Revenues are quickly becoming the new watermark through which to judge companies in the cannabis space, so Cannabis Life Sciences Holdings (CSE:CLSH.U) is fairly chuffed that their subsidiaries, The Oasis Cannabis dispensary and City Trees, have set a new revenue record of USD$ 1 million in March 2019.

To put this in perspective, the $174 million valued Wayland Group (WAYL.C) booked revenues of $1.9m in the first nine months of 2018, a figure the $45 million valued Cannabis Life Sciences will top in a single quarter, from just one of their dispensaries.

This is how the deal to acquire Oasis Cannabis looked in mid-2018, when CLSH.U snagged it:

Since 2017, Oasis has been involved in growing, extraction, conversion, processing and operating a dispensary. Its grow, extraction, conversion and processing facility had its best month ever last month in generating $200,000 in gross revenues.

Today? Oasis Cannabis dispensary processed approximately 400 orders a day and bagged $560,000 in net sales revenue last month, up nearly a triple from that point.

Meanwhile, their City Trees wholesale brand added another $453k to the bottom line.

Oasis is also working on their own 25k square foot cultivation and production facility to produce up to 6,600 pounds of their own cannabis. City Trees is doing business out of 33 dispensaries in Nevada.

The CLSH.U team is feeling good:

“In the past 90 days we’ve made a number of positive changes. These changes have resulted in increased revenue, increased margin, consistent growth of daily customer traffic and an organization that is currently executing at a high level. I am really proud of the effort all our team members make on a daily basis. In the weeks ahead we look forward to providing additional information including the results of our quarter ended February 28 2019,” said Andrew Glashow, President and COO of Cannabis Life Sciences.

In Massachusetts, which isn’t included in these numbers, CLSH.U continues to build out.

CLSH started by acquiring In Good Health, an established dispensary located in Brockton, Mass. that’s been around since 2015, enjoys the honour of being the second licensed medical dispensary in the state.This added another 18,000 registered patients and 1,700 homes to their sales and state-wide delivery footprint. That makes them one of 48 licensed dispensaries serving a state with a population of 6.9 million people.

That’s a big customer footprint compared to the state of Colorado, which has 364 dispensaries serving 5.6 million people.

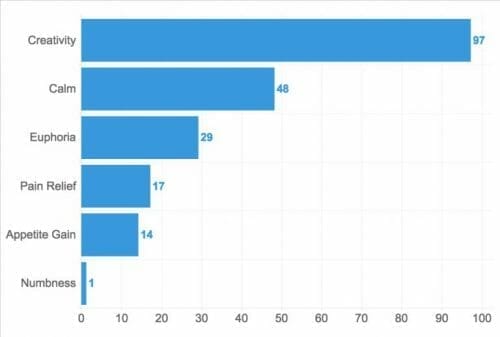

In Good Health’s product range includes CBD, cannabis oils and flower, and their website includes information not only on the products, but also data on what the consumer can expect while ingesting them, such as the ‘mood data chart’ below for their Captain Cook strain.

Recently, CLSH penned an agreement to acquire 80% of weed consultancy, CannAssist.

This deal comes with an 86k square foot facility in Leicester, Mass. that’s expected to produce 28,000 pounds of flower and 240,000 grams of extract a year. Their first harvest is in Q1 2020, and the expected revenue from this facility is north of $100 million.

Jeff Binder, CEO of Cannabis Life Sciences, states the current cultivation in Mass approaches 800k square feet, but the demand it’ll likely serve is ten times that.

Canaccord analyst Bobby Burleson suggests that Cannabis Life Sciences has a $1.50 Speculative Buy rating, while CLSH’s asking price is currently $0.39.

If they’re worth 1/4 of WAYL, with just one dispensary doing double WAYL’s quarterly revenue PER MONTH, well, I’d suggest that’s worth a deeper look.

—Joseph Morton

Full disclosure: Cannabis Life Sciences is an Equity.Guru marketing client.