What a difference a year makes. In fiscal 2018, most cannabis investors were happy to pile money into companies that had zero revenues.

As long as the “production capacity” was going up, “international opportunities” were being explored and the “dispensary footprint” was expanding – that was reason enough for cheer.

That was then.

This is now.

As some of the pretenders are exposed as villains or hype machines, investors are zeroing in on revenues – and even – horrors – profits & losses.

On July 2, 2019 1933 Industries (TGIF.C) released its Q3, 2019 financial results for the three and nine months ended April 30, 2019.

The 1933 Industries business model “incorporates cultivation, extraction, processing, manufacturing, branding, distribution, and ancillary services,” stated entrepreneur Paul Rosen who recently invested $4.5 million in 1933, “There are only a handful of companies that have been able to accomplish this in a short period of time.”

1933 Industries has three subsidiaries, Infused MFG, Alternative Medicine Association AMA) and Spire.

In the July 2, 2019 press release, 1933 admitted that “the expected revenue” for Spire was not realized it is now focusing on consumer branded goods, cultivation and extraction assets, where there is a better return on investment.

AMA is one of Nevada’s largest wholesalers of cannabis products, including branded flower, wholesale distillate and a broad range of concentrates with distribution channels in place throughout Nevada.

To accommodate 1933’s white-labeling product demand, the footprint of AMA’s 12,160 sq. ft. building is– increasing 600% to about 67,000 sq. ft.

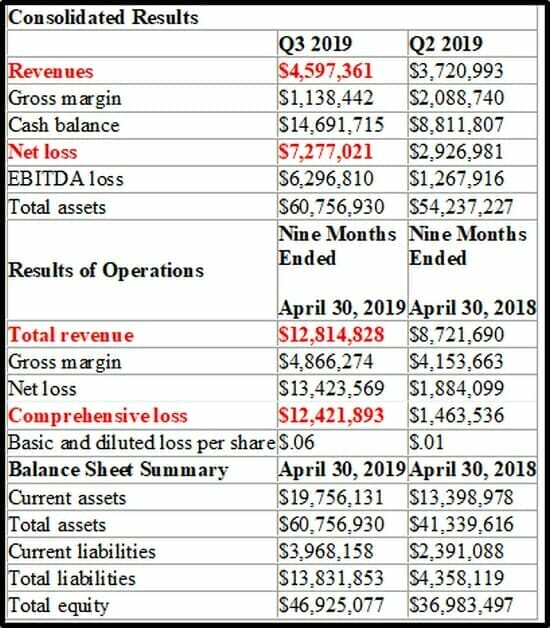

Q3 Financial Highlights:

Revenue of $4,597,361 million, representing a 28% increase from the previous quarter.

Gross margin of $1,138,442 (24.8%) compared to $1,440,557 (43.7%) during Q3 2018.

Net Loss of $7,277,021

According to 1933, the decrease in the gross margin is “primarily due to increased purchases of third-party biomass by AMA to produce concentrates and final products, while increasing market share.”

Net loss is attributed to building infrastructure scale, investing in brand development and a $3,044,86 impairment adjustment of the company’s consulting arm, Spire Global Strategy.

“We are pleased to report strong growth comparatively to our last quarter, driven by rising consumer demand for our AMA cannabis products in Nevada,” stated Chris Rebentisch, CEO of 1933 and the impressive growth of our Canna Hemp line throughout the United States.”

Rebentisch states the 1933 has “spent significantly on the expansion of our infrastructure” to support “the future growth of our brands.”

Are 1933’s net losses acceptable?

It depends on the point of comparison.

For nine months in 2018, CBD producer and distributor Charlotte’s Web (CWEB.C) booked $48 million in revenue and $37 million in gross profit.

In Q4, 2019 Canopy Growth (CGC.NYSE) reported a net loss of $323 million Canadian dollars on $94.1 million revenue. That’s $41 loss per second. $2,500 per minute. $150,000 per hour. $3.6 million dollars a day.

Canopy’s quarterly losses were 3.4 x bigger than its revenues.

1933’s quarter losses were 1.6 X bigger than its revenues.

“Our focus moving forward will be the growth of our consumer-packaged goods portfolio and the innovation of our unique quality-based brands,” stated Rebentisch, “We also intend to invest in our hemp extraction facility, automate our manufacturing processes and move into strategic markets.”

Breaking it down, AMA revenues were $1,784,861 for Q3 2019 up 38% from the previous quarter, while gross margins were a loss of $949,925.

Infused increased sales revenues to $2,812,500 for Q3 2019, which is an 18% increase from the previous quarter and accounts for 61% of 1933’s total revenues for Q3 2019.

Other news release highlights:

Infrastructure Buildout – received Occupancy Permit for its indoor cannabis cultivation facility on June 28, 2019. Facility now ready to begin operations to supply raw materials for its flower and concentrate branded products and white label production.

Hemp Extraction Facility – the fully customized 12,000 sq. ft processing facility will be one of Nevada’s largest hemp extraction operations, allowing for isolation of THC, CBD, CBN, CBG and CBC.

Monthly throughput capacity of 68,000 kgs. of hemp biomass, producing approximately 5,000 kgs. of full spectrum oils or 4,500 kgs. of CBD isolate.

CBD isolate is currently worth about $7.50 per gram, making the targeted production worth a potential $33 million a month in retail sales. Actual sales, cost-of-goods and profit margins still to be determined.

Distribution Expansion – Network of 46 states. selling Canna Hemp wellness line into retail outlets, mostly in California, Nevada, Arizona, and Colorado. The number of retail outlets quickly jumped from 600 to 800 in June, 2019.

IP and Strategic Partnerships – a portfolio of over 250 SKUs of THC and CBD-infused products. 1933 signed three significant licensing agreements over the period with household brand names such as OG DNA Genetics, Birdhouse Skateboards and Gotti’s Gold.

AMA strengthened its partnership with hip hop artist Kurupt for the launch of Gotti’s Gold in Nevada.

AMA also recently signed a two-year agreement with OG DNA Genetics to cultivate, manufacture, distribute and sell OG’s branded cannabis in 1933’s Nevada stores.

DNA’s genetics have won more than 200 awards in all categories at prestigious cannabis events around the world.

Infused MFG, a subsidiary of 1933, recently signed a two-year licensing agreement with House of Hawk, the company owned and operated by pro-skateboarding legend, Tony Hawk.

“Tony Hawk is an internationally renowned athlete who has built a branding empire over the past 30 years, and a partnership with House of Hawk will add brand recognition to Infused’s products,” wrote Equity Guru’s Joseph Morton.

Hawk – the world’s most famous skateboarder- recently celebrated his 50th birthday by creating a “50 Tricks at 50” video.

Organizational Changes:

- Mr. Brayden Sutton was named Chairman of the Board of Directors and stepped down as President & CEO

- Mr. Chris Rebentisch was appointed CEO

- Ms. Ester Vigil was named President

- Mr. Steve Radusch was named CFO

“We have sustained organic growth with a strong platform, realized operational efficiencies across the organization,” stated Rebentisch about the Q3, 2019 results, “we expect increased revenues and margins as we continue on the path to profitability”.

– Lukas Kane

Full Disclosure: 1933 Industries is an Equity Guru marketing client.

What’s with the slavery oppression bigot confederate traitor imagery? wtf. Is this from the company or imagery Equity Guru chose to be “funny”?

Oatsuzn, you hurt my feelings when you put “funny” in quotes. I did not notice the GIF featured Robert E. Lee, and Stonewall Jackson. I just registered it as 2 American Dudes On Horses. I don’t want to be a racist. And I don’t want to hurt your feelings. So I removed the offending image. Thank you for alerting me to the “slavery oppression bigot confederate traitor imagery.”