EuroPacific Metals (EUP.V) holds brownfield gold, and copper-gold projects located in Portugal. The Company is focused on exploration in highly prospective geological settings in Europe jurisdictions. EuroPacific Metals owns a total of 100% equity interest in EVX Portugal, a private Portugal based company, that holds the legal exploration rights from the Portugal Government on the Borba 2 exploration properties, covering approximately 328 square kilometers in the Alentejo region in Southern Portugal. Miguel Vacas is the most advanced prospect within the Borba 2 license.

Today, the Company announced an amendment to an earn-in and partnership agreement with BMP Holding and Indice Crucial, the title holder of the Barrancos Copper-Gold Project along with two new Gold properties under application.

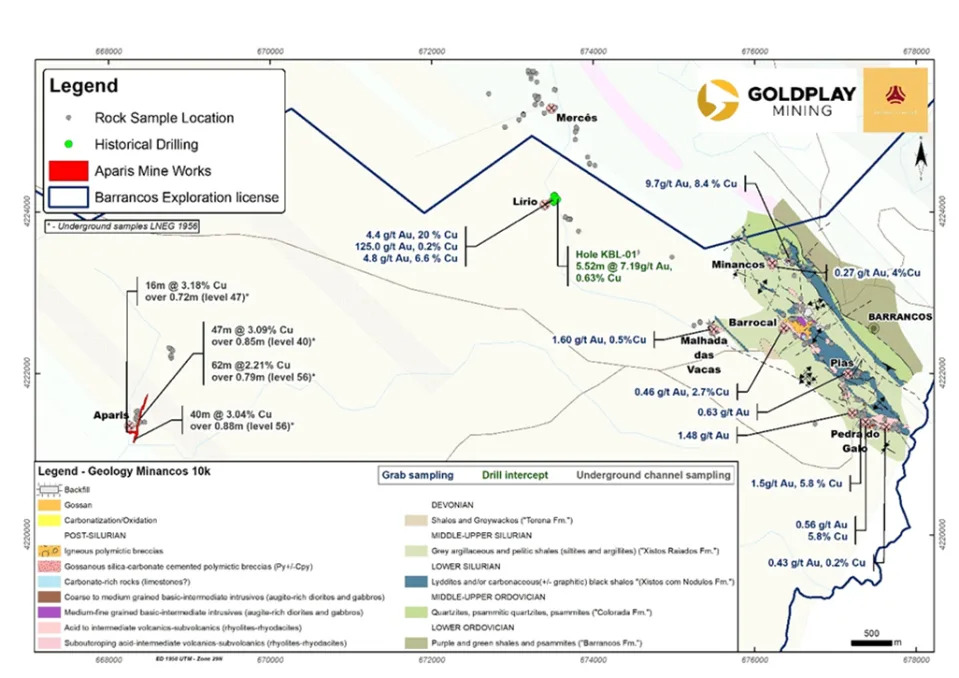

The Barrancos prospect area is located in south central Portugal, approximately 240 km by road east of Lisbon, and covers an area of 54 km2 with the license valid until June 2025.

In June 2021, EuroPacific Metals entered an agreement with Indice Crucial Lda to acquire a 100% interest in the Barrancos copper-gold project, comprised of the Aparis Copper mine and the Lirio gold project. It also includes two advanced exploration applications for the Bigorne and Vilariça copper-gold projects in the north of Portugal.

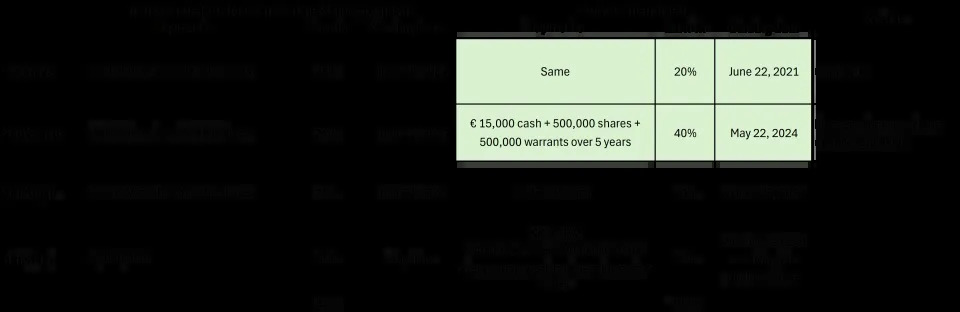

The initial SPA dated 22 June 2021 stipulated that the sale of ICL shares would take place in three stages: (i) in the first stage, BMP would transfer to EuroPacific 20% of the issued and outstanding ICL shares (the “First Stage Shares”), (ii) in the second stage, BMP would transfer to EuroPacific an additional 30% of the issued and outstanding ICL shares (the “Second Phase Shares”), and (iii) in the third stage, BMP would transfer to EuroPacific an additional 35% of the issued and outstanding ICL shares (the “Third Phase Shares”). EuroPacific would also benefit from a call option on the remaining 15% of ICL shares. EUP had already earned in 20% on ICL by paying €100,000 to BMP and issued 100,000 EUP Shares to BMP in accordance with the terms of the first stage of the agreement.

This new amendment now signed replaces the second and third stages of the original agreement by significantly better terms as follows:

| i. | the payment to BMP of €15,000 in cash, 500,000 ordinary shares and 500,000 warrants at 7.5 cents over five years to get to 60% participation on ICL and another cash transfer of €15,000 in the next three months, to get to 80%. | |

| ii. | The remaining 20% to get to 100% on ICL can be acquired, within five years of receiving a mining license, by paying BMP the amount of €800,000 (half paid on cash and the other half on EUP shares). |

The Lirio project, although located close to the Aparis copper mine, is in a separate gold system. It is situated near old Cu mines such as Merces, Malhada das Vacas and Minancos. Previous work which included drilling, detailed surface sampling and general geology of the area identified a prospective gold system that could be extensive. Rock sampling returned highly anomalous gold results up to a maximum of 128 g/t Au.

$0.05 is the major resistance zone. The stock attempted a breakout in recent days, but failed to confirm a candle close above $0.05. Ideally, a nice strong green candle close is what we want to see. A bonus would be a close above the wick high at $0.06. A candle close back below $0.05 would nullify the breakout and bullish momentum.

The stock has some interim support coming up at $0.03. A break would see the stock settle back to $0.015.