It somewhat ominously calls itself, “First Choice for Dark Liquidity in Canada.”

If you don’t know what that means, you’re the mark.

MATCHNOW

TriAct Canada Marketplace LP offers specialized marketplaces and order execution services for Registered Canadian Investment Dealers and their clients to trade Canadian listed equities. TriAct operates MATCHNow, Canada’s premier broker-neutral dark book.

Wouldn’t you just love to have access to a ‘dark book’?

Not for you.

MATCHNow is a non-quoting marketplace where order information is not visible to other traders. A proprietary algorithm automatically matches buy and sell orders. TriAct does not participate on an agency or proprietary basis in any trade.

Designed to offer better execution for institutional, proprietary and retail order flow, MATCHNow combines frequent call matches and continuous execution opportunities in a fully confidential trading book.

Chances are, if you’re reading this, you don’t use TriAct, or Alpha, or Omega, or NEO, to do your trading. You just put your order in on Qtrade or Scotia or whatever, and hope for the best.

But the bigger players are more complicated. They run with systems that play the game differently. They don’t just put an order out and wait for it to be filled.

Here’s how Investopedia explains ‘dark pools’:

Dark pools are an ominous-sounding term for private exchanges or forums for trading securities; unlike stock exchanges, dark pools are not accessible by the investing public. Also known as “dark pools of liquidity,” they are so named for their complete lack of transparency. Dark pools came about primarily to facilitate block trading by institutional investors, who did not wish to impact the markets with their large orders and consequently obtain adverse prices for their trades. While dark pools have been cast in a very unfavorable light in Michael Lewis’ bestseller “Flash Boys: A Wall Street Revolt,” the reality is that they do serve a purpose. However, their lack of transparency makes them vulnerable to potential conflicts of interest by their owners and predatory trading practices by some high-frequency traders.

If you have a million dollars to bet on a trade, and you don’t want to cause a run on the stock, you might go dark. Also, if you’d like to screw with the little guys and squeeze the best possible return on your buy or sell order, you might go dark.

Also, if you want to absolutely gut punch a stock, and don’t want it being traced back to you, you might go dark.

You may be surprised how often you’re buying from, or selling to, or had your expected sweet price snapped up a millisecond earlier than your trade by dark pools.

In the week ending November 10, 11% of trades involving Enbridge (ENB.T) were using dark money. 3.8% of HIVE Blockchain (HIVE.V) trades did same. 27.6% of Potash Ridge (PRK.T) trades came through the TriAct MatchNow set up, and 40% of the Horizons US Dollar Currency ETF (DLR) were similarly dark.

This is not a small thing, in fact 40% of all trading in 2014 came through off-exchange trading, and it’s not put in place to protect the little guy. At all.

The dark money option is explained by Matchnow as follows:

- Trading is done at mid-point by default

- Active orders can save up to 50% of the [Canadian National Best Bid/Offer] spread, providing an attractive option to crossing the spread

- Liquidity providers gain access to active flow higher in the routing table, finding size while avoiding the noise on the lit markets

- Liquidity providers also trade with other liquidity providers, finding sizable liquidity matching off against natural contra passive orders

- Control your orders with “Minimum Fill Quantity”, “Minimum Tradelet Size Executed” and “Cash Constraints” to lock in the liquidity you’re looking for

- Trade odd lots for free at the quote in the dark

Confused? You’re kind of supposed to be.

And here’s why: You’re the guy buying at the bid, and selling at the ask. The bigger guys are running systems that look at the trades you’re asking for and front run them, or keep their big trades essentially secret until the end of the day, keeping you out of the loop. You don’t know your stock is being shittered, and you don’t know by who, or why. It just is.

Sometimes it happens because someone wants to make money before you get to the front of the line. But sometimes it happens for more nefarious reasons.

You’re out there sweating blood, hoping that a big fish sees what you see about that precious little gem in your portfolio, that they’ll then launch into a buying run and the stock will move up 15%, but the big fish got his piece on the quiet, in the dark, without the market knowing.

This sucks, but the market often does. What sucks even harder is when these systems are used not to get a better price for a seller, but to send a stock into the crumple zone without leaving a fingerprint.

That’s what our looks into the trading of Nexus Gold (NXS.V) appear to show happened to that company’s stock in September and October of this year when, on three dates, millions of shares were dumped into the market at once, on no poor news, and for no apparent advantage.

If you’ve got $500k of shares in NXS and you don’t like what it’s doing as a company, you don’t dump those shares all in one hit because, on the junior markets, that would crater the company stock and you’d get a terrible return on your money.

So, usually, you’d sell it in smaller pieces over a long period, or you might call the company and say, “Hey CEO, I’m about to dump a bunch of your stock. Got anyone who might like to give me a good price for it?” If the CEO does, they’ll perform a ‘cross’, and the company stock stays high while the seller gets out clean.

But if the seller wants to crater the stock, then they’ll just keep dropping it, a few hundred K at a time, getting it low enough that the sells begin to trigger stop losses, meaning investors who have told their trading desks to sell a stock if it hits a certain point, will hit that point and have their asset sold automatically. This further lowers the share price, and creates an investor vacuum where folks decide to get out until the dust has settled.

Panic ensues. Long holders start asking questions of themselves, like, “How much money am I prepared to lose on my faith that this company is good?” and “Do I have enough money left to pay my rent if I sell right now?”

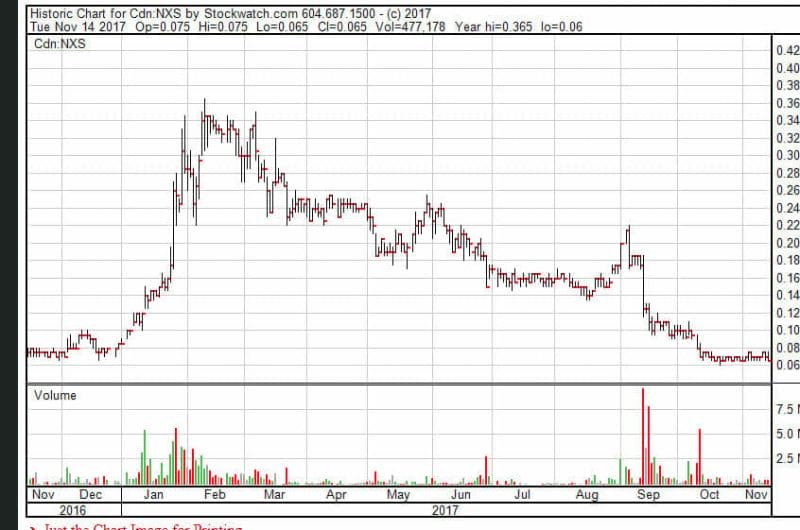

Here’s the Nexus Gold trading chart for the last year. In mid-September, it got cratered twice in two days. That happens sometimes, folks want to get their money out and don’t want to wait, maybe the company has some bad news to release or a sector is getting killed.

Little Timmy needs braces and so dad dumps to the market.

Someone has a hot tip on a lithium play and has lost patience on the gold play, and we’re suddenly upside down.

But on these two days, almost all of the selling volume came through TriAct. In big chunks. In fact, folks watching the market that day recall seeing large anonymous asks dropped regularly, skipping around in price, being pulled shortly after they landed, seemingly giving the market intentional jitters.

The dumpage was extreme. Look at the volume on those days; nearly ten million shares, then 7.5 million shares and later, in October, one more day of death rattles shove the company to the curb, for 5 million-plus more in trading volume.

The average trading day for the company, even with those massive dump days, is 465k of volume. So we’re looking at three days where the average was beaten by 10x, 15x, and 20x.

And all for a loss. And almost all on TriAct. And all in a fashion that could only be considered dumb trading, or intentionally hurtful trading.

I asked execs at the company, off the record and on, if they knew who was dumping the stock, and they told me they don’t. They also said nobody called the company to ask about results or express dismay at the operations of it, which is something you’d expect if someone was going to throw $750k of shares away. They tell me the activity appeared to be the antithesis of smart trading, if you wanted to get the best price for your stock, and appeared destructive in nature, especially being as it happened in the dark.

I asked if the company tried to fight back, and was told no – that there wasn’t much they could do other than watch, and that to push people into that churn would reward the poor behaviour of the seller.

They don’t know why this happened, or who caused it. The suspicion is, someone wanted to drive it down hard so they could buy it back cheap. But the buyback hasn’t happened. The stock has sat at around $0.07 since.

Vancouver, Canada, September 13, 2017 – Nexus Gold Corp. (TSX-V: NXS, OTC: NXXGF, FSE: N6E) wishes to confirm that the Company’s management is unaware of any material change in the Company’s operations which would account for the recent increase in market activity. The Company will continue to provide updates of any material changes if, and when they occur.

That news release came after the big sell off, and it wasn’t the company’s first. It had put out similar news in June on the back of another, lesser, unexplained dive.

But there was no negative news anywhere near these trades. In fact, the only news pre-September sell-off had been good news – that the company had acquired 250 sq. kms of land at the Rakounga Project in Burkina Faso, which they’re working now. That news came two weeks before the crash.

The news two weeks subsequent reported good results from the drilling of one property, and admittedly weak results from another, neither of which one would assume would kill the stock or propel it.

SO WHAT HAPPENED?

It’s likely, if I were to guess, that someone made a move on Nexus to batter their stock sufficiently so they could either make an effort to buy it up cheap (hasn’t happened yet) and/or attempt to get a seat on the board (hasn’t happened to my knowledge), or it was a straight up personal assault looking to damage an insider’s holdings.

Or someone really wanted to get out of the stock for no good reason, and did so in a way that intentionally brought about a crazy low return. Unlikely.

This post on CEO.CA’s NXS feed is pertinent, and what got my attention:

@Brownie As a former pro, I’ve seen this type of selling countless times. The reason behind it is never easy to determine and sometimes it doesn’t matter. This was not the result of a stop loss being triggered. It was a case of a large seller liquidating a position.No effort was made to contact the company to set up a buyer or buyers, the seller simply pounded out 3 orders each with a lower limit than the previous one. Since there wasn’t any follow through selling by that seller today one could assume that he’s probably done.A lot of stock was bought by other pros and it was being flipped out today.What happens now depends on the price of gold and more importantly upcoming assay results.

SO WHAT HAPPENS NEXT?

The company continues to do work on the ground, and on the new property, even if that work isn’t reflected in the share price. Results on Niangouela were weak, admittedly, but that property is pretty green and early stage, and insiders at the company tell me they weren’t expecting to be driving Rolls Royces on the back of that deal. Results on the Bouboulou property were decent.

Nine of 10 holes from maiden drill program at Bouboulou intersected gold

- – 4.41 g/t Au over 8.15m, including 23 g/t Au over 1m at Bouboulou

- – 5.21 g/t Au over 3.05m, including 15.5 g/t Au over 1m at Bouboulou

- – 1.04 g/t Au over 23m, including 4.1 g/t over 1m at Bouboulou

- – 1.23 g/t Au over 9m, 1.1 g/t Au over 4m at Niangouela

- – Sampling as high as 17.3 g/t Au at newly acquired Rakounga concession

Let’s talk about Rakounga – news from today:

Four of the first five drill holes intersect gold

- – Hole RC-001 returns 26m of .82 g/t Au, including 2m of 4.11 g/t Au

- – Hole RC-002 returns 32m of 1.01 g/t Au, including 2m of 5.65 g/t Au

- – Hole RC-003 returns 6m of 1.06 g/t Au & Hole RC-005 returns 4m of 1.38 g/t Au

“We’re pleased with what is an excellent start to this program,” said Nexus senior geologist, Warren Robb in today’s news release. “We are encouraged with the extent of these intercepts and will continue to test these structures along strike.”

They should be encouraged. That Bouboulou is contiguous with the Rakounga means they’re zeroing in on where they think there’ll be a sweet spot, and that the stock didn’t move tells you that big trading fall-off has landed a stigma on the company that will only be shaken with news and results.

But when it is shaken, understand that Nexus was worth double, even triple what it is now before Rakounga was a part of their deal, and before they got through their drilling, and before Dark Pool McGee finished his work.

So if Rakounga results continue to expand, and if Bouboulou keeps doing what it does, there’s some upward mobility action to be had that could go potentially far beyond what you’d normally expect – because NXS has had a boot on its neck for a few months now. When that boot is removed, the reaction will be to lift. And if ‘the big buyback happens’ to take advantage of the low price, that’s a whole other deal.

Or, to put in bluntly, as this more recent post at CEO.CA does:

homeboy14A good time to accumulate – timing is everything

— Chris Parry

FULL DISCLOSURE: Nexus Gold is an Equity.Guru marketing client