EuroPacific Metals (EUP.V) holds brownfield gold, and copper-gold projects located in Portugal. The Company is focused on exploration in highly prospective geological settings in Europe jurisdictions. EuroPacific Metals owns a total of 100% equity interest in EVX Portugal, a private Portugal based company, that holds the legal exploration rights from the Portugal Government on the Borba 2 exploration properties, covering approximately 328 square kilometers in the Alentejo region in Southern Portugal. Miguel Vacas is the most advanced prospect within the Borba 2 license.

Today, the Company announced a drill program expansion with an additional hole down to 350 meters targeting the high grade zone below the fourth hole where the Company intersected a mineralized section (results pending) and at approximately 80m to the north where the Company recently announced the results of the first hole comprising 22.8 m grading 2.76% Cu, including 9.0 m grading 7.49%.

Chief Executive Officer, Karim Rayani stated:

“We are very excited with the progress made to date. Most of the holes drilled have confirmed the continuity of the deposit which is open in all directions. We are looking forward to receiving the assays pending – confirming the first good impressions from core observations, at the same time gather information from the depth extensions of the mineralized system with the undercut hole targeting 350 meters.”

The initial program tested the section on the supergene blanket which is thought to extend down to 80m below surface and represents an immediate target for a shallow open cut operation with a non-expansive hydrometallurgical Copper plant. Miguel Vacas mine area located approximately 180 km east by road from Lisbon and approximately 70 km east from Évora, the Alentejo region capital.

A decision was made to extend the drilling program with an undercut inclined 350m hole to test the “fresh” mineralization below the oxidized rich material in the same section of hole EBMV004 which shows a wide mineralized section.

The Company has completed 10 holes at the Miguel Vacas copper deposit totaling 1,060 meters. Most of the holes intercepted a wide quartz-breccia zone varying from approximately 5 meters up to more than 25 meters thick. An undercut > 350m hole is in progress in addition to the initial plan.

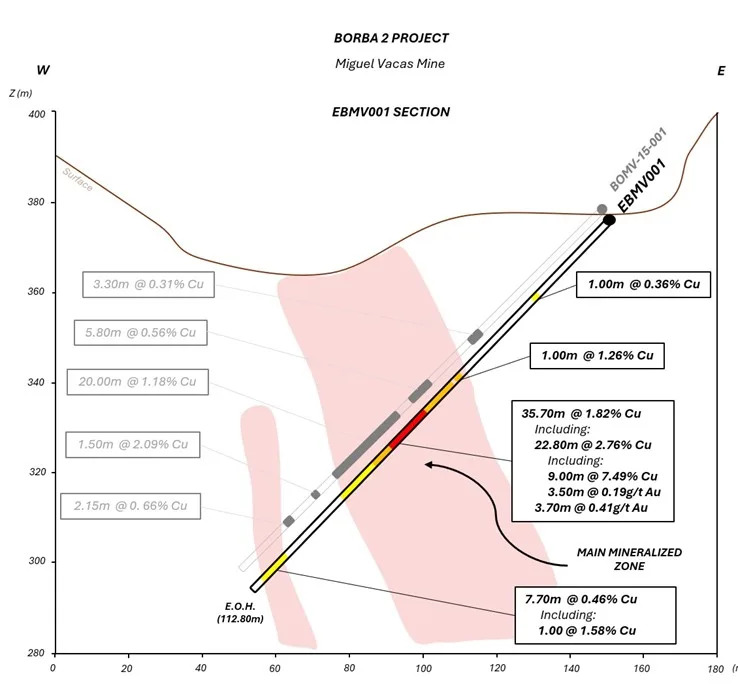

Results have been received for only two of the ten holes drilled. The first hole (EBMV001), confirmed previous drill core intercepts and returned better than expected results including a continuous intercept of 22.8m grading 2.76 % Cu, including 9.0 meters grading 7.49 % Cu with these high-grade results strongly influenced by a 1-meter section grading 45.6 % Cu and an adjacent 1m interval grading 4.45% Cu.

The 2024 drill program is now in the middle of the 1,500 meters campaign with the objective of further defining a shallow open pit resource of oxide Copper mineralization recoverable by hydrometallurgical methods. Step out drilling will be undertaken on a later stage focused on the assessment of the sulphide rich (> 80m) part of the deposit below the oxidized blanket. Below this depth sulphides include mainly chalcopyrite and pyrite as the most abundant ore minerals.

$0.05 is the major resistance zone. The stock attempted a breakout in recent days, but failed to confirm a candle close above $0.05. Ideally, a nice strong green candle close is what we want to see. A bonus would be a close above the wick high at $0.06. A candle close back below $0.05 would nullify the breakout and bullish momentum. Interim support comes in at the $0.03 zone.