In May 1867 the US government purchased Alaska from Russia for 2 cents an acre. In February 1995 an investment fund bought a $7 million stake in eBay that appreciated 74,500% in 4 years.

In June, 2017 Zinc One (Z.V) closed a deal on two Peruvian zinc projects for a final cash payment of US $1,150,000.

Did Zinc One just pull off the Deal of the Century?

That may be over stating it.

But Z shareholders must be drooling with pleasure at the upside on this acquisition.

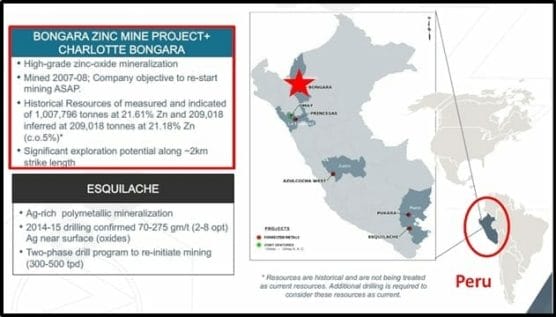

The Canadian company now controls the Bongará Zinc-Oxide Project and the Charlotte Bongará Zinc-Oxide Project which lie at the ends of a 6 km trend of known zinc.

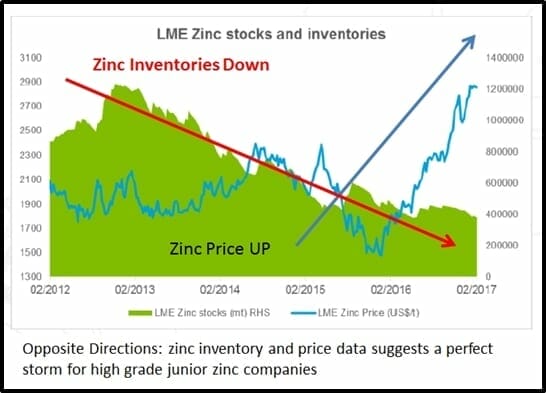

Zinc is an anti-corrosive added to iron or steel to prevent rusting. According to a report by the International Lead and Zinc Study Group (ILZSG) 2017 global demand for refined zinc rose 3.6% with mine output decreasing 1.2% – creating a 4.8% gap.

Big mines are closing: the Lisheen Mine in Ireland and the Century Mine in Australia made their final shipments in 2016. There is a rush to secure new supply lines.

Peru is a mining mecca. The country is pregnant with copper, gold and zinc.

Peru’s President Kuczynski is an economic pragmatist who has been known to wear pink vests and play the flute at campaign rallies.

Yah – the guy has balls:

But Peru’s top politician is not a flake. Kuczynski previously worked at the World Bank and the International Monetary Fund (IMF). 15% of Peru’s GDP comes from the mining industry.

Kuczynski loves mining the way cats love mice.

Kuczynski’s Chief of Mining recently told a group of journalists that “Peru has been listed as Latin America’s most attractive mining country by The Fraser Institute – and we want to stay in that position.”

So the geology is good. The commodity is red hot. And the mining laws are favorable.

But are the grades any good?

Turns out, the grades are more than good.

The Bongará Zinc-Oxide Project was in production in 2008 with grades higher than 20%.

To put that in perspective, Teck’s (TECK.NYSE) Red Dog Mine in Alaska produces an average head grade of 15% zinc. In 2016 the mine made a gross profit of about $500 million.

Okay, you’re thinking, “Zinc One has high grades – but the good stuff is probably buried under a mountain”.

Well no – as it turns out – Bongará Zinc-Oxide mine was processing ore that was removed almost at surface.

Could Zinc One be the new “Red Dog”?

In our opinion – the answer is “Yes” – but they have a way to go.

The first plan of action is a Q3 shallow drill program with tight spacing in the zones of known mineralization. Zinc One intends to have 43-101 technical report completed early in 2018.

“The high-grade Bongará Zinc-Oxide Project will be our major focus in the near term,” confirmed James Walchuck, CEO of Zinc One. “We are going to use all of the management’s collective skill sets to advance the project. We remain bullish on the zinc commodity pricing.”

China recently shuttered 26 zinc mines in Hunan province due to serious environmental breaches.

Zinc One is up 500% from its 52-week low. But these junior developers bob up and down like moody teenagers. The stock is trading at 25% discount from its price a month ago.

Good entry point?

You decide.

The Peruvian developer is currently trading at .47 with a market cap of $26 million.

FULL DISCLOSURE: Zinc One is an Equity Guru marketing client. We signed them because we think the stock is going higher.