Years ago, after the graphite spike and before the lithium boom, the cobalt jump, and the vanadium moment, rare earths had a hot second in the sun. It wasn’t a long second, but the internet was booming and electric vehicles were being thought about and we all had rechargeable batteries jammed into anything with a battery hole, and the markets got frothy for metals they’d never heard of before, which were largely sourced from places you’d rather not be doing business with (like Australia.. shudder).

And of course every deal guy found themselves a parcel of land in the scrub and announced they too had a rare earths play and everything ran until the first guys had to put a drill in the ground and ruin it all.

Then there was a long darkness, where the folks with real rare earths projects couldn’t buy a coffee because of all the fakey ones ruining the story, and we had other things to put our money into. Like crypto and blockchain and.. e-sports… Oy.

A Sector Aflame with Potential: The Rare Earth Elements Saga

Rare earth elements (REEs), with their unique properties, are indispensable for cutting-edge technologies and green energy solutions, but their supply chain is mired in complexity, often overshadowed by geopolitical strife and environmental concerns.

REEs are vital for a wide range of modern technologies and industries as they are key components in high-strength magnets, batteries, and other materials essential for renewable energy technologies, electric vehicles, smartphones, and defense applications. Their unique magnetic, catalytic, and luminescent properties enable the miniaturization of electronic devices and enhance the efficiency of green energy solutions like wind turbines and solar panels.

So when the entirety of the financial markets decided REEs were just too hard to think about, some of those actual-for-realsies projects went into hibernation for years, while a small handful of dedicated enthusiasts soldiered on.

We also mentioned an insane stock pump right nextdoor to them, where a million bucks was spent telling the Germans that their neighbour ‘might even’ be as good as the Wicheeda, and which saw that no-work, no-resource, huge-pump ticker briefly rocket to a market cap more than 5 times that of DEFN.

We wrote about that too, which coincided with that stock imploding.

Job done.

But the fact that a fat baseless promo program COULD make a rare earths play with no real asset or news run to a $150 million market cap made a lot of people take notice. Maybe, just maybe, rare earths still had some juice in the tank after all these years?

Before the wave comes the ripple, and I’m always watching for that ripple because first mover advantage in the markets is often good for an extra 2-to-5-bagger before the hyenas show up.

I’M IN FOR REEs – NOW WHAT?

Where does that leave us, the small batallion of folk who believe in rare earths, understand their multiple uses, and can see there’s a huge and ongoing supply crunch that will likely drive commodity prices for the forseeable – and that the markets aren’t scared of them anymore?

If we take the now healthy uranium space as a helpful guide, being as it’s more mature as a sector and has had the same sort of supply choke, development struggles, and ticker over-saturation issues as rare earths had, there are three things we should look for:

- Real resources

- Legitimate project developers

- Jurisdiction advantage

- CASH

Missing any one of the above? Kill it. Burn it with fire.

Turn it into a cannabis shell. Use it as organic nuclear reactor shielding. Bury it under the exchange.

- A good resource in the hands of someone who doesn’t know what to do with it (or how to raise money) is going to be a long, slow, expensive project to drill, let alone develop;

- A developer running a project in Ukraine or South Sudan is going to be paying off too many bodies and dodging literal landmines to get anything done;

- A project in a nice, happy, mine friendly place like Quebec isn’t going anywhere if there isn’t a load of actual element in the ground to get at;

- And none of the above matters if they can’t raise dollars to move things along, without overly diluting the share base

Mining tech-heads will expand this list to 85 things, but realistically it comes down to the three above.

In fact, there ought to be a mark, like the Heart Foundation tick, that a mining explorer gets if they have those three qualities, that tells retail investors you can remove ‘might steal all my money and do no work’ as a significant risk element.

For mine, you can add ‘is early stage’ to your checklist, because I’m a big fan of getting in while there’s still a lot of value to be had if everything goes right.

Where would you find such a thing? Allow me.

The NeoTerrex (NTX.V) Narrative

In the verdant landscapes of Quebec, armed with a robust portfolio of three (count em) 100%-owned REE properties, this newly listed NeoTerrex is on a quest to unearth the potential of rare earth metals—and to demonstrate from the outset that they’re doing things the right way.

NTX, with its focus on ethical and sustainable extraction methods, aims to bolster the global supply chain right from the heart of Quebec, without tearing the heart out of the environment, and ensuring they don’t fall into the trap of going hype-crazy along the way.

A familiar cry for me, when gauging an explorer, is do they DO THE WORK? Are they actually putting dents in their property and are they showing progress?

Over 20 new occurrences discovered since 2022 – before they went public and could capitalize on the news – is evidence to me that the intention is to be real.

Strategic Moves and Milestones: NeoTerrex’s Path to Preeminence

2024 stands as a landmark year for NeoTerrex, underscored by its listing on the TSX Venture Exchange and the launch of a maiden drill program at the Mount Discovery project. This initiative marks a pivotal step in their journey, thanks to the project’s high-grade mineralization and strategic locale.

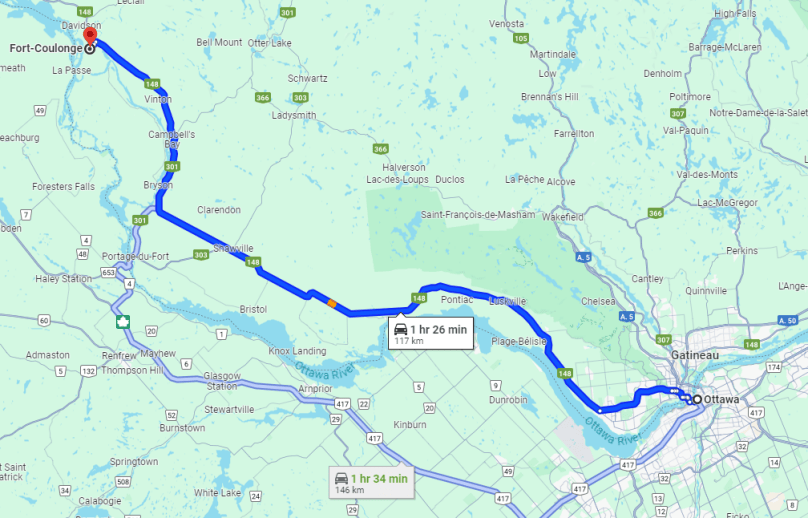

Strategic locale, you say? Why yes – not only does Quebec love themselves a local mine in the making, but the properties in question aren’t buried in the wilderness, they’re close to infrastructure.

THE BANGER: MOUNT VICTORY REE PROJECT

- Located 90 minutes NW of Ottawa

- Low cost electricity

- Well qualified labor force

- Excellent infrastructure with road access

- Lower cost exploration

- High Neodymium, Praseodymium and Dysprosium values in grab samples

- Historic work went looking for gold, silver, copper, zinc, nickel, platinum and palladium, before REEs had much value

- Among the highest Neodymium values in entire province

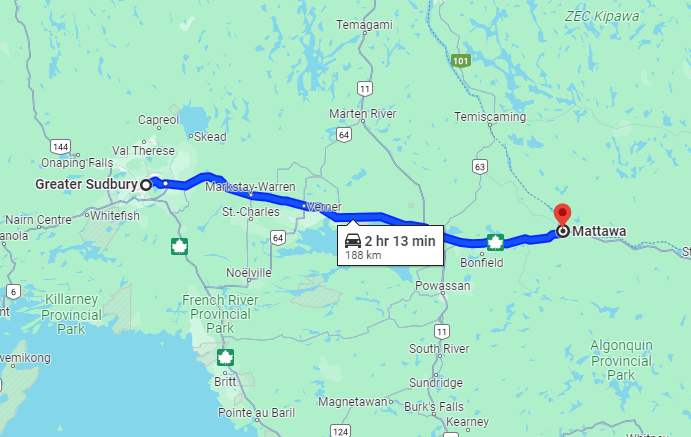

THE DICE ROLLS: THE LINDSAY AND BEAUCHENE REE PROJECTS

- Located in Quebec, on Ontario border, 32 kilometres east-northeast from the town of Mattawa, Ontario

- Acquired through staking in 2022 based on similarities with the geological model of the Mount Discovery project, though far less explored

- Located along the northern side of a major rift, an important geological feature associated with the mineralization at Mount Discovery

- Acquired due to presence of a large and strong geophysical anomaly (magnetic/radiometric) and monazite respectively

- Easily accessible by road. Local infrastructure consists of gravel roads accessible from the nearby highway and the town where a host of services are available. Both railway and electrical power lines are on the property.

- Large radiometric anomalies detected by a 2020 government regional survey, similar to strength and shape to well known rare earths deposits like Kipawa and Niobec

Investing in Tomorrow: The NeoTerrex Opportunity

For the forward-thinking investor, NeoTerrex presents an enticing proposition because they’ve blown out of the gate with all the good bones you’d hope for a year or two down their pubco journey, and removed a lot of risk early on. With approximately $6 million in cash reserves, no debt, and a significant portion (35+%) of shares held by insiders, the company’s financial health is robust, allowing them to explore at will and not risk having to finance in trying times.

The Lindsay and Beauchene are, admittedly, largely unexplored and not core to the business at this stage, but considering they cost the company nothing but staking costs, it’s a decent bet to have them on hand. There’s a lithium property as well – a legacy play that doesn’t have much market interest right now, but I’d take it if someone handed it to me.

For mine, I like that there are no dark horses of the apocalypse zeroing in on this thing. If the drill does its work, there’s a lot of value to be had at just a $16 million market cap. If REEs continue to become scarce, and military, green energy, battery, and electronics manufacturers continue to have to source their materials from China and the like, we could see a real government mission to bring these projects forward quickly, In addition, REE processing capacity, once a struggle in Canada, is being built out quickly.

Beyond the Horizon: Challenges, Commitments, and Community

As NeoTerrex advances its exploration efforts, the company remains vigilant of the broader implications of its work. Embracing environmental, social, and governance (ESG) principles, NeoTerrex is not just mining for minerals; it’s aware that ‘playing nice’ will be almost as key going forward as playing at all. Through transparent engagement with local communities and a commitment to sustainable practices, NeoTerrex is focusing on responsible resource development now without being told to do so later, when the risk of capital and time crunches could be a problem.

IN SHORT:

- SOLID property with two inexpensive backup plays

- GREAT location with enthusiastic local support

- TREMENDOUS capital position with deep insider support

- HEATING UP sector where others have already begun promoting

- INEXPENSIVE market cap with strong hands buying on the open market

THIS JUST IN:

Always like it when news drops while I’m telling people to expect news.

- Four (4) new discoveries made with assays yielded greater than 1 per cent Total Rare Earths Oxides (“TREO”) in grab samples.

- New occurrence of 9.21 per cent TREO expands mineralization footprint 1,000 metres northeast of the King showing and 400 metres east of the Ruy Lopez showing.

- A total of 26 distinct occurrences made on the property since the start of exploration work in 2022.

- Assay results for 238 additional grab samples pending.

- 2,000 metre maiden drill program to commence next month.

Don’t like rare earths? OK, still good economics and structure.

Don’t like mining? OK, they’re doing it responsibly.

Sick of overly promotional bullshit? OK, I hope you can see this ain’t that.

Sick of pretend players not advancing their work? OK, again, this ain’t that.

Sick of smallcaps running out of capital? OK, but they’re stacked.

Sick of overvalued plays RTOing way more expensive than they should be so retail gets pounded out? OK, but this is a $14m valuation with three properties and almost half of their present market cap sitting in cash.

NTX. Watchlist it.

— Chris Parry

FULL DISCLOSURE: Not a client, though an insider at the company does have a commercial relationship with Equity.Guru so assume conflicts and do your own due diligence. We may purchase stock in the open market, depending on price action. Defense Metals is an Equity.Guru marketing client which is why, let’s be honest, I jaw-boned them into the story.