An effective “Corporate Update” should answer two questions: 1. “What have you done?” and 2. “What are going to do?

Potash Ridge’s (PRK.V) July 19, 2017 corporate update succeeds on both fronts.

- What Have You Done?

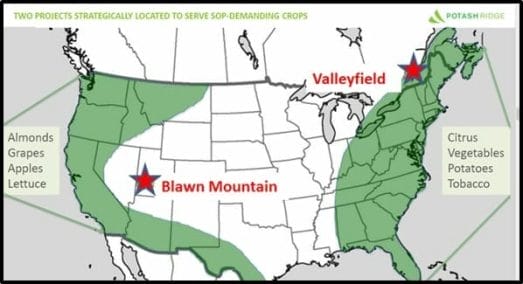

In H1, 2017 Potash Ridge hit the following milestones regarding its Blawn Mountain SOP Project:

- Made a final $700,000 payment to convert the exploration agreement into a mining lease.

- Published an updated NI 43-101 compliant pre-feasibility report (PFR).

- PFR predicts Blawn Mountain lowest cost producer of SOP in North America.

- Average net cash operating costs after by-product credits of $177/ton of SOP.

- Projected after-tax net present value of $482 million.

- Established “Proven & Probable” mineral reserves of 153 million tons.

- Geochemical modeling predicts 19 million tons of M&I alumina resources – worth a couple of billion dollars at current spot prices.

- An average of 255,000 tons of SOP per annum during first 10 years of operation – generating about $150 million a year in sales.

- 46-year project life.

“Blawn Mountain has the ability to become a world class disruptive global producer in the SOP sector,” stated CEO Guy Bentinck. “Recent interest in our by-product alumina has the potential to enhance the robust economics at Blawn Mountain.”

In H1, 2017 Potash Ridge hit the following milestones regarding its Valleyfield SOP Project:

- Secured construction contract with SNC-Lavalin for the construction of Valleyfield mine.

- Closed an off-take agreement for up to 25% of the annual SOP production.

- Signed funding arrangement with Jones-Hamilton Co to sell hydrochloric acid production.

- Locked in a 5-year deal to purchase sulphuric acid.

- Engaged Novopro to advance the project through engineering and mine construction.

“We are currently focused on bringing Valleyfield into production,” stated Bentinck. “With a fixed capital costs, we have a clear path to construction, production and near-term cash flow.”

- What are you going to do?

In H2, 2017 Potash Ridge intends to hit the following milestones regarding its Blawn Mountain and Valleyfield SOP Projects:

- Secure debt and equity financing package for Valleyfield.

- Advance discussions with SOP off-take partners for Valleyfield and Blawn Mountain.

- Complete engineering for Valleyfield.

- Obtain environmental permits for Valleyfield.

- Do a deal for Blawn Mountain’s alumina resource.

- Complete metallurgical testing.

- Incorporate alumina economics into the NI 43-101 compliant report.

- Negotiate a fixed price for Engineering, Procurement, and Construction of Blawn Mountain.

“Potash” – you say.

“What about cobalt?” “What about cannabis?” “What about gold?”

Well yes, we like batteries, weed and precious metals.

But we also like new low-cost mines serving markets in supply deficits.

PRK is focused on the production of premium SOP fertilizer used to boost production of crops including tomatoes, spinach, strawberries and avocados.

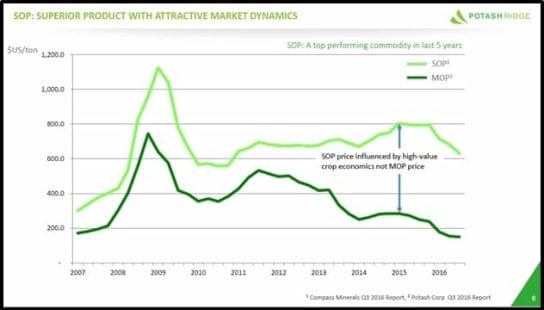

SOP is about 300% more expensive than its more plentiful cousin, MOP.

Potash is climbing the mother of all demand curves: According to the World Bank, farmers will need to produce 50% more food by 2050 to avoid a global famine.

In Q1, 2017 North American SOP prices exceeded CAD$805/tonne.

Included in the July 19, 2017 Corporate Update, Potash Ridge announced that Andrew Squires will become the new President and Chief Operating Officer (COO).

Mr. Squires is a mechanical engineer with a technical, financial and operational track-record in oil production, energy storage and aerospace. Exactly the kind of guy you want around when you are building a mine.

The Board of Directors got shuffled, while Guy Bentinck continues as CEO.

“These changes strengthen the leadership team and will provide additional resources for the development of the Valleyfield and Blawn Mountain projects,” stated Bruce Duncan, Chairman.

Consider yourself updated.

FULL DISCLOSURE: Potash Ridge is an Equity Guru client. We think they are going to build a very profitable mine.