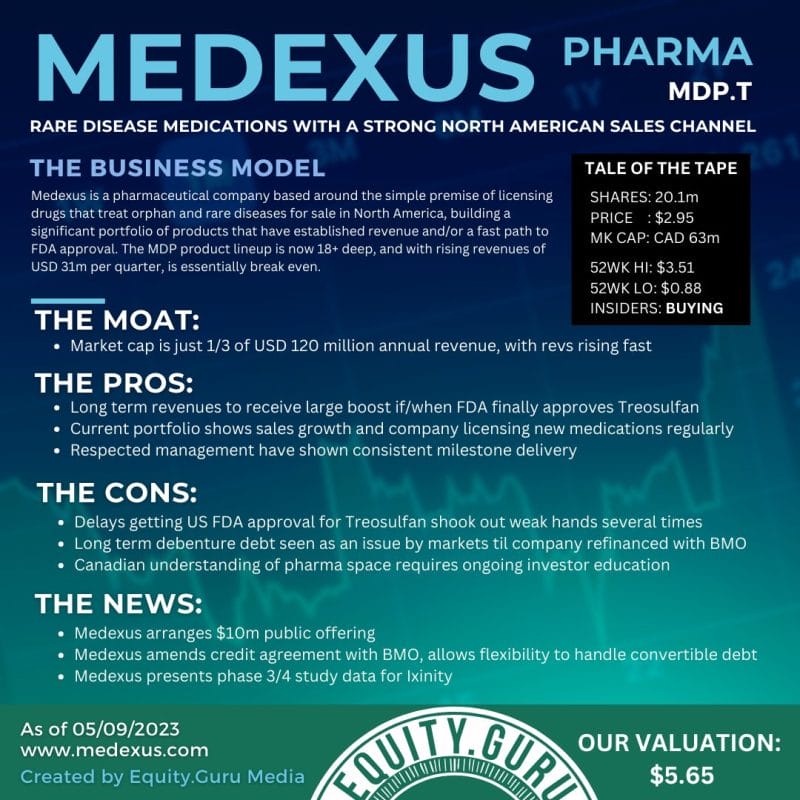

Specialty pharmaceuticals is a unique niche in the pharma sector. Where companies like Eli Lilly pour billions into developing a drug candidate from scratch with the very real possibility that the drug will fail during trials and never make it to market, specialty pharma companies, like Medexus Pharmaceuticals (MDP.T), find already approved drugs from other jurisdictions and bring them to the North America market. Drug development risk averted.

Today, Medexus Pharmaceuticals announced fiscal Q3 2024 results of revenue of $25.2 million, operating income of $1.6 million and adjusted EBITDA of $3.2 million. All dollar amounts are in US Dollars.

Here are the financial highlights:

- Revenue of $25.2 million and $87.1 million for the three- and nine-month periods ended December 31, 2023, a decrease of $3.5 million and an increase of $7.6 million, or (12.2)% and 9.6%, compared to $28.7 million and $79.5 million for the three- and nine-month periods ended December 31, 2022. The $7.6 million year-over-year increase comparing the nine-month periods was primarily attributable to the recognition of 100% of Gleolan net sales in total revenue during the entire financial year 2024 period, continuing strong Rupall demand growth, and strong first fiscal quarter 2024 sales of IXINITY. The $3.5 million year-over-year decrease comparing the three-month periods was primarily attributable to decline in sales of IXINITY over the second and third fiscal quarters of 2024 and the accumulating effect of continued effective unit-level price reductions for Rasuvo.

- Adjusted EBITDA* of $3.2 million and $15.1 million for the three- and nine-month periods ended December 31, 2023, a decrease of $2.0 million and an increase of $3.8 million, or (38.5)% and 33.6%, compared to $5.2 million and $11.3 million for the three- and nine-month periods ended December 31, 2022. The changes in Adjusted EBITDA* were primarily attributable to the changes in revenue mentioned above, together with reductions in operating expenses in third fiscal quarter 2024.

- Available liquidity of $8.2 million (December 31, 2023), consisting of cash and cash equivalents, compared to $13.1 million (March 31, 2023). The primary factor in the net decrease in cash comparing March 31, 2023 to December 31, 2023 was Medexus’s use of cash to make the final maturity date payment in respect of the company’s convertible debentures in October 2023, offset by, among other things, cash provided by operating activities of $5.5 million and $17.1 million for the three- and nine-month periods ended December 31, 2023.

- Operating income of $1.6 million and $10.0 million for the three- and nine-month periods ended December 31, 2023, a decrease of $1.3 million and an increase of $5.1 million compared to $2.9 million and $4.9 million for the three- and nine-month periods ended December 31, 2022.

- Net loss of $0.5 million and $1.0 million for the three- and nine-month periods ended December 31, 2023, an improvement of $1.0 million and $4.6 million compared to net loss of $1.5 million and $5.6 million for the three- and nine-month periods ended December 31, 2022.

- Adjusted Net Loss* of $0.5 million and $1.1 million for the three- and nine-month periods ended December 31, 2023, an improvement of $0.4 million and $6.2 million compared to an Adjusted Net Loss* of $0.9 million and $7.3 million for the three- and nine-month periods ended December 31, 2022. Adjusted Net Income (Loss)* is adjusted for the non-cash unrealized gain of $0.0 million and $0.1 million for the three- and nine-month periods ended December 31, 2023 and the unrealized loss of $0.6 million and unrealized gain of $1.7 million for the three- and nine-month periods ended December 31, 2022.

“Our third quarter results reflect yet another quarter of positive operating income and positive Adjusted EBITDA*,” commented Ken d’Entremont, Chief Executive Officer of Medexus. “However, we believe the results also reflect certain changing business conditions affecting our operations, in particular recent adverse trends in IXINITY demand and Rasuvo product-level performance. In response, we have moved quickly to reduce costs, including a reduction in allocation of sales force resources. For IXINITY, we will seek to maintain existing demand but reduce investments in IXINITY’s growth, with the pediatric indication as a tailwind if and when approved. For Rasuvo, we will continue to defend Rasuvo’s strong formulary status. We look forward to increasing our focus on Gleolan, as an institutional sales-based product that we believe will complement our commercialization activities for treosulfan if and when that product is approved.”

Marcel Konrad, Chief Financial Officer of Medexus, added, “We had an excellent third quarter from a cash perspective generating $5.5 million in cash provided from operating activities. This cash generation combined with our quick recognition of and reaction to the changing business environment provides a solid foundation to manage the future needs of our business.”

When it comes to Treosulfan:

“On treosulfan, we are pleased to report that the data collection phase of medac’s effort to respond to the FDA’s information requests on treosulfan is now complete,” Mr d’Entremont continued. “It will take time for medac to process and submit the information as part of an NDA resubmission, but progress to date remains in line with our previous expectations for this to occur in the first half of calendar year 2024.

At time of writing the stock is down 27% on the financial results.

The stock has gapped down hard and has broken below the support level of $2.40-$2.50. On the positive side, the stock is finding buyers at the major support around $1.70. This is a pivotal level as this is where the stock broke out to end the downtrend and led to the beginning of a new uptrend. As long as the price remains above this support, the uptrend technically remains intact. A close below would nullify a lot of the upside momentum. The next resistance comes in at the $2.40 zone.