By Peter Epstein of Epstein Research

Are happy days here again?

These days, positive sentiment prevails in the gold sector, and it only took 4.5 years to reestablish.

That’s right, in Aug-2011, gold topped at US$1,917/oz and then began an insidious decline, pausing in Jun-2013 for two months, then down about 23% over the following 28 months to US$1,050/oz in Dec-2015.

From peak to trough, gold was down roughly 45%. Has the tide turned? From bottom, the gold price has bounced nearly 21% to US$1,268/oz.

I never talk about precious metal junior companies in the context of a rising gold price. Today might be an exception. The market seems different. Trading volume is up, share prices are up, M&A is up and investor sentiment has improved. Things feel different.

Sentiment in the Gold sector has improved.

One need not believe that hyper-inflation is just around the corner, that stock markets will crash 30% next month, or that the gold price will end the year at US$2,000/oz.

US$1,400/oz would make a world of difference. Gold is an attractive call option on a growing number of known gold-friendly scenarios, (global debt bubble, negative interest rates, China/Russia/U.S.relations, Donald Trump, collapse of Petrodollar paradigm) with tail risks like hyper-inflation, nuclear war, terrorist activity, cyber-attacks, pandemic, currency or bank collapses thrown in for free. Complacency is arguably at dangerous levels. Are we approaching a Minsky Moment?

Readers looking for ideas may be wondering if soaring share prices have rendered the opportunity officially missed. My vote on that score is no. When the next wave of investment capital sweeps into the gold sector, there will be fewer juniors to absorb it. Evidence is mounting that a change in sentiment is at hand.

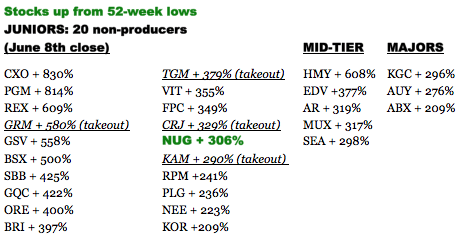

Just today (at the time of writing), it was announced that Goldrock Mines (GRM.V) is being acquired by Fortuna Silver (FVI.V) at a hefty premium. Goldrock is up 587% from its 52-week low as a result. Five prominent gold Majors are up, on average, nearly 250% from their respective 52-week lows. Stocks have soared from 52-week lows, but not so much from 2 years ago

The chart below shows that Goldrock is not the only one enjoying thrilling share price appreciation. Yet, despite recent gains, it’s worth reminding readers that even after big rallies, the average gold stock, as measured by the GDXJ ETF, is almost exactly flat from 2 years ago and down 60% from its 2012 high. Also, I can’t justify a statement that gold juniors have moved too far too fast, when a gold Major like Kinross Gold (K.T) is up nearly 300% from its 52-week low.

Circling back to Goldrock, I think this particular takeout is bullish for the sector. When the bottom dropped out of the gold market, giant low-grade heap-leach projects fell out of favor, (recall Allied Nevada’s (ANV) dramatic fall from grace, and the Midway Gold (MDW.V) fiasco).

The Goldrock deal signals a belief by Fortuna, and possibly other companies, that gold/silver prices have bottomed and that the economics of a properly run bulk heap leach mine makes sense again. The transaction serves as a reminder that after 3 years of cost cutting, curtailments and asset sales, mid-tier & Major gold/silver companies have holes to fill in their production pipelines.

All of the above leads me to a company that warrants a closer look, NuLegacy Gold (NUG.V).

NuLegacy did an admirable job sustaining itself in the dark days from mid-2013 to late-2015. In fact, the Company did better then that, it prudently advanced the Iceberg deposit, in the highly prolific Cortez gold-trend of Nevada, earning a 70% stake in the project. Iceberg is on trend with 3 of Barrick’s largest, highest grade, lowest cost gold deposits (Pipeline ~21+ mm oz @ 2.2 g/t, Cortez Hills ~15+ mm oz @ 4.1 g/t, and Goldrush ~10+ mm oz @ 10.2 g/t).

NuLegacy has 4 large, strong backers in OceanGold, Barrick, Waterton Global & Tocqueville

The earn-in required $5 million of qualifying exploration expenditures, an amount not easy to come by in the dark days, but Chairman Albert J Matter and CEO James E Anderson got the job done.

Somewhat unexpectedly, newly diluted partner Barrick Gold declined to clawback a majority ownership position in Iceberg, leaving NuLegacy with 100% of a materially de-risked deposit. In my opinion, this was the best thing that ever happened to the Company, as it led to OceanaGold acquiring a 19.9% stake and sparked a revaluation of the Company, a process that’s ongoing.

As an aside, I would argue that the 52-week low of 8c/shr, for 70% of Iceberg, could be adjusted to 11.5c/shr, for 100% of Iceberg. That suggests to me that instead of being up 306% from its 52-week low, the shares are arguably up 182%.

All told, there are not 1, not 2, not 3 but 4 large, important shareholders, the other two are Waterton Global & Tocqueville Gold Fund. These 4 own 54.7% of the Company. Each has done considerable due diligence, especially Barrick, who’s exploration team knows the deposit extremely well. Barrick’s and NuLegacy’s technical teams compare notes on NuLegacy on a regular basis. NuLegacy Independent Director Rob Krcmarov leads Barrick’s global exploration team. Suffice it to say that he would not be on NuLegacy’s Board if not for Barrick’s continued interest.

NuLegacy has C$8 million in cash, which is a two year liquidity runway. A LOT can happen in two years

Pro forma for warrant exercise proceeds, NuLegacy’s cash balance stands at ~C$8 million. A solid drill campaign is underway, with drill results due out this summer. 9 months ago, NuLegacy was a very high risk gold explorer, and while the Company is still a high-risk explorer, it’s less risky than it was and has much more flexibility. The Company’s new found cash liquidity has effectively extended by two years the embedded call option on the price of gold. During that time, dual paths to increased valuation could unfold 1) higher gold prices 2) finding more ounces & getting them into a NI 43-101 resource estimate.

Readers should be reminded that the Iceberg deposit is worth a lot more to a larger player that has a lower cost of capital and a portfolio of mining assets where economies of scale and synergies could play an important role. Iceberg potentially has great strategic value as well, a theme that will be investigated though the drill bit over time.