As 2016 draws to a close, we as a polite investor society, reflect on the year’s past events and how to better ourselves in the year ahead. And when reflecting doesn’t work, we make wild guesses and place our chips on black. Or Gold.

The junior markets awoke in January of 2016 after a five-year hiatus in which brokerage houses fell like rare earth CEOs, suffering from a hard bear market in commodities and resource stocks that kicked off back in March of 2011.

But in 2016 suddenly everyone was a genius again. Everything went on a tear; gold, copper, even iron ore and the ‘black death’: coal. You name it and it went up. Well, with the exception of uranium, which is the one resource the world really needs more of.

It seemed like everyone got financed and went higher, even with plans that shouldn’t really be getting financing or going higher. It was nice to see some life back in the game. Stock promoters were even cutting back on coke time because there was just so much actual work to be done.

So where do we go from here in 2017?

Will gold make a comeback?

The Au went into a fall in August after a crazy great early 2016. That decline has been a steady, painful drip that hasn’t let off just yet. When resources are strong, gold usually leads the pack, but the shiny really fell of a cliff after the US elections in November. With the Dow rally and US dollar surge it appears that gold’s useful hedge against uncertainty has lost its lustre… for now.

As gold goes so go the junior mining markets. The only action we saw in December was the moves in weed stocks and tech juniors.

My prediction: Gold will rebound when the Dow makes its inevitable correction, which in my guess will happen in the first week in January. If you factor in the craziness if of some of Trump’s tweets, in which he’s likely to call German leader Angela Merkel a hot piece of ass, or claim Vlad Putin is a sensitive lover and the inventor of Rice-a-Roni, it is only a matter of time before one of those loose cannon truth-bombs has some serious geopolitical ramifications, which will cause global chaos and see people buying gold bars in the expectation of zombie apocalypse.

Think the South China Sea and start buying canned goods.

So which gold companies have the clout to make a major move in 2017? Here is my list of top picks based purely on instinct, gut, experience, and my asking smarter people than I.

EDV.T – Endeavor Mining Corp. – this trades at approx. $19.40 a share and they own a large portfolio of West African gold mines with targeted production in 2018 of 900,000 oz a year. They were trading in the $25 range prior to gold’s breakdown.

DGC.T -Detour Gold Corp. – this trades at approx. $17.50 a share and is a pure Canadian gold play with the Detour Lake gold mine. It should produce about 550,000 oz in 2017.

BTO.T – B2Gold Corp. – this trades about $3.05 a share and has numerous projects in West Africa, Nicaragua and the Philippines. This a Clive Johnson company which I feel has plenty of upside potential.

NUG.V – NuLegacy Gold Corporation trades around $0.25 with lots of potential in its Nevada Iceberg project. Some of its major shareholders include Barrick Gold, Oceana Gold and Tocqueville Gold Fund (the world’s largest gold fund).

IDM.V – IDM Mining Ltd. – This Rob McLeod company just announced it is selling its portfolio of Yukon properties to Strikepoint Gold Inc. (SKP.V) and focusing 100% of its efforts to it’s Red Mountain gold property near Stewart, B.C. Red Mountain has the potential to be a high grade monster in the likes of Eskay Creek, and McLeod knows how to make it work.

Lithium’s second wave

Though there’s been talk of a second lithium wave for a solid month now, that industry still has to do some bloodletting, and some ‘me toos’ need to move aside for things to really heat up. Just as happened in 2015 when weed took a dive, which helped clear out some non-starters that were clogging the market, so too does lithium need to send a few of those folks who’ll never drill their dirt to meet their maker.

The cobalt market is also looking to take off, telling investors that it has a higher upside than lithium due to supply strangulation and odious origins of existing output. That seems likely at some point, but when that point kicks in is the question. Will it rely on lithium to kickstart it, or run it’s own race?

Lithium and EV battery commodities like cobalt, manganese, nickel, and graphite may move higher in 2017, but the risk that the junior market is oversaturated as is, makes guessing the when difficult.

I hear Lithium-X (LIX.V) is getting ready for another big push, and there’s been some recent buying that points to that being real. Southern Lithium (SNL.V) is making a run and associated outfits like Nano One Materials (NNO.V) also tell me they’re gearing up for big things.

Oil, but?

Yes, oil! Lots of smart people are talking about oil and gas coming back early in 2017, and I don’t think they’re wrong. Look, you’re not going to do well putting the RRSP into oil because it has a limited lifespan before lithium really picks up and takes over, but there is a lifespan, and there will be significant profits to be had.

Zinc and copper and lead, oh my?

Zinc and copper and lead, oh my?

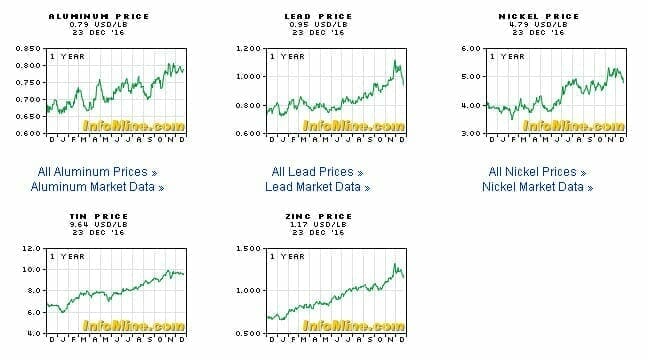

Metals enthusiasts often point to copper as being undervalued and ready for a big upward swing, but the recent price charts show copper maybe turning south of late [see right].

While that’s happening, what’s been going on with the lesser metals has been quite extraordinary.

Base metals are killing it. Zinc is on an absolute tear, lead has gone nutso, aluminum is hitting nice levels and tin is bringing the A-game. Tin!

Base metals are killing it. Zinc is on an absolute tear, lead has gone nutso, aluminum is hitting nice levels and tin is bringing the A-game. Tin!

While that’s all nice, and points to increased production demands of end users as being worth betting on, you’ve got to move a lot of tin and aluminum to move a market upwards. Gold and silver are still letting the side down. They’re like the Sedin Brothers of precious metals. You don’t want to bet against them exactly, but they’re not exactly helping you lift the cup.

Weed: Bubble on or burst away?

A lot of people have bought new homes from their weed profits this year, and while it’s easy to dismiss the weed run as all hype, that industry has already had it’s initial ‘hype spike’ in 2014/15. What’s happening now is less bubble and more long term speculation.

Yes, maybe there’ll come a point where Canopy Growth Corp drops from a $1.4 billion company to a $600 million company, but only for a short while. The future of weed grows quickly as more and more US states clamber aboard, new nations open up, and Canada’s healthy and now well-funded public companies move into all of the above, as well as it’s own fast-liberalizing space.

Weed proper isn’t, for mine, the big future space to bet on, but it is the space that will see the fastest ramp up for the next quarter. Value-added products will eventually benefit from a cheapening of the root product, but for now I’m being told by guys high up in the weed space that there’s a monumental shortage of product looming in Q1-Q2, that newly licensed companies will not be able to fill. This is why companies like Aurora are making grand 800k sq. ft. plans, and why Canopy is raising money quickly and buying things up. It’s why new guys like Emblem and CannaRoyalty and (soon) Green Organic Dutchman are quickly valued in the hundreds of millions.

The market is divided between those who think those valuations are untenable, and others who think they’re following the Amazon road of valuation based on future market share that will be monetized at a later date, somehow, we don’t know how just yet.

I’ll admit, I’ve shifted from the former to the latter camp.

The amount of hard currency that has flowed into this market in quick time, with no expectation of an immediate return, comes from big money people buying future share of the market. It’s based on deals expected with Rexall and Canadian Tire and Safeway, not patient databases in the thousands now. It’s based on being able to go in and monetize Australia, or plants millions of acres in Jamaica and get them exported, not whether or not you can squeeze a better yield out of 20k sq. ft in Moose Jaw.

Companies like Aphria and Tinley and True Leaf and CannaRoyalty and Kushtown shouldn’t be valued at anything close to what they are based on current revenues, or even next year’s revenues. The market is buying based on revenues in 2024 right now, and it’s showing a real commitment to the space in doing so. This money is committed for the now, and for the future. It’s not four-month hold stuff that’ll move into zinc or biotech or whatever wave comes next. The market is valued as it is because the market has committed capital to itself that will build something worthy of that capital injection.

Look at Invictus MD Strategies as evidence. That company was an arbitrage situation – it had more cash on hand than its market cap value, by a hefty margin. It was unloved and unsupported – until the boss raised some money for a nice LP purchase, then suddenly it was a company worth many many millions, with folks complaining it was overvalued.

Can’t make anyone happy these days.

So what do I like in weed right now? I think there’s value in Marapharm (MDM.C), which is making fast moves in the US, Emblem (EMC.V) refuses to sit still, and CannaRoyalty (CRZ.V) is a buy it and forget it deal, for me. Of the LPs, Supreme Pharma (SL.C) has always been an outfit I’ve made money on, and whenever I’ve recommended it, it has proved the doubters wrong in quick time. May it always be thus.

So there you have it. I predict gold will buck the trend and see a reversal of fortune. It is only a matter of time before the incoming Commander in Queef goes to war against Spain or commits to sending a man to Uranus or shuts down the US State Department because “Sad!”, then bring on the correction and watch these gold companies go on a run.

My guess is weed has some fuel left to burn in 2017, and as far as other industries go, the writing will be on the wall at the Cambridge Resource show in Vancouver on January 22 and 23. The amount of exhibitors and the content will truly demonstrate the viability and health of each sector, as it has every year for the last many.

In the past few years, the event saw fewer and fewer exhibitors with most of the attendees not looking for deals but, rather, killing time while their booth attracted crickets.

The industry insider will show you what the market is doing by the either happy or completely suicidal look on their faces. Personally, we’re making a big push into resources in 2017, so that should tell you what we think is up.

— Chris Parry