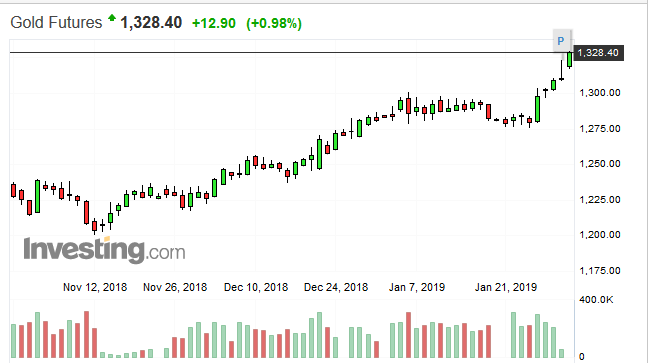

Earlier this week, we talked about the potential for an upside breakout in gold.

We talked about a little technical pattern called a Golden Cross, and how it might be cueing up a trend reversal.

We talked about the $1,300 resistance level, and the need to push past it before the metal gets cut loose.

So far, so good…

It’s beginning to look like we have a bonafide breakout on our hands here.

Of course, we can’t rule out a free-for-all between bulls and bears, a battle royale.

It wouldn’t surprise me if gold chopped around this level for the next week or two before launching its next assault on higher ground.

But then again, it could just continue to rip higher.

In recent Equity.Guru offerings, we also talked about the positive fundamentals supporting higher precious metals prices…

Read: Gold: uncharted waters – the technicals, the peak of discovery, the opportunity

… and the importance of assessing jurisdictional risk…

In this era of heightened geopolitical tension, protectionism, terrorism, despotism, what have you… there’s a strong case to made for elevating ‘jurisdiction risk’ to the top of one’s due diligence checklist.

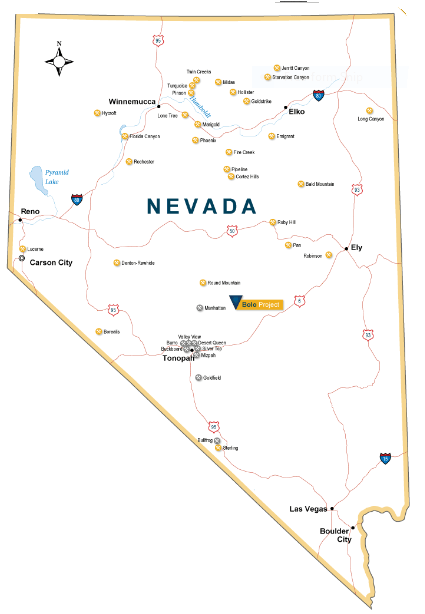

If a country’s risk profile exceeds your comfort level, look elsewhere, focus on safer, friendlier climes. Take Nevada for example.

A brand new Nevada ExplorerCo:

Barrian Mining (BARI.V) is a fresh new player in the junior exploration arena. It’s set to begin trading imminently.

Bolo, the company’s 3,332-acre flagship property, is located 90 kilometers northeast of Tonopah, Nevada.

Nevada, in case you don’t know, is one of the friendliest mining jurisdictions on the planet, currently ranked number three by the Fraser Institute. It’s also top shelf in terms of global production where it’s currently ranked 4th in the standings.

The proven/under-explored asset:

Bolo boasts good, year-round road access – all the necessary infrastructure is within easy reach.

Though money has been spent here, some US $3.3M, this is an under-explored piece of ground. No modern geophysical or geochemical surveys have been conducted on the property.

The project has heaps of untapped potential.

Bolo is a Carlin-type setting – its mineralization is similar to the Pinson, Lone Tree/Stonehouse, and Turquoise Ridge/Getchell gold deposits, all multimillion-ounce orebodies defined by high-angle structures.

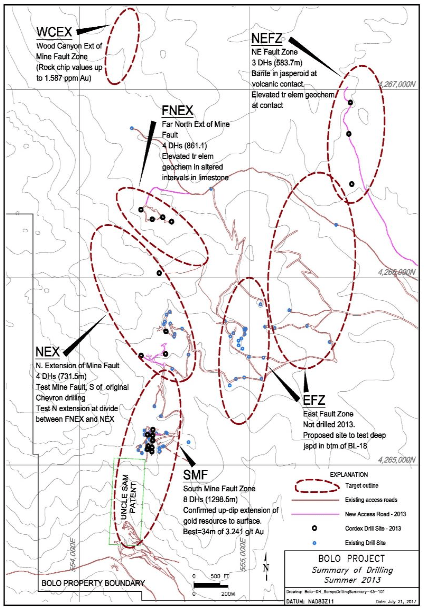

Surface sampling has defined widespread gold mineralization along two parallel north-south trending faults – the Mine Fault and the East Fault.

Significantly, alteration along the Mine Fault has been traced for 2,750 meters – outcrop samples returned gold values of up to 8.6 g/t gold.

The East Fault has been traced for 2,200 meters and has sampled up to 4.7 g/t gold.

Widespread anomalies offer numerous zones and targets for further exploration.

Modern-day geophysics and geochemistry will help fine-tune and prioritize these target areas.

Drilling by Columbus Gold back in 2013 yielded a number of stand out intercepts.

From Bolo’s South Mine Fault Zone:

- Hole DH-BL-38: 133 meters of 1.28 g/t gold from surface (includes 30.5 meters of 3.24 g/t gold)

- Hole DH-BL-39: 90 meters of 1.0 g/t gold from surface.

- Hole DH-BL-41: 52 meters of 1.27 g/t gold from surface.

- Hole DH-BL-54: 58 meters of 41.13 g/t silver from surface (includes 7.6 meters of 220 g/t Ag).

These are solid hits. If similar results were released today, in this market, they would attract an immediate following.

You might ask…

“If this is such a great Carlin-type property, why hasn’t it been making headlines?”

Great question. The fact is, Bolo once belonged to Columbus Gold (CGT.TO). It was tied up in their project portfolio for years, gathering dust, completely overshadowed by their Montagne d’Or project in French Guiana.

In a plan to unlock the value of projects like Bolo, Columbus spun off its U.S. exploration assets into Allegiant Gold (AUAU.V).

Allegiant, looking for a skilled and motivated team to do Bolo justice, joint ventured the project to Barrian.

Moving along…

The terms of the joint venture between Barrian and Allegiant are spelled out in a Jan. 22 press release:

ALLEGIANT has granted Barrian, a private gold exploration company in the process of completing an IPO, the option to acquire up to a 75% interest in the Bolo gold project, located in Nevada. Barrian can earn an initial 50.01% interest in Bolo by issuing common shares valued at US$1.0 million to ALLEGIANT over a 3-year period, and by incurring exploration expenditures of at least US$4.0 million by December 31, 2022. Barrian can earn an additional 24.99% interest in Bolo, for a total of 75%, by incurring an additional US$4.0 million in exploration expenditures within 2 years of earning the initial 50.01% interest. If Barrian does not earn an additional 24.99% interest in Bolo, it will transfer 0.02% back to ALLEGIANT such that ALLEGIANT will hold a 50.01% interest in Bolo.

Something to consider: Barrian negotiated hard to get that remaining 25% worked into the deal. Allegiant stood its ground, refusing to deal away the entire project. That speaks volumes. It says something about the value Allegiant places on Bolo.

Barrian has immediate plans for Bolo…

For H2, a first phase exploration campaign will include:

- Drone flying and imagery analysis.

- Ground IP and magnetic geophysical surveys for deep penetrating 3D analysis.

- Grid soil and rock sampling across the anomalous areas.

- Geological modelling to prioitize H2 drilling targets.

- A 1,700 meter drilling program of expansion and exploration drilling.

Initially, the company plans to drill in the direct vicinity of where the historical holes cut significant mineralization. Example: DH-BL-38 and its 133 meters of 1.28 g/t gold from surface (including 30.5 meters of 3.24 g/t). From there, it’ll likely be a process of stepping out with the benefit of modern geophysical / geochemical surveys in hand.

Groundwork on the project could begin as early as the first week of February.

Nevada loves its miners…

The are no permitting issues at Bolo – the company can build up to 77 drill pads. That’s a lot of freedom to probe the subsurface. They can go as hard as they want and as fast they want.

If gold suddenly goes on a tear, management won’t hesistate in adding rigs and meters to this first phase of drilling. “Drill baby drill’ will become their motto.

In addition to Bolo:

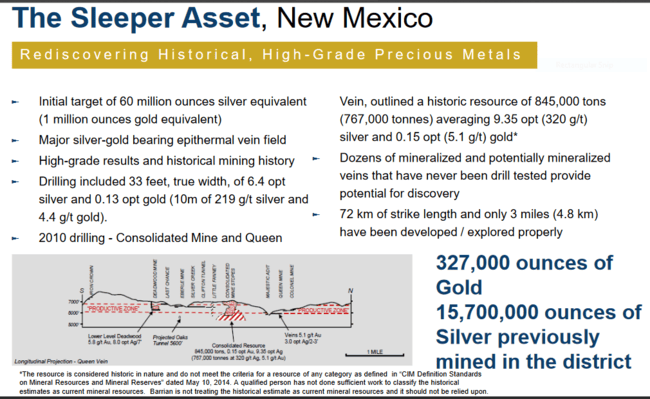

The company also has a past producing silver property in its portfolio.

Epithermal in nature, the Sleeper Asset in New Mexico produced some 327,000 ounces of gold and 15,700,000 ounces of silver back in the day.

Barrian is currently compiling data on Sleeper. If precious metals do indeed go on a tear, as I suspect they will, Sleeper will be roused from its slumber and subjected to an aggressive exploration campaign.

Barrian management:

This is an impressive team.Their skillsets range from mining and capital market expertise to advancing and monetizing exploration assets. Bottom line, this crew knows how to deliver shareholder value.

Changing gears (joysticks?):

*MINING FOR MILLENNIALS*: – that’s what’s on page one of Barrians investor deck.

People say that young’uns aren’t interested in mining.

Think again. The most successful video game over the last 10-years is Minecraft. Kids are obsessively mining for resources all day every day, pissing off their parents to no end.

That should be a big fat clue for mining execs looking for ways to draw greater attention to their stock.

Barrian is onto something here.

The traditional mining crowd is growing older. They’re growing less tolerant to risk. And mining is a high-risk arena.

High-risk investments are better suited to a younger audience – those with the benefit of time and energy to bounce back should they take a financial hit.

Equity Guru’s Chris Parry has been active on this front in recent days. In a very timely and potentially trend setting piece, he stated…

If you’re in business in the public markets and you don’t talk specifically to younger investors, you’re not likely to be in business in the public markets for long. The old audience – the one that doesn’t like our animated gifs and bristles when we put ‘motherfucker’ in print, the guys who send legal threats when we tear apart their pump and dumps and don’t understand what the Streisand Effect is – they’re dying off, year by year. And those who are still clinging to life are hanging on to their fixed income until the flesh falls away.

Parry’s offerings on the subject are must-reads…

Read: Mining for minors: Time for resource companies to figure out the money is in millennials

And where Barrian Mining is concerned, must-listens…

Final thoughts:

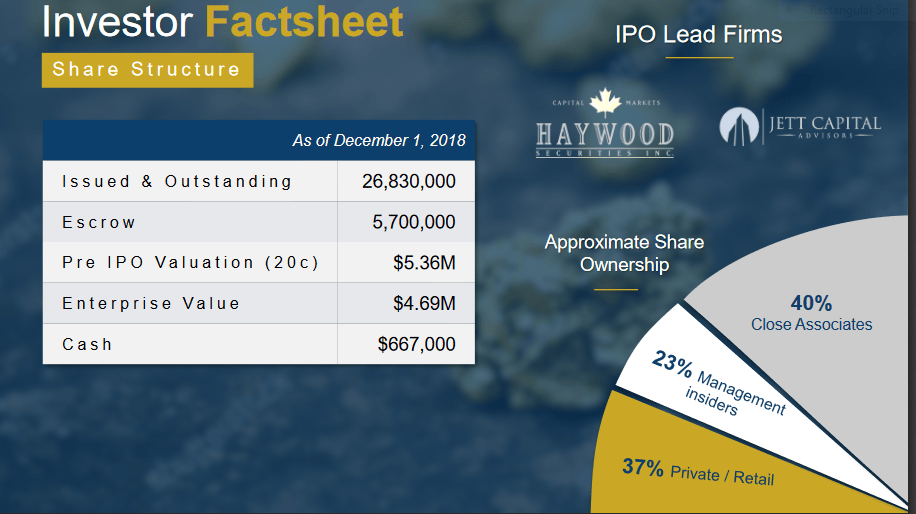

Barrian is backed by good people, a good asset, and a strong shareholder base.

The share structure here is super tight.

The company will come out of the gate with roughly $4M in the till and immediately put boots to the ground.

2019 newflow will be strong.

Lastly, it’s important to remember that gold producers are rapidly depleting their resource bases. Forced to scale back exploration spending during the lean years, they’re now desperate to replace those ounces. They’re on the hunt.

Barrian’s IPO couldn’t be better timed.

Drill baby drill.

END

~ ~ Dirk Diggler

Full disclosure: Barrian Mining is an Equity Guru marketing client.

Feature image courtesy of Mining.com