[Reposted as part of our ongoing investing column at VancouverIsAwesome.com]

As part of our Investing is Awesome series, we like to highlight the local companies in Vancouver that are making big changes in the world, and that you can actually buy a piece of. Yes, you, with the high rent and three jobs.

We’re not talking Kickstarters that don’t kick, or private equity deals where you buy in and never see your money back, or deals where you need five zeros in your investment number to qualify to take part, we’re talking the good old stock market, where you can go to the bank, open a trading account, and buy a piece of local businesses.

In Canada, young startups that decide to go public, meaning the general public can buy their stock, generally list on the Toronto Venture Exchange (formerly known as the Vancouver Stock Exchange). That allows them to sell more stock when they need to raise money, instead of borrowing it from the bank or bringing in venture capitalist vultures. When they show enough pluck and make enough money, they graduate to ‘the big board’.

One such Venture company that has made waves through 2016 is a mob called Nano One Materials, which trades under the ticker symbol NNO.V.

Nano One has a handful of patents relating to a technology they’ve developed that could change one of the biggest innovations of the modern world; the lithium ion battery.

You know the lithium ion battery as that thing that powers every Tesla, solar cells, wind turbines, most of the taxis in town, your cellphones and tablets, your game controllers, computers, power tools, aerospace industries, electric wheelchairs, remote controls, your smoke alarm, the timer on your microwave, the power pack that keeps you alive when you’re Pokemon Go’ing, the VCR clock that your grandmother hasn’t been able to set since 1989…

It’s a pretty big deal. Mostly because lithium ion cathodes are not cheap to produce and, contrary to their green promise, require a bunch of hard toxic work to find, expensive, far flung elements and run the chemical processes needed to turn them into batteries.

Let’s take cobalt as an example. To get at cobalt on planet Earth today requires, currently, trade with the Democratic Republic of the Congo. Not just one of the biggest tyrant governments in Africa, the Congo is also home to what’s called ‘artisanal mining’, though it would be better described as ‘shoving kids down into deep, dark, toxic holes in the floor of someone’s kitchen, and having them chisel away at poisonous rock with a sharpened stick, hanging from a rope for ten hours, for pennies a day’. The by-product is then sold to Chinese companies, who then process it and sell to battery manufacturers, who in turn stick said cobalt into our cellphones.

It’s a crappy, exploitative business for which, right now, there’s not much alternative. Which is where Nano One comes in.

Nano One’s tech does a bunch of things. It enables lower grade raw materials which means they could unlock value in some of the crap that the battery guys currently dismiss. It puts atoms in closer contact with each other which simplifies the process and makes better battery materials. Their process is also versatile, basically a chemical assembly line, that enables many different recipes of nickel, manganese, aluminum, iron, cobalt, aluminum etc… They are not a one trick pony and can shift with market demand. One of their chemical recipes completely removes cobalt from the mix, allowing those lithium ion cathodes to be produced from, “crystal structures formed from inexpensive raw materials reacting at mild temperatures under atmospheric pressures in fast acting, versatile conditions.”

Translated: Nano’s tech assembles low-cost raw materials in solution, prior to industrial driers and kilns completing the reaction, turning those raw materials into ceramic powders. “Innovative control of particle size eliminates the need for repetitive grinding, milling, filtering and prolonged thermal treatment that are common to other dominant industrial processes.”

Translated further: To make a positive electrode for a rechargeable Duracell, you need to get a good source of lithium, nickel, manganese, cobalt… then you have to torture all of those until you have them working as one.

Cobalt-based cathodes are attractive because they have high volumetric capacity, low self-discharge and high-discharge voltage. What sucks about them, however, is they’re expensive, a little toxic, and… well.. kids shoved down kitchen holes?

Manganese cathodes will kill a guy less, and are cheaper, but the manganese tends to dissolve into the electrolyte during cycling. Which sucks because you’re not pulling in that Dragonite if your battery hits zero inside ten minutes.

Nano One’s process is making many of these recipes already and they are also saying, “Wait, you guys! We think we can do this better,” to which the ‘you guys’ being described say, “Yeah, prove it.”

So that’s what Nano is doing. They’re building a pilot plant that will allow them to walk in a suit from Samsung or Apple or Microsoft or Google or Tesla and show them how their tech can be deployed in the real world production processes, by actually producing the cathode in front of them, making said cathode better, cheaper, and less poisony.

To do that, they have to raise $10 million.

Scratch that: To do that, they went ahead and RAISED $10 million, mostly from government grants because the government is all, “Geez guys, it’d be great if every lithium-ion battery sold had to shoot a few nickels to Canada.”

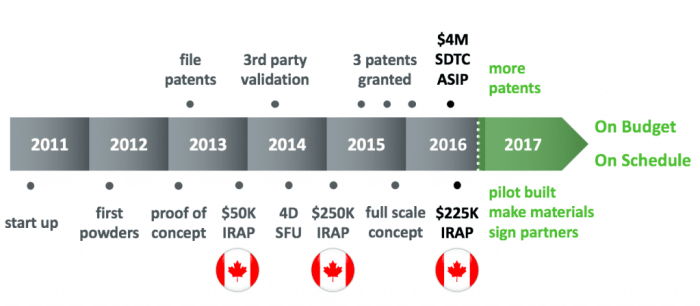

Here’s a chart. You like charts.

You’ll notice the words ‘proof of concept’ show up back in 2013, which means the concept that Nano One can do this has been confirmed. It’s not speculation, it’s confirmation. Realization!

You’ll also notice a litany of government science grants, which is also great, because it helped get the pilot plant under construction, and those grants are non-repayable, which means the company received millions of dollars for free, without diluting the shareholder base. For an investor, that’s lovely. Thanks, government!

You’ll also note the word ‘patents granted’. This too is important because those patents are a little broader than most. If Nano One licenses or sells their tech to a big Samsung or LG type of player, they’ll make SO MUCH MONEY. But if one of those players decides to substitute one metal in the lithium-ion cathode for another, they’re infringing on Nano One’s patents. SO MUCH MONEY.

Little Nano One, little local tech gods with grand plans and big ideas, have it cinched up both coming and going. Do the business, rake it in. License the business, rake it in. Someone else does the business, rake it in.

In situations like this, you always like to assess risk. That is, if I invest in a company like this, am I likely to find, in six months time, the tech doesn’t work or they ran out of money or the CEO is wanted for six murders in Reno in ’83?

Well, we’re pretty sure Nano’s CEO is okay (statute of limitations being what it is), and there’s enough money to be comfortable for quite a while, given the pilot plant is paid for and nearly done, and we’ve established the tech works. So what’s the risk?

That someone out there in the world has just figured out how to get a coconut to store more energy than a cellphone battery. We’re not there yet.

A year ago, you could have bought Nano One stock for $0.26 per share, and those who did have enjoyed a near doubling of their money. Today, it costs $0.47 per share, which values the company at $27 million.

If you like what Nano One is doing, and believe that pilot plant, opening in early 2017, will be the start of a lot of interesting partnerships and licensing deals, now may be a good time to talk to your broker (or use your broking app) to pick some up. The stock hit $0.69 mid-year for a hot minute, so even a return to that level is a 50% profit.

I spoke to Dan Blondal, the CEO of the company, earlier in 2016 for the Equity.Guru podcast, and he was full of more details. Have a listen.

— Chris Parry

FULL DISCLOSURE: Nano One Materials (NNO.V) has paid a placement fee to VancouverIsAwesome.com for this article. The author has no commercial interest in the company.