As a general rule, I’m not a Big Board guy. Companies that have set up as big players and gone through their risk removal and are functioning businesses with profit and loss, where the big fish have already taken the upside – for me, those are ‘investments,’ which is fine. but won’t make me rich.

Simply put, moving a billion dollar market cap to a 3x takes a lot of heavy lifting and usually some structural change, and sometimes a brother doesn’t want all the work. Soemtimes you just wants to buy up all the stock at 2c when nobody is looking, and watch it rise to 6c when the engine kicks over one time.

For a Cameco to bring investors a triple means either uranium as a commodity has gone on a price tear, or someone has made an acquisition offer, or they’ve fallen over ass-backwards into a new property that glows at night.

But for that 2c stock to go up, often all you need is two or three committed buyers with day jobs to be in at the same time, and maybe two pieces of good news spread out over a couple of weeks.

My perfect deal – my absolute zinger, the kind that gives me nights where I can’t sleep for the giddyness of it all, is when I find a 2c deal that nobody is watching, that has ‘good bones’ and good people who have been there before, and could sell off an asset or two without ruining the business model, and have exposure to sectors that are hot right now, and others that will be hot soon.

Usually, those deals are priced cheap because whoever is setting it up for glory hasn’t finished accruing cheap stock yet. They don’t want the story out there until they’re done buying. They won’t even sell into your buying action, just to put you off the scent.

But occasionally you’ll meet a guy who is an honest player, who’s been at it a little long, and ducked and covered when the markets got bad only to now find, when he could use some price action, everyone has forgotten what he owns.

That guy is Alf Stewart, chairman of Searchlight Resources (SCLT.V).

Alf is a good dude. A ‘hail fellow well met’ type with lots of stories and a crooked smile and a lot of laps under his belt, including some as a securities regulator. But there’s nothing Alf likes talking about more than Searchlight, and I get it. I’m beginning to like talking about Searchlight myself.

WHAT THE HELL IS SEARCHLIGHT

I’m glad you asked. SCLT is a $2 million market cap explorer and, hey, where’d everyone go?

Look, I hear you. The concept of a 2c mining explorer stock is legendary, almost a stereotype. It’s code for ‘zombie company’ a lot of the time. It’s used as a mockery by people not in the business for people who are.

“Oh sure, tell me about your 2c stock,” they say, rolling their eyes.

Well, shut up and listen for a minute.

Two uranium properties near Patterson Lake in Saskatchewan. That’s a nice start – uranium is spitting fire right now, that’s got to be worth $2 million by itself, but I’m not done yet.

Imagine one of those properties ALSO has rare earths in good numbers, while the other ALSO has cobalt and vanadium and copper. Still only worth $2 million?

Now let’s say they have a third property, this one with nickel and platinum elements.

Lets pretend they have another one with copper, lead and zinc.

Still only worth $2 million?

I’m not done yet. Let’s say they also had seven pegmatite targets showing lithium, cesium, tantalum and more rare earths.

Holy Jesus on a pogo stick, they’re basically set to pull unassembled electric vehicles out of the ground, what do they NOT have? I mean, no gold?

Yes. There’s gold too.

In fact, right around the location of four past producing high-grade gold mines.

Where?

Saskatchewan. All of it. All projects within a brisk drive of each other. Some projects with multiple metals in the one spot. Some of those metals being in sectors that are filthy hot right now (uranium, lithium), some that will be soon (rare earths, copper) and others that could run at any time (gold, cobalt, nickel).

All for $2 million.

I mean, if you have $2 million lying around, let’s end this right now and arrange a call with Alf because you can have all the upside yourself without letting anyone else know and just drill as you like.

But if you don’t have $2 million on hand, if you only have say $26,000, as I write this, according to level ii data, SCLT is $26,000 in buying away from a double, and it presumably runs from there.

Go get that 4c stock, people! Eat it for lunch. Be a bully at the table!

But what’s the downside?

I mean, it’s a 2c stock. If you’re the only one at the party who shows up in costume, it’s going to be a long night.

The downside of a low priced stock with not much trading volume is, you don’t know if you’re going to be living this life for a while. If you put in $20k and get the thing to 4c, maybe you incite others to join in and we’re off to 10c land or more.

Or, maybe you’re the only one and there’s nobody to sell to down the road. Pick your poison.

But this applies to any microcap stock. The beauty of it is, it can only go to zero – you might lose 1x your investment. But it can also go moonshot. The presence of risk is played off against the potential for reward.

So what’s the chance this lifts?

There are no definites in the public markets, but there are some good signs that I think can lower your risk.

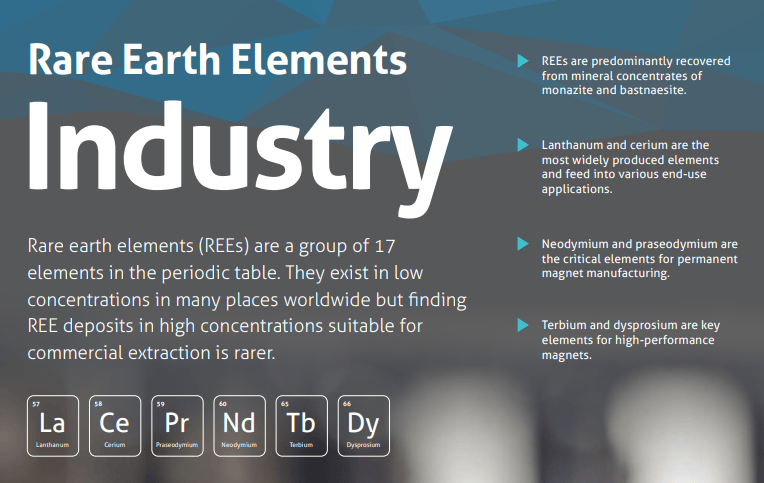

- Multi-sector exposure: Uranium is eating worlds right now, lithium was a short time ago, and copper is always threatening. But those rare earths have me intrigued.

- The work is not expensive: For metals that give off radiation, you still want drills turning ideally but you can do a lot of good work just flying over with the right equipment and getting back good data, and a lot of these metals fall into that category. SCLT is doing that now.

- Saskatchewan loves a good mine. It’s one of the best jurisdictions in the world for explorers, and all of SCLT’s projects are there.

- Let’s talk rare earths: REEs have had a few cycles where they got investors interested but fell off dramatically, even though they’re in short supply. Saskatchewan is looking to fix this, and in a big way.

Excelsior Saskatchewan!

For real.

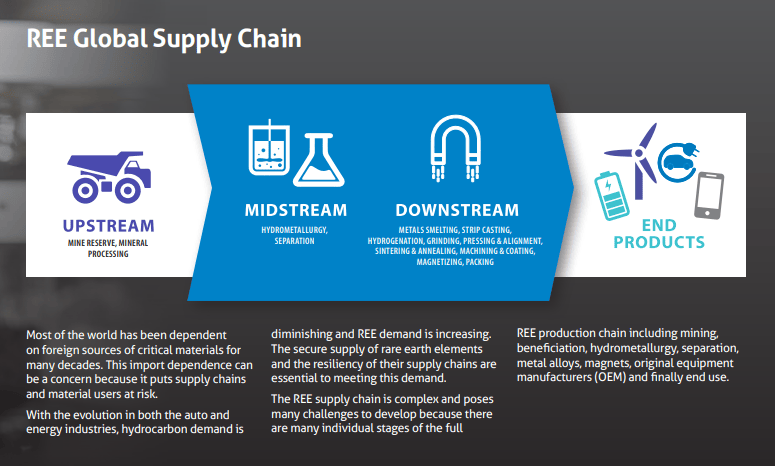

Rare earths, for a long time, were largely a Chinese industry. That country has a lot of the stuff, and uses a lot in manufacturing and sends a lot out for export, but has been going through it for decades to the point where it’s starting to dry up. Every now and then, when there’s a shortage and prices run, China will go into protection mode and threaten to stop exporting, and the world freaks out for a bit because there’s no plan B if China decides to keep their metal to themselves.

The reason for that is obvious – China produces 61% of the planet’s REEs currently, with that glorious denizen of capitalism and democracy, Myanmar, coming in second. Australia and Thailand chip in, but 98% of the rare earths Europe uses come from China… 98%!

That won’t go on forever – right now it’s estimated that, at the current growth of demand and without any major new source of production, the planet will run out of rare earths (some more than others) within 25 years. To put that into context, it’s expected we’ll out of of petroleum in 50 years, even with our current shifts away from fossil fuels.

So what do we do about that?

Enter Saskatchewan.

Saskatchewan is building a rare earths processing facility that so far has received $71 million in provincial government funding, and will be operational NEXT YEAR.

The expectation is that the province will become a global hub, and allow local supply to double quickly. It’s estimated the facility will create enough rare earth end products to build half a million electric vehicles per year.

This is great for Canada, great for Saksatchewan, and great for Searchlight.

Sure, there’s uranium there and they’re going to find out how much in due course, but this rare earths kicker is a nice side hustle that, in time, could be really important.

Show your work!

Okay, real world example time.

Let’s talk hafnium, a rare earth generally processed in part as a by-product of nuclear reactor operations. It’s used for nuke control rods because it has a mondo high melting point. It’s also used for plasma welding torches and rocket nozzles, or nose cones.

Elon Musk’s SpaceX recently announced it would be reducing its rocket nose cones in size, despite that ultimately decision limiting their performance and reducing payload capacity. Why?

Because hafnium, son. It’s expensive – $5k per kilogram by some estimates – and that’s before you work it. It’s tough to find, tough to process, tough to separate, and in demand.

Working hafnium isn’t easy because, like, heat resistance makes it tough to smelt. Also, fine grains of the stuff can spontaneously combust in oxygen which isn’t ideal.

And when SpaceX sends a rocket into space, and the rocket stages separate, all that hafnium is lost. SpaceX rockets may return to earth, but the hafnium doesn’t.

The Washington Post reports NOAA researchers collected and analyzed particles in the stratosphere that indicates the presence of rare elemental metals niobium and hafnium, which “are common in spacecraft manufacturing and can be found in semiconductors, rocket chambers and other applications.” The discovery “sheds light on the environmental aftermath of a growing number of rockets, satellites and other human-made spacecraft that give off metal vapors as they reenter the atmosphere.” The researchers also “identified aluminum, lithium, copper and lead in the stratosphere – all of which are linked to alloys used by the aerospace industry.”

So Elon chooses to use less, even if it means limiting what he can achieve. IF ONLY THERE WAS A RELIABLE SUPPLY SOMEWHERE.

Now let’s ask Searchlight if they have hafnium.

“The Kulyk Lake rare earths and uranium property has high grade REEs hosted in monazite pegmatites, the same pegmatites that host uranium. REE oxides exceed 50% in trench samples we’ve taken,” says Alf. “And, yes, we just found hafnium.”

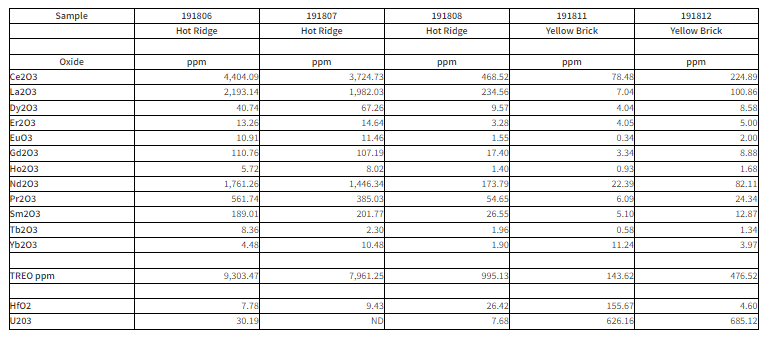

The HfO2 numbers you see down the bottom there, just above the uranium numbers – that’s your hafnium oxide. Yellow Brick may be short of some of your favourite metals compared to the others, but it’s interesting in uranium and hafnium.

Boomshanka.

Now go deeper.

Now, I’m not going to tell you that Searchlight Resources is going to save the space program, or even find its way into a nosecone. There’s a whole lot of horse races that need to be won before you can get to the Grand National.

But, for now, Searchlight has a lot of lottery tickets for a lot of lotteries, and only a $2 million market cap which COME ON NOW, THAT’S ABSURD, DON’T YOU THINK?

A 2c stock can be a dead stock. But it can also, very quickly, be a 3c stock, or a 10c stock, or…

SCLT. Go take a look your own damn self, and I’ll see you on the moon.

— Chris Parry

FULL DISCLOSURE: We all up in this thing. Client. Own it. Buying it. Talk to a financial advisor before you take bets on any stock but if you do decide to bully this thing around, let’s do lunch and talk about what we’re going to name our yachts.