Gold stocks, including that objectionable subculture of junior exploration companies, have been in hibernation during a multi-year bear market. It’s been a long loooong winter for this hapless sector.

Many traders, speculators and investors that were around during the last bull cycle bailed out long ago. Those that are still in – the Gold Bugs – are hanging on by a thread. Barely. Conviction, dignity and self-respect shredded, Gold Bugs prefer the solace of the shadows, afraid to step into the light for fear of being mocked, ridiculed… sent packing into the hills by mobs of angry crypto-thumpers.

Some of us here at Equity Guru, however, believe that this desolated backdrop, this scorched landscape of an arena called junior exploration, is on the verge of sprouting new growth. Plenty has been written on the subject. EG’s Lukas Kane, for example, recently offered a number of take-aways from the World Gold Council’s latest report.

A taste…

Gold has a longer tail. Shaved flakes of bullion have been found in Paleolithic caves dating back to 40,000 B.C. “Foul cankering rust, the hidden treasure frets,” wrote Shakespeare in 1602, “But gold that’s put to use – more gold begets.”

Gold demand rises and falls, but it never dies.

Classic Kane…

The Bull Cycles:

I’ve witnessed several junior-gold-exploration-stock bull markets over the years. They always seem to materialize unexpectedly, often from extended periods of investor apathy. When they do turn, the action can be intense. For those ExplorerCo’s holding the right claim blocks, the action can be downright epic. Aurelian Resources and their Fruta Del Norte gold deposit in Ecuador is one example from the past: from a mere $0.40 to over $40.00 in a short space of time.

Other wealth generating episodes from the past include Eskay Creek in the Golden Triangle of British Columbia, Hemlo in Ontario, Pierina in Peru, Kilo 88 in Venezuela… the Carlin Trend in Nevada. The juniors’ that participated in those discoveries generated untold riches for early loyal shareholders.

The Unimaginable Peak:

A case has been made that we’ve run out of large gold deposits, that there are no more major world-class discoveries to be made, that planet Earth is tapped out.

Ian Telfer is the latest expert to opine on the subject. It’s only a theory, but it’s a theory that is gaining wide acceptance – ‘Peak Gold’.

Headline…

‘We’re right at peak gold’: All major deposits have been discovered, declares Goldcorp chairman

The sub-title for the above article asks rhetorically, then states…

“Are we bad at finding it? Or have we found it all? My answer is we found it all.”

That’s some trippy ass’d notion when you really think about it. Space colonization – tapping into the sub surface resources of distant planets – may be our only real play now.

Of course there’s always asteroid mining – that should be a piece of cake.

For balance, some of the comments I’ve read online recently – comments from professional geologist types – call the peak gold thesis ‘pure bunk’… ‘lazy thinking’. Fair enough, but there’s more…

Many of the truly ginormous deposits on planet Earth, like those in the prolific Witwatersrand Basin in South Africa, are nearing the end of their life cycles. It’s estimated that South Africa, once boasting annual production of over 1,000 tonnes of gold a half-century ago, produced a mere 167.1 tonnes in 2016. What’s even crazier is that it’s predicted South Africa will completely exhaust its gold reserve base in less than four decades. This, according to the Environmental Economic Accounts Compendium published by African Statistics Day.

Let’s just say that we have peaked…

Let’s just say that all of the major world-class gold deposits on the planet have indeed been discovered, cherry-picked, exploited. Shouldn’t that trigger the mother of all gold bull markets in the not-too-distant future? Shouldn’t the mere possibility of such a scenario unfolding create immediate positive-price-pressure in the metal and the companies that chase after it?

The market can be annoyingly obtuse at times. I don’t believe for a moment that the market is ‘efficient‘. At some point, the market is going to catch on that there’s only so much gold left to be discovered, save for the odd heavily laden Spanish galleon sent to Davy Jones’ Locker, or the occasional ‘gold train’ plowed deep into the Polish landscape.

In my way of thinking, gold deposits that have yet to be found, though they may fail to live up to the ‘monsters’ discovered in decades past, will be all the more precious, all the more coveted, in the months and years to come.

Narrowing Down the Search:

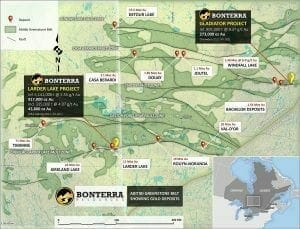

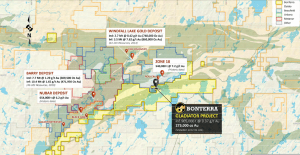

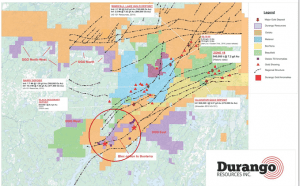

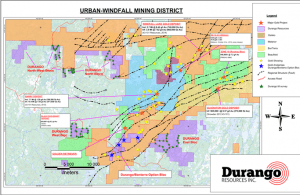

Windfall Lake, approximately two-hundred kilometres northeast of Val-d’Or Quebec, may be the most actively explored region in Canada right now. Its geological address puts it in the Urban-Barry Greenstone Belt within the Abitibi Subprovince. Note the size and scale of some of the more significant gold deposits on the map below.

Speaking to the structural geological setting of the general area…

Major regional crustal shear zones cross the Abitibi and is considered the plumbing system for these significant gold deposits. A related splay of a major shear zones crosses this greenstone belt, which helped fertilize the area with gold.

Unlike other areas of the country where access and exploration activity is reduced to a seasonal pursuit, Windfall Lake is largely accessible year-round via a network of well-maintained logging roads.

The Players:

The main players in the Windfall area are Osisko Mining, Bonterra Resources, Beaufield Resources, and a small strategically positioned company called Durango Resources.

To set the table, three weeks ago, Osisko Mining (OSK.T) released a long-awaited resource estimate for its Windfall Lake project. I’m still trying to comprehend the number of meters OSK has drilled into this project thus far, some 597,000 meters! That’s like 597 kilometers or 371 miles! That’s like driving from Toronto to Montreal, and then taking a dozen or so laps around Griffintown to boot!

The resource at Windfall is high-grade: mineral resources across multiple zones total 601,000 ounces at a grade of 7.85 g/t Au in the indicated category – 2,284,000 ounces at a grade of 6.7 g/t Au in the inferred category. The resource was calculated using a 3.0 g/t Au cut-off. Approximately 40K meters of recent drilling was not incorporated into this resource. The gold resource at Windfall Lake is destined to grow.

Bonterra Resources (BTR.V) is no slouch in the drilling department either. The company’s Gladiator Project is only a handful of kilometers to the southeast of the Windfall Lake deposit.

Bonterra has a 2012 resource estimate for Gladiator outlining some 273,000 ounces grading 9.37 g/t Au. This resource is way out of date as the company is in the midst of an aggressive, six drill rig, 70K meter program focused on extending and defining known mineralization. A resource update due in H2 of this year will factor in more than 100K meters of additional drilling since the 2012 resource number was tabled. This will be a highly anticipated event for the Windfall Lake area.

Durango Resources (DGO.V) is a junior that has strategically wedged itself, via multiple claim blocks, throughout the Windfall Lake camp. Due to this strategic positioning, the company became the subject of intense speculation a little over a year ago. Note the price and volume spike on the chart below…

The speculation was over a number of unsolicited offers made for its Trove Property (circled in red on the map below), a project further to the southwest of Osisko’s Windfall Lake project.

The Deal:

As it turned out, it was Bonterra at the door, and they ended up acquiring an option to gain full title of the Trove property, the terms of which are outlined below:

- Pay $150,000 and issue 1,500,000 common shares within two business days of the date the TSX Venture Exchange accepts the transaction (the “Closing Date”);

- On or before the first anniversary of the Closing Date, pay a further $150,000 and issue an additional 1,500,000 common shares;

- On or before the second anniversary of the Closing Date, pay $200,000 and complete a minimum of $1,000,000 in exploration expenditures;

Durango will retain a 2% net smelter returns royalty in respect of the Trove Property. Bonterra may purchase 50% of this royalty at any time for $1,000,000.

Trove was an important (missing) piece to Bonterra’s puzzle. It’s a direct extension of the south-west mineralized trend that the company is currently exploring on its Gladiator project.

The Gain:

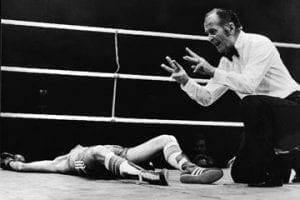

I think it was a smart deal this all-female Durango management team negotiated with Bonterra for Trove. The $500K in cash payments keeps the treasury stoked. The BTR shares, once fully vested, will be worth approximately $1.5M (based on recent trading levels). If the market develops an appetite for junior gold stocks, as I believe it will, those shares could represent considerable means for the company. The 2% NSR could also become a very valuable asset if BTR connects the dots between Gladiator and Trove. I like the deal, and it was negotiated at a time when the sector was sucking wind, on the mat… down for the count.

You might think, “sure… Durango scored some cash and paper, but they’ve given up control of all of their valuable Windfall Lake claims!” Well, not quite.

The OTHER Windfall Lake Claim Blocks:

Durango holds an additional 8,653 hectares in the Windfall Lake camp…

Durango’s claim blocks in the west, north and northwest group are crosscut by important northwest-southeast structures which extend to the mineralized areas of Windfall Lake.

The company still controls a fair chunk of ground in the area (DGO’s claim blocks are shaded in light purple below)…

These 100% owned claim blocks are suddenly in the news. Note the claims marked ‘Durango North Blocks’ in the above map – this news concerns them.

A till sampling program launched last November – a program deemed top priority due to cross cutting fault systems striking towards the Windfall Lake’s main mineralized system – returned some interesting results.

Thirty-six (36) 5kg till and thirty-six (36) duplicate soil samples were collected, analyzed for fine fraction analysis, and sampled for gold grain count and dense fraction. Of the 36 till samples taken from the area, 17 samples representing 47% of the samples collected returned gold grains, and 25 till samples of the multi-element assays reported gold anomalies between 5 ppb and 3480 ppb representing 74% of the samples collected.

Gold grains in soils are always an eye opener. They’re an anomaly. They lend validity to the geological potential of a project.

Two of the soil samples collected along these northern claim blocks were highly significant: sample DGT-30 returned 3.48 grams per tonne gold – sample DGT-17 returned 1.16 grams per tonne gold. Commenting on these results, Marcy Kiesman, President of Durango stated…

In light of the exciting assay results from the Windfall Lake till and soil sampling program, the second phase exploration program has been expedited as recommended by our geologist. We aim to have formulated drill targets produced on our Windfall Lake Properties in the near future.

On June 4th, the company initiated a second phase of till sampling and mapping on these northern claim blocks.

Additional areas which were unreachable due to weather conditions in November 2017 will also undergo till sampling and mapping this week. The crew is expected to complete the program within 10 days and further results will be announced as they become available.

The area which reported a soil assay of 3.48 g/t gold will undergo additional soil and rock sampling. It’s possible that this area will develop into a priority drill target for the company.

Geological consultant George Yordanov, P.Geo stated…

“Durango is positioned for discovery with gold mineralization in the area being structurally controlled by a northeast trending deformation corridor and Durango’s property being cross cut by a fault system striking towards the Windfall Lake main mineralized system.”

Final Thoughts…

Durango is run by an intelligent and savvy group of women. Though Windfall Lake is their highest priority project at the moment, their property portfolio extends over four provinces and each individual project appears to have merit.

The deal Durango management struck with Bonterra sets up the company with sufficient flexibility, and freedom, to move their projects forward, and perhaps capitalize on an acquisition opportunity should one come their way.

A quick peek under the hood shows 37.76 M shares outstanding and $1.1 M in cash. The company’s current market-cap is approximately $3 M.

Should a significant discovery be made on their northern Windfall Lake claim blocks, the current share price would represent outstanding value.

END

~ ~ Dirk Diggler

Full Disclosure: The author does not own shares in Durango Resources.

Feature image courtesy of The Daily Beast.

guess you folks are all crickets now over clean commodities huh

Not sure what you mean by “clean commodities,” Bob.

Are you talking about battery materials? Lucas had a post about Ceylon Graphite just this am. We cover a few cobalt companies.

Is there anything in particular you’d like to see more of on EG?

He means Clean Commodities the company.

I’m not silent on them. I feel like they used us six months back and abused shareholders, told mistruths and blew out paper.

We won’t do business with that crew again, and will write nothing about them that hasn’t been triple verified. It happens, sometimes.

Once.