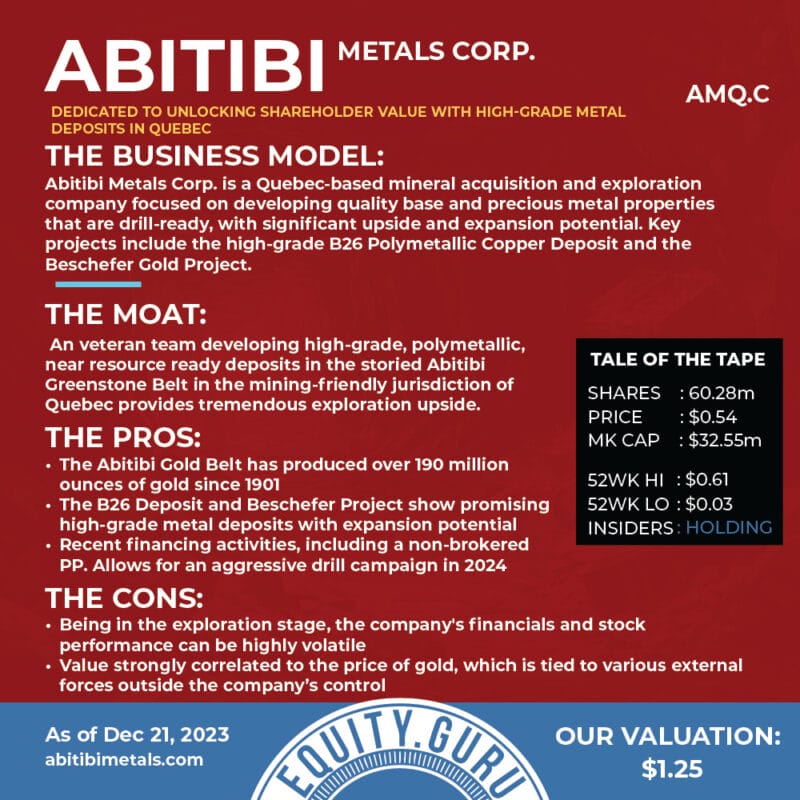

Gold mining in the Abitibi region began in the early 1900s and has led to the establishment of more than 124 mines. At least 15 of these mines have produced over 3.5 million ounces of gold each. The total gold content in the belt, considering past production, current reserves, and resources, surpasses 300 million ounces. This impressive figure has firmly established the Abitibi as Canada’s largest gold district and one of the most prolific gold-producing regions in the world. Companies like Abitibi Metals Corp. (AMQ.C) are leveraging their exploration expertise in this highly prospective mining-friendly region to create tremendous value potential for their investors.

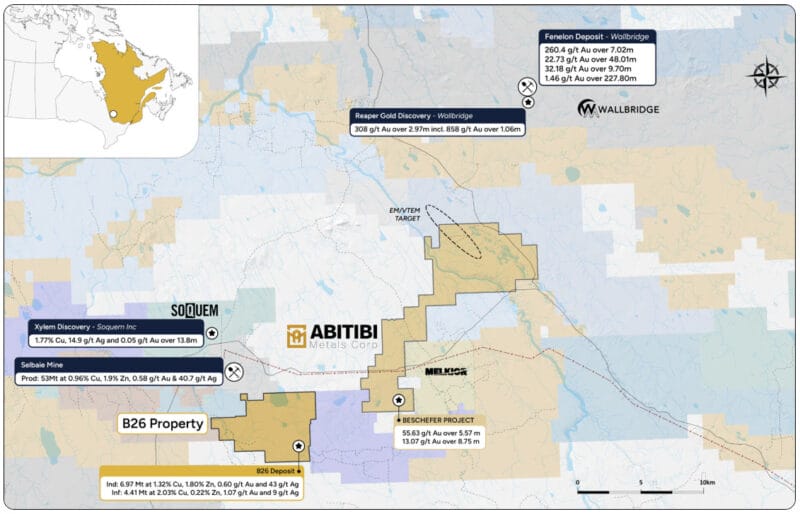

Abitibi Metals is primarily focused on its high-grade B26 Polymetallic Copper Deposit and the Beschefer Gold Project.

B26:

B26 is located 5 km south of the Selbaie mine and about 90 km due west of Matagami in the province of Quebec. Abitibi has signed a 7-Year Option Agreement to earn 80% from SOQUEM Inc. which includes 9.9% in equity, a $14.5 million work commitment and $400,000 in cash. Since SOQUEM pulled its first positive core on the property in 1997, it conducted a systemic exploration campaign at the project with 254 drill holes for over 115,311 meters of total depth. These efforts produced a resource estimate in 2018 of:

- Indicated: 6.97 Mt at 2.94% Cu Eq (1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag)

- Inferred: 4.41 Mt at 2.97% Cu Eq (2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag)

Abitibi has already closed a series of financings with strategic investors as well as upsizing its latest PP offering to $10.0 million which will give it more than enough to build on this impressive historical resource.

Beschefer Gold Project:

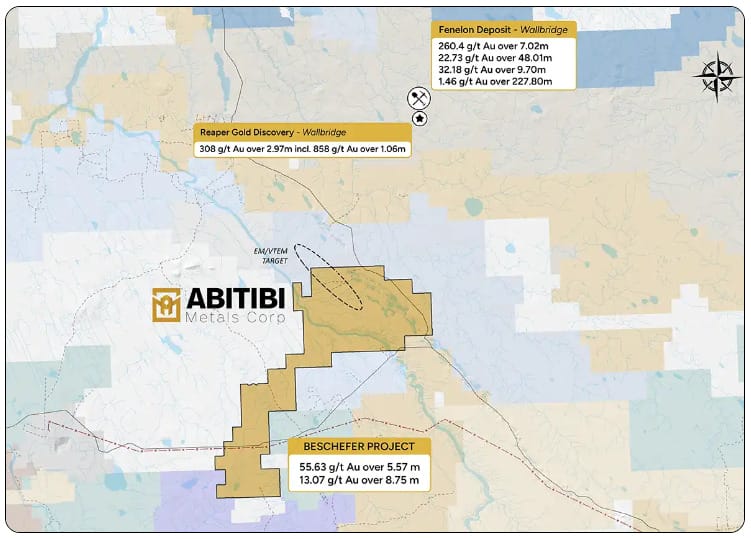

The Beschefer project is located 45 kilometres northeast of the Casa Berardi gold mine (Hecla Mining) and 28 kilometres southwest of the Fenelon Gold deposit. Abitibi inked a 4-Year Option Agreement to earn 100% from Wallbridge Mining (TSX:WM) for the 962-acre project.

The company planned 2,500 metres of drilling at Beschefer in October with the goal of expanding high-metal factor zones which encompassed intersections such as 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres.

More about Abitibi Greenstone Belt:

The geology of the Abitibi Greenstone Belt is a key factor in its richness in gold and other metals. Formed over 2.6 billion years ago, the belt consists of metal-rich volcanic rocks and major deformation zones. These geological features have given rise to several economically viable deposits of gold, silver, zinc, copper, and other base metals. The majority of the rich gold deposits in the Abitibi are located along major fault lines in deformation zones, such as the Cadillac-Larder Lake zone and the Destor-Porcupine zone. These zones have been foundational for gold camps that have historically produced significant quantities of gold.

Despite its long history of mining, the Abitibi Greenstone Belt continues to be an active mining region with considerable potential for new discoveries. This ongoing potential, combined with the infrastructure, skilled workforce, and mining-friendly policies in Ontario and Quebec, makes the Abitibi an attractive location for junior miners and exploration companies.

The Abitibi’s prominence in the mining world is not only due to its rich resource endowment but also because of the region’s history of significant mining mergers and acquisitions transactions, which have totaled around $12 billion since 2013. These transactions underline the continuing economic importance and potential of the region in the gold mining industry.

What we think:

Abitibi Metals is on the move and generating significant interest from both institutional money and gold majors. It seems something is afoot and 2024 could be a very interesting year for the company, adding considerable value to its story as well as generating growth for its investors. Although there is never any guarantee for success, Abitibi is operating in a sweet spot of location, resource potential and financial self-sufficiency. If what comes out of the ground comes close to what is expected, the company could make for a legendary exit. As always do your due diligence and speak with an investment professional before making any portfolio decisions. Good luck to all.