On October 21, 2019, Barrian Mining (BARI.V) reported the first drill results from the recently completed 1,838 metre reverse circulation (RC) drilling program at Bolo Gold-Silver Project, located in Nye County, Nevada, USA.

The “Bolo Gold-Silver Project” is Barrian’s flagship asset, located 90 kilometers northeast of Tonopah Nevada (pop. 2,478). It hosts Carlin type gold mineralization and is fully funded and permitted.

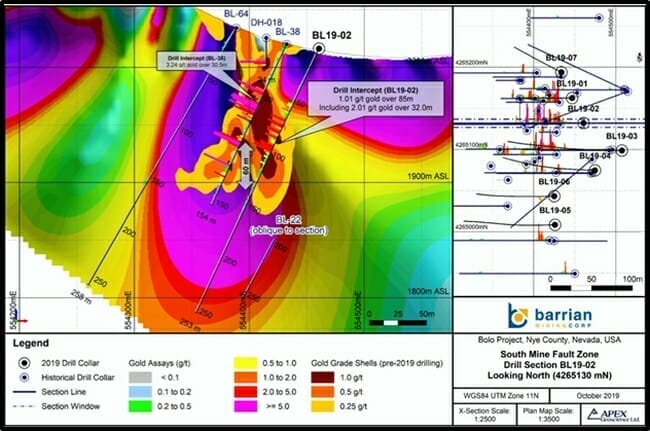

Hole BL19-02 intersected 32.0 metres of 2.01 grams-per-tonne (g/t) gold starting at 67 metres down hole, within a broader zone of mineralization averaging 1.01 g/t gold over 85 metres starting at 49 metres down hole.

These results extend the footprint of gold mineralization approximately 60 metres vertically below the previous drilling on section.

What does “32.0 metres of 2.01 grams-per-tonne (g/t) gold” mean for Barrian Mining?

It means: game on.

“Initial drill results” are important.

It’s a bit like a Chef dipping his finger tentatively into a simmering sauce that he has just created.

If the first taste is unpleasant, the sauce may be salvageable, but it’s not confidence-inspiring for the people who’ve invested in the restaurant.

Barrian received full gold fire and multi-element analytical results from ALS Global for hole BL19-02, which was drilled to a total depth of 253 metres.

Full gold fire assaying is generally the most accurate. It involves the following steps:

- Dissolve the rock sample in a crucible using a lead glass flux.

- Apply heat.

- Remove crucible from heat.

- Molten glass (with no metals) is poured off

- Metal is poured into a mold and allowed to cool until it solidifies.

- Apply biochemical extraction techniques

- Weigh gold and silver, compare to original sample, calculate grams/tonne.

Despite the solid first reported drill hole, on October 21, 2019 BARI stock dropped a couple of pennies (10%) on 2.7 million shares traded.

Why did this happen?

Doesn’t the “Efficient Market Hypothesis” state that all stocks trade at rational prices since all information is known to all market participants at all times?

The “Efficient Market Hypothesis” does have application to mega-cap stocks like Apple (AAPL.NASDAQ), Freeport-McMoRan (FCX.NYSE) and Bank of China (3988.HK) – but it has less application in the hurly burley world of junior mining stocks.

Example: The Junior Gold Miners ETF (GDXJ.NYSE) is a $4 billion bundle of junior gold companies, including explorers.

It takes a minimum of five years to build a mine.

If the Chairman of the Fed has a successful bowel movement and the price of bullion goes up $3 – that could not possibly affect the intrinsic value of a gold explorer.

Yet the GDXJ floats up and down with the spot price of gold.

Check it out: 98% of the time, if the spot price of gold goes up, the GDXJ goes up (and vice versa). It’s illogical. But that’s what happens.

In Barrian’s case, it may be investors looking at the chart, thinking, “BARI stock has had a good summer/fall run, let’s sell into the news.”

At any rate, BARI is out of the gate strong with its first drill results, and it still has a tiny market cap of $10 million.

“We created Barrian with a goal of finding top quality assets and have a tremendous team that can work together and deliver value for shareholders and these first results have demonstrated this ability,” confirmed Brad Telfer, BARI Director and Co-Founder.

“Barrian anticipates additional drill results over the coming weeks,” stated the October 21 press release, “The remaining unreported drill holes intersected significant mineralized intersections that will provide potential to expand the South Mine Fault Zone and Uncle Sam Zone.

“There are no permitting issues at Bolo,” stated Greg Nolan Equity Guru mining expert, “the company can build up to 77 drill pads. That’s a lot of freedom to probe the subsurface. They can go as hard as they want and as fast they want.

If gold suddenly goes on a tear, management won’t hesitate in adding rigs and meters to this first phase of drilling. “Drill baby drill’ will become their motto.”

Figure 1: Bolo Gold Silver Project BL19-02 Drill Section (Showing Resistivity)

“Saskatchewan displaced Ireland from the top mining jurisdiction spot this year,” stated the 2018 Fraser Institute Mining Survey, “Saskatchewan was followed by Nevada in second.”

The top jurisdiction in the world for investment based on the Investment Attractiveness Index is Nevada.

Nevada Gold Investment Highlights:

- 225 million ounces of gold mined to date

- 80% of USA gold production

- Home of multiple 20-million-ounce gold deposits

- Transparent, predictable and established permitting rules/guidelines

- 22 processing facilities

- Nevada juniors recently bought-out by gold majors

- Modern highway network

- Accessible 12-months a year

Bolo isn’t Barrian’s only Nevada project.

On October 11, 2019 Barrian Mining (BARI.V) announced that it has staked an additional 40 contiguous mineral claims at its ”early-stage Troy Canyon gold and silver project” located in Nye county, Nevada, about 230 kms north of Las Vegas.

“The discovery of significant gold mineralization, open at depth below previous drilling, provides a compelling exploration target,” stated Maximilian Sali, BARI CEO and Co-Founder about the October 22, 2019 Bolo results, “We believe the grade-interval product returned from BL19-02 represents an exceptional result in comparison with other 2019 publicly reported Nevada drill intercepts.”

Full Disclosure: Barrian Mining is an Equity Guru marketing client.