Zinc is an anti-corrosive metal, added to iron or steel to prevent rusting.

We first wrote about Zinc One (Z.V) on May 17, 2017 – stating that “there is a serious zinc deficit looming – and fortunes can be made if you know how to play it.”

To support our assertion, we unearthed an obscure supply-deficit indicator: the “smelter treatment charge”.

Zinc miners pay a fee to convert zinc concentrates into pure zinc. The 2017 benchmark smelter treatment charge is 30% lower than it was in 2015 ($172/tonne vs. $245/tonne). There is so little zinc around that miners have been able to negotiate a 30% reduction in the cost of smelting.”

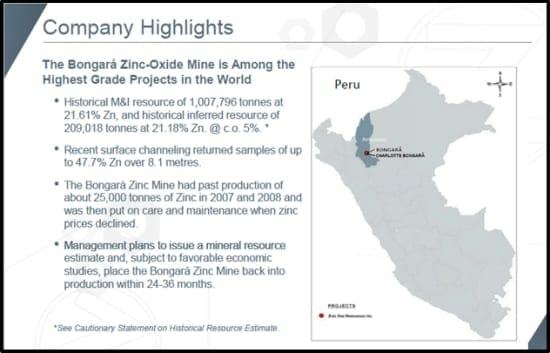

High-Grade projects in Peru hold promise

Zinc One controls the Bongará Zinc-Oxide Project and the Charlotte Bongará Zinc-Oxide Project in Peru – which lie at the end of a 6-kilometer trend of known zinc.

In the following months, the stock price of Zinc One drifted listlessly.

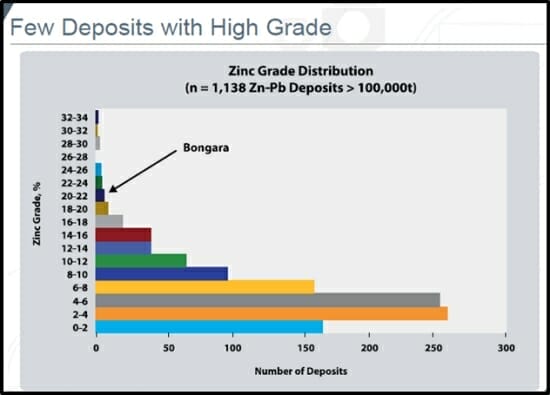

We wrote about Zinc One again on June 28, 2017 stating that, despite the drift, “Zinc One is up 500% from its 52-week low” – and the Peruvian project has “very high grades”.

To put this in perspective, Teck’s (TECK.NYSE) Red Dog Mine in Alaska produces an average head grade of 15% zinc. In 2016 the mine made a gross profit of about $500 million. Could Zinc One be the new “Red Dog”? In our opinion – the answer is “Yes”.

A couple of weeks ago we re-stated our opinion that “there are strong reasons to invest in Zinc One.“

- Potential near-term production restart

- Drill-confirmed, exploration potential along 6 km corridor.

- Low risk due to past production

- Mature mining jurisdiction.

- Exceptionally high grade, at surface

- Massive exploration potential.

- Anticipated new resource estimate.

- Proven metallurgy

- Accomplished management team.

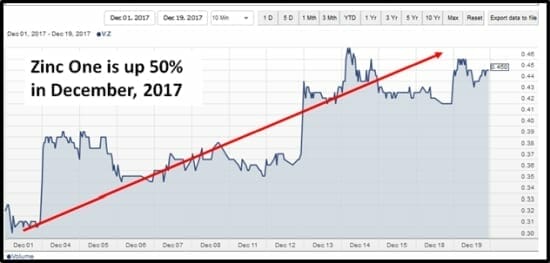

On December 13, Zinc One announced that it has received a permit for 124 drill platforms, allowing for three holes per platform with an average drill depth of about 25 metres.

“This is one of the most important milestones we have reached thus far,” stated James Walchuck, Zinc One CEO, “We are confident that we will be able to confirm the historic resource – 1Mt of 21.6% Measured and Indicated and 0.21Mt of 21.2% Inferred.”

The drill program is significant because the targeted Mina Chica and Bongarita sectors have never been drilled. A new resource estimate according is anticipated by the end of Q2 2018.

On December 19, 2017 Zinc One reported results from its surface-sampling program the Bongará Zinc Mine Project in north-central Peru.

Highest grades include a surface channel sample with 31.92% zinc over 32.2 metres, a surface channel sample that yielded 28.98% zinc over 51.2 metres, and 36.50% zinc over a 6.0-metre depth in an exploration pit.

The above results were in the southern end of a 1.4-kilometre long trend of zinc trend called Mina Grande.

Zinc One share price rose 7% on 1.7 million shares traded, after the December 19 channel sampling results.

Selling Zinc in the middle of a BitCoin hurricane is a thankless task, but despite the deafening roar of blockchain and cryptocurrencies – Zinc one has been steadily gathering momentum throughout the month.

The impending shortage of zinc is happening because two of the world’s largest zinc mines have run out of ore (Australia’s Century mine, and the Lisheen mine in Ireland).

Zinc One CEO, Jim Walchuck has recently been on a roadshow, giving presentations to institutional investors in Toronto, New York and London.

Peru’s Energy and Mines Minister Gonzalo Tamayo stated that Peru is focused on, “the recovery of mining investment in 2018.”

According to Mining.com, Chinese year-to-date zinc production is down 1.3% to 5.65 million tonnes.

“Zinc prices have followed a 70% surge in 2016 with a nearly 25% gain this year to move comfortably above $3,000 a tonne.”

Exploration companies are sometimes described as baby turtles scuttling across the beach toward the ocean.

99% of them end up in the belly of a seagull.

Zinc One has hit the high tide line, and it’s moving fast.

Full Disclosure: Zinc One is an Equity Guru marketing client, and we own stock.