On February 12, 2019 Supreme Cannabis (FIRE.T) released its financial & operating results for the period ending December 31, 2018.

7ACRES’ 340,000-square foot hybrid greenhouse in Kincardine, Ontario – combines the best practices in indoor cannabis cultivation with the power of the sun.

The result is indoor-quality buds with sun-grown characteristics.

Saskatchewan and New Brunswick recently became 7ACRES’ seventh and eighth provincial partners alongside British Columbia, Alberta, Manitoba, Ontario, Nova Scotia and PEI.

Q2 2019 Financial and Operational Highlights

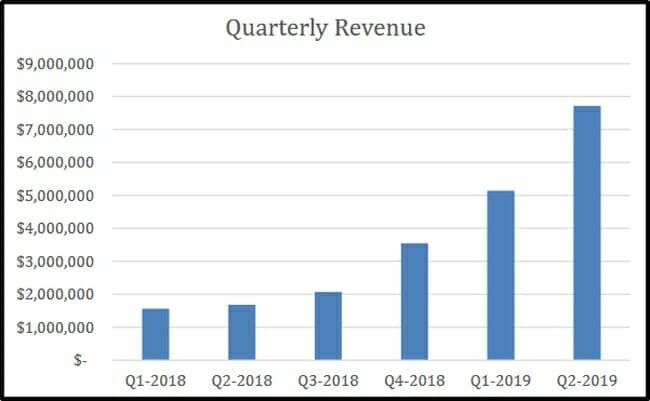

- Revenue of $7.72 million, a 359% increase from Q2 2018 ($1.68 million) and a 50% increase from Q1 2019 ($5.14 million).

- Strengthened balance sheet by raising $100 million through a bought deal offering of 6% unsecured convertible debentures due 2021

- Made its first shipments of 7ACRES branded Cannabis to six of Canada’s provincially regulated adult-use channels.

- Contracted Medipharm Labs to facilitate the launch of cannabis oil products line.

- Partnered with Khalifa Kush Enterprises to launch premium cannabis products for the Canadian and international markets excluding the U.S.

- Net comprehensive loss of $1.55 million, compared to a net loss of $2.03 million in Q2 2018 and a net loss of $5.39 million in Q1 2019.

For the six months ended December 31, 2018, Supreme’s total construction expenditure on its 7ACRES Facility was $45.3 million – with capitalised borrowing costs of $2.7 million.

The increase in construction expenditure is the result of rapid expansion of the 7ACRES facility including the newly licensed growing rooms.

Subsequent to Q2 2019

- 7ACRES facility received Health Canada approval for 30,000 square feet of additional production space

- Graduated to the Toronto Stock Exchange from the TSX Venture Exchange

- 7ACRES entered into a supply agreement with the New Brunswick Liquor Corporation and has been registered as a supplier in the province of Saskatchewan, expanding distribution into eight provinces.

“Our Q2 results show meaningful revenue growth quarter-over-quarter and continue to reflect our strong operational execution,” stated Navdeep Dhaliwal, CEO of Supreme Cannabis. “Since Supreme received its license over two years ago, we have been one of the fastest scaling LPs in Canada, demonstrated by one of the strongest first years of revenue in the sector.”

On Friday, February 12, 2009 FIRE’s stock price dropped from $2.21 to $1.92 – on a newsless-day.

The internet’s collective brain-trust puked up a puddle of theories: “They walk it up and down while retail takes it in the ass” “Lol – the shorties got carried away today” “Looks like a lot of downward pressure attempts to buy in cheap before financials Tuesday.” “3 million share Market-On-Close Order sell from Anonymous today – doesn’t just look like profit-taking”.

Market-on-close orders are executed at or just after closing. These orders do not specify a target price. It ensures that the transaction is executed, but it leaves the investor vulnerable to end-of-day price moves.

We’ll leave the analysis of Friday’s anomalous trading activity to the technical chartists and conspiracy theorists.

Supreme grows premium quality weed. That’s its religion. Its hobby. And the reason it exists.

The B2B model allows 7ACRES to grow its revenue through high value bulk sales while maintaining its focus on cultivation, without the expense of patient acquisition and retention or retail order fulfillment and logistics.

Supreme’s future hinges on its ability to establish 7ACRES as a dominant brand

Selling $7.72 million of weed and booking a net loss of $1.55 million – may not sound like a healthy business – but it’s gangbusters compared to Wayland’s (WAYL.C) recent quarterly loss of $12 million or MedMen’s (MMEN.V) quarterly loss of $66 million.

“During Q2, 2019 we made our first shipments of 7ACRES-branded product to adult-use markets in six provinces,” stated Dhaliwal, “The consumer feedback has been overwhelmingly positive.”

“With construction on the flowering room at 7ACRES scheduled to be completed by the end of March, we’re looking forward to increasing our production capacity,” continued Dhaliwal, “This quarter validated many aspects of our consumer driven market thesis and demonstrates the strength of our IP around scaled cultivation.”

On December 6, 2018 it was announced that “Supreme Cannabis will be the exclusive producer of KKE branded products in Canada and, subject to certain approvals, international markets (other than the U.S).”

“The team at Supreme Cannabis understands how to produce high quality cannabis at scale,” stated Wiz Khalifa, principal of KKE, “I am very excited to be working with them to bring Khalifa Kush quality products to Canada and other international markets.”

Full Disclosure: Supreme Cannabis is an Equity Guru marketing client, and we own the stock.