Emerita Resources (EMO.V) is a natural resource company engaged in the acquisition, exploration, and development of mineral properties in Europe, with a primary focus on exploring in Spain. The Company focuses on traditional base metals (zinc, lead and copper) and precious metals (silver and gold).

The company has a 100% interest in the Iberian Belt West (IBW) project that contains a combined 18.8 Mt maiden mineral resource including a 14.07 Mt indicated resource at 7.63% ZnEq and a 4.71 Mt inferred resource at 9.29% ZnEq. The company also holds the Nuevo Tintillo project, both located in the famous Iberian Pyrite Belt in southern Spain. Emerita is also awaiting a final court decision on the Aznalcóllar mine – one of the largest undeveloped zinc assets in the world – that contains the Los Frailes and Aznalcóllar deposits, both former past producing open pit mines.

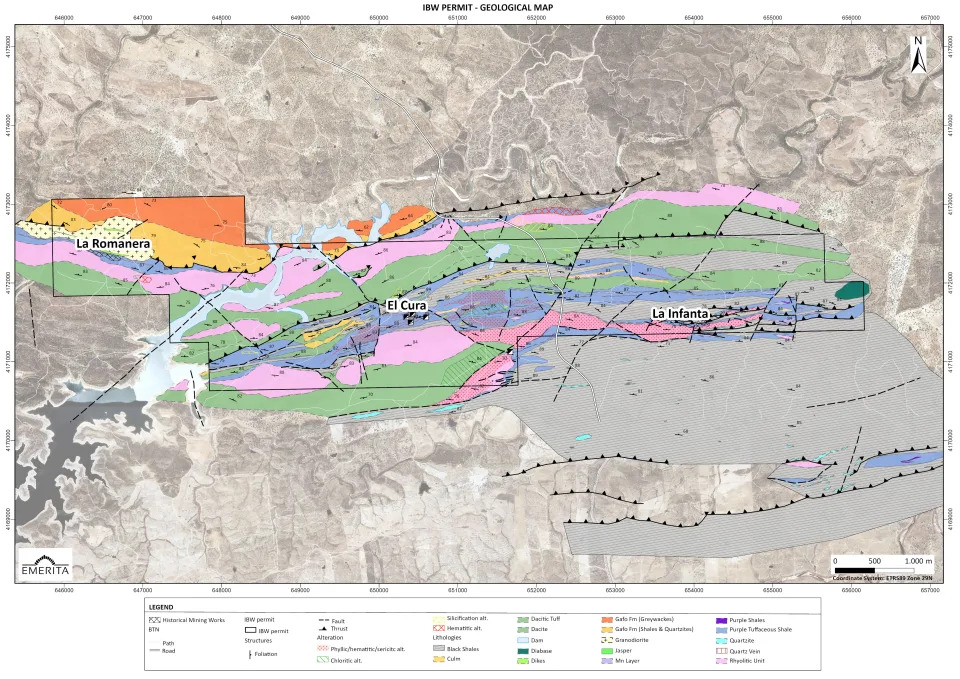

Today, Emerita Resources announced that it has intersected significant new mineralization in drilling at El Cura deposit area, part of Emerita’s wholly owned Iberian Belt West project. IBW hosts three previously identified Volcanogenic Massive Sulfide (VMS) deposits: La Infanta, La Romanera and El Cura. These results are from El Cura deposit area only.

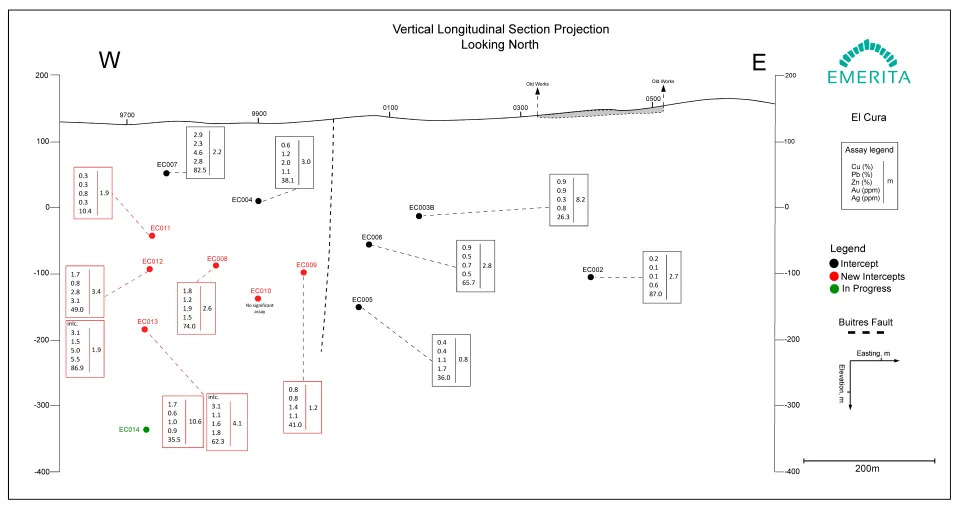

Emerita has completed detailed geological mapping, as well as geophysical and geochemical surveys across the property, culminating in an initial scout drilling program. This widely spaced core drilling intersected significant mineralization over approximately 400m x 300m (strike x dip-length), within a mineralized corridor of at least 600m of strike length. One of these initial drill holes, EC007, intersected 2.2m grading 2.9% Cu; 2.3% Pb; 4.6% Zn; 2.81 g/t Au and 82.5 g/t Ag in the western portion of the drilled area.

An additional 2,300m in 8 diamond drill holes was subsequently budgeted to follow up this result. Approximately 220m of strike length was tested, focusing on the westernmost 200m of the 600m corridor, in the area of drill hole EC007. Massive to semi-massive sulfides were intersected down to 340m down hole (hole EC013) and remains open at depth and along strike to the west and east at this level.

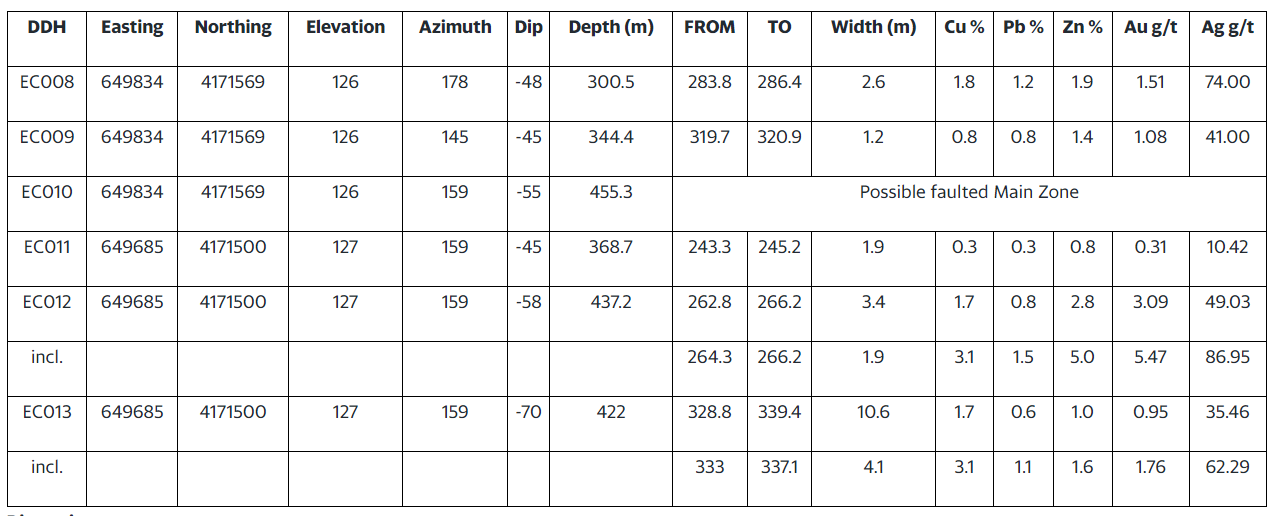

Assay results from these holes above are presented in this table:

Results of the Company’s investigations to date at El Cura show a high-grade massive sulfide body, that strikes WNW-ESE, dips steeply to the north and plunges to the west characterized by high grades in copper and gold (EC012: 3.4m grading 1.7% Cu, 3.09 g/t Au, and EC013: 10.6m grading 1.7%, 0.95 g/t Au). The true thickness is approximately 75 to 85% of the intercept length.

Further into the footwall there is a second mineralized zone which is highly siliceous and sericitic with disseminated sulfides up to 25% in volume characterized by moderate Zn and Pb grades.

It is noteworthy that the EC013 intercept is the thickest to-date at El Cura, as well as the deepest. Hole EC014 is in-progress, designed to cut the deposit further down dip at a step out distance required for establishing an Indicated Mineral Resource drill spacing.

Joaquin Merino, Emerita’s President states “These six new drill holes have demonstrated the continuity of the El Cura massive sulfide body with high grades, especially in copper and gold. They transform El Cura into a very exciting target for the ongoing drill program. Importantly, this area is adjacent to potential planned underground infrastructure and close to the conceptual mill plant location and drilling is still shallow in this area”.

Given the strong results, additional drilling is being accelerated at El Cura. With the high-grade, near surface character of the El Cura mineralization, good potential exists to quickly outline significant tonnage near to envisioned development and processing facilities for the Romanera and Infanta deposits.

Accordingly, a second rig was mobilized to El Cura and is expected to collar its first hole before month’s end. The two drills will then work to complete an additional 3,500m of drilling representing 13 to 15 additional holes, doubling the drill database for subsequent mineral resource estimation. The Company has the required drill platforms permitted to complete this program.

We have an amazing set up here for those technical analysis investors. The stock broke above the range at $0.50 back in May, hit highs of $0.78, before pulling back. In breakouts, pullbacks like this are normal. In fact many breakout traders and investors wait for pullbacks back to the breakout zone rather than chasing the breakout move.

The retest of $0.50 occurred a few days ago and we printed a very nice hammer candle with a large wick. Buyers are stepping in. The stock can make a move back to recent highs as long as this hammer candle is held. Stop losses are placed below $0.455.