Yield Growth’s (BOSS.C) subsidiary Urban Juve has arranged to put their hemp-based beauty products in ipsy’s glam bag.

Ipsy is a monthly subscription service where subscribers get a makeup bag of five cosmetics samples, including skincare items, perfumes, nail and skin products and makeup.

Ipsy’s monthly glam bag pushes Urban Juve’s products out to three million members and over half a billion people every month.

Urban Juve’s products will include educational videos and product details to help familiarize prospective buyers, who the company hopes will review, recommend and repurchase their products.

“Our products in the hands of this engaged ipsy base of beauty, wellness and skin care shoppers will strengthen our launch efforts by raising awareness of the quality and the difference our formulas can make to the feel and appearance of skin,” said Penny Green, chief executive officer of Yield Growth.

The monthly subscription market has grown by more than a 100% a year over the past five years with the largest retailers pulling in more than $2.6 billion in sales in 2016, up from $57 million 2011, according to Forbes.

This arrangement also gives Urban Juve exposure to ipsy’s social media channels, which will draw millions of eyes onto their products.

Q1 2019 Financial News

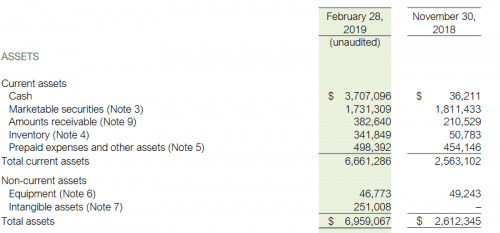

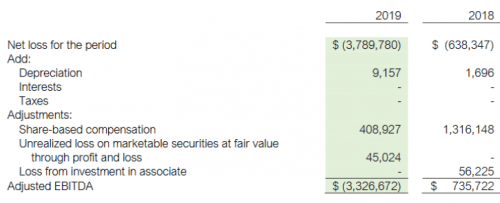

Yield also released numbers for Q1 2019.

Yield made $800,714 in revenue for the three months ending Feb. 28, 2019, down from $1,808,813 from the same period last year due to a consulting contract which netted the company a one-time revenue of $1,800,000.

This year’s revenue numbers were driven by licensing contracts that the company anticipates will be a reoccurring factor in their finances going forward.

Yield launched their first product sales this quarter, with their lip balm, anti-aging serum cream and three moisturizers coming out near the end of the quarter in Feb. 2019.

Product sales increased 85% from the first month to the third month of the quarter, and Urban Juve has launched six more products since the quarter ended, bringing their total number of SKU’s up to 11.

Yield will launch another nine products in Q2 and Q3 through their Wright and Well brand, and anticipates their aggressive marketing and sales efforts will yield substantial product revenues in both of those quarters.

Yield’s losses come from a mix of the price of scaling, decreasing licensing revenues and increased expenses.

These are from mostly marketing expenses, which include marketing and packaging design for 200 products in development, new websites in development for Urban Juve and Yield Growth, and market exposure programs. Yield also went public on the CSE, OTC and Frankfurt stock exchanges in that time.

The losses here represent the price of doing business for a new aggressively-growing company.

Yield Growth shares rose by $0.01 to close at $0.65.

The company has 87,299,140 shares issued and outstanding and a market cap of $55 million.

We’re optimistic that this company is ready for takeoff.

—Joseph Morton

Full disclosure: Yield Growth is an Equity.Guru marketing client.