This isn’t going to happen tomorrow or next week or next month, but from a technical standpoint, silver is on the path towards $50 per oz.

Gold and copper yesterday (May 21st 2024) printed new all time record highs and the uptrend continues to remain intact. Metals are performing:

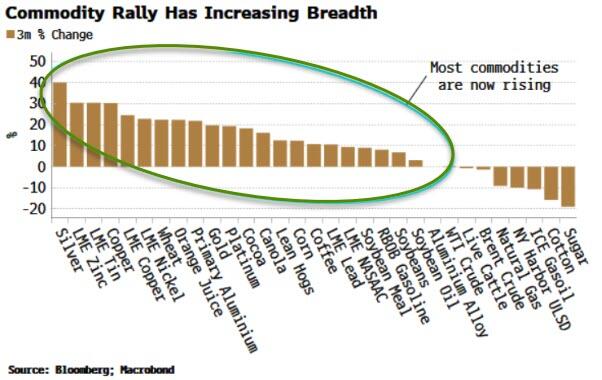

Some are calling this a new commodity super cycle. A recent article on Zerohedge discusses rising commodity prices and how this will impact inflation data… meaning a likely sell off in the bond markets resulting in rising interest rates. But that is for a different article. However, I want to show you these two charts from that article:

And in terms of the CRB Industrial Index:

It is an exciting time to be a metals investor.

Copper has been taking a lot of the headlines with headlines such as “Copper is the new oil“. Seasoned commodity investors may remember the idea of the electrification of the economy. Copper being the prime metal for this and resulting in an increase in demand for the base metal while supply remains limited.

Billionaire Stanley Druckenmiller is bullish on copper:

“Copper is a pretty simple story, takes about 12 years, greenfield to produce copper, and you got EVs, the grid, data centers, and believe it or not munitions. These missiles all got enough copper in them and the world’s getting hot that we just think the supply-demand situation is incredible for the next five or six years,”

Jeff Currie, chief strategy officer of Energy Pathways at Carlyle, thinks copper longs is the “highest-conviction trade I’ve ever seen“, mentioning its use in AI, green energy and the military.

But not much love and headlines from Wall Street when it comes to silver.

In many of my articles, I have highlighted that silver acts more as a monetary metal positively correlated with gold than it does with the base metal, copper. Even though silver is primarily used for industrial purposes. To me, silver provides the best of both worlds. In terms of a major catalyst for increased demand, it comes down to solar panels.

Readers know that I am primarily a technical trader/investor. In recent articles, I have highlighted that silver confirmed a major breakout taking out a resistance zone held since August 2021. I then spoke about the major retest as silver pulled back. A lot of bulls were worried, but you must remember: price does not move in a straight line! It moves in waves and as long as the previous higher low is held, the uptrend remains intact!

Let’s take a look at the current silver setup from the weekly timeframe. Here is my projected trajectory:

Zooming out, I want to show you the levels I am working with. Our next upside target for silver is the $36 zone. After that, it will be the $44 zone before we start to target $50. But you must note one thing: silver has broken out of a trendline and has confirmed its first higher low (retest coming in at $26) in this new uptrend. Speaking about the trendline breakout, you may see the sideways skeleton of an inverse head and shoulders pattern.

The takeaway is that on the weekly chart, a new uptrend has begun and we should expect multiple higher lows and higher highs towards the eventual path to $50.

In terms of what is ahead for the price of silver in the next few weeks, I expect a pullback down to the $30 zone for an important retest. This is where I expect buyers will jump in. A WEEKLY candle close below the $30 zone would dampen the bullish mood on silver.

On the daily chart, you can already see an engulfing candle being printed.

On the intraday chart I am already seeing a range develop and price is currently testing the support area of this range. A break would lead us to the $30 zone.

But remember, we need the break here intraday. The uptrend can continue if silver confirms a close above $32.36. However looking at the longer term charts, the probability of a retest of the major $30 zone seems more likely.

This would also coincide with the US Dollar pulling back to retest the 105.50 zone.

In summary, the silver uptrend remains intact and I expect a pullback to the $30 zone where buyers will step in once again for another higher low swing.

Happy trading.