FOR SALE: FIXER UPPER NEXT TO MANSION

Imagine you’ve put your 3-bedroom. 2-bathroom house up for sale for $1 million. You’ve done your price research, had the landscapers in, buyers are interested, and you’re feeling good about things.

Then your neighbour decides to put their house, a one bedroom with an unfinished bathroom that hasn’t been cleaned since 2011, also up for sale at a price of $3 million, justifying that price in the listing on the basis that it’s next door to your beautiful looking home which it describes as ‘the nicest in the neighbourhood.’

Only an idiot would buy the neighbour’s place, right?

Well, apparently not.

Last month, traders, speculators, and easily fooled weirdos from Hamburg bought stock in Neotech Metals (NTMC.C) on the basis of bonkers promo hype that it was going to the moon because its property, which was bought for $50k and a grab bag of shares and hasn’t been worked since 2011, is nextdoor to the advanced, fat resourced Wicheeda project, owned by Defense Metals (DEFN.V).

That promo took NTMC’s market cap to $150 million in just a few weeks, while DEFN – the real thing – sat at $60 million.

Take it away, Tommy.

Junior mining’s unbelievable.

Neotech Metals grabbed some ground near Defence Metals 3 months ago.

Defense has one of the best rare earths deposits out there. It’s in BC. Targeting 10% of global REO production. Great people.

Get this. Neotech is worth 2.25X MORE than Defence.… pic.twitter.com/r1LyNMkNAI

— Tommy Humphreys (@tommyhump) December 14, 2023

Or, it was, for a minute.

After Tommy tipped attention toward what was happening, the regulators jumped all over NTMC and halted it for two weeks, forced it to stop namedropping DEFN, and insisted it make some retractions.

Today the stock was unhalted and, well, that’s the end of that.

Down 74% from $3.20 to $0.84 at the close.

NOW THIS was a shit show $NTMC.C $NTMC https://t.co/cDtID4S2VI pic.twitter.com/Gn1nQJLdNY

— X🔮BaystreetBrian🔮X (@BaystreetBrian) January 9, 2024

Let’s be clear – the NTMC pump is dead. Nothing they do is going to take that stock chart back near where it was.

Now they’ll have to actually do some work if they want to move it upward.

MEANWHILE, OVER THE FENCE:

On the same day NTMC fell down a mine shaft of its own making (the only shaft they’re likely to ever build), Defense Metals announced it’s sending mixed rare earth carbonate samples to the Ucore Rare Metals ‘RapidSX’ commercialization and demonstration facility in Kingston Ontario, where it will be tested to see if DEFN REEs can meaningfully supply their facility going forward.

“[This] lays out the framework wherein Defense Metals’ technically strong and readily accessible North American REE resource can be further processed and refined using Ucore’s Canadian-founded technology, RapidSX,” says Ucore Chair and CEO Pat Ryan, adding, “Receiving the sample mixed rare earth carbonate at our Kingston CDF will start the process of determining what may be possible between the companies as we collectively look to fuel the 21st century energy transition.”

For Defense, this is less a big win and more a continuation of several years of consistent progress toward a goal they’ve long aimed for, which is the possibility that they can eventually supply as much as 10% of the world’s REO needs.

And that very real possibility was enough for their neighbours to blast out to the world that being on the other side of the fence was enough to earn them fat profits.

I mean, sure. It might. There’s nothing inherently wrong with closeology.

But why would you buy the less advanced deal next door for $150 million when the real thing can be had for $60 million?

People are starting to figure that out, and that money that was chasing fast and loose promo fodder is now finding its way to the safe and loving arms of DEFN.

NOTHING BETTER THAN THE REAL THING:

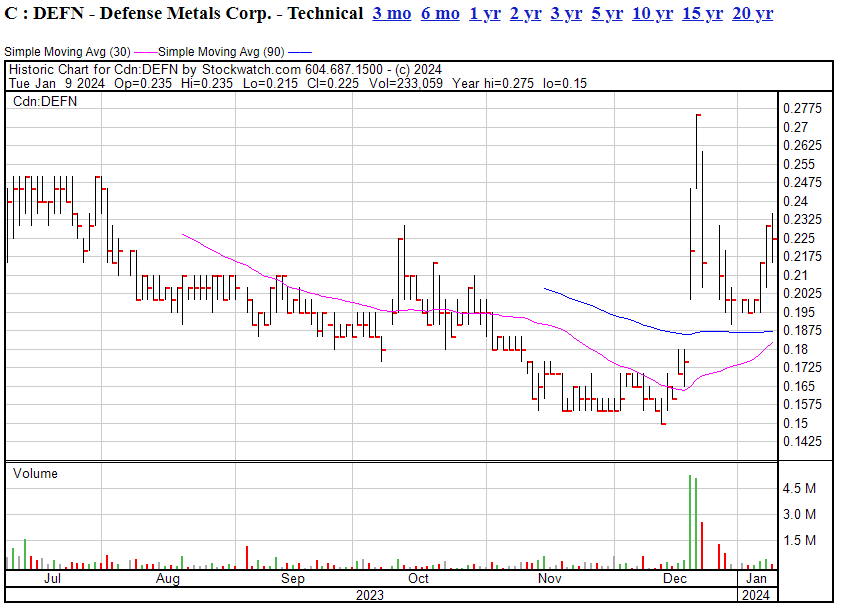

DEFN had been fighting a large iceberg at $0.20 but, as of a few days ago, that’s gone. Now we’re seeing a steady march up, increased volume, and without all the regulator overhang the other guys had to deal with.

That’s a nice step up. Long may it continue in an orderly fashion.

Here’s the thing – the neighbours still REALLY want you to know Defense’s property is amazing.

Even after the feds kicked them in the regulatory junk.

That’s their Twitter bio RIGHT NOW, after the retractions and the wrist slaps and the two week halt.

“Hi everyone, have you heard we’re ‘adjacent to known rare earth mineralization?'”

Oh, you don’t say? You mean DEFENSE METALS? Is that what’s nearby?

THE LONG HAUL:

Brothers and sisters, don’t let me get out of here without pointing out why rare earths are needed:

In addition to the continued rise of wind and solar, the EIA projects that we’ll see a massive deployment of grid battery storage capacity—which is expected to triple by 2025.

Most of this battery storage capacity is going to be built in the renewables-heavy grids of CA and TX pic.twitter.com/bVjJHN7tmo

— Joey Politano 🏳️🌈 (@JosephPolitano) January 9, 2024

That’s a big demand coming. That coming need from solar and wind farm growth (both of which are starting to close in on coal in terms of energy supply) will mean a bigger need of elements such as rare earths, especially those easy to access and of high grade.

Well, thanks to the folks at MinerDeck, we can see where that supply is likely to come from. Top 3, boys!

Rare Earths yearly drilling highlights — 2023 pic.twitter.com/ypGlzpJr9z

— MinerDeck (@MinerDeck) December 27, 2023

Some might point to Defense Metals’ British Columbia location as a potential hazard, with BC having a reputation as a high cost province for those wanting to develop producing mines. Which is fair. BC wants you to do things right, and that’s not always fast or cheap.

That might be changing, however, as several mines are progressing in BC and there’s a growing awareness that mining is both necessary to a strong technology economy, and not necessarily an environmental negative.

Business in Vancouver:

Should all 16 [critical minerals] projects get approved and built, it would represent a total investment of $36.5 billion for development and construction – which is roughly the equivalent of a single large liquefied natural gas plant and its upstream operations. [..] In the near term, the 16 mines would generate an estimated $80 billion in economic output, labour income of $22 billion, total GDP of $38 billion and $11 billion in taxes.

Over the life of the mines, the study estimates total long-term economic output of $793 billion, labour income of $184 billion, total GDP of $398 billion and $155 billion in tax revenue.

No small potatoes.

And with that BC base comes one really big plus; Defense Metals is close to export hubs.

WRAP IT UP, PARRY:

Okay. Looking at the highlights, Defense has a project with huge upside potential, a long history of achieving development milestones, and they’re in a critical sector that is becoming all the more important to source locally. They’ve got legit partners and nearby infrastructure to get their materials processed in-country. They’re also located in BC so they’re close to export infrastructure, and the neighbours caught a wave to $150 million valuation based on closeology and rampant hype.

I don’t need to tell you what to do next. You’ve got it from here.

UPDATE: Hell of a dead cat bounce, Bob. Neotech up 157% the next day to $2.16, but at least now we’re clear that nobody jumping in really thinks there’s a worthy project here, they’re just riding a meme stock.

— Chris Parry

FULL DISCLOSURE: Defense Metals is an Equity.Guru marketing client and we’ve bought stock, so yeah, we’re conflicted, but in the best way.