International Frontier Resources (IFR.V), their story is one of a classic ‘early-mover’, a highly entrepreneurial undertaking. You know what they say about the early bird…

It all started five years ago when the government of President Enrique Pena Nieto pushed through reforms that ended the seventy-six-year state-run monopoly in Mexico’s energy sector. PEMEX. Pemex’s life-force was dependant upon a massive reservoir of offshore oil – a reservoir that is nearing the end of its life cycle.

Pemex’s very existence is being challenged by plummeting production and paralyzing debt. As a consequence, Mexico was forced to open its borders to competition. Foreign companies that employ the latest E&P (Exploration and Production) technology, like Int Frontier, have been invited to bid on a number of onshore and offshore projects.

This informative report by Equity Guru’s Lucas Kane delves into the Pemex fallen dynasty narrative in much greater detail.

The Auction Arena:

With Pemex on the ropes, the Mexican government has turned auctioneer in order to revitalize its under-capitalized energy sector. From the ‘Projects’ page on the company website:

Mexico’s historic energy reform announced in 2014 has established a new legal framework for Mexico’s energy industry and is expected to attract the billions of dollars in foreign investment needed to revitalize Mexico’s oil and gas industry. The Secretaria de Energia (SENER) has issued a five-year, four round tender plan (2015-2019) for the denationalization of 914 oil and gas blocks. IFR believes that there are a significant number of under exploited oil & gas fields in Mexico that will be issued in these bidding rounds.

also…

In August 2014, SENER began the bidding process for assets by announcing that Round One would include: (i) 169 blocks, comprised of 109 exploration blocks and 60 production blocks and (ii) 14 blocks under joint ventures with PEMEX. The tender process commenced in the first quarter of 2015, and license agreements were awarded throughout 2015 and into 2016.

These Mexican assets are highly desirable. The auctions Int Frontier are attending involve mature onshore fields with proven oil reserves and a history of drilling.

In auctioning off these mature onshore blocks, the Mexican government is welcoming bids from oil and gas companies of all sizes, including juniors. Aside from establishing a platform for healthy competition, it creates equitable opportunity across-the-board. This is how it’s done. This is dynamic, innovative, and enlightened thinking. I suspect the country has learned its lesson – the immutable fact that state-run monopolies suck.

Two types of projects go on the auction block:

The offshore projects on the auction block are good for the super-major – the larger companies with deep, DEEP pockets.

The onshore mature oil field auctions are the ideal arena for a company like Int Frontier. Acquiring a mature field – one with a proven track record – is viewed as a potential building block. Such a block can do wonders for the evolution of a small company. It presents them with the opportunity to gain a foothold in a highly prospective region, without deploying onerous amounts of capital. The potential payoff is a steady stream of revenue.

This is the same business model that was deployed in Canada and Texas during the early innings of their oil and gas sectors. Small companies prospered using this model. They leveraged their assets, acquired addition ground, and expanded their operations. Some grew into large entities. Some grew into giants.

Partners, pals – the JV (joint venture):

Int Frontier is not going it alone in Mexico. The company has formed a joint venture with Grupo IDESA – a right-down-the-center 50/50 joint venture company to bid on prospective projects, and if successful, explore and develop them.

Grupo IDESA, one of the largest petrochemical companies in Mexico, has a proven track record in the oil and gas arena. Together, the joint venture boasts a number of invaluable skillsets: field and technical expertise, finance, Mexican regulatory, engineering and logistics… just to name a few.

This 50/50 joint venture is called Tonalli Energia.

A successful auction:

In May of 2016, after a successful auction, Tonalli Energia was awarded Block 24, an onshore field that goes by the name of Tecolutla.

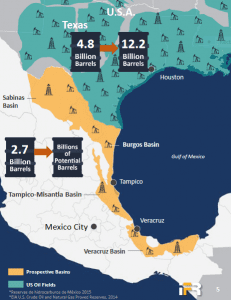

The Tecolutla block lies within the Tampico-Misantla Basin, a prospective onshore ‘Super Basin’ with huge unconventional oil and gas potential.

It’s important to note that the company, with a goal of growing a rich stable of assets, is not content sitting on this one project alone. Management is in the process of running dd (due diligence) on prospects coming up in the next round of bidding. This next round, scheduled for this summer, will be an onshore conventional auction containing lands that are adjacent to their Tecolutla block. Another auction will take place in September, one which will offer the opportunity for the company to bid on onshore unconventional reserves.

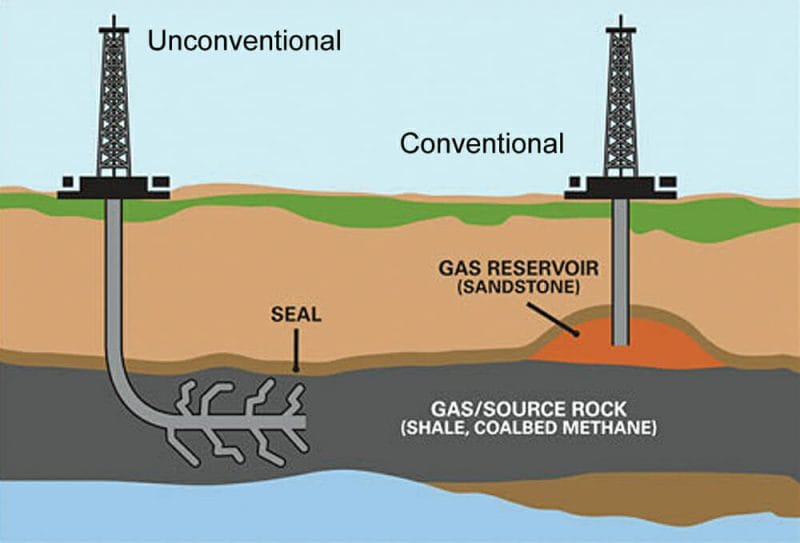

For those unfamiliar with the nomenclature, the distinction between conventional and unconventional is illustrated below.

Regarding the opportunity to gain additional ground via the auction arena. This, from the company’s fact sheet…

Opportunity to acquire new assets and adjacent unassigned lands in bidround 3.2 and the onshore unconventional round 3.3; auctions scheduled tooccur on July 25, 2018 and September 5, 2018, respectively.

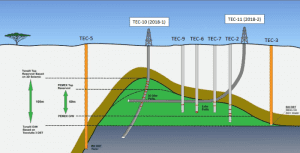

Tecolutla is a mature onshore field. Four key past producing wells (Tec-2, Tec-6, Tec-7 and Tec-9) were drilled by Pemex between 1956 and 1972. These four wells, which yielded between 256 and 453 bod (barrels of oil per day) collectively produced approximately 1.9 million barrels of oil in their time.

There’s potential for a substantial untapped resource at Tecolutla – Tonalli Energia is gunning for what Pemex left behind.

The Tecolutla block, due to its significant production potential, could be one of those ‘building blocks’ mentioned earlier… one of those critical steps a small company takes as it clears a path toward bulking up, gaining traction and growth.

Unlocked Potential via 3D:

Tonalli Energia’s team of experts believe that Pemex – the previous operator of the project – failed to mobilize Tecolultla’s full potential. Not even close. Their 3D seismic data suggests (reveals) a significantly underdeveloped reservoir. This is where the opportunity lies.

Tonalli Energia’s first well, Tec-10, will be an important first step in tapping and confirming this latent production potential.

From the ‘Projects’ page on the company’s website…

Like many oil and gas fields in Mexico International Frontier’s technical team believes oil production from Tecolutla has not been optimized. The team has re-evaluated the field using existing well control and 3D seismic and believe that horizontal drilling and workovers will yield daily production results that exceed the historical peak production of 900 barrels per day and significantly increase recoverable reserves. To execute the plan our team intends to deploy advanced carbonate drilling, completion, stimulation and recompletion techniques in the Tecolutla Block.

Recent Events:

The joint venture received final authorization from the Mexican government in January to allow the JV to commence drilling at Tocolutla. Drill pad construction began last month. The Tec-10 directional development well spud date is scheduled for mid April. That’s only a week or so away.

What’s ALG.c? That’s not Algernon’s ticker.

* I meant ALG.C….. in any case that’s wrong.