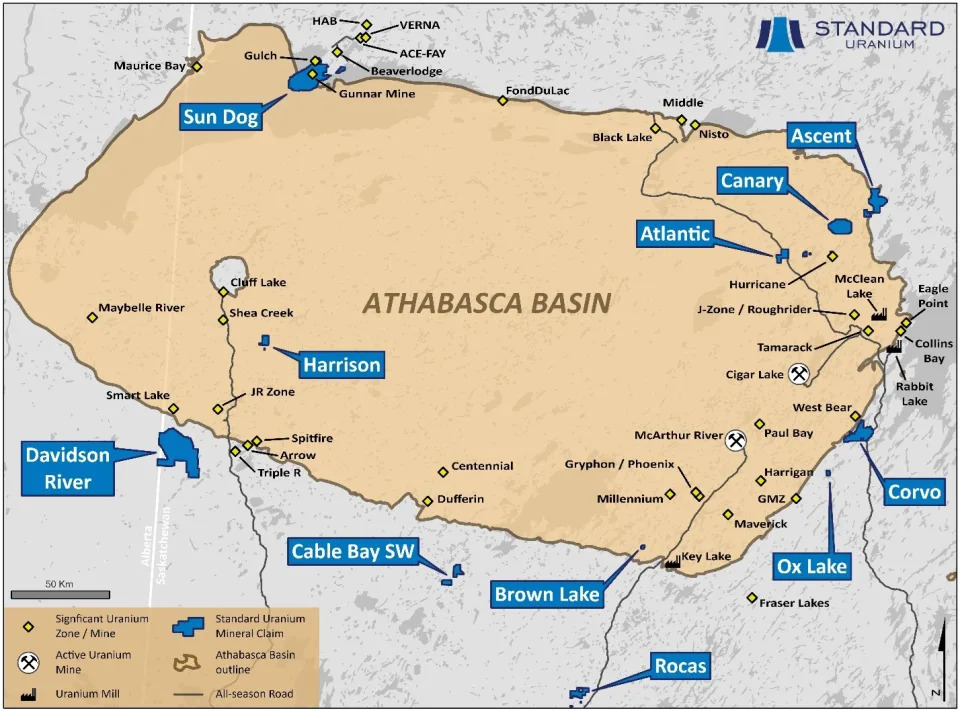

Standard Uranium (STND.V) is a junior uranium explorer operating in the Athabasca basin in Saskatchewan, Canada. The Company holds interest in over 209,867 acres in the world’s richest uranium district.

Today, Standard Uranium announced that it has commenced drilling activities at the Company’s 3,061 hectare Atlantic Project which is situated in the prolific Eastern Athabasca Basin. The winter program is the first drill campaign undertaken by the Company on the Project following successful identification of high-priority targets in 2022-2023.

The Project is currently under option to ATCO Mining Inc. (CSE: ATCM). Pursuant to the Option, the Optionee can earn a 75% interest in Atlantic over three years. The Optionee-funded winter 2024 drill program is planned to satisfy the first year of minimum exploration expenditures required by the Option.

“The team and I are thrilled to announce that the drill is spinning ahead of schedule, kicking off our ambitious 2024 exploration season,” said Sean Hillacre, President & VP Exploration for the Company. “There will be rocks in the box just in time for me and Jon Bey to continue sharing our story at the 2024 PDAC Convention, and we look forward to keeping the market updated as we progress our first eastern Athabasca drill program.”

The Project covers 6.5 km of an 18 km long, east-west trending conductive exploration trend which hosts numerous uranium occurrences. The Company completed a high-resolution ground gravity survey on the western claim block in 2022, revealing multiple subsurface density anomalies, potentially representing significant hydrothermal alteration zones in the sandstone rooted to basement conductors.

The drill program is designed to follow up on highly anomalous uranium results returned from drill hole BL-16-32, in addition to testing the newly outlined gravity lows defined by the 2022 ground survey.

On the western Atlantic claim block, drilling by Denison Mines in 2016 (Hole BL-16-32) identified 342 ppm uranium over 0.5 metres at the base of the sandstone, just north of target area A (in the figure above). Winter drilling will be focused in target area A which is defined by a 1,400-metre x 850-metre density anomaly at the unconformity coinciding with stacked EM conductors and an interpreted regional fault.

The chart set up is still showing market structure of a cup and handle reversal pattern. The trigger remains a daily candle close above the $0.09 zone. So far, this zone remains resistance and sellers are stepping in to defend this zone. The stock recently found support at the $0.06 zone which is a zone bulls should watch.

The major support zone comes in at the $0.045 zone.