While we Canadians celebrated Thanksgiving yesterday, the stock markets in the US had a monster day. And I mean MONSTER day. Stocks put on their best day in 6 months, on the hopes of stimulus talks doing well…and I would argue…pricing in the victory of a certain Presidential candidate.

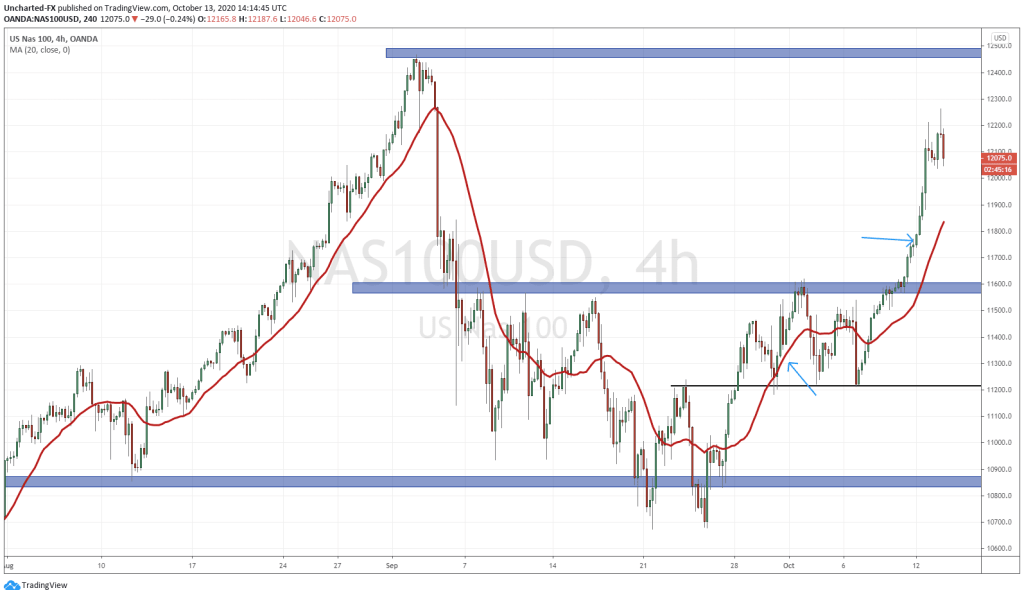

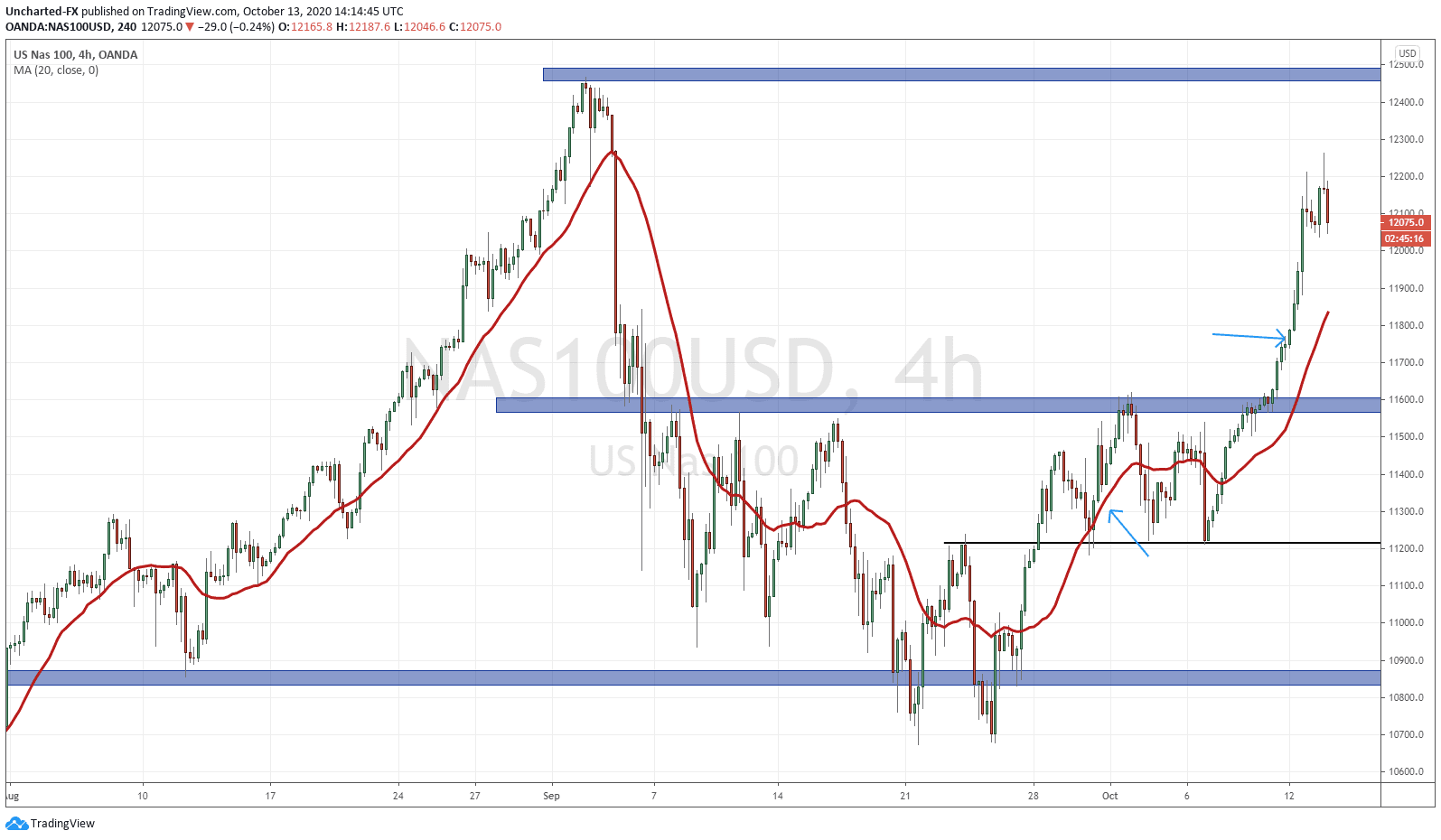

From our Nasdaq trade entry, we entered on the double bottom breakout and then retest, and we were front running the inverse head and shoulders pattern! Our entry was around 11300, and yes, there was a lot of volatility along the way. But as long we held our stop loss zone, which coincided with a higher low level in the trend, we had the potential to make new highs AND the uptrend remained intact. It was that President Trump tweet regarding scrapping of stimulus talks which took our position into the negative, but albeit for 12-16 hours. Once again, our higher low level still held which was key!

Price then reversed and hit our take profit level at 11765. A 3% gain and over 400 pips for those trading CFDs!

The arrows on the chart point to our entry and exit points. However, as my readers can probably see by now, we did trigger a broader inverse head and shoulders pattern with the break above 11,600. This pattern was also seen on the other equity indices as I spoke about last week. So there was a second entry in case you missed out with the break and close above 11,600. If you entered on that break, you are probably still in the trade targeting new record highs.

My game plan was to see price breakout and then pullback to 11,600. That did not happen. Remember the monster move yesterday. Well fear not, we will enter now on a higher low swing confirmation. This means a pullback (like we are doing now) and then a break and close above previous highs (up at 12,200). That can be a second entry where we ride the uptrend wave, and we can place our stop loss below the pullback lows. The risk vs reward might not be the greatest as there will be a lot of take profit targets at previous highs (around 12,500) so be prepared to react to a price sell off there.

So what caused this monster rally? The markets have still been propped on hopes of a new stimulus deal. The President lowered his stimulus deal to 1.8 Trillion, and news agencies were reporting there was an agreement between the Democrats and the Republicans. This still has not been confirmed, so we have the chance for a “sell the news” set up.

My readers have known that these markets only care about cheap money. Equity markets remain the best place to make yield in this macro environment, and will continue to do so. One can argue that markets are up because they are now pricing in a Biden presidency. A Biden Presidency means more debt on a monumental scale, the likes of which we have not seen before. A President Trump victory would still cause markets to go up mind you, as the cheap money factor will not change, but the Democrats are known for their spending and social programs and higher spending levels in general.

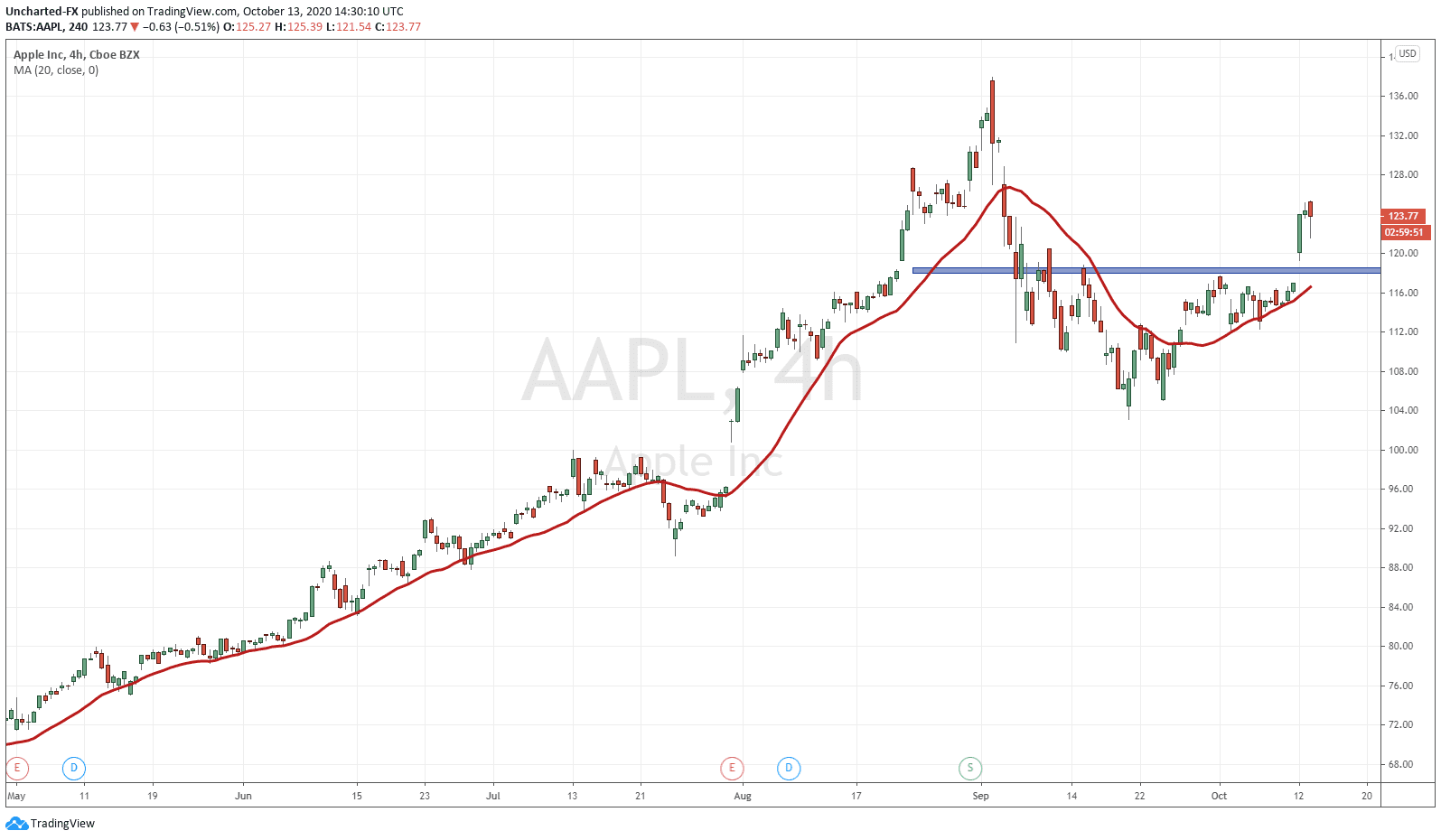

At the time of writing, the S&P and the Dow are red, but the Nasdaq has turned green for the day. The price action of Tesla and Apple have been major factors in the Nasdaq and broader equity moves. We have an Apple event which could help boost the Nasdaq move today.

The Apple breakout above 118.30 played a huge part in the Nasdaq gains. The stock has pulled back today which I believe is quite normal. As long as we remain above the breakout zone, we are still in the uptrend.

The upcoming major event today is the Apple Iphone 12 unveiling. It is scheduled for 10am PST/ 1pm EST. If we see Apple continue the move higher, the Nasdaq will follow suit. This is what I will be watching for further upside on a re-entry for the Nasdaq.