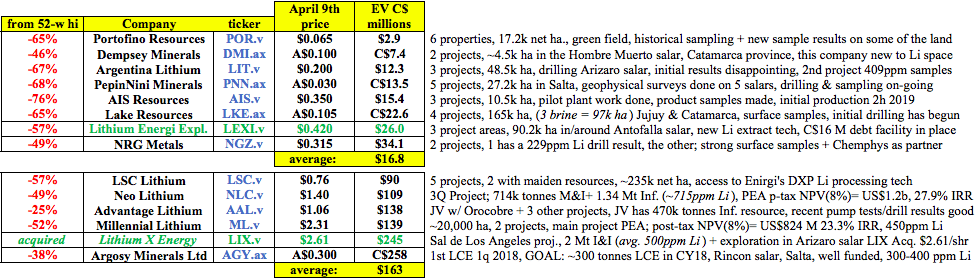

In the past several months, 2 Preliminary Economic Assessments (“PEAs“) have been released on lithium brine projects in Argentina. Neo Lithium [TSX-V: NLC] reported on its Tres Quebradas project, and Millennial Lithium [TSX-V: ML] delivered a PEA on its Pastos Grandes project.

A noteworthy observation is the timeline to reach full capacity. Initial production for each is slated for 2021, with a 3-yr. ramp up period through 2023. Of course, that assumes everything goes according to plan. Yet, readers need look no further then Argentina lithium producer Orocobre Ltd. [TSX: ORL] to recognize the difficulties involved in exploring, permitting, developing, funding, delivering feasibility & environmental studies, designing, constructing & trouble-shooting solar evaporation ponds.

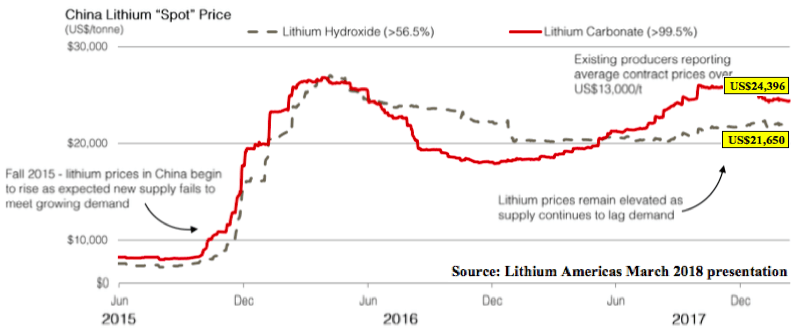

Looking back at Orocobre’s June 2015 corporate presentation, on page 3 it says, “Production is expected to meet the nameplate monthly run rate of 1,450 tonnes of lithium carbonate (~17,500 tonnes annualized) during Q4 CY 2015.” Fast forward nearly 3 years…. Orocobre is forecasting a FY ending June 2018 total of 12,600 tonnes. (~72% of nameplate capacity). As an aside, this says a lot about the global lithium industry’s ability to ramp up production quickly! Lithium prices have soared, yet the supply response has been lethargic.

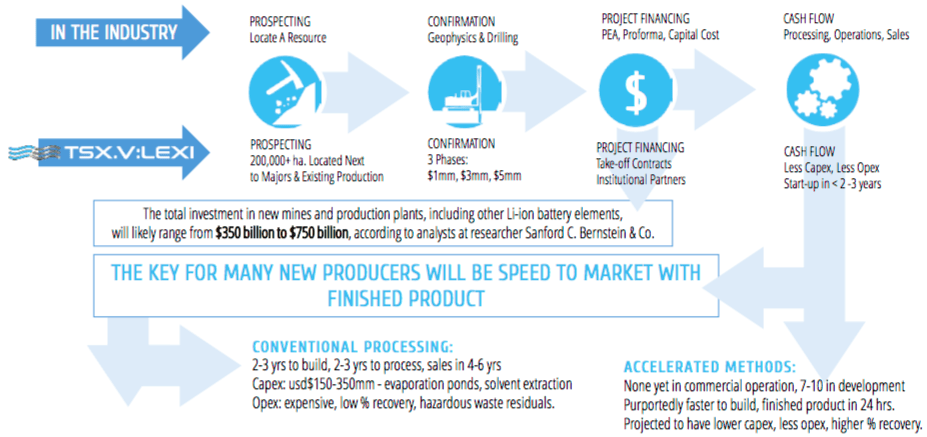

Looking forward, if/when one or more accelerated lithium extraction technologies are proven technically & economically viable at commercial-scale, there could be a backlash against conventional ponds. Projects well underway, like Neo Lithium’s, Millennial Lithium’s, Galaxy Resources’ [ASX: GXY] Sal de Vida, Lithium X’s Sal de los Angeles (recently acquired for C$265 M by a Chinese group) and Lithium Americas’ [TSX: LAC] / SQM’s [NYSE: SQM] Caucharí-Olaroz will almost certainly be allowed to operate.

However, new projects with first production not until the mid-to-late-2020’s, could face fatal challenges in permitting. Therefore, the door is wide open for prospective projects that propose to use technology that bypasses evaporation ponds. To be clear, embracing an accelerated Li brine extraction technology, none of which are proven at commercial-scale, introduces a new set of risks, but risks that I believe are well worth taking.

Huge Land Position + New Tech in Top Lithium Brine Jurisdiction

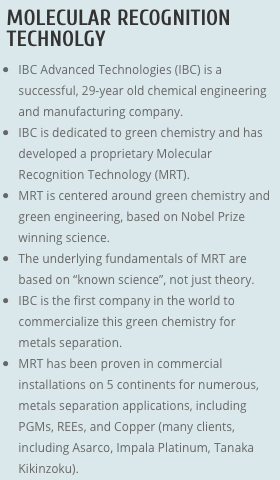

Lithium Energi Exploration (“LEXI”) [TSX-V: LEXI] / [OTCQB: LXENF] is a lithium brine junior with 3 project areas in northwestern Argentina in and around the Antofalla salar in Catamarca province. Management is proactively making a move to sidestep evaporation ponds by aligning with a proven metals separation methodology called (“MRT“), which stands for Molecular Recognition Technology. LEXI proposes to use MRT for the accelerated extraction and purification of lithium from brine solution.

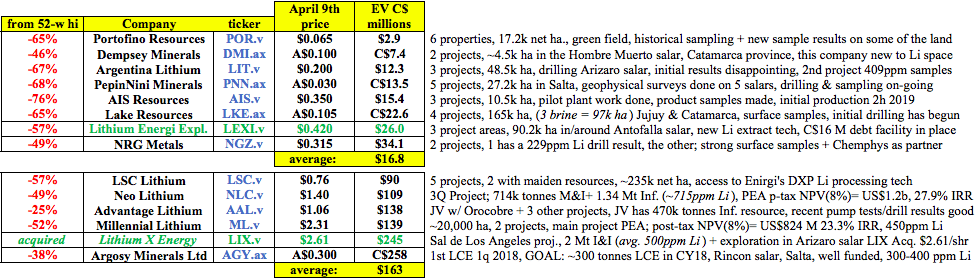

LEXI holds title to 90,244 hectares (“ha“) of Li brine-prospective properties in Catamarca province, plus rights of first refusals (“ROFRs”) to acquire 148,839 additional ha, of which 110,380 ha are located in the Antofalla Salar complex, and 38,459 ha are in the Pipanaco Salar, ~50 km due west of Catamarca city. If LEXI executes their ROFRs, it would become the single largest Li brine property holder in all of Argentina, bigger than FMC Corp [NYSE: FMC] & Albemarle Corp. [NYSE: ALB]. LSC Lithium [TSX-V: LSC] is the current leader, it controls a net 234,519 ha across multiple provinces, in 5 main project areas.

Located less than 20 km west of FMC’s lithium operation (Argentina’s largest lithium producer) in northern Catamarca province, the Antofalla Salar hosts one of the largest basins in region. It’s over 130 km long and up to 5-10 km wide. In September 2016, Albemarle, the world’s largest producer of lithium products, announced the acquisition of exploration and acquisition rights in the center of this salar, and expressed its belief that Antofalla “will be certified as the largest lithium resource in Argentina.”

Besides Albemarle, several other public companies have property in and around Antofalla. Advantage Lithium [TSX-V: AAL] has 10,653 ha on the northern tip of the salar. Argentina Lithium & Energy Corp. [TSX-V: LIT] recently locked up ~14,300 ha, also in the northern part of the salar.

And, Ultra Lithium [TSX-V: ULI] has 5,400 ha near some of LEXI’s property. Advantage, Ultra, Argentina Lithium & LEXI surround Albemarle’s central position in the salar. Successful drill results from Albemarle or any of LEXI’s neighbors would be great news for the Company.

What Could LEXI’s Extensive Early-Stage Properties be Worth?

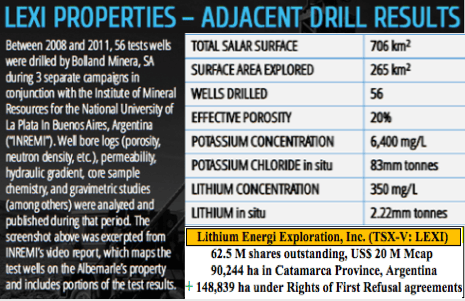

While it’s hard to place a value on green field Li brine properties in northwestern Argentina, there have been recent transactions of parcels, some green field, others with historical exploration data, that could offer rough guidance. Not much is known (in the public domain) about the Antofalla salar, except that 56 “test wells” were completed between 2008-2011 that averaged 350 mg/L Li.

Argentina Lithium & Energy’s recent transaction including a block of 5,300 ha works out to about ~C$860/ha. This property comes with work commitments over 4 years. Work commitments are not a bad thing — active exploration is to be expected — but not having them offers maximum funding and exploration flexibility. LEXI has no work commitments on any of its land, including parcels controlled under ROFRs.

A new entrant to Argentina (first new name since LSC Lithium a year ago), Dempsey Minerals [ASX: DMI], is optioning ~4,500 ha in the Hombre Muerto salar of Catamarca. The acquisition cost, which includes shares, stock options and performance shares, equals ~C$1,000/ha. LEXI has no shares, options or performance shares associated with any of its property, or land controlled under ROFRs.

In December of last year, Millennial Lithium agreed to pay ~C$2,300/ha plus a 3.5% royalty over 36 months for a 100% interest in 2,492 ha in Salta province. That land had key strategic value (because it was contiguous to their flagship project, with known Li values). It’s worth noting that none of LEXI’s properties, including those controlled under ROFRs, have third-party royalties attached.

In November, LSC announced 3 transactions, it acquired the 2,595 ha Mina Teresa property in Salinas Grandes salar, Jujuy province for about ~C$980/ha, a 583 ha parcel in Salta province for ~C$1,970/ha and another 1,472 ha in Salta for ~C$590/ha.

In October, AIS Resources [TSX-V: AIS] agreed to pay ~C$885/ha for 2 projects totaling 7,750 ha in Jujuy province. The properties had historical surface samples showing decent Li values and low magnesium levels, as well as geophysical surveys on them. In May, Liberty Lithium [TSX: LBY] agreed to pay US$5.5 M over 42 months for 70% of a 15,857 ha plot in Salta province, which equated to ~C$670/ha.

Some of these transactions, into the thousands of dollars per hectare, are not directly comparable to LEXI’s unexplored property, but serve as an example of how valuable hectares can become if solid drill results lead to favorable mineral resource estimates, and perhaps promising PEAs.

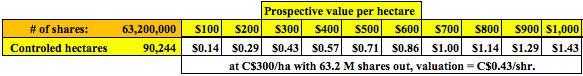

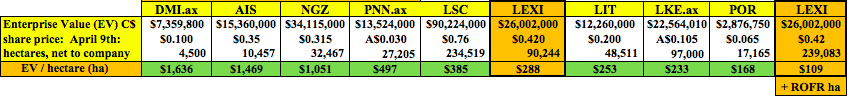

The above chart shows what LEXI’s 90,244 hectares could be worth at various C$/ha milestones. I leave it to the reader to take a stab at valuation, the range of possibilities is quite large. The current share price is C$0.415. So, LEXI is trading at under C$300/ha….

If LEXI executes its ROFRs, it could eventually own a combined {90,244 + 148,839 = 239,083 ha}. Without me guessing how much 239,083 ha might be worth, I simply point out that at today’s share price, LEXI would be trading at a market valuation of ~C$107/ha if it were to execute its ROFRs. Here are several Argentina-focused lithium brine peers…. These 8 are trading at an average of about C$720/ha.

LEXI is working on green field prospects, so there’s a chance they won’t find robust lithium values. But, all early-stage companies working in Argentina & Chile face the same risk. Importantly, LEXI’s Li grade hurdle is probably lower than that of peers. Why? MRT is so selective and efficient, that it should be able to accept lower-grade brine feedstock and still produce a valuable end product at low cost.

Molecular Recognition Technology (“MRT”) Revisited….

The lower the Li grade, the greater the volume of brine that has to be pumped through the MRT facility, and the higher the cost. With MRT, process flow engineering is more of a constraint than brine chemistry.

Think of it this way, MRT’s recovery is 2-3 times higher than that achieved with conventional evaporation ponds, so the Li grade going into the MRT system need only be 1/3 to 1/2 as high. In northwestern Argentina, Li grades appear to range from about 300-400 mg/L Li is salars like Rincon and Antofalla, 500-550 mg/L Li for Millennial’s project in Salta, to 700-750 mg/L Li for Neo Lithium’s Tres Quebradas in Catamarca.

So, potentially in production sooner & cheaper, highly-scalable via modular additions to reach production levels equal to the plans of most of the larger players. Importantly, by ramping up modularly, LEXI could significantly (but not entirely) self-fund growth cap-ex.

All of this is great on paper, but what about funding? LEXI has secured a C$16 M credit facility from Arena Investors, LP, a major U.S. institutional investor. The facility is structured as an unsecured lending arrangement with up to five tranches (each a “Note”), specifically being an initial C$4 M tranche at closing, (LEXI has drawn down the C$4 M) and up to four C$3 M tranches (notes) thereafter.

This substantial liquidity should allow the Company to complete a resource estimate on a large portion of its properties.

In August of last year, LEXI executed an agreement with privately-held IBC Advanced Technologies (“IBC“), to utilize a metals separation technology known as Molecular Recognition Technology (“MRT”) for highly selective lithium extraction. From testing to commercial operations, MRT has repeatedly been proven as one of the most advanced, efficient, and eco-friendly refining technologies in the world for segregating metals, at commercial-scale, in both mining and recycling applications, with up to 99.99% purity. NOTE: {MRT is not proven at commercial-scale for Li extraction from brines}.

Actually, that’s (both) 99%+ purity AND 99%+ recovery of Li, from a single run through a closed loop system. Those figures come from actual lab-scale results of MRT Li extraction from brines.

IBC has started full-scale engineering for a small commercial-scale processing plant in Catamarca province. The facility will be modular, making it highly scalable, with an initial configuration of 1,000 tonnes per year of Lithium Carbonate Equivalent (“LCE“). It will be designed to be able to ramp up to as much as 25,000 tonnes of LCE.

The completion of engineering will give LEXI full design drawings, equipment specifications, tank, pump, and column sizes, feed preparation, process flow and block diagrams, instrumentation and final piping arrays, sequential step descriptions for all input/output changes, all valve diagrams, and a complete operating manual.

If all goes according to plan, IBC’s engineering could be completed around the same time that LEXI achieves its first resource estimates.

Exploration Efforts Off to Great Start

On March 27th, management announced positive results from its initial geophysical surveys on parts of the northern section of its holdings in the Antofalla Salar. Interpreted brine horizons were detected throughout the entire 80 sq. km (8,000 hectare) area, suggesting the possibility of lithium-bearing brine. Conductive horizons were detected from just below surface to about 400 meters deep.

LEXI’s Director of Exploration, Miles Rideout, noted,

“Having conducted or supervised the acquisition of thousands of kilometers of TEM soundings in brine environments over the last thirty years, I’m pleased to report that the initial geophysical results exceeded our expectations.”

LEXI’s CEO, Steven Howard added,

“There are published assay results from drilling in the same basin just 3 km south of these properties and Argentina’s largest lithium producer is just 30 km to the east… Interpreting such an extensive volume of potential subsurface lithium brines in this first step of our exploration program is significant.”

Although resistivity values from TEM surveys cannot confirm the presence or grade of lithium, the survey results to date have identified highly conductive zones consistent with similar lithium-bearing brine aquifers known to exist in the region.

“Based on comparative results with similar sedimentary salar strata where lithium-bearing brines are hosted, these data indicate a likely-continuous, buried horizon of high conductivity in this part of the Antofalla basin complex.”

With such compelling initial geophysical results, plans for LEXI’s drilling campaign later this year are well underway to test for chemistry, lithology, porosity, pump rates, and other hydrogeological factors.

Strategic Partners Kicking the Tires?

There’s been a lot of JV / merger talk coming from western Australia hard rock lithium players this year. Many pundits believe that Argentina will soon follow on the consolidation front. While it’s too early for LEXI to be taken out (they have good balance sheet liquidity & tremendous exploration upside, why would they sell now?) — it’s great to know that the Company already has a seat at the table when Major & mid-tier battery & automakers get serious about locking up supply from Argentina.

A few weeks ago CEO Steven Howard traveled to Hong Kong, Shenzhen, Huizhou, Beijing, Tianjin, Seoul & Tokyo with his corporate financial advisory team, Jett Capital Advisors. He met with prominent battery / cathode manufacturers, and energy materials companies. Members of Jett Capital are returning to Asia for follow-up meetings this week.

There are 13 Argentina-focused lithium juniors on my list, 2 are still quite tiny, 3 are already aligned with larger partners, and 1 has outperformed the pack, leaving it with a market cap of > C$250 M— that leaves just 7 names of interest …. but many dozens of suitors, not just from Asia, but from Europe & Scandinavia. Not just battery & cathode manufacturers, but global electric vehicle companies. Not just electric vehicles (including buses & trucks), but commercial & grid-scale storage solutions providers.

Conclusion

The combination of a very large land portfolio and a promising technology, could enable LEXI to reach production at its designated rate of 1,000 tonnes LCE/yr. before better known brine projects in Argentina & Chile. If successful, LEXI would be in production at a total cost well below what peers are looking at to design / construct ponds and processing facilities.

Funding for at least the remainder of the year is taken care of through LEXI’s non-dilutive debt arrangement with Arena Investors, LP. Simply put, I know of no other early-stage lithium juniors with this impressive a package of attributes and a market cap of just ~US$ 20 M.

— Peter Epstein

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Lithium Energi, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Lithium Energi are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Lithium Energi and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.