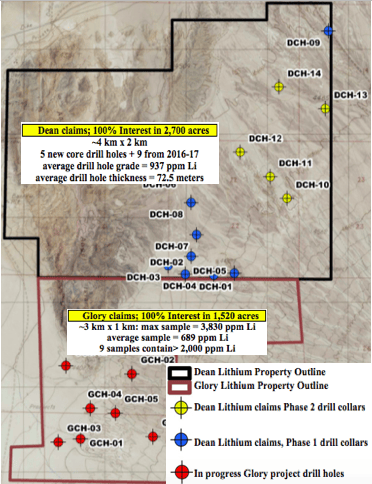

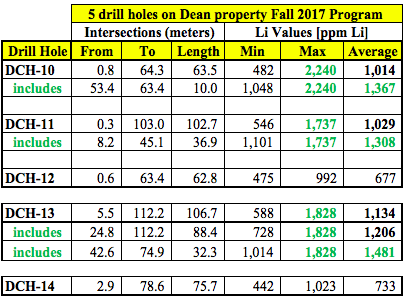

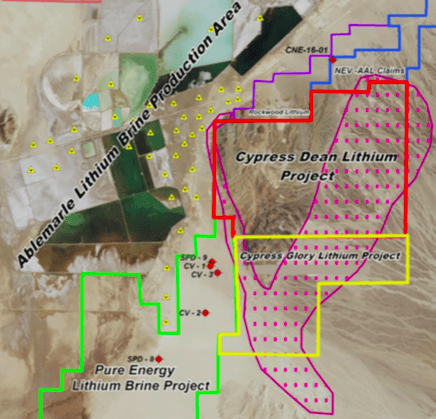

On January 9th, Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF) / (Frankfurt: C1Z1) [market cap = C$ 15.5 M] released 2 additional core holes from its Fall 2017 Clayton Valley, Nevada, drill program. Results include the best intersection to date, {hole # DCH-13}; 107 meters (350 feet) of 1,134 ppm lithium (“Li“) at the Dean property. Note: {I consider the Dean (2,700 acre) and Glory (1,520 acre) claims to be parts of the same overall project}. Cypress continues to expand the claystone-hosted Li mineralize

In DCH-13, Li values increased at depth, starting at 24.8 meters, the grade averaged 1,206 ppm Li over 88.4 m.

NOTE: {the hole terminated in mineralization and remains open at depth}

The 2 holes support the observed continuity of mineralization over a long northeast trend, extending roughly 4 km in length by 2 km in width across the Dean property alone. 4 drill holes have also been completed on the neighboring Glory property claims, assays are expected by the end of January. The Glory footprint measures about 3 km by 1 km.

According to the press release, quote,

“Extraction studies are under way to determine the solubility of the Li and other mineral constituents within the claystone. Bench-scale scoping tests revealed moderate extractions of Li in sulphuric acid solution, increasing to 74% recovery with increasing temperatures. The extractions were achieved with relatively low additions of sulphuric acid for lithium-bearing claystone deposits, measured at a rate of 140 to 170 kgs of acid/tonne.

Results are encouraging and clearly indicate that extractions and acid consumptions of Cypress’s claystone deposits are significantly better than seen in refractory claystone deposits. Further test work is under way to improve results by refining leach conditions, checking for mineralogical variability across properties, and determining methods of Li recovery from the leach solutions.”

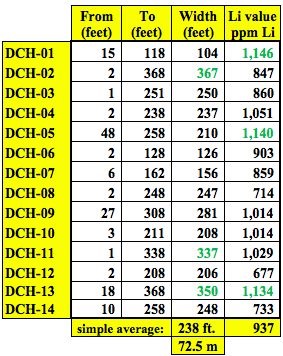

Cypress has completed 5 new core holes on its 100% owned Dean property. Readers may recall that on December 5th, management announced results from the first 3 holes. Drill results included an intersection of ~337 ft. (102.7 meters “m”) of 1,029 ppm Li in hole # DCH-10.

In hole # DCH-10, dark greenish–blackish mudston

DCH-11 included an interval of consistently higher grades starting at a depth of just 27 ft. (8.2 m). Samples averaged 1,308 ppm Li over 121 ft. (36.9 m), suggesting that a higher-grade zone may exist within the overall northeast trend. According to management, holes to date, “clearly show a large, tabular, lithium-bearing formation underlying the Dean property.“

All 9 previous holes at Dean encountered significant Li values within claystone, which ranged up to 1,790 ppm Li and averaged about 950 ppm Li. Mineralization outcrops at surface, and the average thickness was ~220 ft. (67.0 m). Li-bearing claystone is considered open in all directions.

With the addition of the 5 new assays, the combined 14 holes at Dean have an average mineralized thickness of 238 ft. (72.5 m), and an average grade of ~937 ppm Li. The Dean property hosts Li values in an area about 4,000 m (13,120 ft.) long by about 2,000 m (6,560 ft.) wide. That’s about 800 sq. hectares (1,975 sq. acres).

Cypress controls 100% of the contiguous Dean and Glory clai

Cypress’ 2 properties host Li mineralization that is neither brine nor hardrock. Li is hosted in a soft claystone, like the Li endowments at Global Geoscience (ASX: GSC) [project at Pre-Feasibility Stage in Nevada, market cap = ~C$485 M] and Bacanora Minerals (TSX-V: BCN) [main project in Sonora Mexico at Feasibility Stage, pro forma market cap = ~C$400 M]. Lithium Americas (TSX: LAC) also has a prominent claystone-hosted Li

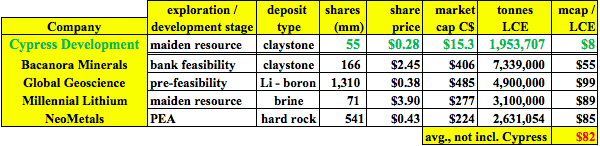

The chart below shows a rough relative valuation of various clay, brine and hardrock lithium juniors at various stages of development. Cypress is thought to be just 2-3 months from a maiden resource. For my estimate of LCE tonnes I used the formula; length x width x thickness x rock density = 4,000 m x 2,000 m x 72 m (thick) x 2.5 (meters cubed – density). Then I haircut that figure by 25% to be conservative, and applied a further 50% discount to account for the tightness of drill spacing. More infill drilling will be necessary post maiden resource estimate to the reach the full tonnage potential of the Dean & Glory claims.

Cypress is trading at a 90% discount to the other companies in the chart. Even accounting for the much more advanced stage of peers, Cypress appears to have a low relative valuation. Consider that if Cypress’ share count and share price were both to double, the mcap / tonnes LCE ratio would increase to $32/tonne LCE, but that would still be a 62% discount to the peer average of $82/t LCE. Having said that, Cypress is not doubling its share count anytime soon! In fact, the Company is fully-funded through a maiden resource, and management believes that a PEA could be delivered (it depends on drilling & metallurgy) by year-end– with minimal new share issuance.

Interview of CEO Bill Willoughby, PhD, PE

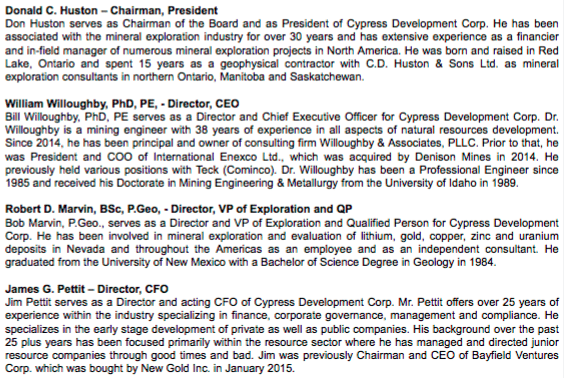

I recently conducted an interview (by phone and email) with Bill Willoughby, PhD, PE, CEO & a Director at Cypress. Bill is ideally suited for the job at hand. Cypress is sitting on unconventional Li deposits that will require ingenuity and innovation to extract and process. Bill has 38 years’ experience as a mining engineer in all aspects of natural resources exploration & development.

Bill received a Doctorate in Mining Engineering & Metallurgy from the University of Idaho in 1989. Therefore, he’s as well placed as anyone to assess new methods of processing unconventional lithium deposits. Having said that, reinventing the wheel may not be necessary if extraction and processing can be done at relatively low temperatures, and with relatively low use of acid, but there’s a lot of testing ahead. Bill and his team are also evaluating a number of promising third-party technologies.

Here is my interview with Dr. Bill Willoughby, PhD, PE.

How are Cypress’ deposits similar to, or different from, the 3 major North American claystone resources; Global Geoscience’s Rhyolite R

You used the word ‘claystone‘, and that’s the obvious link between us and the three others. All four are lithium-bearing deposits of volcanic origin, located in Nevada and northern Mexico. Rhyolite Ridge and Cypress are geographically close, and the only ones near a producing lithium brine operation, which is Albamarle Corp.‘s Silver Peak.

When you look at the grades in the other three deposits, the lithium values are higher, but the mineralogy appears different, such that we hope Clayton Valley is easier to get the lithium into solution.

In what ways will the work being done by these much larger unconventional lithium developers help Cypress over the next few years?

By unconventional, you mean claystone as opposed to brines or hardrock pegmatites. Any research or processing developments into lithium extraction from clays could be applicable, but possibly proprietary.

Our immediate focus right now is to see how well we can get the lithium into solution, and what reagents and conditions that takes. Once there, we will be able to evaluate how to get to a product, for which there are a number of companies right now working on solutions.

Based on the dimensions of known lithium mineralization, about 4,000 x 2,000 meters on the Dean project alone, with an average mineralized thickness of ~ 72 meters and average drill hole grade of ~ 940 ppm Li — is it possible to make a rough estimate of the potential scale of the Dean deposit?

Yes, that’s possible, and it’s certainly something we think about. However, until we have an independent QP tell us we have adequate drilling and enough information for a NI 43-101 compliant technical report, such an approximation is speculative and I have to advise against it. We are working towards that stage through drilling and laboratory tests and we hope to have a maiden resource by the end of the first quarter.

Some believe it will be nearly impossible to obtain water rights in Clayton Valley. Where does Cypress stand with regard to water?

The concerns over water rights have centered around the existing lithium producer in Nevada protecting its brine resources from new operations. Mining and processing claystone will not present the same impacts as would a new field of brine wells, and we are optimistic that the differences will become apparent assuming we are successful moving forward.

A major hurdle for your deposits is finding a way to process them in an environmentally friendly & cost effective manner. How is Cypress attacking this challenge?

We are working methodically, collecting samples and running those samples through scoping bench scale tests to determine under what conditions we get the lithium to leach, and what other elements leach along with it.

Once we have enough representative material from drilling to say we’ve addressed possible variability in mineralogy throughout the deposit, we can move on to a metallurgical program that addresses specific leaching and recovery methods.

Lithium prices in China are above US$ 20,000/tonne. Are there proven processing technologies available that are expensive, but might make sense if Li prices remain strong?

Possibly, yes — calcining or leaching with a strong acid, could be considered “proven,” but we don’t have enough information yet to say whether such steps are needed. We have to see where the drilling and test work takes us.

The Dean & Glory deposits are pre-maiden resource. At what exploration or development stage might a strategic or financial player invest in Cypress?

We have enough cash right now to do the work in front of us, and then some, so we don’t have any pressure to bring in a partner. This is a good place to be in for a junior. Obviously, if a good partner or offer comes along, we will consider it, but right now, that’s not at all our focus.

Thank you Bill for your time, I look forward to drill results at the Glory property and updates on ongoing metallurgy work.

Disclosures: The content of this article / interview is for illustrative and informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Cypress Development Corp. and the Company was an advertiser on [ER]. By virtue of ownership of the Company’s shares and it being an advertiser on [ER], Peter Epstein is biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.