, and the market is in the process of asking how, exactly, that marijuana is going to be sold.

Sportsdesk Consulting

I saw this coming a few months ago and, in a fit of opportunism, made myself available as a consultant to discerning LPs who need a strategy to get their dope to market ahead of their competitors.

The first few meetings were polite wastes of time. I delivered neat presentations outlining the market available to the potential client LPs, and the most efficient ways to go after them. There were reasonable and aggressive sales strategies, timeline projections… all printed on 8 x 10″ colour glossy paper, neatly bound and hand delivered to be followed along with as I presented. After receiving many polite handshakes, but no callbacks, I changed strategies ahead of my meeting with the 4th LP.

Arriving at their boardroom with no literature or prepared presentation at all, I initially sat down and said nothing. It got nice and awkward, and I let that build until one of the VPs asked: “So… I understand you’re here to consult on our retail strategy?”

I cleared my throat, and leaned in close. They leaned in too. After pausing for dramatic effect, I said: “Brands.” And leaned back, looking very impressed with myself.

The company looked at me expectingly, then at each other.

“Brands,” I said, as I turned my palms skyward and nodded once. “It’s that simple.”

As soon as some suit opened his mouth to ask what I was talking about, I cut him off.

“Brands. Brands and brands and brands and BRANDS! I’m talking about class-leading, consumer-facing, heart-and-mind winning BUH-RANDS!!”

They all leaned back. Stunned by my brilliance.

“I’m going to put your high-test weed in smoke brands and cosmetics brands and liquid caps and solid caps and chewing gum and hair curlers! All with their own BRANDS!”

I got up and started gesticulating wildly across the table to the wide-eyed, smiling audience.

“Pop and breath mints and hair products and feminine hygiene brands! We’re going to make it so that your weed is in everything and so that consumers won’t even THINK of spending their hard-earned cash on any product that hasn’t been seared with the quality assurance that they expect, no, demand, from your unique, trustworthy BRAND!”

They got up out of their seats, because by then I was jumping up and down like Tom Cruise on Oprah’s couch and yelling, “Brands! Brands! Brands!” and the clients started jumping up and down, too and yelling “Brands! Brands! Brands!” and we were both jumping up and down yelling “Brands! Brands! BRANDS! BRANDS!”

When I ran out of steam, they burst into applause and offered me a $1 million dollar retainer on the spot. I only turned them down because it would mean giving up blogging.

Was patient zero mis-diagnosed?

While I continue to maintain that these companies are going to have to actually produce dope in these kinds of volumes before I believe their projections (currently running somewhere around 10x – 15x current unit sales), the market is right to wonder what they’re doing about delivery. There’s sure going to be a lot of it out there, and whether the market is saturated or not, the stuff isn’t going to jump into pipes and start smoking itself.

It’s unclear exactly when the conventional knowledge about how stuff is sold got mis-weighted in the pot sector. The herd may be over-amplifying the “marketing” part of “sales and marketing” because we want to believe that clever ideas can sell. It might just be a self-fulfilling condition of the instagram age. One way or another, this disease has infested the cannabis equity markets, and caused both investors and companies to lose their goddamned minds and froth at the mouth for consumer brands that haven’t yet been tested with consumers.

The recent Canopy acquisition of Hiku has further entrenched the concept that squacking “brand!” like a wild jungle bird is the best way to move product. Marketing is the only language that Hiku speaks. I watched Hiku CEO and EG Twitch Stream recurring guest Trent Kitsch speak at the Vancouver Arcview conference back in April, and he seemed like a guy who might go to his 6th grader’s PTA meeting and ask, in a concerned voice, about the class’ social media presence. (“Is it properly managed? Have the teachers thought about platform curation and how it might effect their brands?”)

Canopy’s move puts them in control of the industry’s most recognizable brand… of coffee shop.

The Canopy offer for Hiku amounts to $230 million in stock. That’s almost exactly where the market valued Hiku this past December, when DOJA bought Tokyo Smoke to make Hiku a thing. Canopy is getting something for their money, and that something is a series of high-traffic brick and mortar retail locations that have people chomping at the bit to go play Amsterdam as soon as October rolls around. Because they’ve got a strong brand.

The rest of it is left over parts. Canopy doesn’t need 7,000 square feet of production space in Kelowna, no matter how the product is branded. They’ve got close to 100x that in active space alone. “Lifestyle cannabis brands” DOJA and Van Der Pop are worth about as much as any product line with zero sales, but the Tokyo Smoke brand is worth the money, because it’s a series of real locations that will really draw real people who really want to smoke real dope… from the brands they trust!

The genuine article

Recognizability is only half the trick. Successful brands have earned the goodwill they hold with consumers. For their contribution to this ongoing branding frenzy, Equity Guru sponsor Invictus MD Strategies (GENE.V) hired NY ad firm Authentic Brands Group to to “develop a collection of lifestyle-inspired cannabis brands,” on July 11th. ABG’s website lists 48 (authentic) brands that the company is the “owner, curator or guardian” of. Many are fashion brands, not really my thing, so there were only 12 of the 48 that I could identify. Crucially, seven of the 12 I’ve heard of are the “brands” of individuals. And they’re individuals that you’ve heard of too. Elvis Presley, Marilyn Monroe, Micheal Jackson and Muhammad Ali are all ABG “brands”. As near as we can tell, Gene Simmons manages his own brand.

I don’t think even the most ruthless self promoter can claim to have made Muhammad Ali, Elvis and Michael Jackson into “successful brands.” Sportsdesk Consulting would leave the blogging business in a hurry if the job being offered was to convince people that Muhammad Ali is great.

The disease is spreading

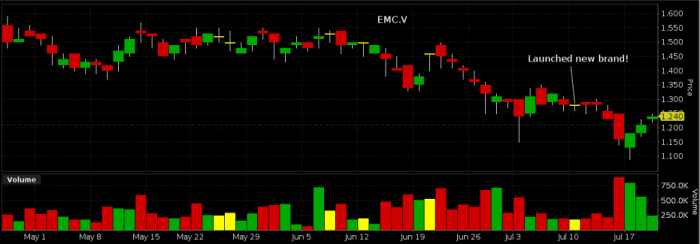

Last week, Emblem Cannabis (EMC.V) put out a news release that “inspired Canadians to Get Curious with the launch of new adult-use cannabis brand, Symbl.” Anyone want to see the concept packaging for Symbl?

I, for one, am curious about what the hell they’re thinking. Emblem is one of the tightest run companies out there. They’re one of few approved suppliers in Alberta. A partnership with aspiring retail chain Fire and Flower could get them some some storefront, they’ve formed a JV with a German company to work on supplying oil overseas… Unlike most companies their size, Emblem is actually shipping product. EMC sold 123.9 kg of product to Canadian patients and to other LPs last quarter. I’ve considered Emblem undervalued for a while and didn’t think it could get any worse, but in the week following their infection by branditis, Emblem took a beating.

To be fair, the branding exercise may have simply not been rated; baked in quickly without even registering. But it’s hard not to read this action as Emblem observers looking at each other for a few low-volume days to see what the crowd was going to do before finally deciding nothing was nothing good.

EMC announced a deal to take a position in private LP Nuvera yesterday that put them back on track, and I continue to consider it undervalued among its peers. Emblem is building out nearly 1/4 million square feet, figures to have 50,000 sq ft active by the end of the summer, and has $80 million in cash. That makes for an enterprise value of $91M, among the lowest of the cultivator-class that we track. It’s an operating enterprise, with the right licenses and decent throughput, and that’s the type of company that I want to be holding once this market starts valuing businesses on their merits. Emblem is not an EG sponsor, but this author is a shareholder.

Bad viral memes that just won’t go away always start off as successful viral memes. Newstrike (HIP.V), Emerald (EMH.V) and Namaste (N.V) built billions worth of market cap off of squacking about brands but, having not yet grown or sold a gram of product to anyone between the three of them, the effect has begun to wear off. Emerald bounced off a bottom yesterday after a week-long high-volume slide that got started when they were conspicuously absent from a list of LPs that the BC Liquor effort was going to do business with. Newstrike has been frothing at the mouth about brands since they learned to walk, has Alberta and BC supply approval, but the former market darling is having trouble getting traction lately.

A healthy, normal, thriving company can be achieved despite infection.

EG sponsor Choom Holdings (CHOO.V) has a familiar narrative: they’re out to create a vertically integrated cannabis producer. Choom’s production facilities are objectively way under-developed compared to their peers. All of their cultivation assets are in the application stage. Forget not having grown and sold a gram, Choom hasn’t even built a room that COULD grow and sell a gram. Somehow, they don’t seem worried.

Choom’s full-blown branditis is expressed in the form of a sharp aesthetic and class-leading messaging. It’s all stapled to a neat back-story, and gives the sense of a bright, inviting future.

Choom is showing us that they’re good at branding instead of telling us. When it comes down to the specifics of their retail operation, the allegedly free wheeling crew of burnouts from Hawaii gets organized and clinical. Check out the guy they put in charge of it:

Aussie Jiwani

Mr. Jiwani (BCIT Sales and Marketing, 1994) is a top-ranked National Account Manager, with consistent award-winning success over a 23-year career in the beverage and alcohol industry. Mr. Jiwani was recently a Key Account Manager for BC Retail Chains & Grocery at Arterra Wines Canada (formerly Constellation Brands) and previously held the position of National Account Manager for Molson Coors Canada. Mr. Jiwani has consistently been recognized for his contributions to record-setting sales figures, territory start-up/expansion and new account development and acquisitions. He has a proven ability to over achieve on sales objectives and is a leader in the alcohol beverage industry.

Most companies don’t even have a sales director. Meanwhile, here comes Choom: $132 million market cap with NO lights on, just straight up getting it. The retail industry runs on labour. Talented labour. There isn’t a successful retail brand that didn’t end up that way without a small army of sales reps. These people are professional friends. They spend all day creating and maintaining relationships with doctors, bar managers, convenience store owners, regional distributors… whoever controls the shelf space and sales channels that they need. Then they leverage those relationships to create sales, and the well-earned commission that goes with it.

Choom would certainly like to have a low-cost operation that grows product on trees for around $2/ gram. In the interim, they’re surely happy to put Jiwani’s team to work putting the product they buy from Abcann anywhere it’ll move. Give the people a taste to associate with that name and label…

…because that’s how you build a brand.

(Feature image of autobot logo lighter brand that was once, but is no longer available on Etsy, was jacked from Pintrest user Christina Tedder.)

Also, in addition to the 123.9 kg Emblem sold (in dried flower) in 1Q2018, they also sold 13.4 kg equivalent of oil. This number is actually a huge contributor (20%) to their overall sales to patients , especially seeing as it was their first full quarter selling oils (they started Dec/18/2017). https://i.imgur.com/oir6f0e.jpg