Ashley Gold Corp. (ASHL.C) is the quintessential junior mining explorer, being a small early stage operation run on the smell of an oily rag.

Where Ashley differs from many other junior explorers is what they get done in that scenario, with a geology-focused CEO who barely pays himself, flies coach, lifts rocks, and pitches tents, when he’s not in his one-room zoom office, pounding the phones and poring over data to see if there’s anything out there his competitors have missed.

CEO Darcy Christian wants nothing more than to do the work, a rare bird in an industry filled with market miners who consider drilling to be risky side efforts between financings.

Christian isn’t your average markets guy, so the financings are small.

And he has some investors behind him who believe in him, so he’s not desperate to pump out faux news in the hunt for short term half cent spikes.

Here’s what he IS good at: This week Ashley Gold received exploration permiting for the Howie property, and vital funding from the Ontario Junior Exploration Program (OJEP) – basically, the government didn’t just say, “Sure Darcy, get drilling,” it also paid for $121,000 of work.

This exploration permit encompasses an induced polarization survey, stripping and channel sampling at Katisha, along with 13 drill locations, set to bolster the company’s 2024 gold exploration endeavors in the Dryden area, while the two grants from OJEP cover the Howie and Tabor drone magnetic survey and the 2023 Tabor Lake drill program.

Christian, Ashley Gold’s CEO, expressed gratitude towards the Ontario government for their backing, which has been pivotal, especially in a year challenging for raising exploration capital. This support has allowed the company to advance two of its properties, despite the broader financial constraints facing the sector – all without giving up any equity.

In addition to these developments in Ontario, Ashley completed a promising due diligence visit to the Sahara uranium property that it’s been i discussions over. This visit not only reinforced the potential of the Sahara property for Christian, but also laid the groundwork for closing the definitive agreement.

If all goes well, the property is poised to quickly evolve into a cash-flowing asset, reflecting Ashley Gold’s strategic focus on properties with rapid development potential rather than parking nice cars in the garage.

The Sahara site visit entailed a comprehensive review of historical core data and documents, confirming mineralized zones and setting the stage for an upcoming drilling program. The property’s vast area offers significant expansion potential for known mineralization, as suggested by geophysical data and historical mine explorations. Moreover, discussions with Western Uranium about future collaboration highlight Ashley Gold’s commitment to leveraging local resources and expertise, in terms of the processing of local Sahara mine ore.

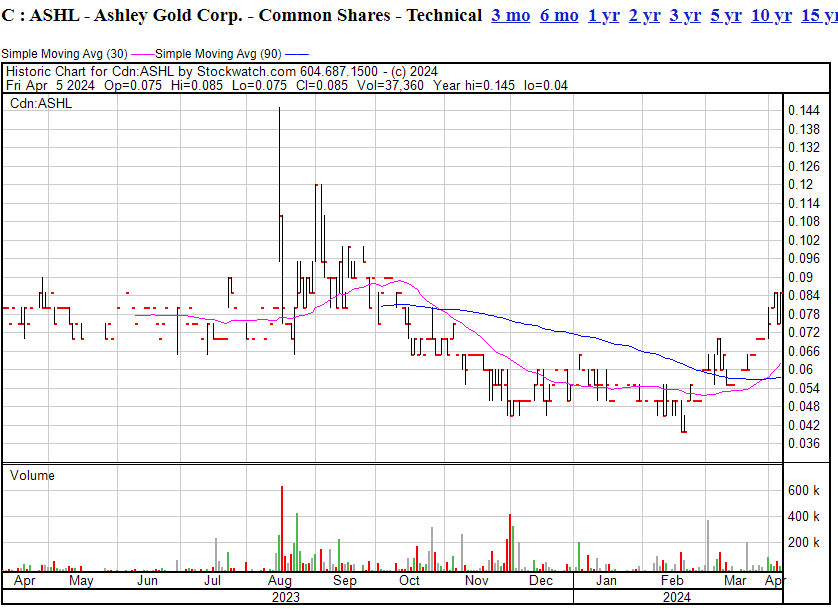

Ashley Gold is a little company, no question (market cap: $2.9 million), but its recent accomplishments underscore its proactive strategy in advancing its exploration projects amidst challenging financial climates and its dedication to unlocking the value of its properties through strategic partnerships and government support. And that little valuation, should it jump a little, will bring a savage return on a 6c.. wait, 7c… no, 8c stock.

This is a client company that completed its program with us months ago, but I’m going to keep barking about them because the share chart is warming up, the work is being executed, and people ought to know.

— Chris Parry

FULL DISCLOSURE: Former client, hold some of their stock, keeping a steely eye on them.